1,050% VMware Price Increase: AT&T Challenges Broadcom's Acquisition

Understanding the 1050% VMware Price Increase

Broadcom's proposed acquisition of VMware is a monumental deal in the tech industry. The offer represents a significant leap from VMware's previous market valuation, sparking concerns about market dominance and potential monopolistic practices. Broadcom's rationale for such a hefty offer likely centers on several factors: achieving significant market dominance in the enterprise software and networking sectors, unlocking substantial synergy potential by integrating VMware's virtualization technology with Broadcom's existing portfolio, and potentially leveraging VMware's extensive customer base for cross-selling opportunities.

- Original VMware valuation: Before the Broadcom offer, VMware held a market capitalization significantly lower than the acquisition price.

- Broadcom's offer price: Broadcom's offer price per share represents a massive premium compared to VMware's pre-offer trading price.

- Percentage increase calculation: The difference between the offer price and the previous market valuation equates to a staggering 1050% increase.

- Key financial aspects of the deal: The deal involves substantial financial commitments, including debt financing and potential asset sales to fund the acquisition.

AT&T's Concerns and the Antitrust Challenge

AT&T's challenge to the Broadcom-VMware acquisition hinges on concerns about potential antitrust violations and the detrimental impact on market competition. AT&T argues that the combined entity would wield excessive market power, potentially leading to increased prices and reduced innovation in the networking and software sectors. This concern stems from the overlapping portfolios of Broadcom and VMware, particularly in networking and virtualization technologies, creating a scenario of concentrated power and potential market manipulation.

- AT&T's specific concerns about market concentration: AT&T highlights the potential for reduced competition and the suppression of innovative alternatives.

- Potential impact on AT&T's business: The acquisition could negatively affect AT&T's ability to negotiate favorable terms with key vendors, potentially leading to higher costs.

- Legal arguments used by AT&T: AT&T's legal challenge centers on arguments related to reduced competition, market manipulation, and anti-competitive practices.

- Regulatory bodies involved in the review process: Various regulatory bodies, including the FTC (Federal Trade Commission) and potentially international authorities, are involved in reviewing the proposed acquisition.

Implications for the Tech Industry and Consumers

The potential long-term effects of the Broadcom-VMware acquisition on the tech industry are far-reaching. The significant VMware price increase, if the acquisition proceeds, could lead to ripple effects across various sectors. Businesses could face higher costs for cloud computing and enterprise software, potentially stifling innovation and hindering the growth of smaller competitors. Consumers might indirectly experience increased IT costs, impacting the pricing of various products and services.

- Impact on cloud computing costs: Increased VMware licensing costs could translate into higher cloud computing prices for businesses and individuals.

- Potential for reduced innovation in virtualization technology: A less competitive market could hinder the pace of innovation and development in virtualization technologies.

- Effects on enterprise software pricing: The acquisition could lead to increased pricing and reduced choice in enterprise software solutions.

- Consumer-facing implications (indirectly through increased IT costs): Higher IT costs for businesses may eventually lead to increased prices for consumer goods and services.

Future Outlook and Regulatory Scrutiny

The future of the Broadcom-VMware deal remains uncertain, hanging in the balance of ongoing regulatory scrutiny. The likelihood of success depends heavily on the outcome of antitrust reviews by various regulatory bodies. Potential outcomes range from complete approval to rejection or, more likely, a modified deal with concessions demanded by regulators. The decisions will have far-reaching implications for Broadcom, VMware, their competitors, and the broader tech landscape.

- Timeline for regulatory decisions: The regulatory review process can take several months, even years, to complete.

- Potential compromises or modifications to the acquisition: To secure approval, Broadcom might be forced to divest certain assets or make other concessions.

- Long-term implications for Broadcom and VMware: The outcome will significantly impact the future strategies and market positions of both companies.

- Impact on other tech mergers and acquisitions: The outcome of this deal will set a precedent, influencing future merger and acquisition activity in the tech sector.

Conclusion: The Future of VMware and the Price Increase Debate

The proposed acquisition of VMware by Broadcom, resulting in a substantial VMware price increase, has sparked a significant debate regarding its impact on competition and the tech industry at large. AT&T's antitrust challenge highlights serious concerns about market concentration and the potential for negative consequences for businesses and consumers. The regulatory outcome will determine the future landscape of virtualization technology and have far-reaching implications for cloud computing, enterprise software, and the broader tech market. The "VMware price increase" and the resulting "Broadcom acquisition fallout" will undoubtedly shape the future of the industry. Stay informed about further developments concerning this crucial acquisition by following our updates on the "Broadcom antitrust" case and the impact of tech mergers. The debate surrounding the "VMware price increase" is far from over, and its ramifications will be felt across the tech ecosystem for years to come.

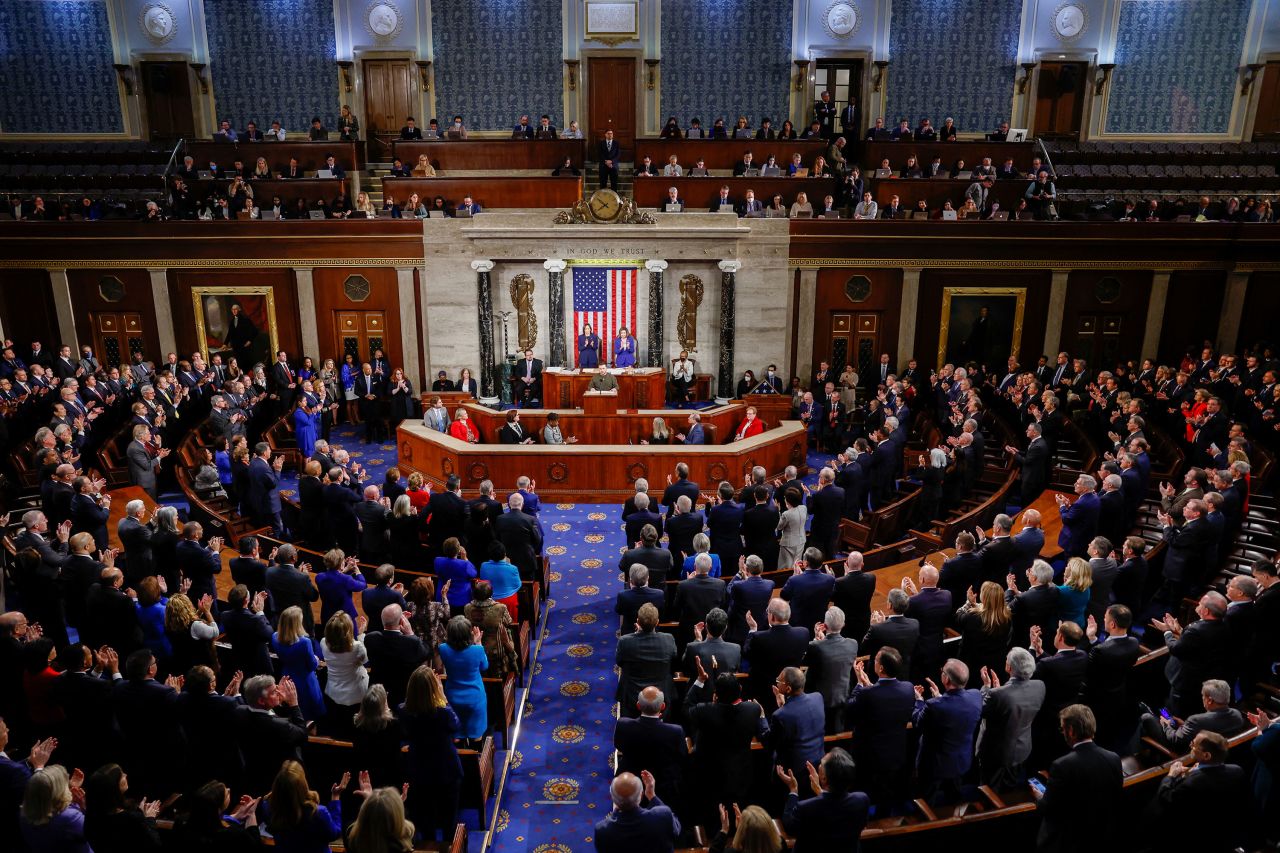

Live Stream Trump Addresses Joint Session Of Congress

Live Stream Trump Addresses Joint Session Of Congress

Watch Mobland Episode 9 Tom Hardy And Pierce Brosnan Free Online

Watch Mobland Episode 9 Tom Hardy And Pierce Brosnan Free Online

Bandidos Atuam Contra A Pm Tiroteio Deixa Dois Policiais Feridos

Bandidos Atuam Contra A Pm Tiroteio Deixa Dois Policiais Feridos

Taoiseach Rejects Claims Of Antisemitism As Absurd

Taoiseach Rejects Claims Of Antisemitism As Absurd

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim And Justin Baldoni Lawsuit