1,050% VMware Price Increase: AT&T's Reaction To Broadcom's Acquisition Proposal

Table of Contents

Understanding the 1,050% VMware Price Increase

The 1,050% figure isn't a simple across-the-board increase. The mechanics are complex and depend on several factors, including existing licensing agreements, specific VMware products used, and the terms of the Broadcom acquisition. The substantial increase stems from Broadcom's anticipated changes to VMware's pricing strategy post-acquisition. This likely reflects Broadcom's aim to maximize returns on their investment, potentially through a shift towards more expensive, subscription-based models or higher per-unit costs.

- Complex Calculation: The precise calculation of the VMware price increase varies depending on the specific contract and product usage. It's not a straightforward percentage applied uniformly.

- Broadcom's Strategy: While official statements haven't explicitly detailed the 1,050% figure, Broadcom’s acquisition strategy suggests a focus on profitability. This almost certainly involves restructuring VMware’s pricing model.

- Official Communication: [Insert link to relevant Broadcom press release here, if available]. [Insert link to relevant VMware statement here, if available].

- Impact on Licensing: The VMware price hike will significantly increase licensing costs for existing and prospective customers, impacting budgets and potentially slowing down adoption.

AT&T's Stake in VMware and Potential Financial Exposure

AT&T relies heavily on VMware's virtualization technologies for its vast IT infrastructure. The exact extent of AT&T's investment in VMware products and services isn't publicly available, but given its scale, it's safe to assume a substantial financial exposure. The 1,050% VMware price increase translates to potentially billions of dollars in added costs for AT&T annually.

- Significant Dependence: AT&T's network infrastructure likely relies significantly on VMware solutions for server virtualization, network virtualization, and cloud management.

- Financial Exposure: The magnitude of the potential financial impact is considerable and could significantly affect AT&T’s bottom line. Independent analysts should be consulted for specific estimations.

- Mitigation Strategies: AT&T may explore several options to mitigate the cost, including:

- Renegotiating existing contracts with VMware.

- Exploring alternative virtualization solutions from competitors like Citrix, Nutanix, or migrating to public cloud providers like AWS, Azure, or Google Cloud.

- Implementing cost-optimization strategies within its IT infrastructure to reduce reliance on specific VMware products.

AT&T's Potential Reactions and Strategic Options

AT&T faces a critical decision: accept the increased costs, negotiate aggressively with Broadcom, or explore alternative technologies. Each option carries significant implications.

- Acceptance: Accepting the increase would severely impact AT&T’s profitability and potentially necessitate cost-cutting measures elsewhere.

- Negotiation: AT&T might leverage its size and influence to negotiate more favorable pricing terms with Broadcom. However, success is not guaranteed.

- Alternative Solutions: Shifting to alternative virtualization technologies or cloud platforms could be a long-term solution but involves significant upfront investment and potential disruption.

- Expert Opinion: [Insert quote or analysis from an industry expert on AT&T's likely response here].

Broader Market Implications and Industry Reactions

The VMware price increase isn't just an AT&T problem; it impacts all VMware customers. Other large telecommunications companies and enterprise-level organizations face similar challenges. This could lead to a reevaluation of virtualization strategies across the industry and potentially accelerate the adoption of cloud-native technologies.

- Wider Impact: This massive VMware price increase creates uncertainty and may slow down adoption of VMware solutions.

- Industry Response: Other major corporations are likely to publicly express concern or explore alternative options, potentially leading to increased competition in the virtualization market.

- Regulatory Scrutiny: The Broadcom acquisition might face antitrust scrutiny and regulatory hurdles, potentially influencing VMware's pricing strategies and future developments.

Conclusion: Navigating the VMware Price Increase – What's Next for AT&T and the Industry?

The 1,050% VMware price increase presents a significant challenge for AT&T and the broader technology landscape. AT&T’s response—whether through negotiation, migration to alternative technologies, or acceptance—will have major financial and strategic consequences. The situation highlights the growing importance of cost-optimization and strategic flexibility in navigating the ever-changing technological landscape. This dramatic "VMware price increase" stemming from the "Broadcom acquisition" will undoubtedly reshape the "VMware cost implications" for numerous organizations and accelerate the move towards cloud-native solutions and alternative virtualization options. Stay informed about further developments concerning the "VMware price increase" and the "Broadcom VMware acquisition impact" by following industry news and analyst reports. Understanding the "future of VMware" is crucial for anyone involved in IT infrastructure planning.

Featured Posts

-

Miley Cyrus On Her Fathers Narcissism A Complex Family Dynamic

May 31, 2025

Miley Cyrus On Her Fathers Narcissism A Complex Family Dynamic

May 31, 2025 -

France A Muslim Mans Death And The Far Lefts Anti Islamophobia Discourse

May 31, 2025

France A Muslim Mans Death And The Far Lefts Anti Islamophobia Discourse

May 31, 2025 -

Jack White Joins Detroit Tigers Broadcast Hall Of Fame Talk And Baseball Insights

May 31, 2025

Jack White Joins Detroit Tigers Broadcast Hall Of Fame Talk And Baseball Insights

May 31, 2025 -

Analyse Du Potentiel Boursier De Sanofi Par Loeil Du Loup De Zurich

May 31, 2025

Analyse Du Potentiel Boursier De Sanofi Par Loeil Du Loup De Zurich

May 31, 2025 -

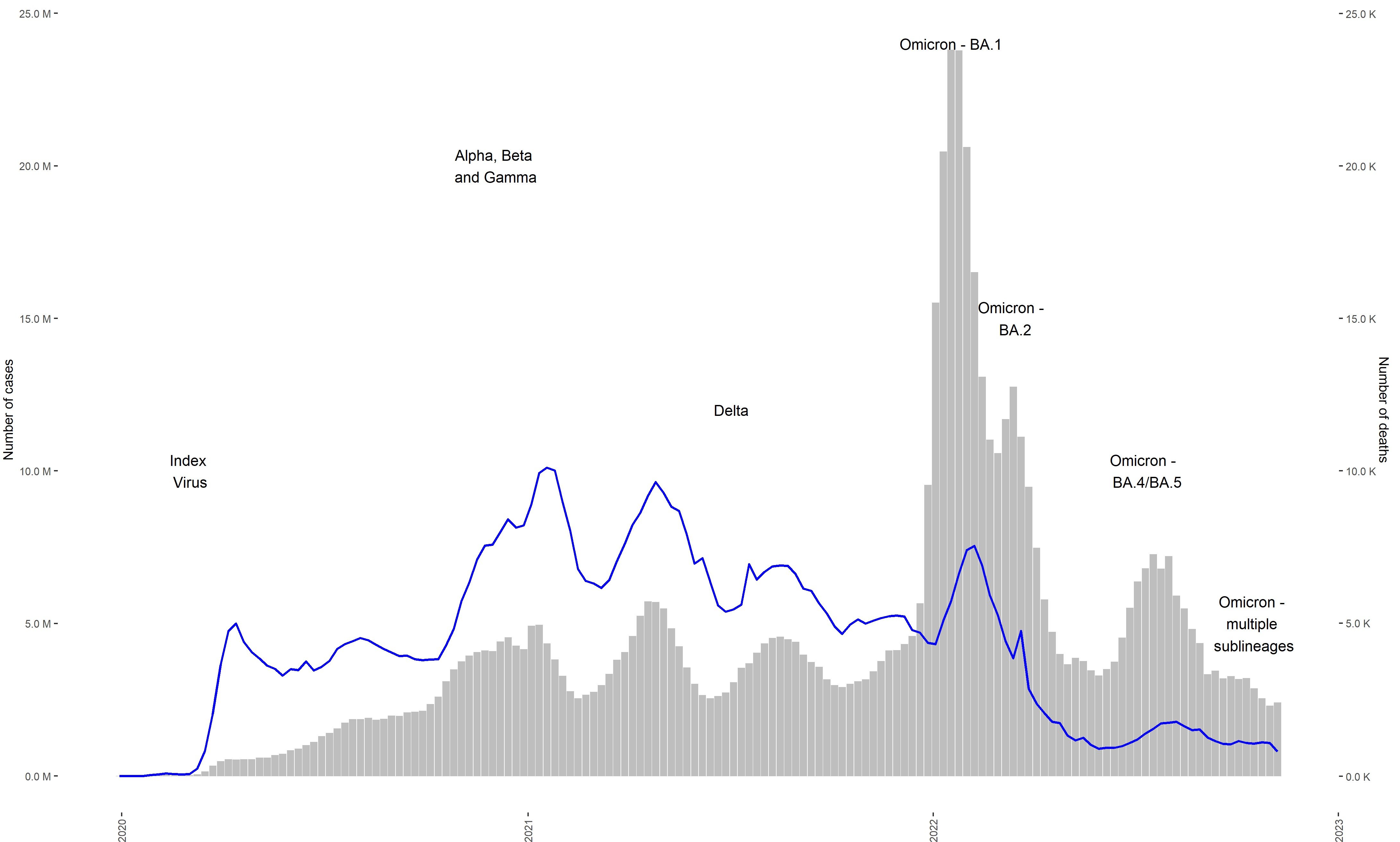

New Covid 19 Variant A Driving Force Behind Rising Global Cases According To Who

May 31, 2025

New Covid 19 Variant A Driving Force Behind Rising Global Cases According To Who

May 31, 2025