$1.231 Billion In Oil Revenue Recovery: The Representatives' Strategy

Table of Contents

Identifying Lost Revenue Streams

The first step in achieving this substantial oil revenue recovery was the meticulous identification of lost revenue streams. This involved a multi-pronged approach focusing on uncovering hidden losses and quantifying the exact amount lost.

Uncovering Hidden Losses

Identifying where the lost oil revenue was hidden proved challenging, but crucial for the overall success of the recovery effort. The process involved several key steps:

- Audits of past contracts and agreements: A thorough review of all historical oil contracts and agreements was undertaken. This included examining payment schedules, production figures, and tax obligations to identify any discrepancies or inconsistencies. This meticulous auditing process was vital for uncovering hidden clauses and loopholes that had led to revenue loss.

- Data analysis to pinpoint discrepancies and inconsistencies: Advanced data analytics techniques were employed to analyze vast datasets related to oil production, sales, and taxation. This allowed for the identification of anomalies and inconsistencies that might have otherwise gone unnoticed. This included comparing reported production levels against actual production figures and identifying discrepancies in tax payments.

- Investigation of potential fraud and corruption: A dedicated investigation team was assembled to probe allegations of fraud and corruption within the oil sector. This involved interviews with key personnel, analysis of financial records, and collaboration with law enforcement agencies. This proactive approach was crucial in identifying individuals and entities responsible for illicit activities.

- Collaboration with international organizations to track illicit financial flows: International collaborations with organizations specializing in combating financial crime were established. This facilitated the tracking of illicit financial flows and the identification of offshore accounts used to conceal lost oil revenues. This international cooperation was pivotal in recovering funds stashed outside the country's jurisdiction.

- Use of advanced forensic accounting techniques: Expert forensic accountants were engaged to employ sophisticated techniques to reconstruct financial transactions and unravel complex accounting schemes used to misappropriate funds. This expert analysis was critical in building a strong case for the recovery of lost oil revenue.

Quantifying the Losses

Once potential areas of revenue loss were identified, the next crucial step was accurately quantifying these losses. This involved:

- Detailed financial modelling and projections: Sophisticated financial models were developed to accurately estimate the amount of revenue lost due to various factors, including underpayment, tax evasion, and fraudulent activities. These models accounted for fluctuations in oil prices and production levels.

- Expert testimony from economists and financial specialists: Expert testimony from leading economists and financial specialists was crucial in substantiating the calculated losses and providing credible evidence for legal proceedings. Their independent assessments added significant weight to the claims.

- Development of comprehensive reports and documentation: Meticulously detailed reports and comprehensive documentation were compiled to support the claims of lost revenue. This ensured transparency and provided irrefutable evidence for legal and negotiation processes. This documentation served as the cornerstone of the legal case.

Negotiating and Recovering Funds

With the extent of the losses quantified, the focus shifted to recovering the funds. This involved strategic legal approaches and the building of crucial coalitions and alliances.

Strategic Legal Approaches

The legal strategy employed was multifaceted and strategically tailored to the specific circumstances of each case. Key aspects included:

- International arbitration and litigation: International arbitration and litigation were pursued to recover funds from entities based in other countries. This involved navigating complex international legal frameworks and building a strong legal case. This demonstrated a commitment to pursuing all available legal avenues.

- Negotiation and settlement agreements: Negotiations and settlement agreements were sought to expedite the recovery process in certain cases. This involved engaging in constructive dialogue with the parties involved to reach mutually beneficial agreements. This approach balanced assertive action with the pragmatism of efficient resolution.

- Collaboration with international legal authorities: Collaboration with international legal authorities was instrumental in pursuing legal action against entities operating across borders. This facilitated the sharing of information and the coordination of legal efforts. International cooperation proved essential in overcoming jurisdictional challenges.

- Leveraging existing treaties and agreements: Existing international treaties and agreements were utilized to strengthen the legal claims and ensure compliance with international law. This leveraged the existing legal framework to bolster the recovery efforts.

Building Coalitions and Alliances

Strengthening their position required strategic alliances and public pressure. This involved:

- Building alliances with other countries facing similar challenges: Alliances were formed with other nations experiencing similar challenges in oil revenue management. This created a united front and enhanced negotiating leverage. Collective action proved far more effective than isolated efforts.

- Engaging with international organizations to enhance leverage: Engagement with international organizations specializing in resource management and anti-corruption provided additional leverage in negotiations and public advocacy efforts. Their support added credibility and amplified the message.

- Public pressure campaigns to raise awareness and influence negotiations: Public pressure campaigns were implemented to raise awareness about the issue and influence negotiations. Transparency and public engagement were integral in maintaining accountability and influencing outcomes.

Implementing Preventative Measures

To prevent future losses, a series of preventative measures were implemented, focusing on strengthening regulatory frameworks and building internal capacity.

Strengthening Regulatory Frameworks

Strengthening the regulatory framework was paramount in preventing future oil revenue loss. This involved:

- Improving transparency and accountability in the oil sector: Increased transparency and accountability measures were put in place across the oil sector. This included enhanced reporting requirements and independent audits. Transparency was key to deterring future illicit activity.

- Enhancing contract oversight and enforcement mechanisms: Mechanisms for overseeing contracts and enforcing compliance were strengthened to ensure fairness and prevent future revenue leakage. Stricter oversight reduced opportunities for exploitation.

- Implementing stricter regulations and compliance standards: Stricter regulations and compliance standards were adopted to minimize opportunities for fraud and corruption. This included stronger penalties for non-compliance.

- Investing in technology to improve data management and monitoring: Investment in advanced technologies for data management and monitoring was undertaken to enhance the detection of discrepancies and anomalies in real-time. Technology played a vital role in proactive risk management.

Capacity Building and Training

Investing in human capital was crucial for sustainable oil revenue recovery. This included:

- Training programs for government officials and industry professionals: Comprehensive training programs were developed to equip government officials and industry professionals with the skills and knowledge needed to effectively manage oil revenue. Well-trained personnel were essential for effective implementation of new regulations.

- Development of specialized expertise in oil revenue management: Efforts were made to develop specialized expertise in oil revenue management within the country. This included recruiting and training experts in relevant fields.

- Investment in technology and infrastructure to support improved governance: Investment in technology and infrastructure was made to improve the efficiency and effectiveness of governance structures related to oil revenue management. This included upgrading data systems and establishing dedicated units.

Conclusion

The $1.231 billion oil revenue recovery demonstrates the effectiveness of a comprehensive strategy involving meticulous loss identification, assertive legal action, and proactive preventative measures. By combining rigorous financial analysis, strategic alliances, and strengthened regulatory frameworks, representatives secured a significant financial win. This success underscores the vital importance of robust oil revenue management systems and diligent oversight to prevent future losses and maximize national benefit. To ensure ongoing success in securing and protecting vital oil revenues, governments and organizations should invest in similar strategies and prioritize transparent, accountable management practices for maximizing oil revenue recovery.

Featured Posts

-

Canada Rejects Oxford Report Most Us Tariffs Remain

May 20, 2025

Canada Rejects Oxford Report Most Us Tariffs Remain

May 20, 2025 -

Bbc And Agatha Christie The Deepfake Controversy Explained

May 20, 2025

Bbc And Agatha Christie The Deepfake Controversy Explained

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Characters And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Characters And Enduring Legacy

May 20, 2025 -

Putin I Pregovori Perspektiva Toncija Tadica

May 20, 2025

Putin I Pregovori Perspektiva Toncija Tadica

May 20, 2025 -

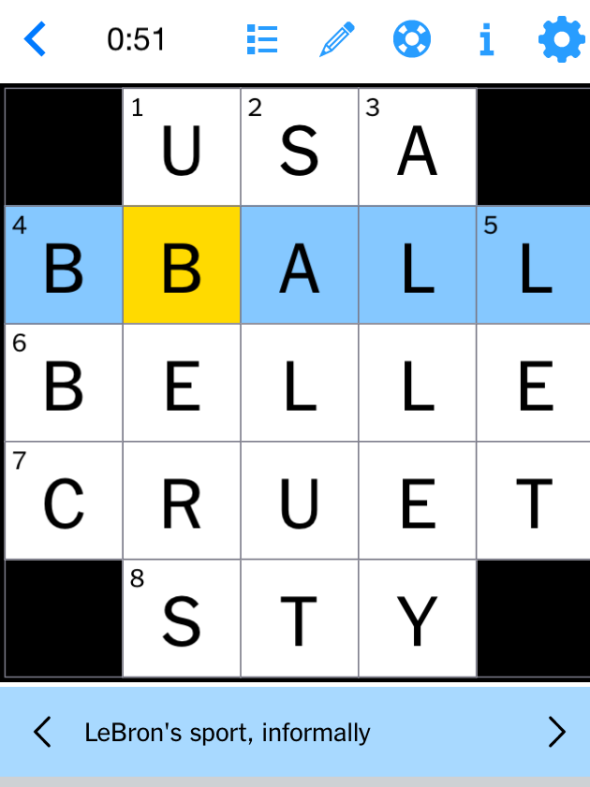

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025