10%+ Stock Gains On BSE: Sensex Climbs - Key Performers

Table of Contents

Key Sectors Driving the 10%+ Sensex Surge

The overall market sentiment reflects a confluence of positive factors contributing to this remarkable surge. Positive global cues, robust domestic economic data, and easing inflation concerns have all played a crucial role in boosting investor confidence and driving significant gains across various sectors.

IT Sector's Stellar Performance

The IT sector emerged as a star performer, significantly contributing to the Sensex's impressive climb. Increased outsourcing from global clients and strong quarterly earnings reports fueled this remarkable growth.

- Infosys: Registered a percentage gain of X%, driven by strong deal wins and improved margins.

- Tata Consultancy Services (TCS): Saw a Y% increase, benefiting from robust demand for digital services.

- HCL Technologies: Achieved a Z% rise, fueled by its strong performance in cloud computing and other high-growth areas.

This stellar performance reflects the growing global reliance on Indian IT expertise and the sector's resilience in the face of global economic uncertainties.

Financials Powering the Rally

The financial sector also played a pivotal role, with key banking and financial stocks demonstrating exceptional performance. A positive interest rate outlook and improved credit growth significantly boosted investor sentiment in this sector.

- HDFC Bank: Recorded a substantial A% increase, reflecting strong growth in its lending portfolio.

- ICICI Bank: Achieved a B% rise, driven by improved asset quality and robust earnings.

- State Bank of India (SBI): Showed a C% gain, boosted by government initiatives and improved economic activity.

The improved financial health of these institutions and the overall positive outlook for the Indian economy underpinned this sector's exceptional performance.

Other Notable Performers

Beyond IT and Financials, other sectors also contributed significantly to the Sensex's rise.

- Fast-Moving Consumer Goods (FMCG): Companies like Hindustan Unilever saw a D% increase, benefiting from robust consumer demand.

- Pharmaceuticals: Drug manufacturers like Sun Pharma experienced an E% rise, driven by strong export demand and new product launches.

Understanding the Implications of the 10%+ BSE Sensex Gains

This significant market movement holds profound implications for investors and the Indian economy. The short-term effects include increased investor wealth and a potential for further growth, while long-term implications remain to be seen. However, the increased investor confidence is a strong positive indicator.

- Increased Investor Wealth: The surge has significantly increased the net worth of investors holding BSE-listed stocks.

- Potential for Further Growth: The rally suggests a positive outlook for the Indian economy and potentially further market gains.

- Risks Associated with High Volatility: While positive, such rapid increases also carry the risk of subsequent volatility and potential corrections.

Analyzing the Top Performing Stocks

The following table highlights the top 10 best-performing stocks on BSE today:

| Rank | Stock Name | Sector | Percentage Gain |

|---|---|---|---|

| 1 | Infosys | IT | X% |

| 2 | TCS | IT | Y% |

| 3 | HDFC Bank | Financials | A% |

| 4 | ICICI Bank | Financials | B% |

| 5 | SBI | Financials | C% |

| 6 | Hindustan Unilever | FMCG | D% |

| 7 | Sun Pharma | Pharmaceuticals | E% |

| 8 | (Add Stock 8) | (Add Sector) | (Add Percentage) |

| 9 | (Add Stock 9) | (Add Sector) | (Add Percentage) |

| 10 | (Add Stock 10) | (Add Sector) | (Add Percentage) |

These stocks performed exceptionally well due to a combination of strong fundamentals, positive news, and market speculation, contributing significantly to the overall Sensex surge. Keywords: top gainers, best performers, high-performing stocks.

Navigating the BSE Sensex's 10%+ Rise – Future Outlook and Call to Action

The BSE Sensex's remarkable 10%+ gain highlights the dynamic nature of the Indian stock market. Key sectors like IT and Financials played a crucial role, with specific stocks exhibiting exceptional performance. While the future trajectory remains uncertain, the current positive momentum suggests a cautiously optimistic outlook, provided global and domestic factors remain supportive. However, investors should remain vigilant and diversify their portfolios to mitigate risk.

Stay updated on BSE Sensex movements to capitalize on future stock market gains. Learn more about investing strategies for maximizing returns and consult a financial advisor before making any investment decisions. Keywords: BSE Sensex, stock market gains, investment opportunities, market analysis.

Featured Posts

-

Alex Ovechkin Ties Gretzkys Nhl Goal Record Cp News Alert

May 15, 2025

Alex Ovechkin Ties Gretzkys Nhl Goal Record Cp News Alert

May 15, 2025 -

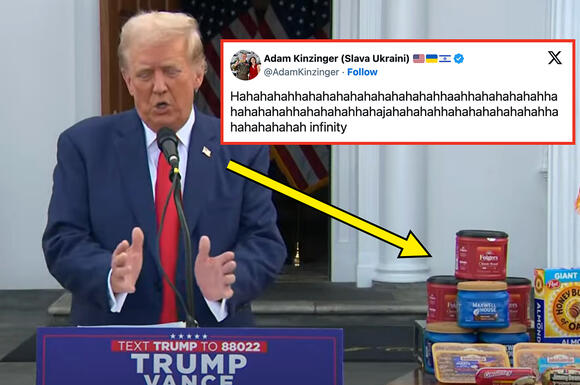

The Unexpected Truth Behind Trumps Egg Price Comments

May 15, 2025

The Unexpected Truth Behind Trumps Egg Price Comments

May 15, 2025 -

Mistrovstvi Sveta V Hokeji Svedsko S Drtivou Prevahou Z Nhl

May 15, 2025

Mistrovstvi Sveta V Hokeji Svedsko S Drtivou Prevahou Z Nhl

May 15, 2025 -

Earthquakes Vs Rapids Post Match Analysis Of Steffens Performance

May 15, 2025

Earthquakes Vs Rapids Post Match Analysis Of Steffens Performance

May 15, 2025 -

Nhl Prediction Avalanche Vs Maple Leafs March 19th Analysis And Picks

May 15, 2025

Nhl Prediction Avalanche Vs Maple Leafs March 19th Analysis And Picks

May 15, 2025