10-Year Mortgages In Canada: Low Popularity And The Reasons Why

Table of Contents

Higher Initial Interest Rates for 10-Year Mortgages in Canada

The Cost of Long-Term Certainty

The primary reason for the low uptake of 10-year mortgages in Canada is the significantly higher initial interest rates compared to shorter-term options like 5-year mortgages. This seemingly simple factor has a profound impact on a borrower's financial obligations. The allure of locking in a rate for a decade is often overshadowed by the substantial increase in monthly payments.

-

Illustrative Example: Let's say a $500,000 mortgage with a 25-year amortization period carries a 5% interest rate for a 5-year term and a 6% interest rate for a 10-year term. The monthly payments would be noticeably higher with the 10-year mortgage, even though the overall interest paid might be slightly less over the entire amortization period. Precise figures will, of course, vary based on the lender and prevailing Canadian mortgage rates.

-

Impact on Monthly Payments: The higher interest rate translates directly into a larger monthly payment. This can strain household budgets, especially during periods of economic uncertainty. Remember that even a small percentage difference in interest rates over a 10-year period can lead to a substantial difference in total interest paid.

-

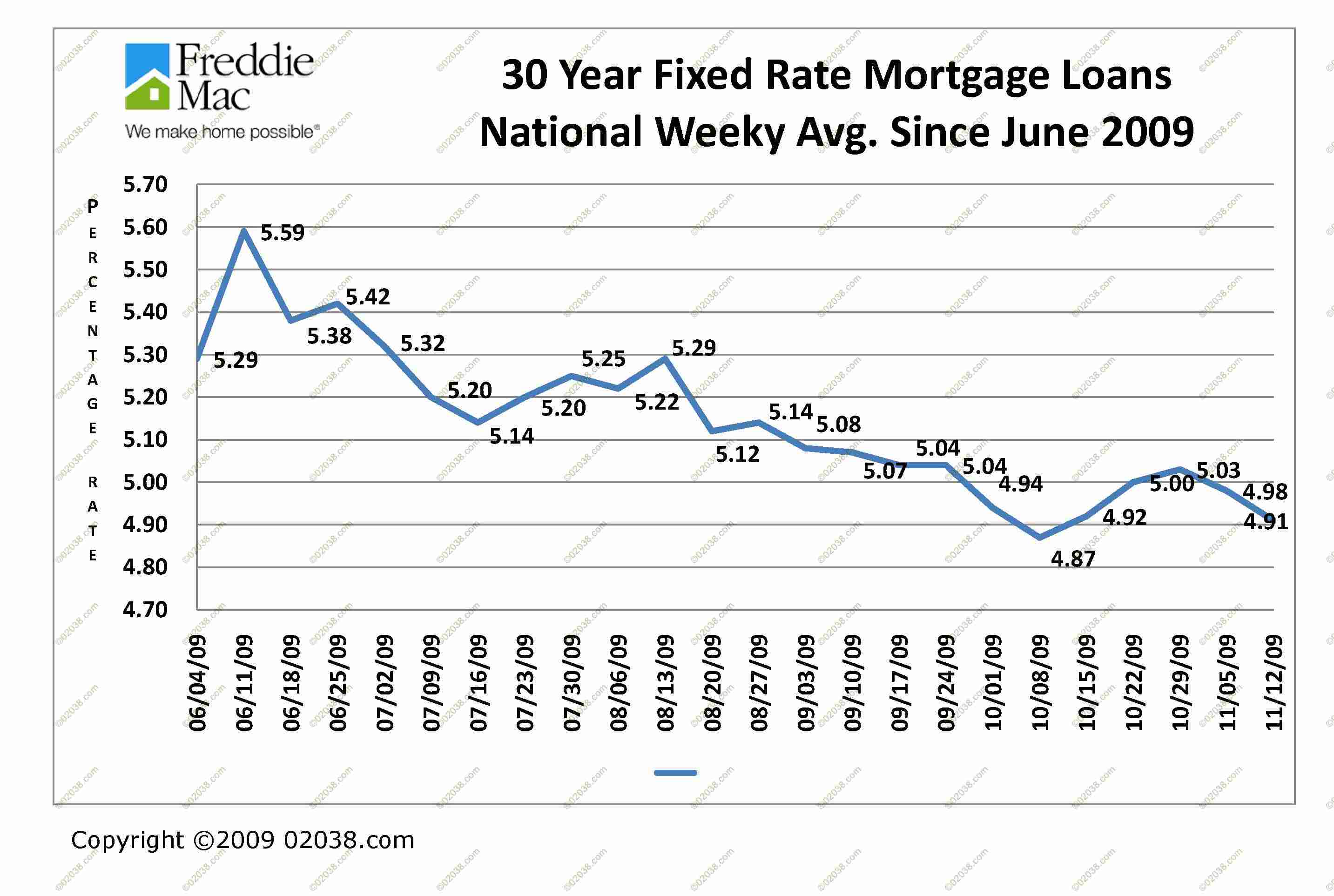

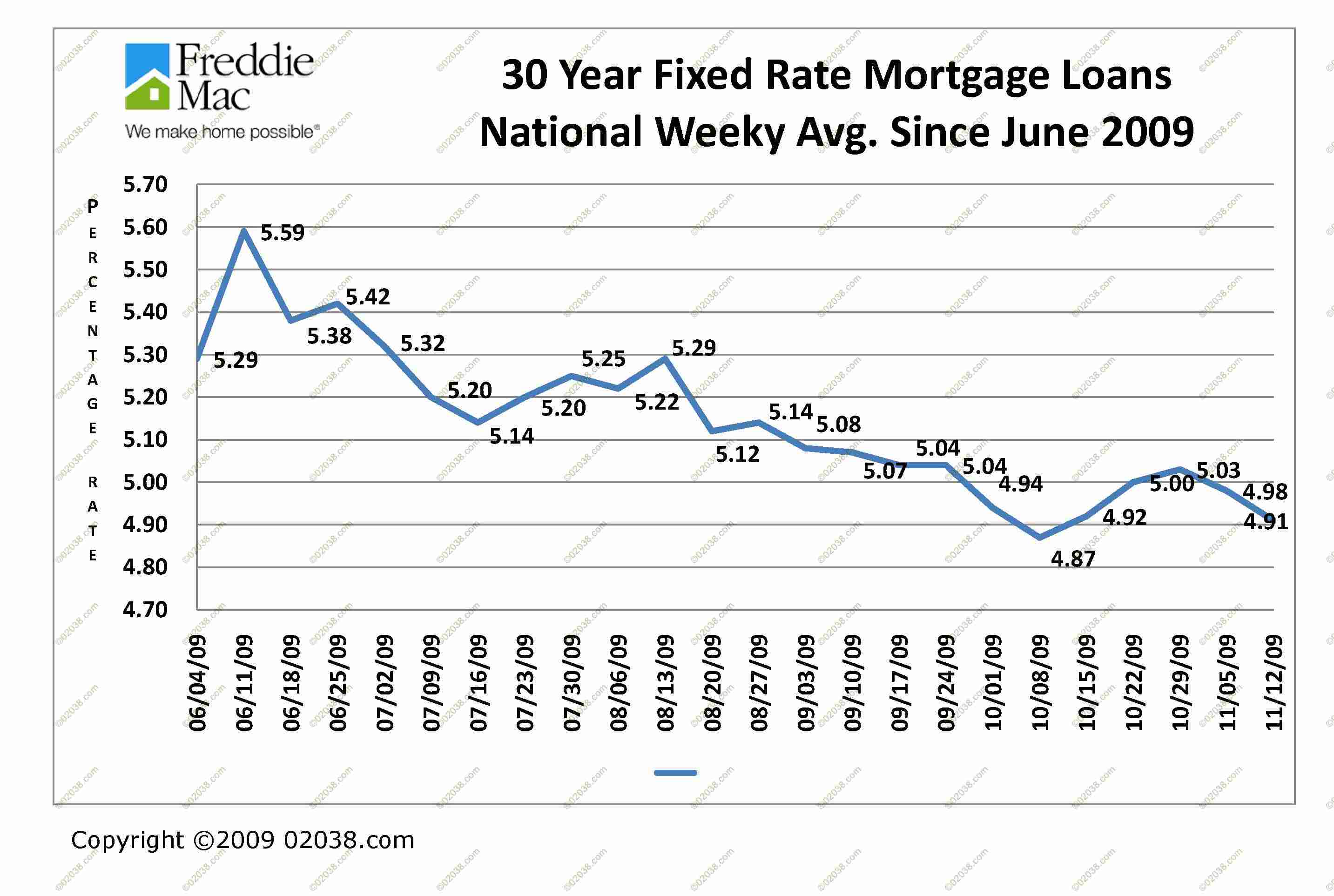

Rate Fluctuations Over the Long Term: While a 10-year mortgage offers the perceived security of a fixed rate, the Canadian mortgage market is dynamic. It's impossible to predict with certainty whether rates will rise or fall over the next ten years. It's possible that rates could drop significantly during the term, making the higher initial rate on the 10-year mortgage look less appealing in hindsight. This uncertainty is a key consideration for many borrowers. Keeping an eye on Canadian mortgage rates trends is crucial.

The Risk of Rate Changes and Prepayment Penalties

Breaking a 10-Year Mortgage

The significant prepayment penalties associated with breaking a 10-year mortgage before its term is complete are another major deterrent. These penalties can be substantial, potentially wiping out any perceived savings from a fixed rate. The calculation method for prepayment penalties varies by lender, often involving a combination of interest rate differential (IRD) and the Interest Rate Differential (IRD) calculation, making it challenging for borrowers to accurately predict the cost of early repayment.

-

Financial Implications of Early Repayment: Unexpected life events, such as job loss or a need to relocate, can necessitate breaking a mortgage early. The financial shock of hefty prepayment penalties can be devastating, especially when dealing with a 10-year term.

-

Comparison with Shorter-Term Mortgages: Shorter-term mortgages, such as 5-year mortgages, involve significantly lower prepayment penalties. This flexibility allows for greater adaptability to changing circumstances, offering greater peace of mind.

-

Uncertainty of Future Financial Situations: Life is unpredictable. Committing to a 10-year mortgage requires a high degree of financial certainty and the confidence that circumstances won't necessitate early repayment and significant financial penalties (mortgage prepayment penalties Canada).

Limited Flexibility and Life Changes

Adapting to Changing Circumstances

A 10-year mortgage offers minimal flexibility. Life changes—job relocation, unexpected expenses, family growth—are common occurrences, and a 10-year term may prove restrictive in these scenarios. The long commitment can create a sense of being financially "locked in," potentially limiting options during periods of change.

-

Difficulty of Refinancing: Refinancing a 10-year mortgage before the term's end is complicated and costly due to prepayment penalties. This contrasts sharply with the relative ease of refinancing shorter-term mortgages.

-

Inflexibility Compared to Shorter-Term Mortgages: The inflexibility of a 10-year mortgage significantly contrasts with the flexibility offered by shorter-term options, which allow for rate adjustments and potential refinancing every few years.

-

Challenges Associated with Changing Financial Circumstances: Significant life changes often bring about changes in income or expenses. A 10-year mortgage may struggle to adapt to these changes. Flexible mortgages Canada offer greater financial adaptability.

Lack of Awareness and Understanding

The Unknown Factor

Many Canadians are simply unaware of the intricacies and implications of a 10-year mortgage. This lack of awareness and understanding contributes significantly to their low popularity.

-

Limited Marketing and Promotion: 10-year mortgages are not heavily marketed or promoted by lenders, resulting in limited consumer knowledge. Understanding mortgages is essential to making an informed decision.

-

Complexities Involved in Understanding the Terms and Conditions: The terms and conditions of a 10-year mortgage can be complex, making it difficult for the average consumer to fully grasp the financial implications. Better consumer education is needed to clarify these aspects.

-

Need for Better Consumer Education: Clear and accessible information on the advantages and disadvantages of 10-year mortgages is crucial to improve consumer understanding and increase transparency in the Canadian mortgage market.

When 10-Year Mortgages Might Be Suitable

Specific Scenarios

While generally less popular, there are specific scenarios where a 10-year mortgage might be beneficial:

-

Individuals with Exceptionally Stable Income and Long-Term Financial Plans: For those with very stable income and long-term financial planning, the certainty of a fixed rate for a decade can be attractive.

-

Those Prioritizing Rate Certainty Above Flexibility: Individuals who prioritize long-term rate certainty over flexibility might find a 10-year mortgage appealing, particularly if they anticipate stable financial circumstances.

-

Situations Where a Longer Amortization Period is Advantageous: In situations where a longer amortization period is desirable to lower monthly payments, a 10-year mortgage could be considered, however, careful consideration must be given to the long-term implications and potential total interest paid.

Conclusion

In conclusion, the low popularity of 10-year mortgages in Canada can be attributed to several factors, including higher initial interest rates, substantial prepayment penalties, limited flexibility, and a general lack of awareness. While they may offer rate certainty for a defined period, the potential drawbacks often outweigh the benefits for most Canadian homeowners. Before committing to a 10-year mortgage, carefully weigh the advantages and disadvantages against your individual circumstances and explore other Canadian mortgage options. Consider consulting with a mortgage broker to determine the best mortgage solution for your long-term financial goals. Choosing the right mortgage, whether a 5-year or a 10-year mortgage, is crucial for your financial future.

Featured Posts

-

Demi Moores Daughter Ruminates On Ashton Kutcher Then Recants

May 06, 2025

Demi Moores Daughter Ruminates On Ashton Kutcher Then Recants

May 06, 2025 -

Demi Moore And Kevin Costner Dating Rumors Explored

May 06, 2025

Demi Moore And Kevin Costner Dating Rumors Explored

May 06, 2025 -

Dow Jones And S And P 500 Stock Market Data May 5th Live Updates

May 06, 2025

Dow Jones And S And P 500 Stock Market Data May 5th Live Updates

May 06, 2025 -

Where To Find Sabrina Carpenter Skins In Fortnite

May 06, 2025

Where To Find Sabrina Carpenter Skins In Fortnite

May 06, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 06, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 06, 2025