$100,000 Bitcoin? Recent Surge Breaks 10-Week High

Table of Contents

Analyzing the Recent Bitcoin Price Increase

The recent Bitcoin price rally is a complex phenomenon driven by a confluence of factors. Let's examine the key contributors to this upward momentum:

-

Institutional Investment: Major financial institutions are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a potential diversification tool. Companies like MicroStrategy and Tesla's significant Bitcoin purchases have had a demonstrable effect on price. This institutional Bitcoin investment signifies a growing acceptance of Bitcoin within traditional finance. [Link to relevant news article about institutional investment]

-

Regulatory Changes (or Lack Thereof): While regulatory clarity remains a key issue, some recent developments, particularly in countries like El Salvador, have fostered a more positive outlook. The lack of significant negative regulatory action in major markets has also contributed to the positive sentiment surrounding Bitcoin. [Link to relevant news article about Bitcoin regulation]

-

Macroeconomic Factors: Global economic uncertainty, fueled by inflation and geopolitical tensions, has driven investors towards alternative assets, including Bitcoin. Bitcoin's decentralized and deflationary nature makes it an attractive safe haven for some. [Link to relevant article on macroeconomic factors influencing Bitcoin]

-

Halving Anticipation: The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, is a significant event that historically has preceded price increases. The anticipation of the next halving is likely contributing to the current bullish sentiment. [Link to article discussing Bitcoin halving]

-

On-Chain Metrics: Increased transaction volume and a rising mining difficulty indicate a healthy and active network, supporting the price increase. This suggests growing demand and network strength. [Link to relevant on-chain data source]

Potential Factors Driving Bitcoin Towards $100,000

Several long-term factors could propel Bitcoin towards the $100,000 mark.

Increasing Institutional Adoption

The continued influx of institutional investment is a significant factor. As more institutional players enter the market, increased liquidity and demand will likely push prices higher. This suggests a growing acceptance of Bitcoin as a legitimate asset class within traditional financial institutions.

Growing Global Adoption

Increasing adoption in developing countries and regions is a powerful driver for price appreciation. As Bitcoin's utility as a medium of exchange and store of value becomes more widely recognized, demand will increase. This global Bitcoin adoption is a key factor in long-term price growth.

Limited Supply and Scarcity

Bitcoin's limited supply of 21 million coins is a fundamental aspect of its value proposition. As demand increases, but the supply remains capped, the scarcity drives up the price. This inherent scarcity is a crucial element underpinning the potential for a $100,000 Bitcoin.

Challenges and Risks on the Path to $100,000

Despite the positive momentum, several challenges and risks could hinder Bitcoin's journey to $100,000.

Regulatory Uncertainty

The evolving regulatory landscape poses a significant risk. Differing regulatory approaches across jurisdictions create uncertainty and could impact investor confidence. Strict regulations could dampen Bitcoin's growth potential.

Market Volatility

Bitcoin is inherently volatile. Sharp price swings are a characteristic feature of the cryptocurrency market. Unexpected market corrections could derail the upward trend. Understanding Bitcoin volatility is crucial for any investor.

Competition from Altcoins

The emergence of competing cryptocurrencies (altcoins) presents a challenge. Altcoins offer alternative investment opportunities, potentially diverting investment away from Bitcoin. This altcoin competition is a factor to consider in long-term Bitcoin price forecasting.

The $100,000 Bitcoin Question - A Look Ahead

The recent Bitcoin price surge is a significant development, presenting a compelling case for future growth. While the factors driving the increase are encouraging, potential challenges remain. A $100,000 Bitcoin is not guaranteed, and the market's volatility should not be underestimated. However, the combination of institutional adoption, growing global usage, and inherent scarcity positions Bitcoin favorably for long-term appreciation. The journey to $100,000 will likely be bumpy, but the potential rewards are significant.

Stay informed about the latest Bitcoin price movements and continue your research into the potential for a $100,000 Bitcoin. Follow our blog for more insightful analysis on the future of Bitcoin and cryptocurrency investing.

Featured Posts

-

Willy Adames Walk Off Hit Wins Giants Home Opener

May 07, 2025

Willy Adames Walk Off Hit Wins Giants Home Opener

May 07, 2025 -

The Cavaliers Dilemma Keeping Caris Le Vert Or Facing A Roster Reshuffle

May 07, 2025

The Cavaliers Dilemma Keeping Caris Le Vert Or Facing A Roster Reshuffle

May 07, 2025 -

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025 -

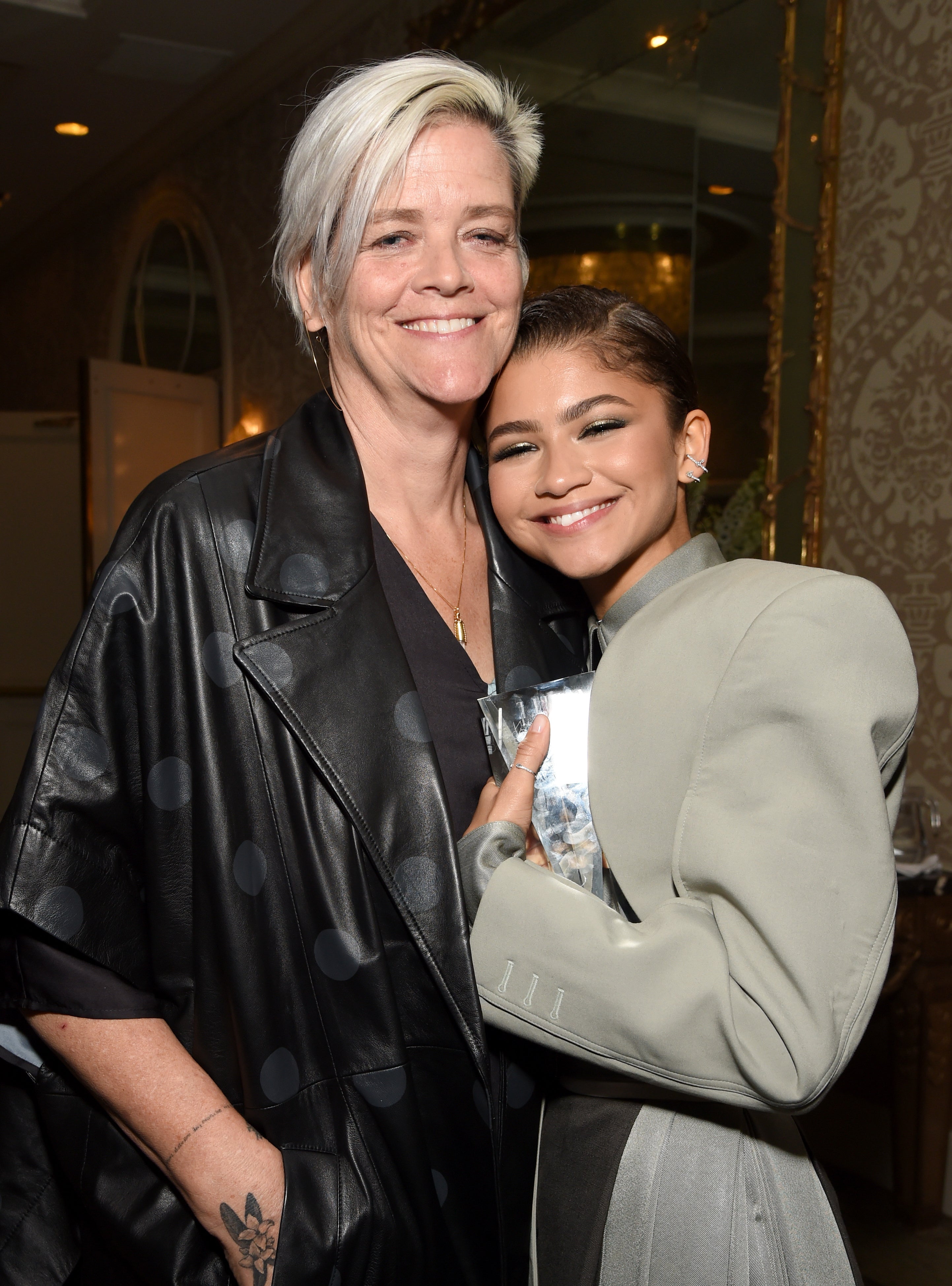

The Breadwinner Zendaya Balancing Career And Family Ties

May 07, 2025

The Breadwinner Zendaya Balancing Career And Family Ties

May 07, 2025 -

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025