100 Days Of Trump: Examining The Changes In Elon Musk's Net Worth

Table of Contents

- The Trump Presidency's Initial Economic Impact

- Early Market Reactions

- Impact on Tesla's Stock Price

- Analyzing Elon Musk's Net Worth Fluctuations

- Net Worth Calculation Methodology

- Tracking Net Worth Changes

- Factors Beyond Trump's Policies

- Internal Tesla Factors

- Global Market Conditions

- Long-Term Implications

- Post-100 Day Perspective

The Trump Presidency's Initial Economic Impact

Early Market Reactions

The early days of the Trump administration saw a mixed market reaction to his proposed policies. Initial optimism surrounding promises of deregulation and tax cuts led to a surge in several market indices.

- Dow Jones Industrial Average: Experienced a significant upward trend in the first few weeks, reaching record highs.

- S&P 500: Followed a similar pattern, reflecting broad market confidence.

- Nasdaq: While initially positive, the Nasdaq showed some fluctuations depending on how specific tech companies were perceived as benefiting or being impacted by the new administration's stance.

However, these early gains were not sustained throughout the entire 100-day period. Uncertainty surrounding specific policy implementations and potential international trade conflicts introduced volatility. For example, the initial reaction to Trump's executive orders on immigration caused some short-term market dips before recovering.

Impact on Tesla's Stock Price

Tesla's stock price, a major component of Elon Musk's net worth, experienced a rollercoaster ride during Trump's first 100 days. While the overall market showed initial optimism, Tesla's performance was influenced by both external factors (like the broader market trends linked to Trump's policies) and internal factors.

- Production Challenges: Tesla's ongoing struggles to meet production targets for the Model 3 impacted investor sentiment and stock prices.

- Policy Changes: Potential policy changes regarding electric vehicles and renewable energy, while initially positive for Tesla, also introduced a level of uncertainty into the market.

- Market Sentiment: The general positive market sentiment initially boosted Tesla's stock price; however, periods of overall market correction negatively influenced Tesla as well.

[Insert a chart or graph here visualizing Tesla's stock price fluctuations during the first 100 days of the Trump presidency.]

Analyzing Elon Musk's Net Worth Fluctuations

Net Worth Calculation Methodology

Elon Musk's net worth is predominantly derived from his substantial ownership stake in Tesla, Inc. The calculation involves multiplying the number of shares he owns by the current market price per share.

- Tesla Stock: This is the primary driver of Musk's net worth fluctuations.

- SpaceX Valuation: SpaceX, another company Musk leads, also contributes to his net worth, although its valuation is less frequently updated and publicly available.

- Other Investments: Musk's personal investments in other ventures can also influence his overall net worth, though to a lesser extent.

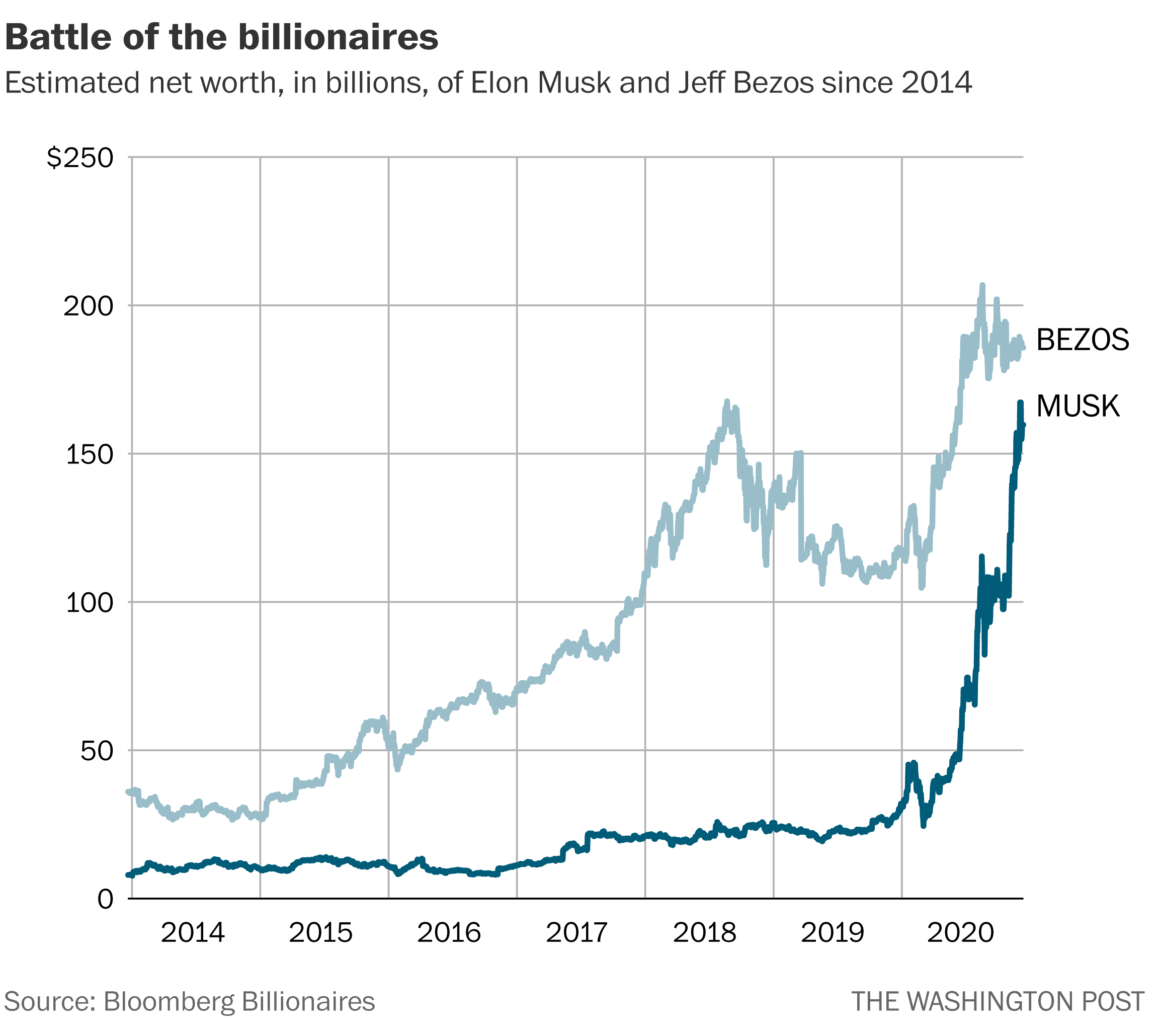

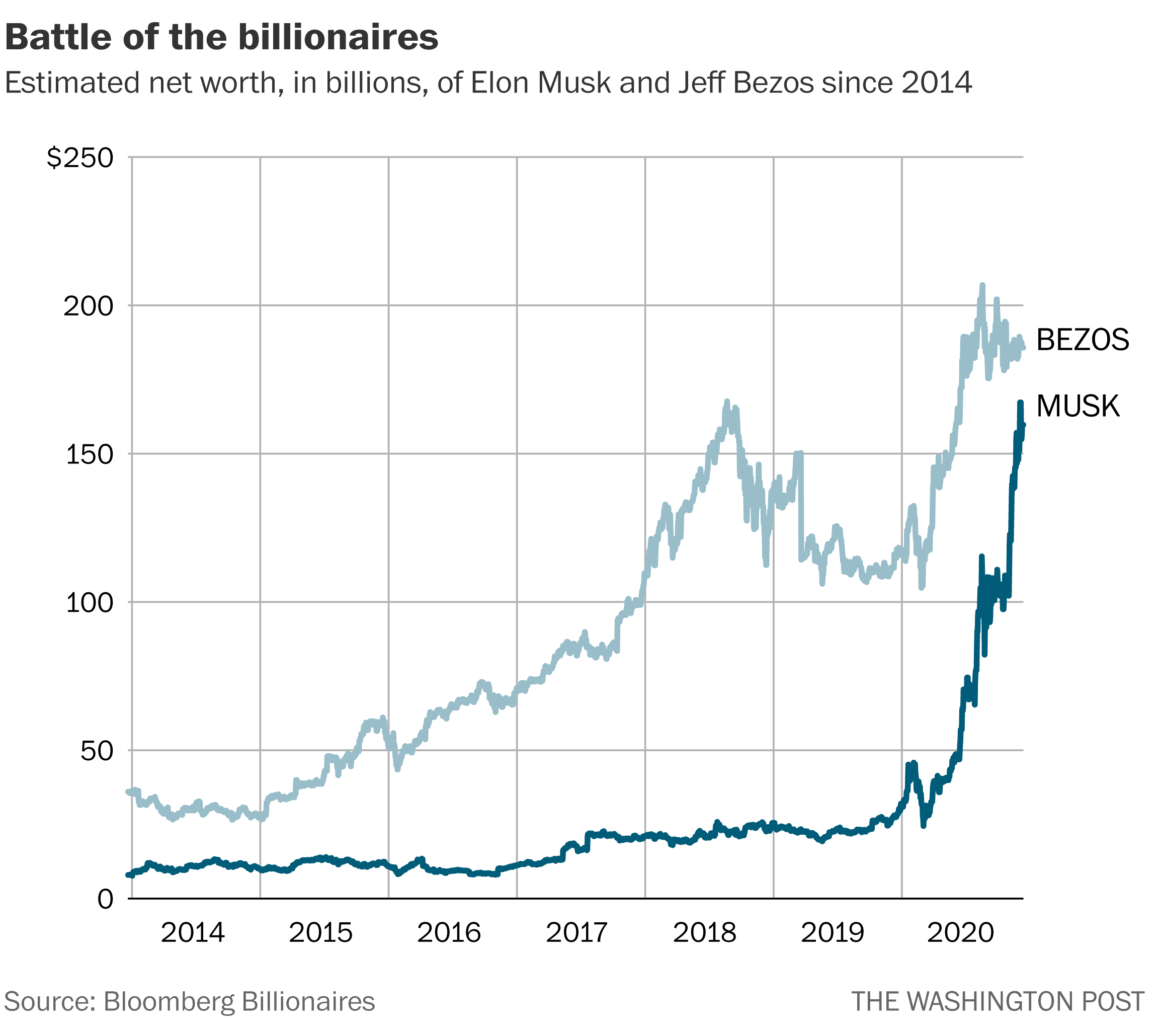

Reputable sources for net worth data include Bloomberg Billionaires Index and Forbes Real-Time Billionaires list. These sources use various methodologies but generally follow a similar approach to calculate and update real-time net worth estimates.

Tracking Net Worth Changes

During Trump's first 100 days, Elon Musk's net worth mirrored the volatility of Tesla's stock price. While the exact figures fluctuate depending on the source and the day of measurement, it's clear that significant changes occurred.

[Insert a chart or graph here visualizing Elon Musk's net worth fluctuations during the first 100 days of the Trump presidency. Highlight the peak and trough points.]

While precise quantification of the total change requires specifying a timeframe, substantial gains and losses were experienced depending on the daily stock performance of Tesla.

Factors Beyond Trump's Policies

Internal Tesla Factors

It's crucial to acknowledge that factors unrelated to Trump's policies also significantly influenced Elon Musk's net worth during this period. Tesla faced internal challenges such as:

- Production Bottlenecks: Meeting Model 3 production targets proved a significant hurdle, affecting investor confidence.

- Executive Turnover: Changes in Tesla's executive team added to the uncertainty surrounding the company's future.

- New Product Launches: The success or failure of new product launches played a substantial role in investor sentiment and stock prices.

Global Market Conditions

Global economic factors also played a part in shaping Elon Musk's net worth.

- Oil Prices: Fluctuations in oil prices affected investor sentiment towards Tesla, as it is perceived as a competitor to traditional gasoline-powered vehicles.

- International Trade: Uncertainty surrounding international trade policies impacted global market stability and consequently, Tesla's stock price.

- Currency Exchange Rates: Changes in currency exchange rates could influence Tesla's financial performance and, therefore, Musk's net worth.

Long-Term Implications

Post-100 Day Perspective

Beyond the initial 100 days, the correlation between Trump's policies and Elon Musk's net worth continued to be complex and intertwined with various internal and global factors. Tesla's stock continued its fluctuating trajectory, with several upward and downward trends shaped by a combination of Trump's ongoing administration, market conditions, and Tesla's own performance metrics.

Conclusion:

The first 100 days of the Trump presidency had a demonstrable, yet complex, impact on Elon Musk's net worth. While initial market optimism linked to Trump's policies positively influenced Tesla's stock, internal challenges at Tesla and broader global economic factors played an equally significant role. The relationship between "Elon Musk net worth Trump" demonstrates the intricate interaction between political events, company performance, and broader market conditions. Understanding this complex interplay requires considering multiple influencing factors and analyzing long-term trends.

Call to Action: Want to stay updated on the complex relationship between politics and the net worth of leading entrepreneurs? Follow our blog for more in-depth analyses on "Elon Musk net worth Trump" and other related topics. Continue exploring the impact of political events on the financial markets.

Where To Start A Business A Map Of The Countrys Best New Locations

Where To Start A Business A Map Of The Countrys Best New Locations

Nyt Strands Game 374 Solutions And Hints For Wednesday March 12

Nyt Strands Game 374 Solutions And Hints For Wednesday March 12

Sharing Experiences The Effect Of Trumps Policies On Transgender Individuals

Sharing Experiences The Effect Of Trumps Policies On Transgender Individuals

Brian Brobbey Physical Prowess Poses A Threat In Upcoming Europa League Match

Brian Brobbey Physical Prowess Poses A Threat In Upcoming Europa League Match

Jared Kushners Quiet Role In Trumps Upcoming Middle East Trip

Jared Kushners Quiet Role In Trumps Upcoming Middle East Trip