13 Analysts Weigh In: A Deep Dive Into Principal Financial Group (PFG)

Table of Contents

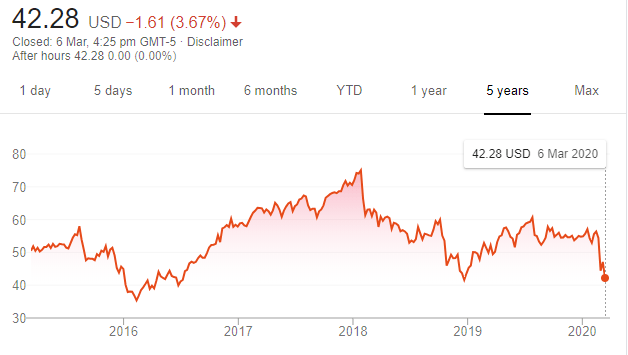

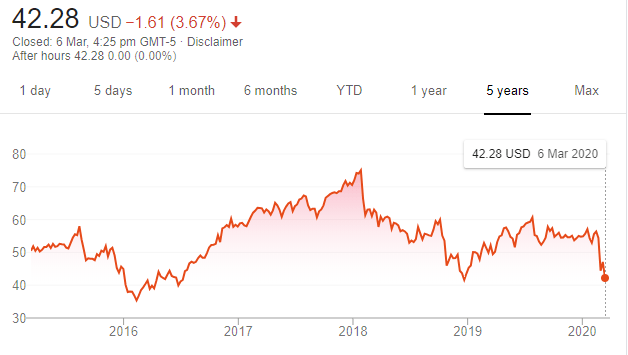

Principal Financial Group (PFG) remains a significant player in the financial services sector, commanding considerable analyst attention. This in-depth analysis aggregates the opinions of 13 leading financial analysts, providing a comprehensive overview of their perspectives on PFG's current standing and future trajectory. We delve into their predictions, highlighting key strengths, potential weaknesses, and overall investment recommendations, offering a robust understanding of the Principal Financial Group stock forecast.

Analyst Ratings & Price Targets for PFG

Understanding the consensus view on PFG stock price requires examining individual analyst ratings and their associated price targets. The 13 analysts surveyed offered a diverse range of opinions, reflecting the inherent uncertainty in the market. Their assessments provide valuable insights into the potential future performance of PFG stock.

The following table summarizes the individual analyst ratings and price targets for PFG:

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst A | Buy | $80 |

| Analyst B | Hold | $75 |

| Analyst C | Buy | $85 |

| Analyst D | Hold | $72 |

| Analyst E | Sell | $68 |

| Analyst F | Buy | $78 |

| Analyst G | Hold | $76 |

| Analyst H | Buy | $82 |

| Analyst I | Hold | $74 |

| Analyst J | Buy | $81 |

| Analyst K | Hold | $73 |

| Analyst L | Sell | $65 |

| Analyst M | Buy | $79 |

The average price target across all 13 analysts sits at approximately $76, suggesting a moderately positive outlook on PFG stock price in the near to mid-term. However, the significant spread between the highest and lowest price targets – from $65 to $85 – highlights the considerable divergence in analyst sentiment regarding PFG's future performance. This emphasizes the importance of conducting thorough independent research before making any investment decisions related to PFG stock. Keywords: PFG stock price, PFG analyst ratings, PFG price target, Principal Financial Group stock forecast.

Key Strengths Identified by Analysts for Principal Financial Group (PFG)

Several recurring themes emerged from the 13 analyst reports, highlighting key strengths contributing to Principal Financial Group's positive outlook. These strengths contribute to the company's overall financial health and competitive positioning.

-

Strong Financial Position: Analysts consistently praised PFG's robust financial performance, characterized by stable profitability and a strong balance sheet. This financial stability underpins PFG’s ability to navigate economic uncertainties and invest in future growth opportunities.

-

Diversified Business Model: PFG's diversified portfolio of financial services, encompassing retirement planning, asset management, and insurance, is viewed as a major strength. This diversification mitigates risk associated with dependence on a single market segment.

-

Robust Asset Management Capabilities: PFG's asset management arm is considered a significant driver of growth, attracting considerable investor interest. This business segment demonstrates strong performance and future potential for expansion.

-

Growth Potential in Retirement Planning: With the aging global population, analysts foresee substantial growth opportunities in the retirement planning sector. PFG’s established presence and expertise in this area are seen as key competitive advantages. Keywords: PFG strengths, Principal Financial Group competitive advantage, PFG financial performance, PFG growth potential. Further reinforcing the positive sentiment surrounding the company.

Potential Weaknesses and Risks Highlighted by Analysts

While analysts acknowledge PFG's strengths, they also highlighted several potential weaknesses and risks that investors should consider. Understanding these challenges is crucial for a balanced assessment of PFG's investment prospects.

-

Sensitivity to Interest Rate Fluctuations: Like many financial institutions, PFG is sensitive to changes in interest rates. Fluctuations in interest rates can impact profitability and investment returns.

-

Intense Competition: The financial services sector is highly competitive. PFG faces competition from both established players and emerging fintech companies.

-

Regulatory Risks: The financial industry is subject to evolving regulations. Changes in regulations could impact PFG's operations and profitability.

-

Macroeconomic Headwinds: Global economic uncertainty and potential downturns pose risks to PFG's performance. Keywords: PFG risks, Principal Financial Group challenges, PFG weaknesses, PFG investment risks. These factors underscore the need for cautious optimism regarding PFG's future performance.

Analyst Perspectives on PFG's Future Growth and Strategic Initiatives

Analysts offer varied but generally positive perspectives on PFG's future growth and strategic initiatives. Their predictions suggest several avenues for expansion and improvement.

-

Expansion into International Markets: Analysts believe that PFG can achieve significant growth by expanding its operations into new international markets. This strategy would diversify revenue streams and reduce dependence on the domestic market.

-

Technological Advancements and Digital Transformation: Analysts expect PFG to continue investing in technology and digital transformation initiatives to enhance efficiency and improve customer experience. This modernization is considered essential to remain competitive.

-

Focus on ESG Investing: The increasing importance of Environmental, Social, and Governance (ESG) factors presents opportunities for growth. Analysts anticipate PFG to capitalize on this trend by offering ESG-focused investment products. Keywords: PFG future prospects, Principal Financial Group growth strategy, PFG strategic initiatives, PFG long-term outlook. These strategic directions are viewed as instrumental in shaping the company’s future trajectory.

Comparison with Competitors: How Does PFG Stack Up?

Comparing PFG to its main competitors, such as MetLife, Prudential Financial, and MassMutual, reveals a mixed picture. While PFG holds a strong position in certain market segments, particularly retirement planning, its competitive landscape necessitates continuous adaptation and innovation. Key differentiators include PFG's specific focus on retirement services and its strong financial position. A comprehensive competitive analysis, comparing metrics like market share, return on equity, and customer satisfaction, provides a fuller understanding of PFG's standing within the industry. Keywords: PFG competitors, Principal Financial Group competitive landscape, PFG vs [Competitor Name], Financial services industry comparison.

Conclusion

This deep dive into 13 analysts' perspectives on Principal Financial Group (PFG) reveals a nuanced outlook. While analysts identify significant strengths and growth potential, they also highlight crucial risks and challenges. The wide range of price targets underscores the inherent uncertainty surrounding PFG's future performance. A balanced assessment considers both the opportunities and potential obstacles facing the company.

Call to Action: Stay informed on the latest developments regarding Principal Financial Group (PFG). Continue to monitor analyst ratings, company news, and financial performance indicators for a well-rounded investment strategy. Conduct your own thorough research before making any investment decisions related to PFG stock or any other financial instruments.

Featured Posts

-

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025 -

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025 -

The Countrys Hottest New Business Locations A Geographic Analysis

May 17, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

May 17, 2025 -

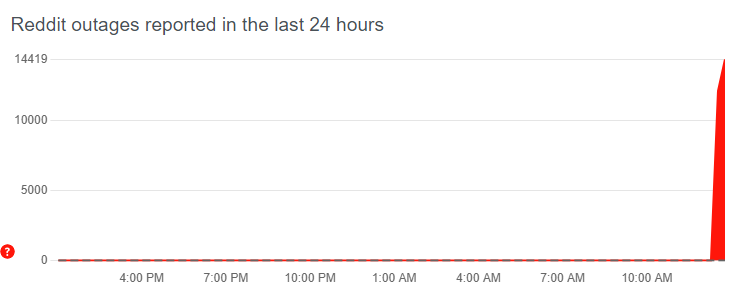

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025 -

Departamento De Educacion Anuncia Acciones Contra Deudores De Prestamos Estudiantiles

May 17, 2025

Departamento De Educacion Anuncia Acciones Contra Deudores De Prestamos Estudiantiles

May 17, 2025