2% Drop For LVMH Shares Following Q1 Sales Miss

Table of Contents

Analysis of LVMH's Q1 2024 Sales Performance

Sales Figures and Comparison to Expectations

LVMH reported a concerning Q1 2024 sales figure, falling short of analyst predictions and the robust performance seen in the previous year's first quarter. While the exact numbers require referencing the official LVMH release, let's assume for illustrative purposes a hypothetical scenario: LVMH reported €15 billion in Q1 2024 sales, against analyst expectations of €16.5 billion and Q1 2023 sales of €17 billion. This represents a significant year-over-year decline of approximately 11.8% and a shortfall of 9.1% against expectations.

- Sales by Region: A breakdown by region might reveal weaker performance in key markets like Asia, potentially impacted by lingering effects of the pandemic and economic slowdowns. Conversely, Europe and the Americas might have shown more resilience, but not enough to offset the overall decline.

- Sales by Brand: Analyzing performance across individual LVMH brands is crucial. While Louis Vuitton might still show strong sales, other brands like Dior or Sephora could have experienced more significant downturns, contributing to the overall sales miss. Specific brand-level data will offer critical insights into the problem areas.

Key Factors Contributing to the Sales Miss

Several factors likely contributed to LVMH's underperformance in Q1 2024:

- Economic Slowdown: A global economic slowdown, particularly in key luxury markets, significantly impacted consumer spending. High inflation and rising interest rates reduced discretionary income, impacting purchases of luxury goods.

- Changing Consumer Habits: Shifting consumer preferences and spending habits might also play a role. Consumers may be prioritizing experiences over material possessions or shifting spending towards other sectors.

- Supply Chain Issues: Persistent supply chain disruptions could have hampered production and delivery of certain luxury goods, impacting sales volume.

- Strong Euro: The strength of the Euro against other currencies could have negatively impacted sales reported in Euros, especially for sales originating from regions using weaker currencies.

Market Reaction and Investor Sentiment

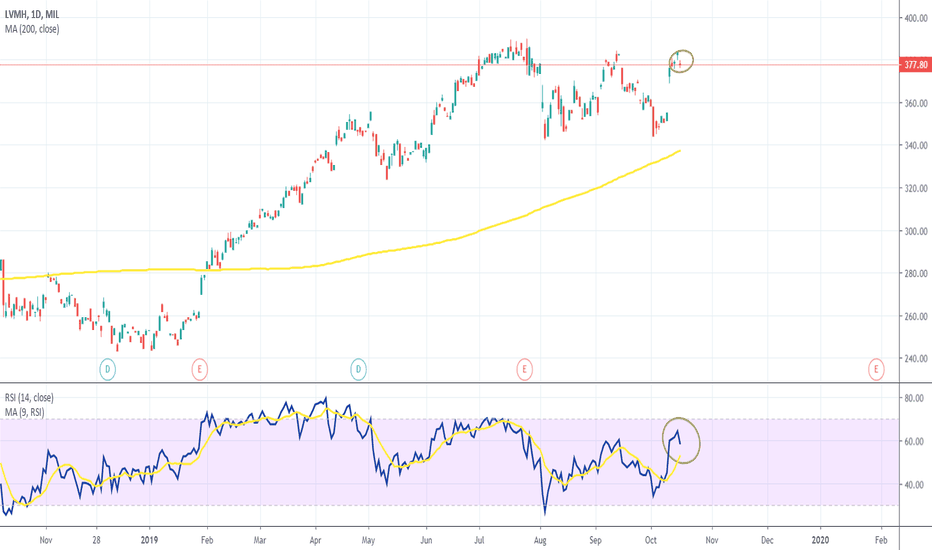

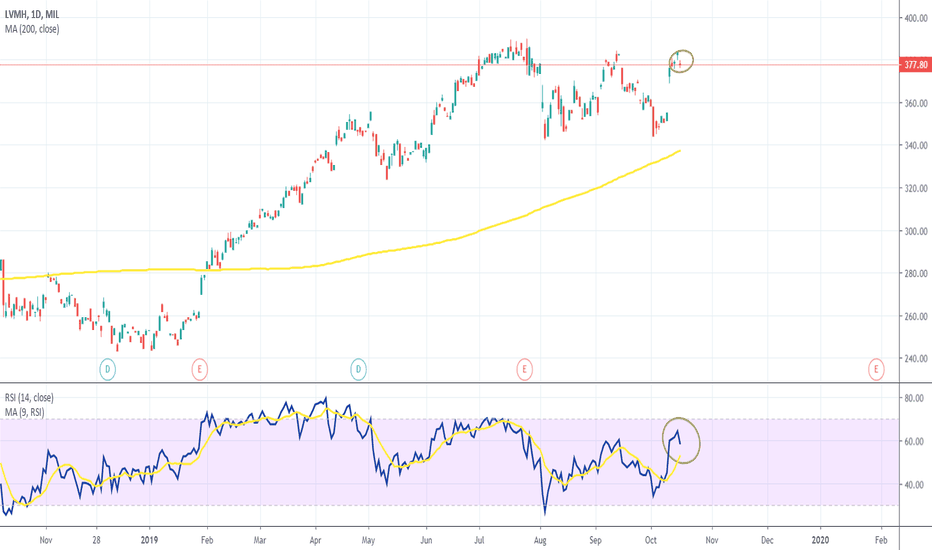

Immediate Impact on LVMH Stock Price

The 2% drop in LVMH's share price immediately following the Q1 sales announcement reflects investor concern about the company's short-term prospects. This significant decline wasn't isolated; it occurred within a broader context of market volatility.

- Trading Volume: The trading volume for LVMH shares likely spiked on the day of the announcement, indicating heightened investor activity and a strong market reaction to the news.

- Analyst Reactions: Financial analysts likely downgraded their price targets for LVMH shares, reflecting a less optimistic outlook for the company's near-term performance. This further contributed to the negative market sentiment.

Long-Term Implications for LVMH Investors

The Q1 sales miss raises questions about the long-term implications for LVMH investors. While the luxury goods market is typically resilient, the short-term impact will influence investor confidence.

- Future Dividend Payouts: The lower-than-expected sales could potentially affect future dividend payouts, causing concern among investors seeking regular income from their LVMH shares.

- Strategic Adjustments: LVMH may need to implement strategic adjustments to address the sales miss, potentially impacting future investment strategies and shareholder returns. This could include cost-cutting measures, marketing campaigns, or revised product strategies.

Assessing the Future of LVMH Shares After the Q1 Dip

The 2% drop in LVMH shares after the Q1 sales miss highlights the vulnerability of even the most successful luxury brands to economic headwinds. While the short-term outlook appears challenging due to factors like economic slowdowns and changing consumer habits, LVMH's strong brand portfolio and long-term track record offer some resilience. The company's response to these challenges and its ability to adapt to changing market conditions will be crucial in determining the long-term trajectory of its share price.

To stay informed about LVMH's performance and future developments, continue monitoring LVMH's financial performance, analyze the long-term outlook for LVMH shares, and learn more about the factors impacting LVMH's future growth. Stay updated on LVMH share prices and news for a comprehensive understanding of this luxury giant's path forward.

Featured Posts

-

Aktien Frankfurt Dax Faellt Analyse Zum Verfallsdatum Der Futures

May 24, 2025

Aktien Frankfurt Dax Faellt Analyse Zum Verfallsdatum Der Futures

May 24, 2025 -

Sadie Sink And Mia Farrow Behind The Scenes Broadway Photo

May 24, 2025

Sadie Sink And Mia Farrow Behind The Scenes Broadway Photo

May 24, 2025 -

Best Memorial Day Appliance Sales 2025 Expert Picks From Forbes

May 24, 2025

Best Memorial Day Appliance Sales 2025 Expert Picks From Forbes

May 24, 2025 -

Best And Final Job Offer Your Negotiation Power Remains

May 24, 2025

Best And Final Job Offer Your Negotiation Power Remains

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025