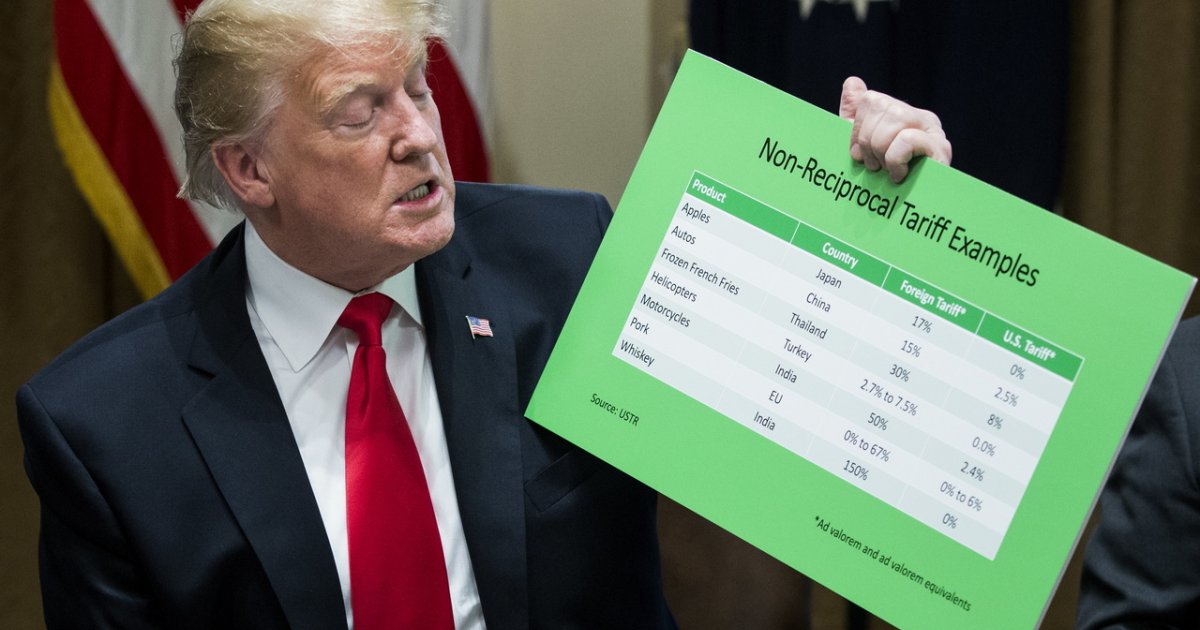

2% Fall On Amsterdam Stock Exchange: Impact Of Trump's Tariff Announcement

Table of Contents

Immediate Market Reaction to Trump's Tariff Announcement

The announcement of the new tariffs triggered an immediate and palpable reaction on the AEX index. Stock prices plummeted across various sectors, highlighting the deep interconnectedness of the Dutch economy with global trade. The impact was particularly pronounced in export-oriented industries and technology companies, which are heavily reliant on international trade relationships. Market volatility soared as investors reacted to the uncertainty created by the escalating trade war.

- Specific Sector Impacts: The technology sector, a key component of the AEX, felt the brunt of the initial shock. Companies heavily reliant on US trade saw sharper declines.

- Examples of Stock Price Drops:

- ASML Holding (ASML.AS) experienced a 1.5% decline within the first hour of trading.

- Philips (PHIA.AS) saw a 2% drop, reflecting concerns about the impact on its US sales.

- Companies heavily reliant on US trade saw sharper declines, averaging a 3-4% drop in the initial trading hours.

[Insert chart/graph here illustrating the AEX's immediate decline post-announcement]

The immediate reaction underscores the significant vulnerability of the AEX to global trade tensions and the pervasive influence of Trump tariffs on the Dutch economy. Keywords for this section include AEX index, stock prices, market volatility, sector impact, immediate reaction.

Long-Term Economic Consequences for the Netherlands

The long-term consequences of these Trump tariffs extend beyond the immediate market fluctuations. The Dutch economy, with its significant export-driven sectors, is particularly susceptible to trade wars. The potential long-term effects include:

- Increased Costs for Dutch Businesses: Dutch businesses importing materials from the US will face increased costs, potentially squeezing profit margins and hindering competitiveness.

- Reduced Competitiveness: Dutch goods will become less competitive in the US market, leading to reduced exports and potential job losses in affected industries.

- Retaliatory Tariffs: The EU may impose retaliatory tariffs on US goods, further exacerbating the economic downturn and complicating trade relations. This could also impact the agricultural sector which is a significant part of Dutch exports. Manufacturing and even tourism sectors could see a knock-on effect from decreased economic activity.

The potential for a prolonged trade war poses a serious threat to the long-term health of the Dutch economy. Keywords for this section include Dutch economy, long-term impact, trade relations, EU, export, import, economic consequences.

Government Response and Mitigation Strategies

The Dutch government has responded to the tariff announcement with a mixture of concern and proactive measures. While official statements acknowledge the severity of the situation, concrete actions are still unfolding.

- Government Statements: Initial government statements emphasized the need for a coordinated EU response and highlighted the potential negative impacts on Dutch businesses.

- Economic Aid Packages: Discussions are underway regarding potential aid packages to support affected businesses, possibly including tax breaks or subsidies.

- EU Cooperation: The Dutch government is actively engaging with its EU partners to formulate a united front against the Trump administration's protectionist policies.

[Insert information about specific government actions if available]

Comparison with Other European Markets

Compared to other major European stock exchanges, such as the DAX (Germany) and CAC 40 (France), the AEX's performance appears to have been disproportionately affected by the Trump tariff announcement. This could be attributed to the Netherlands' high level of trade integration with the US, particularly in the technology sector. Further analysis is needed to fully understand the nuances of the differential market reactions. Keywords for this section include European stock markets, market comparison, relative performance.

Conclusion: Understanding the Amsterdam Stock Exchange's 2% Fall

The 2% fall on the Amsterdam Stock Exchange represents a significant immediate impact from President Trump's tariff announcement, with long-term consequences yet to fully unfold. The technology and export-oriented sectors are particularly vulnerable, facing increased costs, reduced competitiveness, and potential job losses. The Dutch government's response will be crucial in mitigating these negative effects, particularly through coordinated EU action and effective economic support packages. To stay informed about developments on the Amsterdam Stock Exchange and the evolving impact of Trump's tariffs, subscribe to our updates or follow reputable financial news sources. Further research into the AEX index and its complex relationship with global trade is encouraged.

Featured Posts

-

Aex Index Falls Below Key Support Level Amid Market Volatility

May 24, 2025

Aex Index Falls Below Key Support Level Amid Market Volatility

May 24, 2025 -

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025 -

Selling Sunset Star Speaks Out On La Fire Price Gouging

May 24, 2025

Selling Sunset Star Speaks Out On La Fire Price Gouging

May 24, 2025 -

Mamma Mia Ferrari Hot Wheels New Sets Reviewed

May 24, 2025

Mamma Mia Ferrari Hot Wheels New Sets Reviewed

May 24, 2025 -

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025