20 Million XRP Purchased: Whale Activity Sparks Market Speculation

Table of Contents

The Significance of the 20 Million XRP Purchase

The sheer volume of XRP involved—20 million—makes this purchase exceptionally significant. Its impact resonates across several key areas of the XRP ecosystem.

Market Impact

The immediate effect of this massive XRP whale activity was noticeable.

- Price Increase/Decrease: While the exact percentage fluctuation varies depending on the timeframe and exchange, initial reports suggest a noticeable, albeit potentially short-lived, increase in XRP's price. Further analysis is needed to determine the sustained impact.

- Increased Trading Volume: The purchase undoubtedly contributed to a surge in XRP trading volume, indicating heightened market interest and activity. This increased liquidity can be a double-edged sword, potentially fueling both upward and downward price movements.

- Impact on Market Capitalization: The purchase directly influenced XRP's overall market capitalization, albeit marginally compared to the entire cryptocurrency market. However, the psychological impact on investors is arguably more significant.

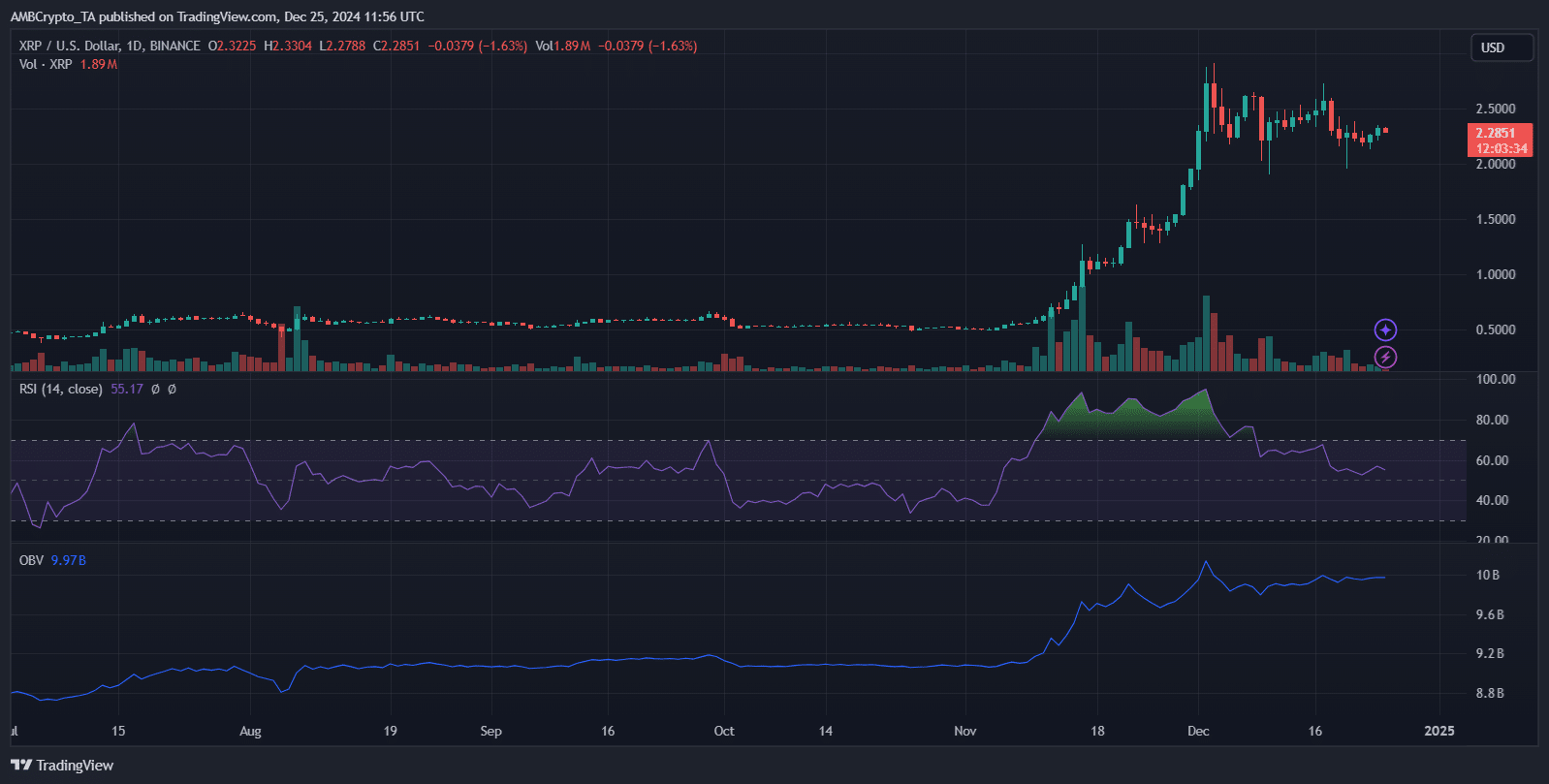

Analyzing charts from leading cryptocurrency exchanges reveals a clear spike in trading activity coinciding with the reported 20 million XRP purchase. Unusual patterns, such as unusually large buy orders preceding the main transaction, also warrant further investigation into potential market manipulation.

Identifying the Whale

Unmasking the identity of the buyer presents a significant challenge.

- Anonymity in Crypto Transactions: The inherent anonymity of blockchain transactions makes pinpointing the buyer extremely difficult. Tracking the origin of the funds and the subsequent movement of the XRP requires advanced blockchain analysis techniques.

- Speculation about Institutional Investors: Many speculate that a large institutional investor or a significant fund might be behind the purchase. This would suggest a strategic, long-term investment in XRP, rather than a short-term trading maneuver.

- Potential for Market Manipulation: While unlikely in this case due to the sheer volume, the possibility of market manipulation cannot be entirely dismissed. Large purchases can sometimes be used to artificially inflate prices, though this carries substantial risks.

Despite the inherent challenges, blockchain analysts are working to uncover clues, leveraging on-chain data to shed light on the buyer’s identity. However, definitive conclusions remain elusive.

Speculation and Predictions Following the XRP Whale Activity

The 20 million XRP purchase has fueled intense speculation and a flurry of price predictions.

Price Predictions

The cryptocurrency community is divided on the implications of this whale activity for XRP’s future price.

- Bullish vs. Bearish Predictions: Bullish analysts believe the purchase signifies growing confidence in XRP, predicting a further price rise. Bearish analysts, however, point to the ongoing legal uncertainty surrounding Ripple and the SEC lawsuit as a major risk factor.

- Price Targets: Predictions vary widely, ranging from modest gains to significant price increases over the next year. These targets are often based on technical analysis, market sentiment, and predictions of Ripple’s success in the ongoing litigation.

- Reasoning Behind Predictions: Predictions are largely based on subjective interpretations of market data and projections about the future legal landscape. The ongoing Ripple vs. SEC case significantly impacts investor sentiment and therefore, price predictions.

Several reputable crypto analysts have weighed in, with their predictions and rationale reported across leading financial news outlets. However, it's crucial to approach all predictions with a healthy dose of skepticism.

Ripple's Role

Ripple's ongoing legal battle with the SEC casts a long shadow over XRP's future.

- Impact of Legal Uncertainty on Investor Sentiment: The lawsuit creates significant uncertainty, impacting investor confidence and affecting XRP's price volatility. A positive resolution for Ripple could significantly boost XRP's value, while an adverse outcome could have the opposite effect.

- Potential Outcomes of the Lawsuit: Possible outcomes range from a complete dismissal of the case to a ruling against Ripple, potentially affecting XRP's classification as a security.

- Ripple's Response to the Whale Activity: Ripple has remained relatively quiet about the 20 million XRP purchase, though the company likely monitors such significant market events closely. Their response, or lack thereof, further fuels speculation.

The legal battle remains a pivotal factor affecting XRP's price trajectory and broader adoption.

Analyzing the Whale's Strategy and Potential Motivations

Understanding the whale's strategy requires considering various possibilities.

Accumulation Strategy

The 20 million XRP purchase could be part of a larger accumulation strategy.

- Long-Term Investment: The buyer may be accumulating XRP for a long-term investment, anticipating significant price appreciation driven by increased adoption or a favorable resolution to the Ripple lawsuit.

- Anticipation of Price Increase: The whale might be anticipating positive news related to XRP or Ripple that could trigger a price surge.

- Market Manipulation (if applicable): Although less likely given the volume, the possibility of manipulating the market for short-term gains cannot be ruled out.

Evidence supporting an accumulation strategy would involve observing continued XRP purchases over a longer period. Such consistent buying pressure could suggest a longer-term vision rather than a short-term trading strategy.

Other Potential Motives

Alternative motives for the large purchase could include:

- Short-Term Profit Taking: The buyer might have acquired the XRP at a lower price and is now taking profits, potentially anticipating a short-term price correction.

- Hedging Against Market Volatility: The purchase might be a hedging strategy, mitigating losses in other parts of the buyer's investment portfolio.

- Other Potential Scenarios: There are numerous other potential scenarios that could explain the purchase, ranging from supporting Ripple's ecosystem to simply taking advantage of perceived undervalued XRP.

Investigating the surrounding market conditions and analyzing any subsequent transactions by the same entity are crucial for gaining a more complete picture.

Conclusion

The 20 million XRP purchase represents a significant event in the XRP market, triggering considerable speculation and price volatility. The whale's motives remain unclear, though several plausible explanations—including long-term accumulation and short-term profit-taking—have been proposed. The ongoing Ripple vs. SEC lawsuit continues to be a major factor influencing XRP's price and future prospects. Monitoring XRP price and trading volume closely following this significant event is crucial. To stay informed about further developments concerning the 20 million XRP purchased and related XRP whale activity, follow reputable cryptocurrency news sources and price tracking websites. Stay informed and make your own informed decisions about investing in XRP.

Featured Posts

-

Ssc Chsl Tier 3 Result 2025 And Final Selection List Check Now

May 07, 2025

Ssc Chsl Tier 3 Result 2025 And Final Selection List Check Now

May 07, 2025 -

Duobele Ir Nba Lyderiu Nesekme Kas Nutiko

May 07, 2025

Duobele Ir Nba Lyderiu Nesekme Kas Nutiko

May 07, 2025 -

Understanding The Conclave Electing The Head Of The Catholic Church

May 07, 2025

Understanding The Conclave Electing The Head Of The Catholic Church

May 07, 2025 -

Multidao Dorme Nas Ruas Do Vaticano Em Homenagem Ao Papa Francisco

May 07, 2025

Multidao Dorme Nas Ruas Do Vaticano Em Homenagem Ao Papa Francisco

May 07, 2025 -

Geen Scream 7 Voor Jenna Ortega Haar Reden Geopenbaard

May 07, 2025

Geen Scream 7 Voor Jenna Ortega Haar Reden Geopenbaard

May 07, 2025