£202 Million Euromillions: Winning Strategies And Financial Planning

Table of Contents

Imagine: your life transforms overnight. The numbers match, and you've won the life-changing £202 Million Euromillions jackpot. This article outlines the essential steps to secure your financial future after such a monumental win, from improving your odds to expertly managing your newfound wealth.

<h2>Smart Euromillions Strategies for Increasing Your Odds</h2>

While winning the lottery remains largely a matter of chance, understanding the odds and employing responsible strategies can enhance your experience.

<h3>Understanding Lottery Odds and Probabilities</h3>

The odds of winning the Euromillions jackpot are astronomical, approximately 1 in 140 million. However, understanding these odds helps set realistic expectations. Many myths surround lottery strategies, such as "lucky numbers" or patterns. The truth is, each draw is independent, and every number combination has an equal chance of winning.

- Quick Picks vs. Choosing Your Own Numbers: There's no statistical advantage to either method. Quick picks are convenient, while choosing your own numbers allows for a personalized approach.

- Playing Consistently vs. Sporadically: While consistency doesn't guarantee a win, it ensures you're in the draw for every opportunity. However, always remember to play responsibly within your budget.

<h3>Responsible Lottery Participation: Setting a Budget</h3>

Before buying your next Euromillions ticket, determine a realistic budget you can comfortably afford. Winning the lottery shouldn't lead to financial ruin, and avoiding overspending is crucial.

- Track your spending: Keep a record of how much you spend on lottery tickets.

- Set a limit: Decide on a maximum amount to spend per week or month, and stick to it.

- Prioritize needs: Ensure your essential expenses are covered before allocating funds to lottery tickets.

<h3>Syndicates: Pooling Resources for Higher Chances</h3>

Joining a Euromillions syndicate allows you to pool resources with friends or colleagues, increasing your chances of winning without significantly increasing your individual financial risk.

- Advantages: Increased ticket purchasing power, shared winnings (if successful), and a more enjoyable group experience.

- Disadvantages: Potential disagreements over the division of winnings, reliance on others for participation, and the need for a clear legal agreement to prevent disputes. Always ensure a legally binding agreement outlines how winnings will be divided to avoid conflicts.

<h2>Financial Planning After Winning £202 Million Euromillions</h2>

Winning £202 million requires a meticulous and professional approach to financial management.

<h3>Seeking Expert Financial Advice: The Importance of Professionals</h3>

Navigating the complexities of managing a vast sum of money requires expert guidance. Financial advisors, lawyers, and accountants are crucial for tax planning, investment strategies, and asset protection.

- Tax planning: Minimizing tax liabilities on your winnings is paramount.

- Investment strategies: Developing a diversified investment portfolio tailored to your goals.

- Asset protection: Safeguarding your wealth through trusts and other legal structures.

<h3>Protecting Your Identity and Privacy Post-Win</h3>

Winning a large lottery prize brings increased public attention. Protecting your identity and privacy is vital to your safety and security.

- Limit public information: Avoid announcing your win publicly unless absolutely necessary.

- Secure your personal details: Use strong passwords and be cautious about sharing sensitive information.

- Consider professional security: Employing security personnel may be wise to protect yourself and your family.

<h3>Strategic Investment and Wealth Management</h3>

£202 million demands a diverse investment strategy to minimize risk and maximize long-term returns.

- Real estate: Investing in property offers potential for rental income and capital appreciation.

- Stocks and bonds: Diversifying your portfolio across different asset classes mitigates risk.

- Alternative investments: Exploring options like private equity or hedge funds (with appropriate professional guidance).

<h3>Charitable Giving and Philanthropy</h3>

Donating a portion of your winnings to charity offers significant tax benefits and personal fulfillment.

- Tax deductions: Charitable donations often reduce your overall tax burden.

- Impactful giving: Choose organizations aligned with your values, maximizing the positive impact of your generosity.

- Establish a foundation: Setting up a charitable foundation allows for more structured and long-term philanthropic efforts.

<h2>Conclusion: Secure Your Financial Future After Winning £202 Million Euromillions</h2>

Winning the £202 million Euromillions jackpot is a life-altering event. Successfully navigating this new reality requires a proactive approach, encompassing smart lottery strategies, responsible spending, and expert financial guidance. Remember that creating a robust financial plan before you even purchase a ticket is a responsible step. Seek professional advice immediately upon winning to secure your financial future, manage your winning Euromillions responsibly, and make informed decisions about investments and philanthropy. Don't let the dream of winning the Euromillions jackpot turn into a financial nightmare—plan ahead and prepare for success. Winning the Euromillions is a significant event, and proper planning will ensure you can enjoy this once-in-a-lifetime opportunity to the fullest.

Featured Posts

-

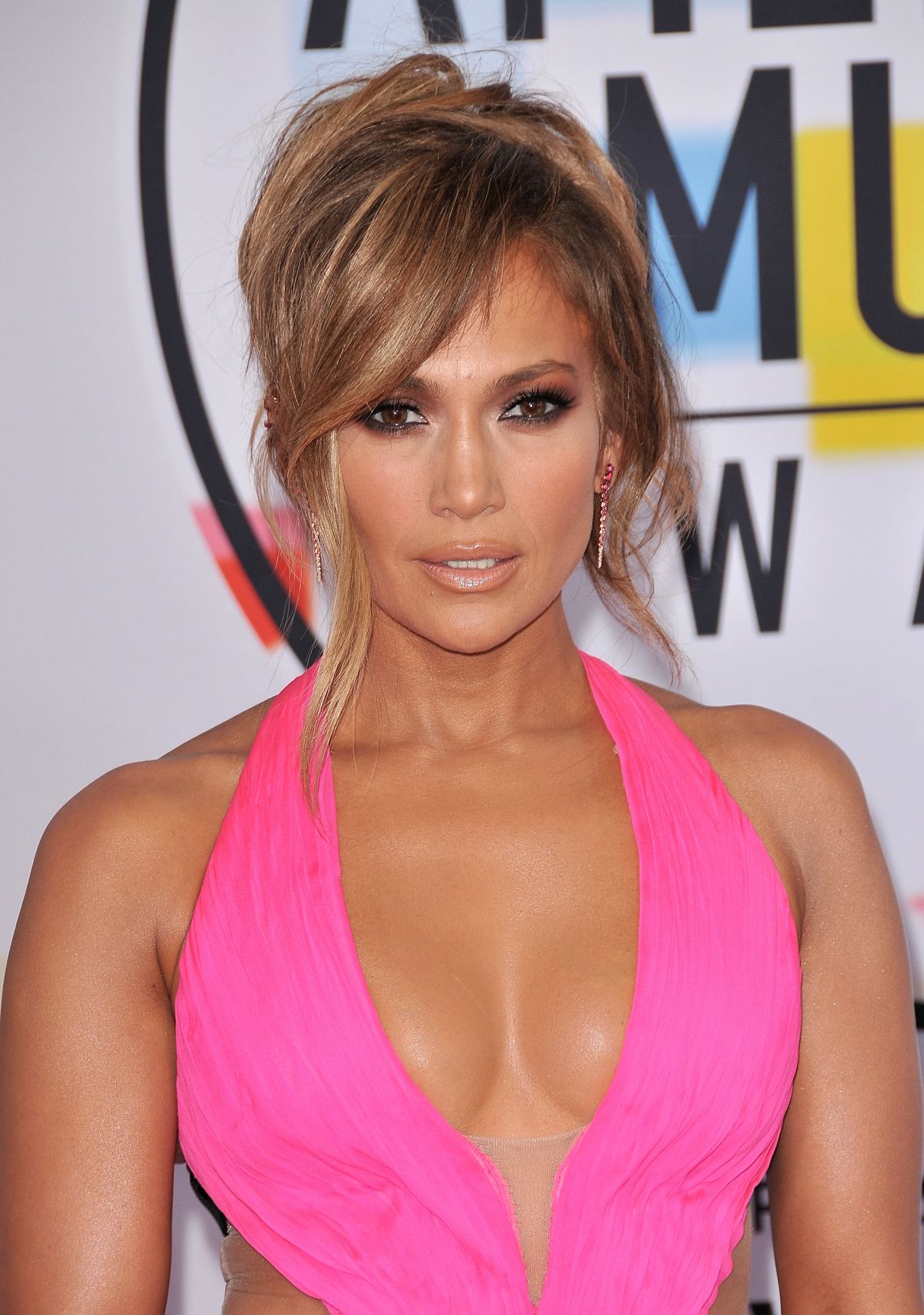

2025 Amas What To Expect At This Years Awards Show

May 28, 2025

2025 Amas What To Expect At This Years Awards Show

May 28, 2025 -

Nathan Broadheads Goal Gives Ipswich Vital Win Over Bournemouth

May 28, 2025

Nathan Broadheads Goal Gives Ipswich Vital Win Over Bournemouth

May 28, 2025 -

Etfs Thrive Unwavering Investor Confidence In Turbulent Markets

May 28, 2025

Etfs Thrive Unwavering Investor Confidence In Turbulent Markets

May 28, 2025 -

Jannik Sinners Italian Open Outlook Following Doping Ban Announcement

May 28, 2025

Jannik Sinners Italian Open Outlook Following Doping Ban Announcement

May 28, 2025 -

2025 American Music Awards Jennifer Lopez As Host

May 28, 2025

2025 American Music Awards Jennifer Lopez As Host

May 28, 2025