2024 Market Trends: Emerging Markets Soar, US Markets Falter

Table of Contents

The Rise of Emerging Markets: A New Economic Powerhouse

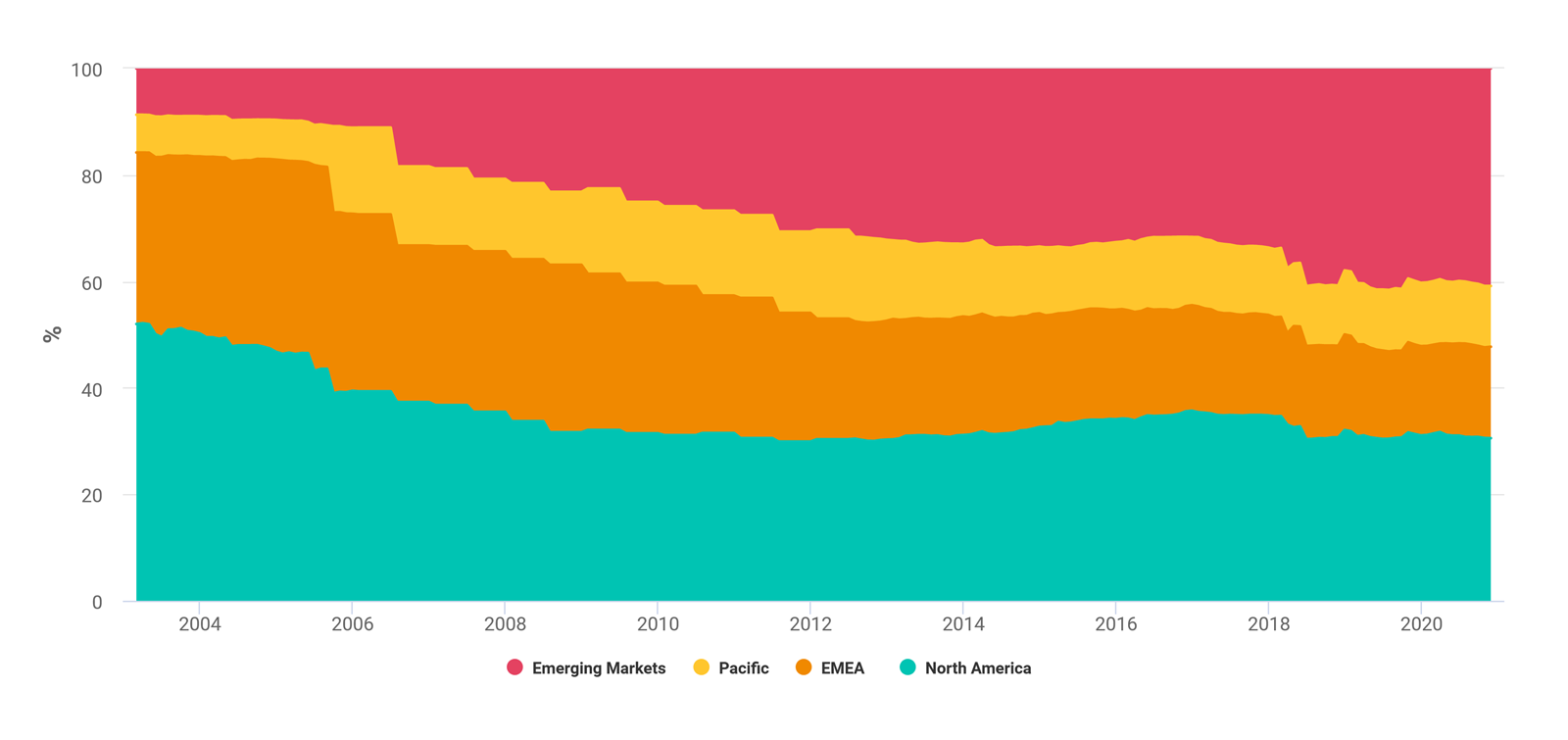

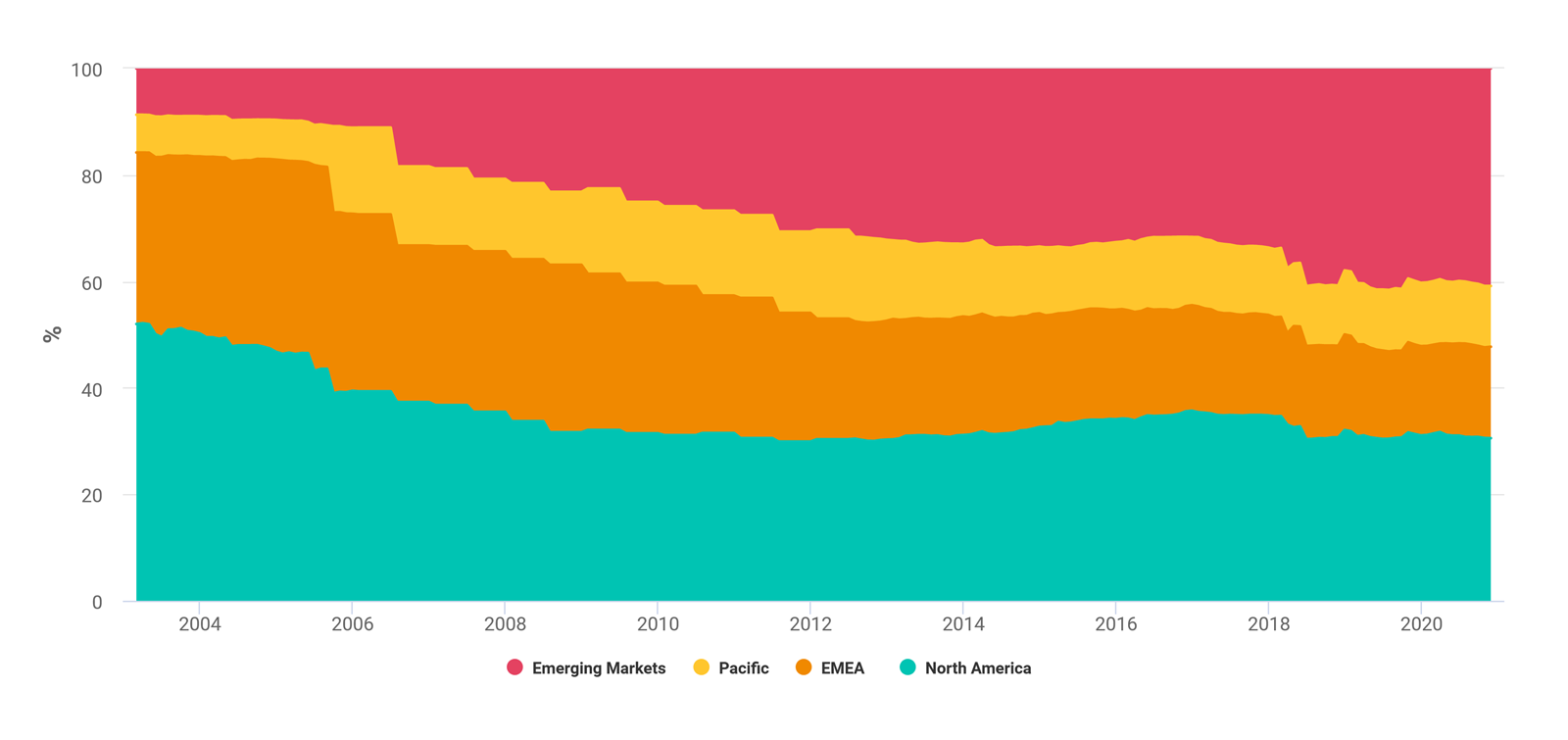

The narrative of 2024 is undeniably one of the rise of emerging markets. These dynamic economies are no longer simply developing; they are becoming significant economic powerhouses, reshaping the global economic order. This growth is driven by a confluence of factors, creating a compelling investment landscape.

Factors Fueling Emerging Market Growth:

-

Increased Consumer Spending in Developing Nations: A burgeoning middle class in countries like India, Indonesia, and Nigeria is driving a significant increase in consumer spending. This fuels demand for goods and services, stimulating economic growth across various sectors.

-

Rapid Technological Advancements and Digital Transformation: Emerging markets are rapidly adopting new technologies, skipping stages of development seen in established economies. This digital leapfrog allows for quicker innovation and efficiency gains. From mobile payments to e-commerce, technology is revolutionizing businesses and consumer behavior in emerging markets.

-

Government Initiatives Promoting Economic Diversification: Many emerging market governments are actively implementing policies to diversify their economies, reducing reliance on commodities and fostering growth in sectors like technology and manufacturing. This strategic diversification reduces vulnerability to global economic shocks.

-

Strategic Foreign Investment in Key Sectors: Foreign direct investment (FDI) is flowing into emerging markets, targeting sectors with high growth potential. This influx of capital boosts infrastructure development, technological advancements, and job creation.

-

Growing Middle Class in Key Emerging Markets: The expansion of the middle class in countries like India and those in Southeast Asia represents a massive increase in purchasing power. This fuels domestic consumption and provides a fertile ground for businesses to thrive.

-

Examples of Strong Performing Emerging Markets:

- India's Tech Sector: India's booming technology sector is attracting significant global investment and creating numerous high-paying jobs.

- African Infrastructure Development: Massive investments in infrastructure projects across Africa are creating opportunities for growth and development.

-

Illustrative Data Points: While specific figures fluctuate, reports from organizations like the IMF consistently show higher GDP growth rates in several emerging markets compared to developed economies. Emerging market indices, such as the MSCI Emerging Markets Index, often outperform their developed market counterparts in periods of growth.

Challenges Facing US Markets in 2024

While emerging markets experience a surge, the US market faces several significant challenges in 2024. These headwinds are impacting economic growth and creating uncertainty for businesses and investors.

Inflation and Interest Rate Hikes:

Persistent inflation continues to erode consumer purchasing power and increase the cost of borrowing for businesses. The Federal Reserve's efforts to curb inflation through interest rate hikes have slowed economic growth and increased the risk of a recession. This creates a challenging environment for investment and economic expansion.

Geopolitical Uncertainty and Supply Chain Disruptions:

Global conflicts and political instability contribute to market volatility and disrupt supply chains. The lingering effects of the pandemic, coupled with geopolitical tensions, continue to impact the availability and cost of goods, hindering economic growth.

-

Relevant Economic Indicators: Data on inflation rates, GDP growth, consumer confidence, and unemployment rates in the US paint a picture of a slowing economy.

-

Vulnerable US Sectors: Sectors like manufacturing and retail are particularly vulnerable to inflation, supply chain disruptions, and reduced consumer spending.

-

Expert Opinions: Many economic experts predict continued volatility and slower growth in the US market in 2024.

Investing in Emerging Markets: Opportunities and Risks

The rise of emerging markets presents significant investment opportunities, but it's crucial to understand and manage the associated risks.

Identifying Promising Investment Opportunities:

-

High-Growth Sectors: Sectors like renewable energy, technology, and infrastructure offer significant growth potential in emerging markets. These areas are often characterized by rapid technological advancement and significant government support.

-

Diversification: Diversification across various emerging markets and sectors is vital to mitigate risk and maximize returns. A well-diversified portfolio can withstand the volatility inherent in emerging markets.

Mitigating Risks in Emerging Markets:

-

Political Instability and Currency Fluctuations: Political instability and currency fluctuations are significant risks in emerging markets. These factors can impact investment returns and create uncertainty.

-

Risk Management Strategies: Hedging strategies, diversification, and thorough due diligence can help mitigate these risks. Investors should carefully research individual markets and companies before committing capital.

-

Practical Advice for Investors: Thorough research, professional advice, and a long-term investment horizon are crucial for success in emerging markets.

-

Successful Investment Strategies: Value investing and focusing on companies with strong fundamentals can yield positive returns in emerging markets.

-

Investment Vehicles: Exchange-traded funds (ETFs) and mutual funds focused on emerging markets offer diversified exposure to these dynamic economies.

Conclusion

The 2024 market landscape reveals a compelling narrative of shifting economic power. While the US faces significant challenges, the growth trajectory of emerging markets presents exciting opportunities. Understanding these trends is crucial for investors and businesses to adapt their strategies effectively. By carefully analyzing the factors driving growth in emerging markets and mitigating the risks associated with investment, you can capitalize on this dynamic shift and build a robust portfolio. Don't miss the opportunity to explore the potential of emerging markets and position yourself for future success in this evolving global economy. Start your research into emerging market investments today.

Featured Posts

-

John Travolta Shares Heartfelt Tribute To Son Jett On What Would Have Been His 33rd Birthday

Apr 24, 2025

John Travolta Shares Heartfelt Tribute To Son Jett On What Would Have Been His 33rd Birthday

Apr 24, 2025 -

Open Ai And Google Chrome The Latest From The Chat Gpt Ceo

Apr 24, 2025

Open Ai And Google Chrome The Latest From The Chat Gpt Ceo

Apr 24, 2025 -

Newsom Calls On Oil Companies Amid Soaring California Gas Prices

Apr 24, 2025

Newsom Calls On Oil Companies Amid Soaring California Gas Prices

Apr 24, 2025 -

La Fire Victims Face Price Gouging Reality Tv Star Highlights Exploitation

Apr 24, 2025

La Fire Victims Face Price Gouging Reality Tv Star Highlights Exploitation

Apr 24, 2025 -

Faa Study Highlights Las Vegas Airport Collision Concerns

Apr 24, 2025

Faa Study Highlights Las Vegas Airport Collision Concerns

Apr 24, 2025