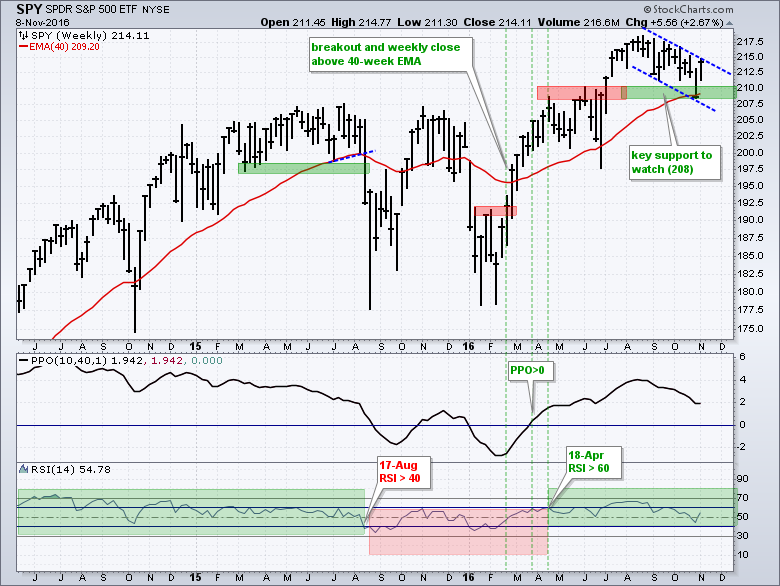

3%+ S&P 500 Surge: Analysis Of The US-China Trade Deal Impact

Table of Contents

The US-China Trade Deal: A Catalyst for Growth?

Recent developments in US-China trade negotiations have injected a dose of optimism into the market. While the relationship remains complex, positive signs of de-escalation in trade tensions have emerged. This shift toward reduced uncertainty is a significant driver of investor confidence.

- Positive signs of de-escalation in trade tensions: A series of meetings and agreements, though not always resulting in sweeping changes, have signaled a willingness from both sides to find common ground and avoid further escalation of the trade war.

- Potential for increased trade volume between the two countries: Easing of tariffs and improved trade relations pave the way for increased bilateral trade, boosting economic activity in both nations.

- Reduced uncertainty leading to increased investor confidence: The lessening of trade war anxieties allows businesses to make long-term plans, driving investment and fueling economic growth. This reduced uncertainty is a significant factor contributing to the improved investor sentiment.

- Specific examples of trade agreements or tariff reductions: While specific details often change rapidly, citing examples (if available at the time of writing) of agreed-upon tariff reductions or specific trade deals reached would strengthen this point. For instance, a reduction in tariffs on agricultural goods could be highlighted as a positive influence.

These developments contribute to investor optimism and increased market activity. The perception of decreased risk, coupled with the potential for renewed economic expansion, has likely fueled the recent S&P 500 surge. Keywords: trade war, tariff reduction, economic growth, investor sentiment.

Analyzing Other Contributing Factors to the S&P 500 Surge

It's crucial to acknowledge that the S&P 500 surge isn't solely attributable to the US-China trade deal. Several other factors have played a significant role in this market upswing.

- Strong corporate earnings reports: Positive earnings reports from major corporations indicate robust company performance and instill confidence among investors. This positive financial outlook directly contributes to increased stock valuations.

- Positive economic indicators (e.g., job growth, consumer spending): Strong job growth and rising consumer spending suggest a healthy economy, further bolstering investor confidence and driving market growth.

- Federal Reserve policy and interest rates: The Federal Reserve's monetary policy, including interest rate decisions, significantly influences market performance. A supportive monetary policy can encourage investment and economic growth.

- Global economic conditions: The overall health of the global economy also plays a crucial role. Positive global economic trends can contribute to a positive market outlook.

The interplay of these factors is complex. While the US-China trade deal alleviates uncertainty, the strong corporate earnings and healthy economic indicators provide a solid foundation for market growth. Keywords: corporate earnings, economic indicators, Federal Reserve, interest rates, global economy.

Assessing the Long-Term Implications

The long-term effects of the US-China trade agreement on the S&P 500 remain uncertain, but several potential outcomes merit consideration.

- Sustained economic growth potential: A stable trade relationship could lead to sustained economic growth, benefiting both countries and positively impacting the S&P 500.

- Increased market volatility (potential risks): While the current trend is positive, unexpected shifts in trade relations or global events could trigger increased market volatility. Geopolitical risks remain a significant factor.

- Geopolitical factors and their influence: Global events and geopolitical instability can significantly impact the market, creating periods of both growth and uncertainty. This is a consideration that must always remain in the investment equation.

- Opportunities for specific sectors (e.g., technology, manufacturing): Specific sectors may see disproportionate gains or losses depending on the terms of any trade agreement. Technology and manufacturing are particularly sensitive to trade relations.

The potential for further market growth exists, but investors should also be aware of the potential for corrections. A long-term perspective, informed by ongoing analysis of the economic and geopolitical landscape, is essential. Keywords: long-term investment, market volatility, geopolitical risks, sector performance.

Investment Strategies in Light of the S&P 500 Surge

The current market conditions call for a thoughtful investment strategy.

- Diversification strategies: Diversifying investments across different asset classes and sectors mitigates risk and protects against market downturns.

- Risk management techniques: Implementing robust risk management strategies is crucial to safeguard investments during periods of market volatility.

- Sector-specific investment opportunities: Certain sectors may offer more attractive opportunities than others, depending on the evolving trade dynamics. Careful sector analysis is vital.

- Importance of long-term investment planning: Long-term investment strategies, aligned with personal financial goals, provide a more stable approach to navigating market fluctuations.

Navigating the current market conditions requires a balanced approach. Combining careful analysis with a long-term investment strategy is crucial for investors seeking to maximize returns while managing risk. Keywords: investment strategy, risk management, portfolio diversification, long-term investment, stock market investing.

Conclusion

The 3%+ S&P 500 surge is a complex phenomenon driven by a confluence of factors. The easing of US-China trade tensions, while significant, is just one piece of the puzzle. Strong corporate earnings, positive economic indicators, and Federal Reserve policy all contribute to the overall market picture. While the current outlook is positive, understanding the ongoing dynamics between the US and China, as well as other global events, remains crucial for investors.

Understanding the complex interplay of factors influencing the S&P 500 requires continuous monitoring of US-China trade relations and broader economic trends. Stay informed on further developments in the US-China trade deal and its impact on your investment strategy. Consider consulting a financial advisor for personalized guidance on navigating the S&P 500 and other market fluctuations. Keywords: S&P 500, US-China trade deal, investment strategy, market analysis, financial advisor.

Featured Posts

-

Landman Ali Larter Previews Angelas Complex Arc In Season 2

May 13, 2025

Landman Ali Larter Previews Angelas Complex Arc In Season 2

May 13, 2025 -

Big Issue Kids Competition Winner Announced

May 13, 2025

Big Issue Kids Competition Winner Announced

May 13, 2025 -

Foreign Automakers In China Learning From The Experiences Of Bmw And Porsche

May 13, 2025

Foreign Automakers In China Learning From The Experiences Of Bmw And Porsche

May 13, 2025 -

Uppgifter Vem Tar Oever Atalanta

May 13, 2025

Uppgifter Vem Tar Oever Atalanta

May 13, 2025 -

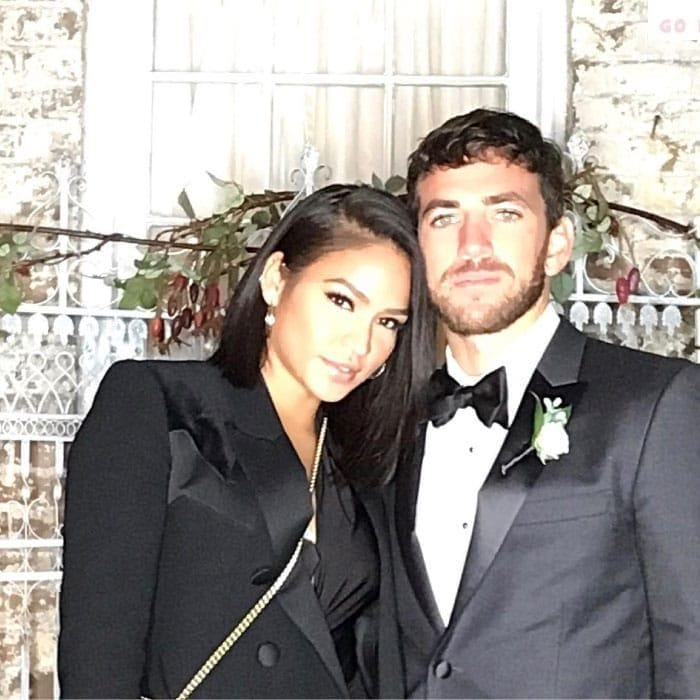

Pregnant Cassie Ventura And Alex Fines Red Carpet Debut At Mob Land Premiere

May 13, 2025

Pregnant Cassie Ventura And Alex Fines Red Carpet Debut At Mob Land Premiere

May 13, 2025