30-Year Treasury Yield Surge: Implications For The 'Sell America' Narrative

Table of Contents

Understanding the 30-Year Treasury Yield Surge

Factors Driving the Increase

Several interconnected factors contribute to the recent increase in the 30-year Treasury yield. Understanding these is crucial to dispelling or confirming the "Sell America" narrative.

-

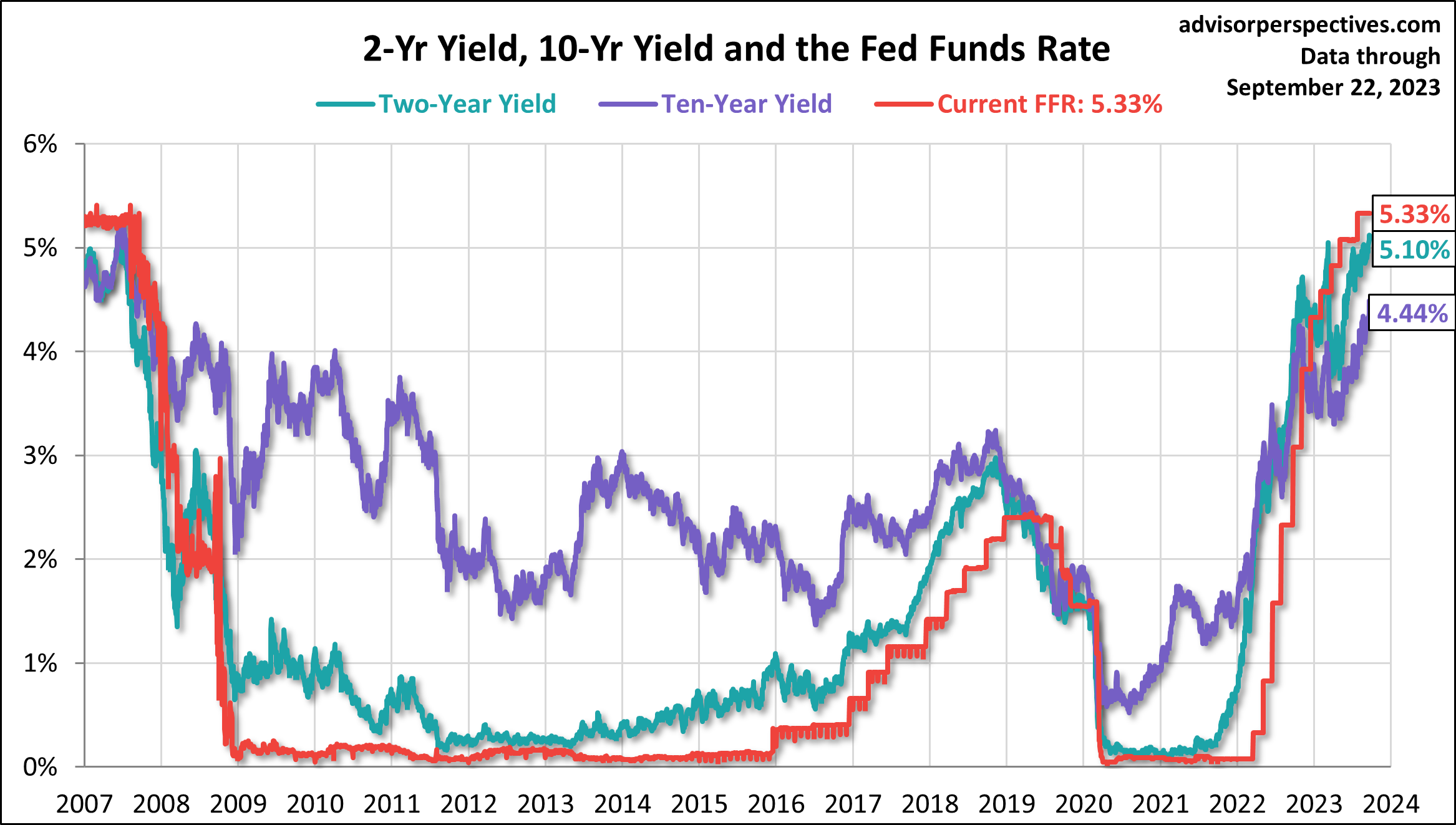

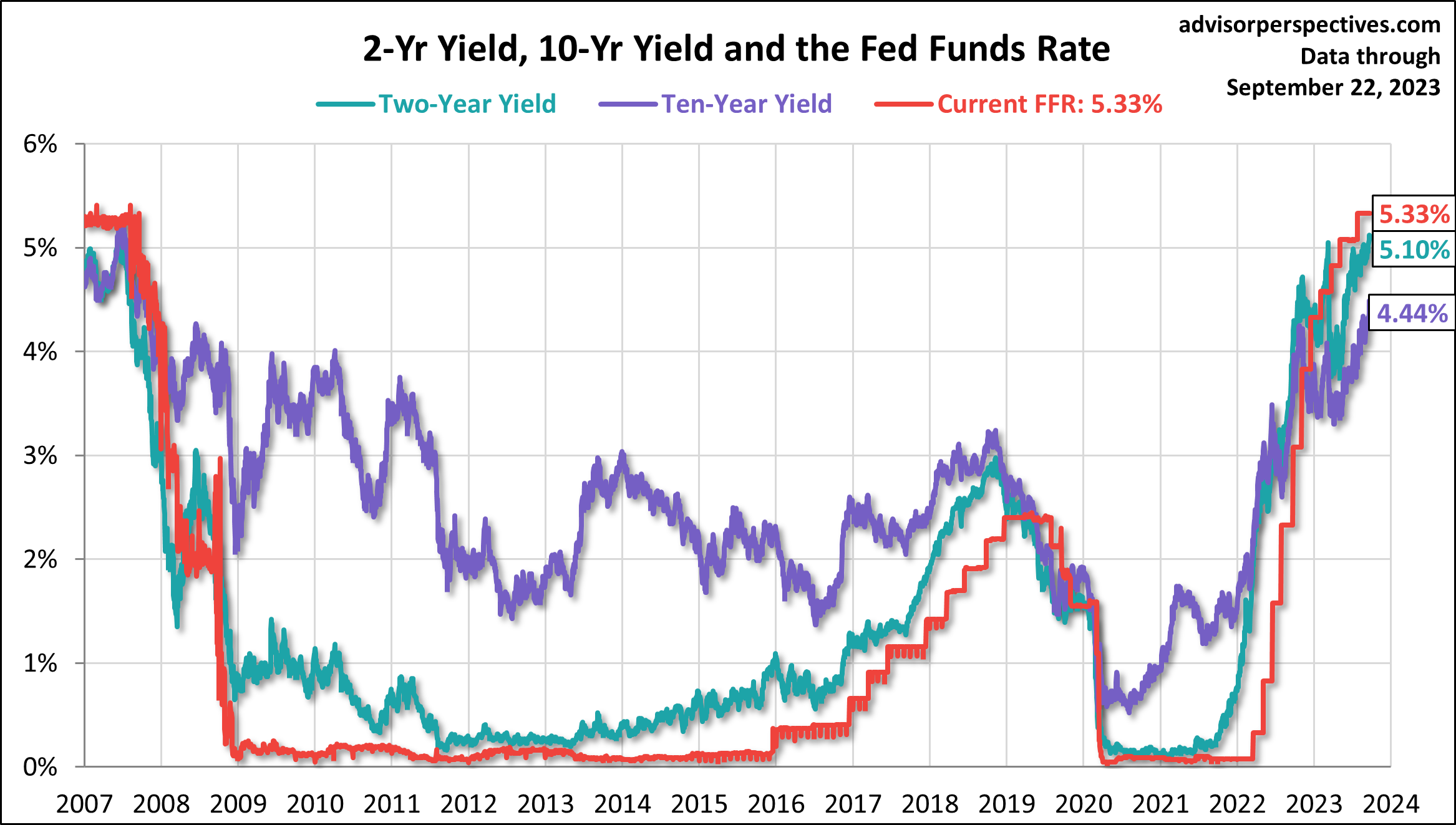

Inflationary Pressures and Federal Reserve Response: Persistent inflation has forced the Federal Reserve to implement a series of interest rate hikes. Higher interest rates generally lead to higher yields on Treasury bonds, including the 30-year yield. The Fed's actions aim to curb inflation, but this tightening monetary policy directly impacts bond yields.

-

Global Economic Uncertainty and Safe-Haven Demand: While the "Sell America" narrative suggests capital flight from the US, global economic instability often increases the demand for US Treasuries as a safe-haven asset. Investors might shift their portfolios towards the perceived safety of US government debt, even amidst concerns about the domestic economy. This counteracts the "Sell America" narrative's premise of widespread capital outflow.

-

Increased Borrowing Needs of the US Government: The US government's substantial borrowing requirements to fund its spending initiatives can also put upward pressure on Treasury yields. Increased supply, all else being equal, tends to push prices down and yields up.

-

Impact of Quantitative Tightening (QT) Policies: The Federal Reserve's quantitative tightening (QT) program involves reducing its holdings of Treasury securities. This reduction in demand can contribute to higher yields.

Analyzing the Yield Curve

The yield curve, a graphical representation of the yields of government bonds with different maturities, provides valuable insights into economic expectations. A steepening yield curve, where long-term yields rise more than short-term yields, often signals anticipated economic growth. However, an inverted yield curve (short-term yields exceeding long-term yields) is frequently viewed as a recessionary predictor. The recent surge in the 30-year Treasury yield, in relation to the overall yield curve shape, requires careful analysis to determine its implications for future economic growth or a potential recession. This nuanced view counters the simplistic "Sell America" narrative.

Assessing the "Sell America" Narrative

Examining Foreign Investment in US Treasuries

The "Sell America" narrative hinges on the idea that foreign investors are significantly reducing their holdings of US Treasuries. To assess this, we need to examine the data on foreign ownership of US government debt. While fluctuations occur, a significant sustained decline would support the narrative. However, alternative explanations, such as currency fluctuations or shifts in global investment strategies, must be considered before concluding that decreased foreign holdings reflect a lack of confidence in the US economy.

Evaluating Other Economic Indicators

Analyzing the 30-year Treasury yield in isolation is insufficient. A holistic assessment requires examining other key economic indicators:

- GDP Growth: Strong GDP growth can offset concerns about the 30-year yield surge.

- Unemployment Rate: A low unemployment rate indicates a healthy economy, weakening the "Sell America" argument.

- Consumer Confidence: High consumer confidence suggests faith in the economy, contradicting the narrative of widespread investor panic.

By comparing and contrasting these indicators with the 30-year Treasury yield, we can obtain a more comprehensive understanding of the economic situation and assess the validity of the "Sell America" narrative.

Alternative Interpretations of the Yield Surge

Increased Demand for Long-Term Bonds

The rise in the 30-year Treasury yield might not solely reflect a "Sell America" sentiment. It could also indicate increased demand for long-term, fixed-income investments, particularly from pension funds and other institutional investors seeking to hedge against inflation or match their long-term liabilities.

Global Factors Affecting Treasury Yields

Global economic conditions significantly impact US Treasury yields. International capital flows, global inflation concerns, and shifts in global monetary policies can all influence the demand for US Treasuries, irrespective of the domestic economic outlook. Attributing the yield surge solely to a loss of confidence in the US economy overlooks these crucial global factors.

Reframing the Narrative Around 30-Year Treasury Yields

In conclusion, the recent surge in the 30-year Treasury yield is a complex phenomenon driven by multiple factors. While the "Sell America" narrative offers a simplistic explanation, a thorough analysis reveals a more nuanced picture. The increase is not solely attributable to a loss of confidence in the US economy. Inflationary pressures, global economic uncertainties, government borrowing needs, and quantitative tightening policies all play significant roles. Furthermore, increased demand for long-term bonds and global economic dynamics influence the 30-year Treasury yield independently of any "Sell America" sentiment. Therefore, relying solely on the 30-year Treasury yield to gauge investor confidence in the US economy is an oversimplification.

Stay informed about fluctuations in the 30-year Treasury yield and its implications for the US economy. Continue to analyze the data surrounding the ‘Sell America’ narrative to develop a nuanced understanding of the situation and avoid simplistic interpretations. Careful consideration of multiple economic indicators is crucial for forming a well-informed opinion on the true meaning of this significant market movement.

Featured Posts

-

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 21, 2025

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 21, 2025 -

O Baggelis Giakoymakis Bullying Basanismoi Kai T Hanatos Se Ilikia 20 Eton

May 21, 2025

O Baggelis Giakoymakis Bullying Basanismoi Kai T Hanatos Se Ilikia 20 Eton

May 21, 2025 -

When College Towns Collapse The Economic Fallout Of Declining Enrollment

May 21, 2025

When College Towns Collapse The Economic Fallout Of Declining Enrollment

May 21, 2025 -

What Happened To David Walliams On Britains Got Talent

May 21, 2025

What Happened To David Walliams On Britains Got Talent

May 21, 2025 -

Watch Peppa Pig Online A Comprehensive Guide To Free And Paid Streaming Services

May 21, 2025

Watch Peppa Pig Online A Comprehensive Guide To Free And Paid Streaming Services

May 21, 2025