47% Spike In India Real Estate Investments: Q1 2024 Report

Table of Contents

Key Drivers Behind the 47% Spike in Indian Real Estate Investments

Several interconnected factors contributed to the extraordinary 47% increase in Indian real estate investments during Q1 2024. Let's examine the most significant drivers:

Reduced Interest Rates and Favorable Government Policies

Lower interest rates on home loans played a crucial role in making property ownership more accessible. The Reserve Bank of India's (RBI) monetary policies, aimed at stimulating economic growth, resulted in significantly reduced borrowing costs. This made mortgages more affordable, encouraging both first-time homebuyers and investors to enter the market.

- Impact of Lower Interest Rates: Data shows a direct correlation between reduced interest rates and increased home loan applications, leading to a surge in property sales.

- Government Initiatives: Several government schemes, such as affordable housing initiatives and tax benefits for homebuyers, further boosted investor confidence and stimulated demand. The simplification of real estate regulatory processes also played a significant role.

- Keywords: home loans, government schemes, affordable housing, tax benefits, infrastructure development, real estate policy

Increased Demand for Residential Properties

The demand for residential properties across all segments – luxury, mid-segment, and affordable – witnessed a significant upswing. This heightened demand is fueled by several factors:

- Population Growth and Urbanization: India's rapidly growing population and ongoing urbanization are key drivers of increased housing demand, particularly in major metropolitan areas.

- Improved Living Standards: Rising disposable incomes and improved living standards have fueled aspirations for better housing, pushing demand higher across segments.

- Data on Sales Figures: Reports indicate a substantial increase in property registrations and sales figures across major cities, confirming this surge in demand.

- Keywords: residential properties, housing demand, urbanization, population growth, property sales

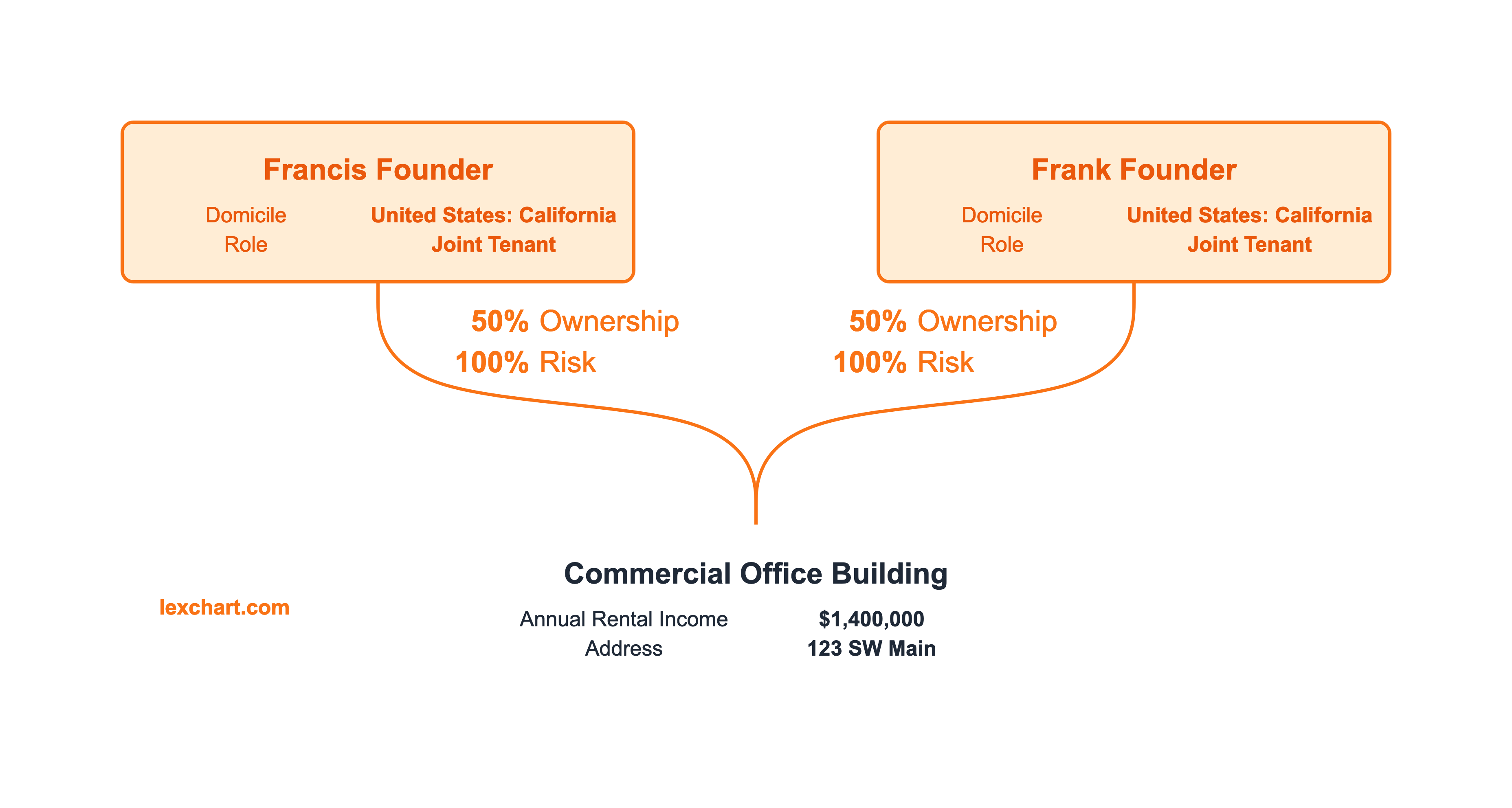

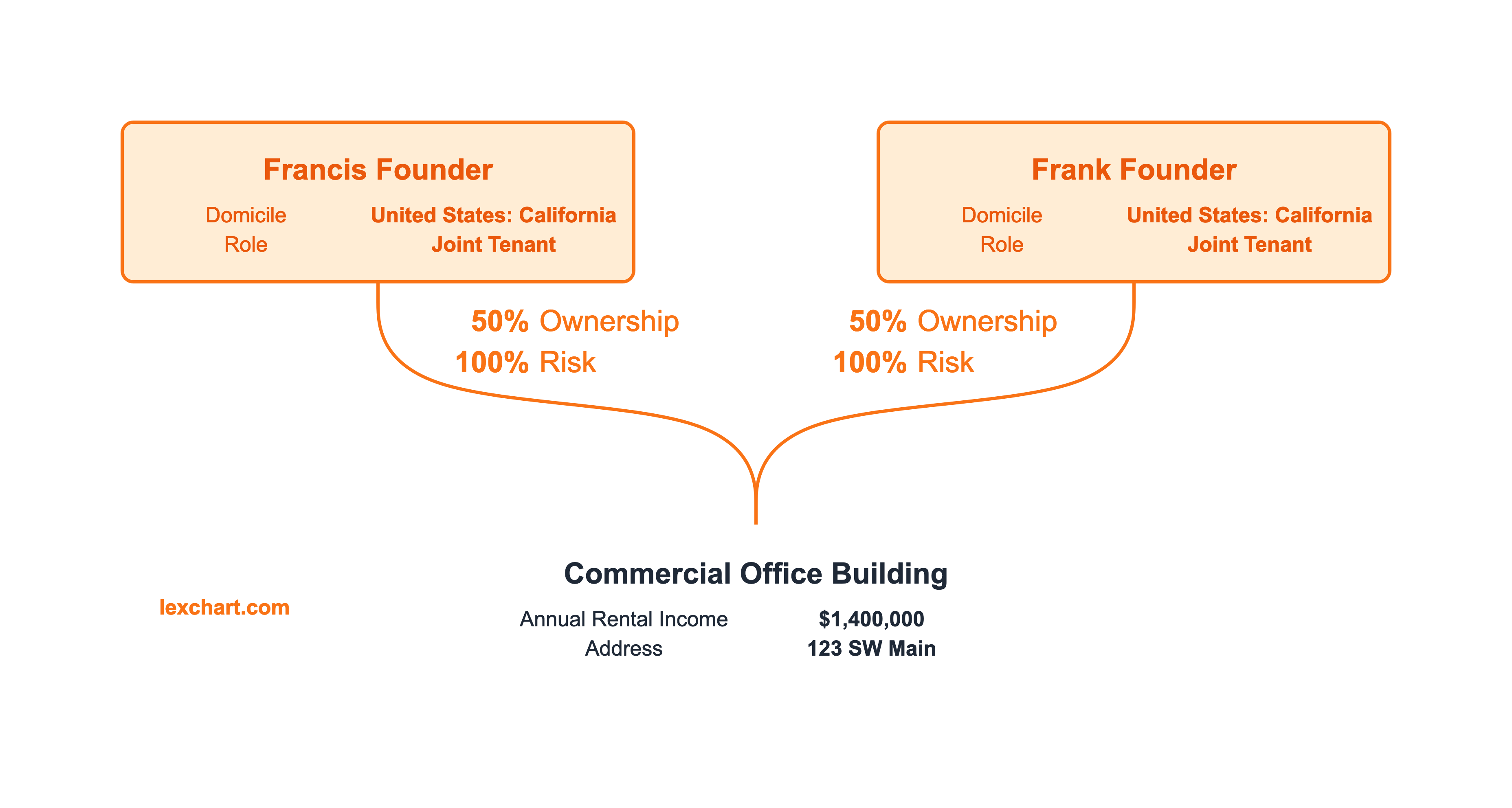

Rise of Foreign Investment in Indian Real Estate

Foreign Direct Investment (FDI) in the Indian real estate sector witnessed a notable increase during Q1 2024. This influx of foreign capital is driven by:

- Stable Economy and Long-Term Growth Potential: India's relatively stable economy and its projected long-term growth potential have attracted significant global investor interest.

- Attractive Investment Opportunities: The high returns and appreciation potential offered by the Indian real estate market make it an attractive investment destination for international investors.

- Examples of Foreign Investments: Significant investments have been made in major cities like Mumbai, Bengaluru, and Delhi-NCR by global real estate firms and sovereign wealth funds.

- Keywords: foreign investment, FDI, global investors, real estate market India, investment opportunities

Regional Analysis: Investment Hotspots in India

The 47% surge in investment wasn't uniformly distributed across India. Certain regions experienced far more significant growth than others.

Top Performing Cities

Mumbai, Bengaluru, and Delhi-NCR emerged as the top-performing cities in terms of real estate investment during Q1 2024. These cities witnessed substantial increases in both investment volume and property price appreciation.

- Mumbai Real Estate: Mumbai continues to be a prime investment destination, driven by its strong economic activity and limited land availability.

- Bengaluru Property Market: Bengaluru's thriving IT sector and young, dynamic population have fueled significant growth in its real estate market.

- Delhi NCR Investment: Delhi-NCR's robust infrastructure and proximity to major industrial hubs continue to attract significant investment.

- Keywords: Mumbai real estate, Bengaluru property market, Delhi NCR investment, top performing cities, real estate hotspots

Emerging Markets and Investment Potential

Beyond the major metropolitan areas, several emerging markets are showing significant growth potential. Tier 2 cities are increasingly attracting investors due to improved infrastructure and government initiatives aimed at developing these regions.

- Infrastructure Development: Government investments in infrastructure projects in these cities are creating better connectivity and amenities, making them more attractive for both residential and commercial development.

- Government Initiatives: Targeted government policies and incentives are aimed at boosting investment and development in these emerging markets.

- Keywords: Tier 2 cities, emerging markets, future investment, real estate growth

Future Outlook: Predictions for the Indian Real Estate Market

The remarkable growth in Q1 2024 begs the question: will this momentum continue?

Sustained Growth or Market Correction?

While the outlook remains positive, several factors could influence future growth:

- Inflation and Interest Rate Changes: Changes in inflation rates and potential interest rate hikes could impact affordability and investor sentiment.

- Global Economic Conditions: Global economic headwinds could also affect investment flows into the Indian real estate market.

- Expert Opinions: Experts predict continued growth, albeit at a potentially moderated pace, in the coming years, barring unforeseen global economic shocks.

- Keywords: market forecast, future trends, real estate predictions, market analysis

Conclusion: Investing in India's Booming Real Estate Market

The 47% surge in Indian real estate investments during Q1 2024 is a testament to the market's dynamism and potential. Driven by reduced interest rates, favorable government policies, increased demand, and rising foreign investment, the Indian real estate sector presents compelling investment opportunities. While potential headwinds exist, the long-term outlook remains positive, making it an attractive market for both domestic and international investors. Capitalize on the booming Indian real estate market and explore the investment opportunities detailed in this Q1 2024 report. Don't miss out on this 47% growth trend!

Featured Posts

-

Shell And Nestle Deny Musks Claims Of Advertising Boycott

May 17, 2025

Shell And Nestle Deny Musks Claims Of Advertising Boycott

May 17, 2025 -

12 Ranked Sci Fi Shows For Every Fan

May 17, 2025

12 Ranked Sci Fi Shows For Every Fan

May 17, 2025 -

Updated Injury Report Giants Vs Mariners April 4th 6th

May 17, 2025

Updated Injury Report Giants Vs Mariners April 4th 6th

May 17, 2025 -

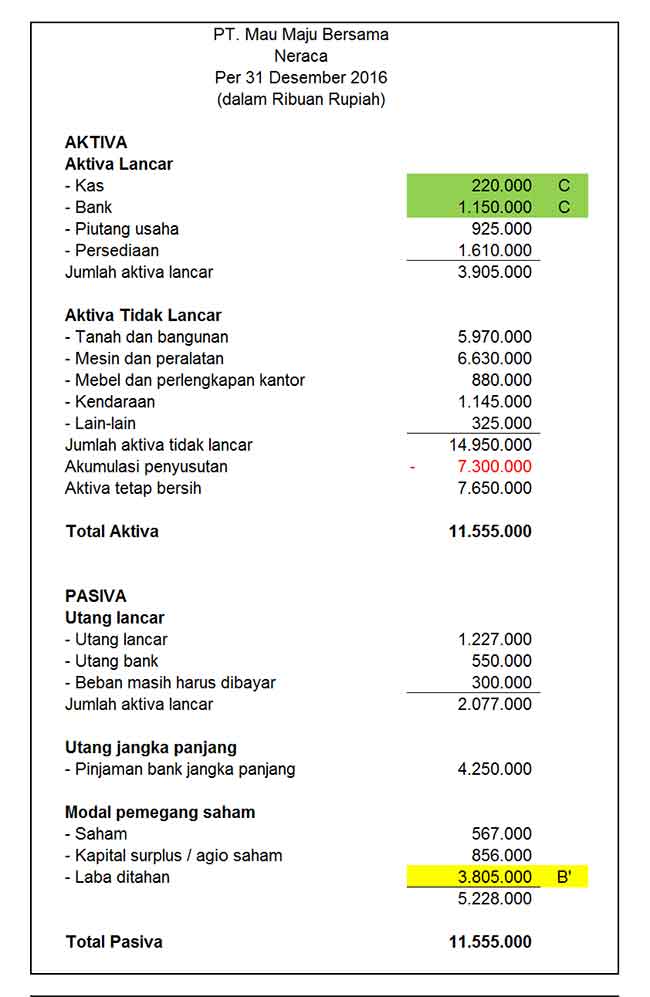

Jenis Jenis Laporan Keuangan Yang Penting Untuk Bisnis Anda

May 17, 2025

Jenis Jenis Laporan Keuangan Yang Penting Untuk Bisnis Anda

May 17, 2025 -

A Guide To The Safest Bitcoin And Crypto Casinos In 2025

May 17, 2025

A Guide To The Safest Bitcoin And Crypto Casinos In 2025

May 17, 2025

Latest Posts

-

Peringatan Houthi Dubai Dan Abu Dhabi Terancam Serangan Rudal

May 17, 2025

Peringatan Houthi Dubai Dan Abu Dhabi Terancam Serangan Rudal

May 17, 2025 -

Key Considerations When Reviewing A Proxy Statement Form Def 14 A

May 17, 2025

Key Considerations When Reviewing A Proxy Statement Form Def 14 A

May 17, 2025 -

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025 -

Analyzing Proxy Statements Form Def 14 A A Step By Step Guide

May 17, 2025

Analyzing Proxy Statements Form Def 14 A A Step By Step Guide

May 17, 2025 -

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025