5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

Do's for Landing a Private Credit Job

1. Master the Fundamentals of Private Credit

Developing a strong foundation in private credit is paramount. This goes beyond general finance knowledge; you need specialized expertise. Private debt is a niche area within alternative investments, so showcasing your deep understanding will set you apart.

- Credit Analysis: Go beyond the basics. Master techniques specific to private debt, including analyzing cash flows, collateral valuation, and covenant compliance for various structures like leveraged buyouts (LBOs).

- Financial Modeling: Build sophisticated models that reflect the complexities of private credit transactions. Practice building LBO models, distressed debt models, and models for mezzanine financing.

- Valuation Techniques: Learn different valuation methodologies relevant to private credit, including discounted cash flow analysis (DCF), comparable company analysis, and precedent transaction analysis. Understanding how these differ from public market valuations is key.

- Take relevant courses or pursue certifications: Consider pursuing the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation to further enhance your credentials.

- Network with professionals: Attend industry conferences and networking events to learn from experienced professionals in private debt and alternative investments.

2. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Generic applications will be overlooked in this competitive field.

- Highlight relevant skills: Emphasize your quantitative analysis skills, financial modeling expertise, and experience with private credit instruments.

- Quantify your achievements: Instead of simply stating your responsibilities, use data to showcase your impact. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in $X savings."

- Customize for each application: Thoroughly research each firm and role before submitting your application. Tailor your resume and cover letter to highlight the skills and experience most relevant to the specific position.

- Use keywords: Integrate keywords from the job description to improve the chances of your resume passing Applicant Tracking System (ATS) screening.

- Showcase projects: Include projects that directly demonstrate your understanding of private credit instruments and transaction structures.

3. Network Strategically

Networking is crucial for landing a private credit job. It's not just about collecting business cards; it's about building genuine relationships.

- Attend industry events: Participate in conferences, workshops, and networking events focused on private credit, leveraged finance, and alternative investments.

- Leverage LinkedIn: Actively use LinkedIn to connect with recruiters, private equity professionals, and individuals working in your target firms. Engage with their posts and participate in relevant groups.

- Informational interviews: Reach out to professionals for informational interviews to gain valuable insights and build your network. These conversations can lead to unexpected opportunities.

- Join professional organizations: Consider joining relevant professional organizations such as the Turnaround Management Association (TMA) to expand your network and access valuable resources.

- Participate in online forums: Engage in online discussions and forums related to private credit to stay updated on industry trends and connect with other professionals.

4. Ace the Interview Process

The interview process is your chance to shine. Preparation is key to demonstrating your expertise and enthusiasm.

- Prepare for technical questions: Be ready to answer in-depth questions on financial modeling, credit analysis, valuation techniques, and specific private credit strategies.

- Practice behavioral questions: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral interview questions, showcasing your problem-solving skills, teamwork abilities, and work ethic.

- Demonstrate firm knowledge: Show that you understand the firm's investment strategy, portfolio, and recent transactions. Research the firm thoroughly before the interview.

- Prepare thoughtful questions: Asking insightful questions demonstrates your interest and engagement. Research the interviewers beforehand to formulate relevant and specific questions.

- Practice your responses: Rehearse your answers to common interview questions to ensure confident and concise delivery.

5. Build a Strong Online Presence

Your online presence reflects your professionalism and expertise. A strong online profile can significantly impact your job search.

- Professional LinkedIn profile: Create a comprehensive and well-optimized LinkedIn profile, showcasing your skills and experience in private credit. Use keywords relevant to the industry.

- Portfolio or blog: Consider creating a portfolio or blog to showcase your financial modeling skills and projects. This allows you to demonstrate your expertise in a tangible way.

- Engage on social media: Engage with industry influencers and thought leaders on social media platforms like Twitter and LinkedIn to demonstrate your knowledge and stay up-to-date on industry trends.

- Personal website (optional): Creating a personal website can further enhance your online presence, providing a central location to showcase your experience and expertise.

- Maintain a consistent online persona: Ensure your online presence across all platforms is consistent, professional, and reflects your brand.

Don'ts for Landing a Private Credit Job

1. Lack of Preparation: Don't underestimate the importance of thorough research and preparation for interviews and networking events.

2. Generic Applications: Don't submit generic resumes and cover letters. Tailor your application materials to each specific job and company.

3. Neglecting Networking: Don't underestimate the power of networking. Actively build relationships with professionals in the field.

4. Poor Interview Performance: Don't be unprepared for technical or behavioral interview questions. Practice beforehand.

5. Ignoring Online Presence: Don't neglect your online presence. Ensure your LinkedIn profile and other online platforms reflect your professional image.

Conclusion

Landing a private credit job requires dedication, preparation, and a strategic approach. By following these do's and don'ts, you'll significantly increase your chances of securing your dream role in the exciting world of private debt and alternative investments. Remember to master the fundamentals of private credit, tailor your applications, network strategically, ace the interviews, and build a strong online presence. Start implementing these tips today and take the first step towards your successful private credit job search!

Featured Posts

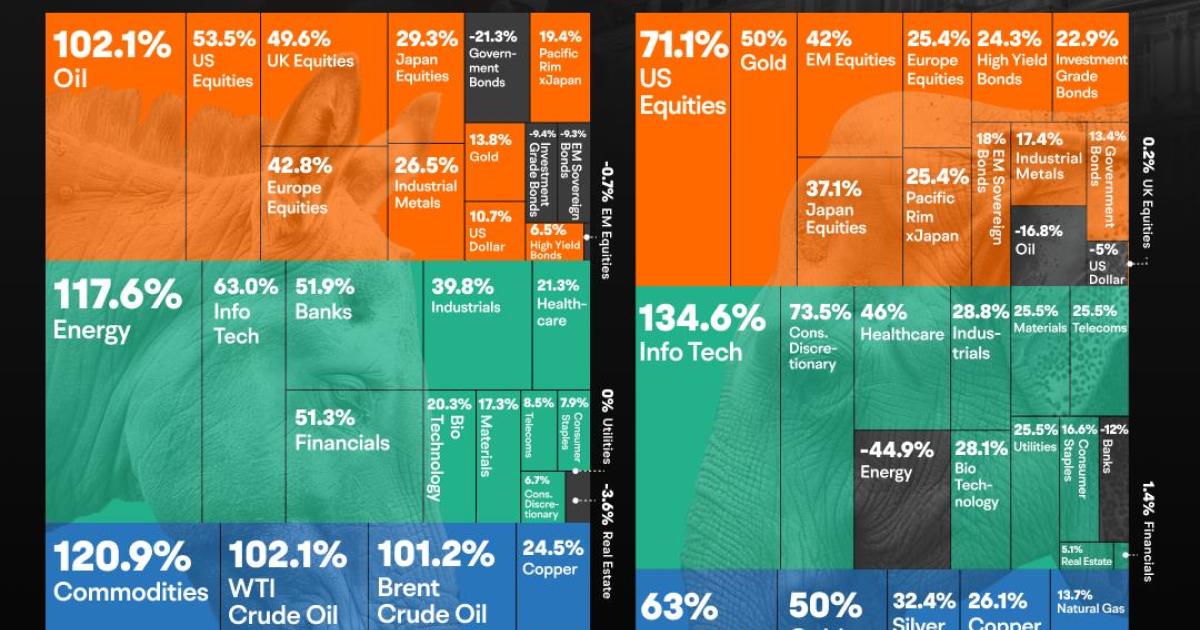

-

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025

Analyzing The Trump Administrations Impact On The Biotech Industry

Apr 23, 2025 -

2024 Istanbul 3 Mart Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

2024 Istanbul 3 Mart Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025 -

The Collapse Of Pierre Poilievres Support An Electoral Post Mortem

Apr 23, 2025

The Collapse Of Pierre Poilievres Support An Electoral Post Mortem

Apr 23, 2025 -

Adeyemi Stilsicher In Dortmund Bvb Star Im Fokus

Apr 23, 2025

Adeyemi Stilsicher In Dortmund Bvb Star Im Fokus

Apr 23, 2025 -

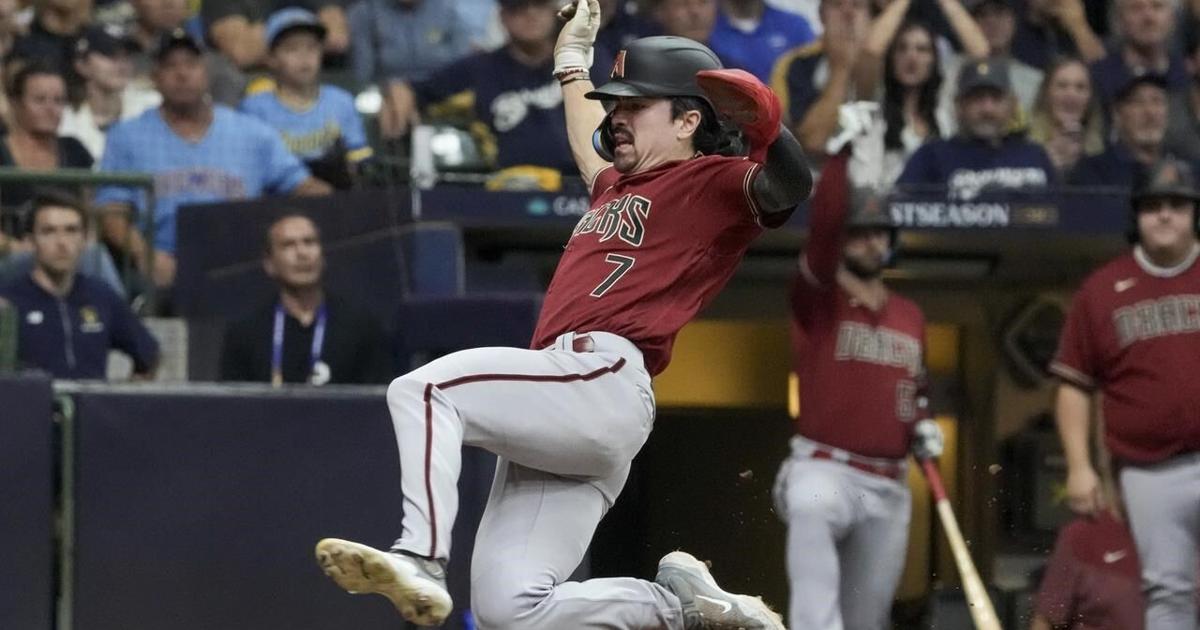

Josh Naylors Game Changing Rbi In Diamondbacks Win Over Brewers

Apr 23, 2025

Josh Naylors Game Changing Rbi In Diamondbacks Win Over Brewers

Apr 23, 2025