5 Do's And Don'ts To Secure A Private Credit Role In Today's Market

Table of Contents

Do's – Maximize Your Chances of Landing a Private Credit Job

1. Showcase Specialized Private Credit Experience

Emphasize relevant experience in areas like underwriting, due diligence, portfolio management, and loan origination within the private credit sector. Generic financial experience won't cut it; recruiters are looking for candidates with a proven track record in private credit specifically.

- Quantify your achievements: Instead of saying "Managed a portfolio," say "Managed a $50 million portfolio of distressed debt assets, achieving a 15% annualized return." Use numbers and data to demonstrate your impact.

- Highlight successful transactions: Detail the complexities and your contributions to successful deal closings. Mention deal size, industry, and the challenges you overcame. For example, "Successfully underwrote and closed a $20 million senior secured loan to a healthcare technology company, navigating complex regulatory hurdles."

- Mention specialized industry knowledge: Demonstrate your expertise in specific sectors like real estate private credit, energy private credit, or technology private credit. This showcases your understanding of industry-specific risks and opportunities.

- Tailor your resume and cover letter: Don't use a generic template. Carefully read each job description and tailor your application materials to highlight the specific skills and experience they're seeking. Use keywords directly from the job posting.

2. Develop a Strong Network within Private Credit

Networking is vital in the private credit industry. Actively engage with professionals in the field to build relationships and learn about potential opportunities.

- Attend industry conferences and events: Networking events provide invaluable opportunities to meet recruiters and hiring managers.

- Join relevant professional organizations: Organizations like the CFA Institute and the Alternative Credit Council (ACA) offer networking opportunities and professional development resources.

- Use LinkedIn effectively: Optimize your LinkedIn profile, connect with recruiters and private credit professionals, and engage in relevant industry discussions.

- Informational interviews: Reach out to professionals for informational interviews to learn more about their roles, gain insights into the industry, and build valuable connections.

3. Master Relevant Financial Modeling and Analytical Skills

Private credit roles demand strong analytical and financial modeling skills. Proficiency in these areas is crucial for success.

- Proficiency in Excel and financial modeling software: Master Excel's advanced functions, and become proficient in specialized software like Argus, deal structuring software, and discounted cash flow (DCF) modeling.

- Demonstrate understanding of financial statements: Show your ability to analyze financial statements, assess credit risk, and perform valuation analyses.

- Highlight experience with financial databases: Familiarity with Bloomberg Terminal, S&P Capital IQ, or other financial databases is highly valued.

- Consider pursuing relevant certifications: Certifications like the CFA charter, CAIA charter, or other relevant certifications enhance your credibility and demonstrate your commitment to the field.

4. Craft a Compelling Narrative in Your Application Materials

Your resume and cover letter should tell a story that highlights your qualifications and career goals.

- Clearly articulate your career goals: Explain why you're interested in a private credit role and how your skills and experience align with the specific job requirements.

- Use action verbs: Showcase your accomplishments using strong action verbs that demonstrate your impact.

- Quantify your achievements: Use numbers and data to quantify your successes and demonstrate the value you bring.

- Proofread meticulously: Errors in grammar and spelling can significantly damage your credibility.

5. Prepare for Behavioral and Technical Interview Questions

Practice answering common interview questions related to your experience, skills, and career goals.

- Prepare examples: Develop concise and compelling examples that highlight your problem-solving skills, teamwork abilities, and resilience in challenging situations. Use the STAR method (Situation, Task, Action, Result).

- Research the firm and the interviewer: Demonstrate your interest by researching the firm's investment strategy, recent transactions, and the interviewer's background.

- Practice your responses: Practice answering common interview questions aloud to build confidence and refine your responses.

- Ask insightful questions: Prepare thoughtful questions to ask the interviewer at the end of the interview, demonstrating your genuine interest and engagement.

Don'ts – Avoid These Mistakes When Applying for Private Credit Roles

1. Don't Neglect the Importance of Networking

Networking is not optional; it's essential for securing a private credit role.

- Attend industry events: Don't miss opportunities to connect with professionals in the field.

- Utilize LinkedIn: Actively engage with your network and reach out to people in private credit.

- Leverage your existing network: Inform your contacts about your job search and seek referrals.

2. Don't Underestimate the Importance of Technical Skills

Lack of technical proficiency will significantly hinder your candidacy.

- Master financial modeling: Develop strong skills in Excel, DCF modeling, and other relevant software.

- Strengthen your credit analysis skills: Deepen your understanding of credit risk assessment and valuation techniques.

- Develop proficiency in relevant software: Familiarize yourself with industry-standard software and databases.

3. Don't Submit Generic Application Materials

Generic applications demonstrate a lack of interest and effort.

- Tailor your application: Customize your resume and cover letter for each specific job application, highlighting the relevant skills and experience.

- Personalize your approach: Show that you've researched the firm and understand their investment strategy.

- Avoid generic templates: Create unique application materials that showcase your individual strengths and accomplishments.

4. Don't Underprepare for the Interview Process

Thorough preparation is crucial for a successful interview.

- Research the firm: Understand their investment strategy, recent transactions, and team structure.

- Practice your responses: Prepare for both technical and behavioral questions.

- Prepare thoughtful questions: Demonstrate your interest and engagement by asking insightful questions.

5. Don't Neglect Follow-Up After the Interview

Always send a thank-you note to reiterate your interest and key qualifications.

- Send a personalized thank-you note: Express your gratitude for the opportunity and reiterate your interest in the role.

- Highlight key qualifications: Reiterate your key skills and experience that align with the job requirements.

- Keep your application top-of-mind: A follow-up note keeps your application fresh in the interviewer's mind.

Conclusion

Securing a private credit role requires careful planning and execution. By following these "dos" and avoiding the "don'ts," you significantly increase your chances of landing your dream job in this competitive market. Remember to focus on building your expertise in private credit, developing a strong network, mastering essential skills, and presenting yourself effectively throughout the application and interview process. Don't delay – start implementing these strategies today to advance your private credit career!

Featured Posts

-

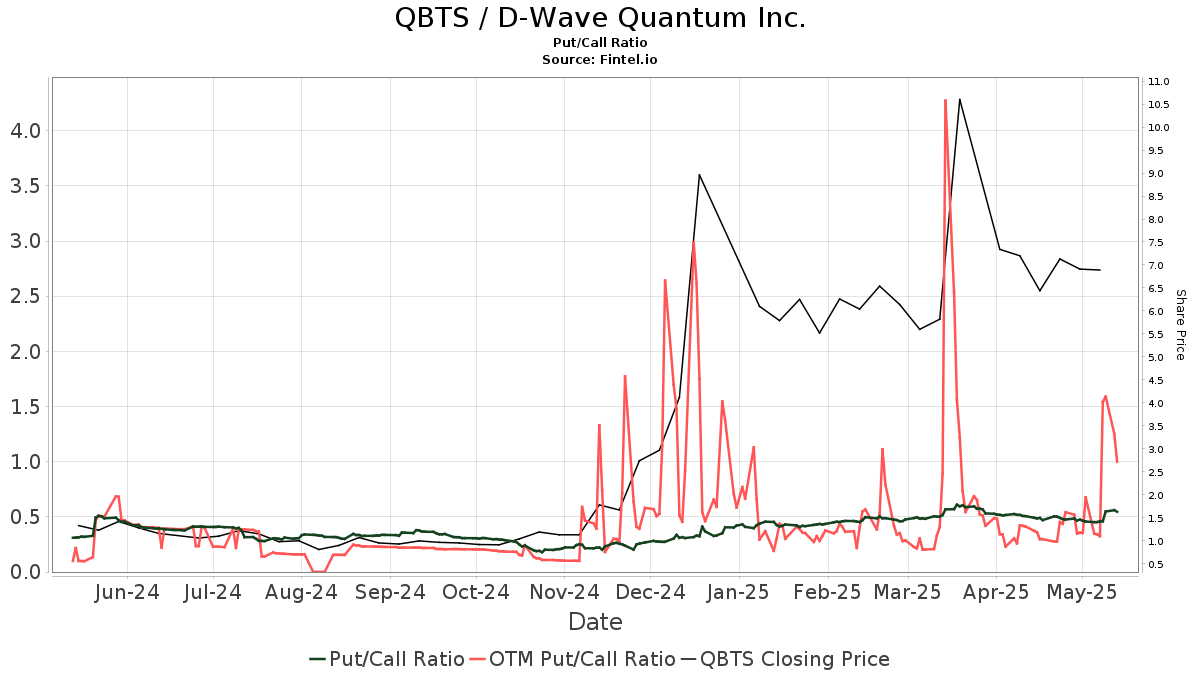

Understanding The Recent Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025

Understanding The Recent Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025 -

Love Monster Activities For Kids Fun And Educational Games

May 21, 2025

Love Monster Activities For Kids Fun And Educational Games

May 21, 2025 -

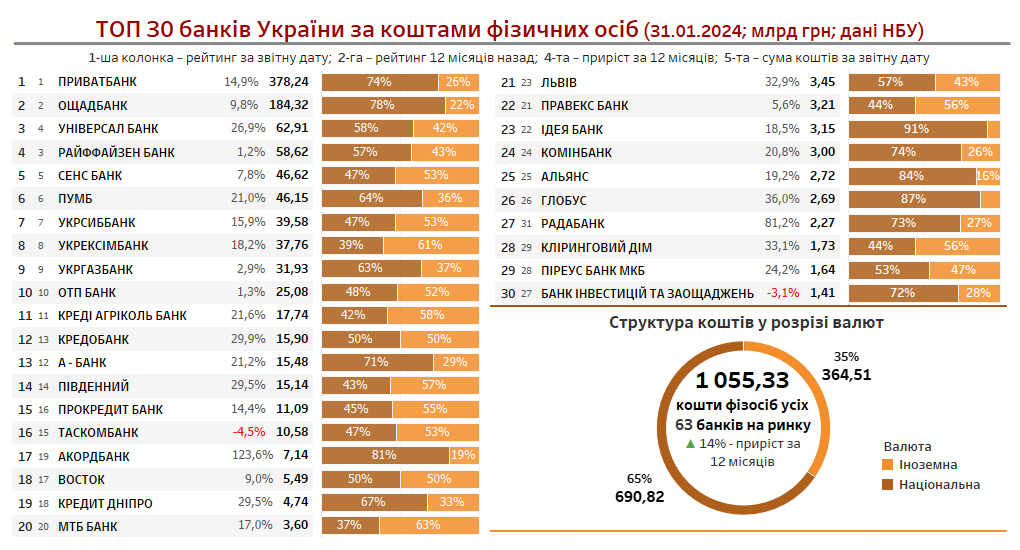

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 21, 2025 -

Metas Defense Strategy In The Ftc Monopoly Lawsuit

May 21, 2025

Metas Defense Strategy In The Ftc Monopoly Lawsuit

May 21, 2025 -

Casting Directors And Barry Ward An Interview On Type Casting

May 21, 2025

Casting Directors And Barry Ward An Interview On Type Casting

May 21, 2025