5 Key Actions To Secure A Private Credit Role In Today's Market

Table of Contents

Master the Fundamentals of Private Credit Investing

To excel in the private credit industry, a deep understanding of its core principles is essential. This involves more than just theoretical knowledge; it requires a practical grasp of various investment strategies and the ability to analyze financial data effectively.

Understand Different Private Credit Strategies

The private credit market encompasses a diverse range of investment strategies, each with its unique risk and return profile. Familiarizing yourself with these is crucial for success.

- Direct lending: Providing loans directly to companies, often bypassing traditional banks.

- Mezzanine financing: Hybrid financing combining debt and equity features, typically higher risk than senior debt.

- Distressed debt: Investing in debt securities of companies facing financial distress, aiming for recovery or restructuring.

- Special situations investing: Focusing on opportunities arising from unique circumstances, such as bankruptcies or restructurings.

- Private equity debt: Providing financing to private equity firms for their acquisitions and investments.

Understanding the nuances of each strategy, including their respective risk/return profiles, is key. You should be comfortable discussing private debt, alternative lending, and the strategies employed by various credit funds.

Develop Strong Financial Modeling Skills

Proficiency in financial modeling is paramount in private credit. You'll be evaluating potential investments, creating presentations for investors, and forecasting financial performance. Mastering these skills will set you apart.

- LBO modeling: Analyzing leveraged buyouts, understanding debt structures, and assessing deal feasibility.

- DCF analysis: Using discounted cash flow analysis to determine the intrinsic value of investments.

- Sensitivity analysis: Assessing the impact of changes in key assumptions on investment returns.

- Waterfall analysis: Modeling the distribution of cash flows to different stakeholders in a debt investment.

Strong Excel skills and a deep understanding of valuation techniques are essential. Demonstrate your abilities through your resume and during the interview process. Practice your financial modeling skills regularly to maintain proficiency.

Network Strategically Within the Private Credit Industry

Networking is crucial for securing a private credit role. Building relationships within the industry opens doors to unadvertised opportunities and provides invaluable insights.

Attend Industry Events and Conferences

Industry events and conferences offer unparalleled networking opportunities. Engage with professionals, learn about new trends, and make connections that could lead to your dream job.

- SuperReturn: A leading global private equity and debt event.

- Invest in Me: Events focusing on various aspects of the private credit market.

- Industry-specific webinars and workshops: Many online events provide networking and learning opportunities.

Face-to-face interactions are invaluable; prepare thoughtful questions, and actively engage in conversations to build rapport with potential employers.

Leverage Online Networking Platforms

Online platforms are powerful tools for expanding your network. Utilize these resources strategically to connect with professionals in the private credit sector.

- LinkedIn: Craft a compelling profile highlighting your private credit experience, skills, and aspirations.

- Industry-specific forums: Engage in discussions, share insights, and build relationships with like-minded professionals.

A strong LinkedIn profile showcasing your private credit expertise is your online calling card. Actively engage with content relevant to the private credit market, and connect with individuals working in the field.

Craft a Compelling Resume and Cover Letter Tailored to Private Credit

Your resume and cover letter are your first impression; make them count. Highlight your relevant skills and experiences, demonstrating your suitability for a private credit role.

Highlight Relevant Experience and Skills

Quantify your achievements whenever possible to demonstrate your impact. Use action verbs to showcase your accomplishments.

- Quantifiable achievements: "Increased portfolio returns by 15% through proactive credit monitoring and risk management."

- Relevant skills: Underwriting, due diligence, credit analysis, portfolio management, financial modeling, and deal structuring.

Focus on experiences that demonstrate your understanding of credit analysis, risk assessment, and portfolio management.

Showcase Your Understanding of the Private Credit Market

Demonstrate your knowledge of current market trends and specific funds or firms. This shows initiative and genuine interest.

- Mention current market trends: Discuss the impact of rising interest rates, economic uncertainty, or regulatory changes.

- Specific funds or firms you admire: Research leading firms and express your interest in their investment strategies.

This demonstrates your understanding of the landscape and your passion for the private credit market.

Ace the Private Credit Interview Process

The interview process is your opportunity to showcase your skills and personality. Prepare thoroughly for both technical and behavioral questions.

Prepare for Technical Questions

Expect questions assessing your technical knowledge and analytical skills. Prepare case studies and practice your responses.

- LBO modeling questions: Be prepared to discuss valuation methodologies, assumptions, and sensitivities.

- Credit analysis scenarios: Practice analyzing credit metrics, assessing risk, and making lending decisions.

Thorough preparation is key to answering technical questions confidently and articulately.

Showcase Your Soft Skills

Private credit is a team-oriented environment. Highlight your teamwork, communication, and problem-solving skills.

- Teamwork: Discuss experiences where you collaborated effectively within a team.

- Communication skills: Demonstrate clear and concise communication, both written and verbal.

- Problem-solving skills: Explain how you approach challenges and find creative solutions.

Effective communication and teamwork are crucial for success in this collaborative field.

Continuously Develop Your Expertise in Private Credit

The private credit market is dynamic; continuous learning is vital. Enhance your credentials and stay abreast of industry trends.

Pursue Relevant Certifications

Professional certifications demonstrate your commitment to the field and enhance your credibility.

- CFA (Chartered Financial Analyst): A globally recognized designation for investment professionals.

- CAIA (Chartered Alternative Investment Analyst): Focuses on alternative investments, including private credit.

These certifications signal your dedication to professional excellence and increase your marketability.

Stay Updated on Industry News and Trends

Keep up with the latest developments through relevant publications, blogs, and resources.

- Industry publications: Follow reputable financial news sources and specialized private credit publications.

- Blogs and podcasts: Stay informed about market trends and best practices through online resources.

Demonstrate continuous learning and staying current with the dynamic private credit landscape.

Conclusion

Securing a private credit role requires dedication, strategic planning, and a proactive approach. By mastering the fundamentals, networking effectively, presenting yourself compellingly, acing the interview process, and continuously developing your expertise, you significantly improve your chances of landing your dream job in this exciting and rewarding field. Start taking these five key actions today to advance your career in private credit and unlock the opportunities within the private credit market. Don't wait; begin your journey to a successful private credit role now!

Featured Posts

-

Understanding The Good Life Exploring Values And Priorities

May 31, 2025

Understanding The Good Life Exploring Values And Priorities

May 31, 2025 -

The Versatile Uses Of Rosemary And Thyme In Cooking And Beyond

May 31, 2025

The Versatile Uses Of Rosemary And Thyme In Cooking And Beyond

May 31, 2025 -

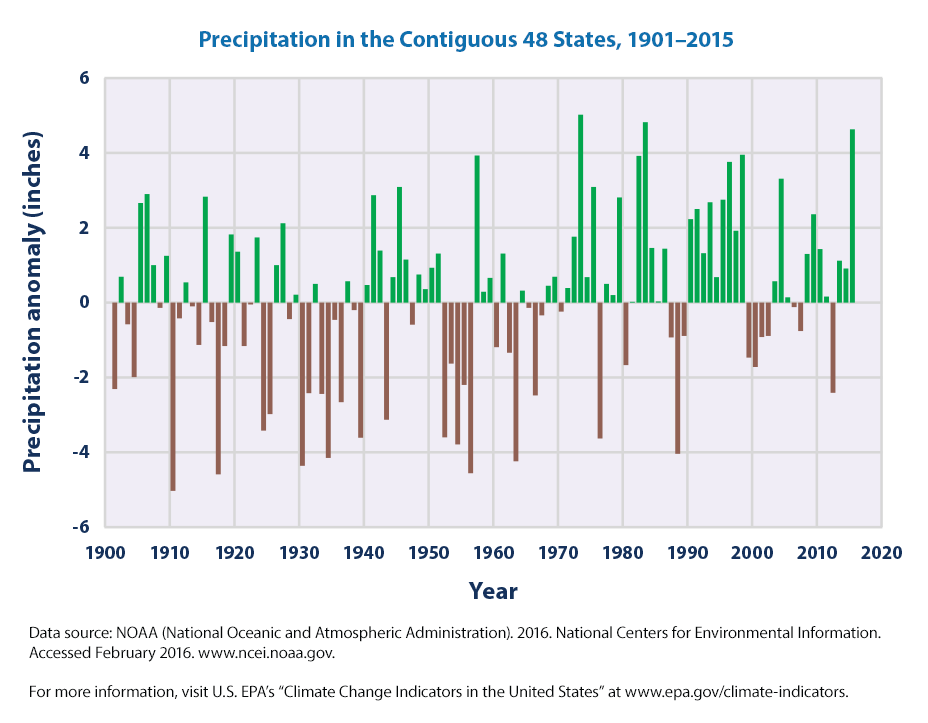

Climate Change Impacts On Precipitation The Case Of Western Massachusetts

May 31, 2025

Climate Change Impacts On Precipitation The Case Of Western Massachusetts

May 31, 2025 -

Carcamusas Receta Facil Y Deliciosa De Toledo

May 31, 2025

Carcamusas Receta Facil Y Deliciosa De Toledo

May 31, 2025 -

Le Retrait Du Trait De Cote A Saint Jean De Luz Amenagement Durable Et Respect De L Environnement

May 31, 2025

Le Retrait Du Trait De Cote A Saint Jean De Luz Amenagement Durable Et Respect De L Environnement

May 31, 2025