5 Key Actions To Secure A Role In The Private Credit Boom

Table of Contents

The private credit market is experiencing explosive growth, creating a surge in demand for skilled professionals. This "Private Credit Boom" presents incredible career opportunities, but securing a role requires strategic action. This article outlines five key steps to help you capitalize on this exciting market expansion and land your dream job in private credit.

<h2>Network Strategically within the Private Credit Industry</h2>

Building a strong network is crucial for success in any competitive field, and the Private Credit Boom is no exception. Strategic networking can open doors to unadvertised opportunities and provide valuable insights into the industry.

<h3>Leverage LinkedIn and Industry Events</h3>

LinkedIn has become the go-to platform for professional networking. To leverage it effectively:

- Attend conferences: Focus on events dedicated to private credit, alternative lending, distressed debt, and other related areas. Networking events offer invaluable face-to-face interactions.

- Engage on LinkedIn: Join relevant groups, participate in discussions, and share insightful content related to private credit and finance.

- Personalized connections: Don't just send generic connection requests. Personalize your requests, mentioning something specific you admire about the person's profile or work.

- Follow industry leaders: Keep abreast of market trends and job openings by following key players and companies in the private credit space.

<h3>Cultivate Relationships with Recruiters</h3>

Recruiters specializing in private credit and alternative investments can be invaluable allies in your job search.

- Target recruiters: Research and identify recruiting firms that focus on the finance industry, specifically private credit and alternative investments.

- Attend recruitment events: Private credit specific recruitment events provide direct access to recruiters and potential employers.

- Maintain contact: Even if you aren't actively searching, maintain regular contact with recruiters. They can alert you to upcoming opportunities.

<h2>Master the Essential Skills for Private Credit Roles</h2>

The Private Credit Boom demands professionals with specific skill sets. Mastering these skills will significantly boost your competitiveness.

<h3>Develop Financial Modeling Expertise</h3>

Proficiency in financial modeling is paramount in private credit. This involves:

- Mastering Excel: Develop advanced Excel skills, including complex formulas, macros, and data visualization.

- Using specialized software: Become proficient with financial modeling software like Bloomberg Terminal.

- Building models: Practice building diverse financial models for various credit scenarios, including leveraged buyouts and distressed debt restructurings.

- Seeking certifications: Consider pursuing relevant certifications to enhance your credentials.

<h3>Understand Credit Analysis and Due Diligence</h3>

A deep understanding of credit analysis is fundamental. This includes:

- Credit risk assessment: Master methodologies for assessing credit risk, including financial statement analysis and credit scoring models.

- Due diligence procedures: Familiarize yourself with the due diligence process for private credit transactions.

- Private credit instruments: Understand different types of private credit instruments, such as direct lending, mezzanine financing, and unitranche loans.

- Gaining experience: Seek internships or entry-level positions in related fields to gain practical experience.

<h3>Build Strong Communication and Presentation Skills</h3>

Effectively communicating complex financial information is essential.

- Clear presentations: Practice presenting financial data concisely and clearly to both technical and non-technical audiences.

- Written communication: Develop strong written communication skills for reports, memos, and other professional documents.

- Presentation skills training: Consider taking courses or workshops to improve your presentation skills.

<h2>Highlight Relevant Experience in Your Resume and Cover Letter</h2>

Your resume and cover letter are your first impression. Make them count.

<h3>Tailor Your Application Materials</h3>

Customize each application to match the specific requirements of the job description.

- Keyword optimization: Use keywords from the job description throughout your resume and cover letter.

- Quantify accomplishments: Always quantify your achievements whenever possible to demonstrate your impact.

- Focus on relevance: Highlight skills and experience directly related to private credit and finance.

<h3>Showcase Your Achievements</h3>

Emphasize quantifiable achievements and results from previous roles.

- Action verbs: Use strong action verbs to describe your accomplishments.

- Relevant projects: Highlight projects where you demonstrated skills relevant to private credit roles (e.g., financial modeling, credit analysis).

- Quantifiable results: Quantify your contributions whenever possible (e.g., "Increased efficiency by 15%," "Reduced costs by $100,000").

<h2>Prepare for the Private Credit Interview Process</h2>

The interview process is critical. Thorough preparation will increase your chances of success.

<h3>Research the Firm and the Interviewers</h3>

Thorough research demonstrates your interest and professionalism.

- LinkedIn research: Use LinkedIn to learn about the interviewers' backgrounds and career paths.

- Company research: Review the firm's website, press releases, and recent transactions to understand their investment strategy and focus.

- Prepare questions: Prepare insightful questions to ask the interviewers, demonstrating your genuine interest.

<h3>Practice Your Behavioral and Technical Interview Skills</h3>

Practice is key to performing well under pressure.

- Behavioral questions: Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions effectively.

- Technical questions: Practice solving case studies and financial modeling problems related to private credit.

- Showcase your skills: Prepare examples that showcase your skills and experience in relevant areas.

<h2>Stay Updated on Private Credit Market Trends</h2>

The private credit market is constantly evolving. Staying informed is essential for long-term success.

<h3>Follow Industry News and Publications</h3>

Stay abreast of the latest developments.

- Industry publications: Read industry publications, such as trade journals and financial news websites specializing in private credit and alternative investments.

- Social media: Follow influential figures and firms on social media platforms like LinkedIn and Twitter.

- Webinars and events: Attend webinars and online events focused on private credit trends and best practices.

<h3>Continuously Expand Your Knowledge</h3>

Continuously enhance your expertise.

- Professional certifications: Consider obtaining relevant certifications such as the Chartered Financial Analyst (CFA) charter.

- Specialized courses: Enroll in specialized courses focused on private credit and alternative investments.

- Regulatory updates: Stay informed about regulatory changes and market trends impacting the private credit industry.

<h2>Conclusion</h2>

The "Private Credit Boom" offers significant career opportunities for skilled professionals. By strategically networking, mastering essential skills, crafting compelling application materials, preparing for interviews, and staying updated on market trends, you can significantly increase your chances of securing a rewarding role in this dynamic industry. Don't delay—take action now to capitalize on the incredible potential of the private credit boom. Start building your career in the exciting world of private credit today!

Featured Posts

-

Germanys Potential New Finance Minister Lars Klingbeil

May 01, 2025

Germanys Potential New Finance Minister Lars Klingbeil

May 01, 2025 -

Redeschiderea Dosarelor X Ce Se Intampla La Galati

May 01, 2025

Redeschiderea Dosarelor X Ce Se Intampla La Galati

May 01, 2025 -

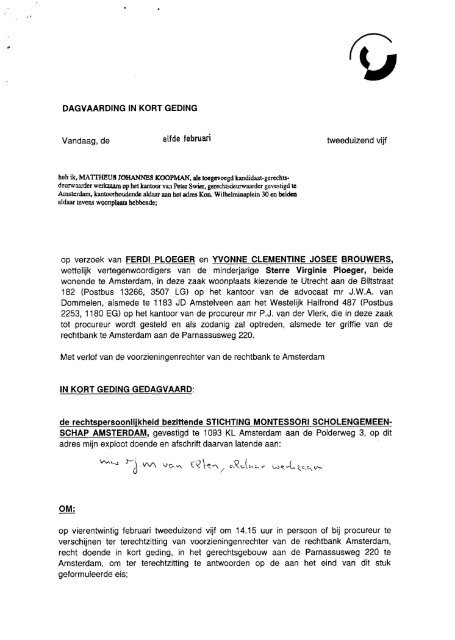

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025 -

Are Los Angeles Wildfires Becoming A Gambling Commodity

May 01, 2025

Are Los Angeles Wildfires Becoming A Gambling Commodity

May 01, 2025 -

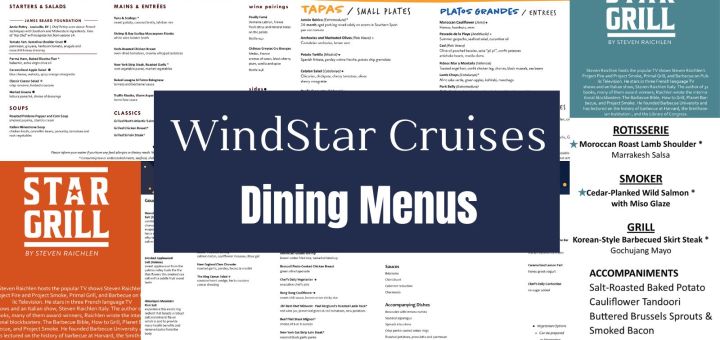

Windstar Cruises Elevate Your Vacation With Exceptional Cuisine

May 01, 2025

Windstar Cruises Elevate Your Vacation With Exceptional Cuisine

May 01, 2025