5 Key Charts For Navigating Global Commodity Markets This Week

Table of Contents

1. Crude Oil Price Chart: Tracking Energy Market Volatility

Crude oil prices are a cornerstone of the global economy, impacting transportation, manufacturing, and inflation. Their volatility directly influences the prices of numerous other commodities and overall economic health. This week's movements are particularly important to watch.

- Brent Crude and WTI Crude: We'll focus on the benchmark prices of Brent Crude (global benchmark) and West Texas Intermediate (WTI) Crude (US benchmark). Observe their price movements closely for indications of supply and demand imbalances.

- Key Influencing Factors: Several factors are currently impacting crude oil prices:

- OPEC+ Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies' production decisions significantly affect global supply. Any announcements or unexpected shifts in their strategy will cause immediate market reactions.

- Geopolitical Tensions: Geopolitical instability in major oil-producing regions creates uncertainty and often leads to price spikes. Keep an eye on news from regions like the Middle East and Eastern Europe.

- Demand Forecasts: Global economic growth projections heavily influence oil demand. Positive forecasts typically lead to higher prices, while negative forecasts can push prices down.

- Technical Indicators: While not the sole focus, technical indicators like moving averages and RSI can provide supplementary insights into potential price direction. These should be used in conjunction with fundamental analysis. [Insert Crude Oil Price Chart Here]

2. Natural Gas Price Chart: Monitoring Energy Security Concerns

Natural gas plays a vital role in heating, electricity generation, and industrial processes. Supply chain disruptions and regional variations in production and consumption make it a particularly dynamic market to follow.

- Regional Price Differences: Analyze price trends in major regions, including Europe, North America, and Asia. These regions often exhibit different price dynamics due to varying supply sources and demand patterns.

- Storage Levels: Natural gas storage levels are crucial indicators of future price movements. Low storage levels signal potential supply shortages and price increases, while high levels suggest ample supply and potentially lower prices.

- Geopolitical Influences: Geopolitical events, such as sanctions or disputes involving major gas producers, can dramatically impact prices and availability.

- Weather Patterns: Extreme weather conditions, such as unusually cold winters or hot summers, can significantly influence natural gas demand and therefore prices. [Insert Natural Gas Price Chart Here]

3. Agricultural Commodity Price Index: Assessing Food Security

Agricultural commodity prices—including wheat, corn, and soybeans—are essential to global food security and are susceptible to various factors.

- Impacting Factors: Several crucial factors affect agricultural commodity prices:

- Weather Conditions: Droughts, floods, and extreme temperatures can devastate crops, leading to price increases.

- Fertilizer Costs: The cost of fertilizers is a significant input cost for farmers. Increases in fertilizer prices directly impact food production costs and consequently, prices.

- Trade Policies: Trade disputes, tariffs, and export restrictions can disrupt the global supply chain and influence prices.

- Food Security and Inflation: Fluctuations in agricultural commodity prices have substantial implications for food security, particularly in developing countries, and contribute to overall inflationary pressures.

- Major Producing and Consuming Regions: Monitor the production and consumption patterns in key agricultural regions like the US, EU, and South America to understand supply-demand dynamics. [Insert Agricultural Commodity Price Index Chart Here]

4. Precious Metals Price Chart: Gauging Safe-Haven Demand

Gold, silver, and platinum are often considered safe-haven assets, meaning their prices tend to rise during times of economic uncertainty.

- Safe-Haven Asset Role: Investors often flock to precious metals during periods of economic instability, geopolitical tensions, or market volatility as a way to preserve capital.

- Interest Rate Changes and Inflation: Interest rate changes and inflation significantly influence precious metal prices. Higher interest rates typically increase the opportunity cost of holding non-interest-bearing assets like gold, potentially depressing prices. Inflation, however, tends to boost gold prices as it erodes the purchasing power of fiat currencies.

- Investor Sentiment: Investor sentiment towards the global economy and specific market sectors plays a significant role in shaping precious metal prices. [Insert Precious Metals Price Chart Here]

5. Industrial Metals Price Chart: Monitoring Global Manufacturing Activity

Industrial metals like copper, aluminum, and iron ore are crucial for construction and manufacturing. Their prices are closely tied to global economic growth and industrial activity.

- Correlation with Economic Growth: The demand for industrial metals is heavily influenced by global economic growth and industrial production levels. Strong economic growth generally leads to increased demand and higher metal prices.

- Supply Chain Dynamics: Supply chain bottlenecks and disruptions can impact the availability of industrial metals and push prices higher.

- Major Producing and Consuming Countries: China, being a major consumer of industrial metals, holds significant influence on global prices. Understanding its economic activities is crucial. [Insert Industrial Metals Price Chart Here]

Conclusion

This week's global commodity market presents both challenges and opportunities. By carefully analyzing these five key charts—crude oil, natural gas, agricultural commodities, precious metals, and industrial metals—investors and businesses can gain a clearer understanding of the market dynamics and make more informed decisions. Stay ahead of the curve by regularly monitoring these essential indicators and using them to navigate the complexities of the global commodity markets. Continue to check back for updates on these key charts and more insights into navigating the global commodity markets.

Featured Posts

-

History Making Nomination Cole Escola For Best Leading Actor In A Play

May 06, 2025

History Making Nomination Cole Escola For Best Leading Actor In A Play

May 06, 2025 -

Surprisingly Good Stuff Affordable And Reliable

May 06, 2025

Surprisingly Good Stuff Affordable And Reliable

May 06, 2025 -

Quick Stephen King Fix Top Rated Show Under 5 Hours On Streaming

May 06, 2025

Quick Stephen King Fix Top Rated Show Under 5 Hours On Streaming

May 06, 2025 -

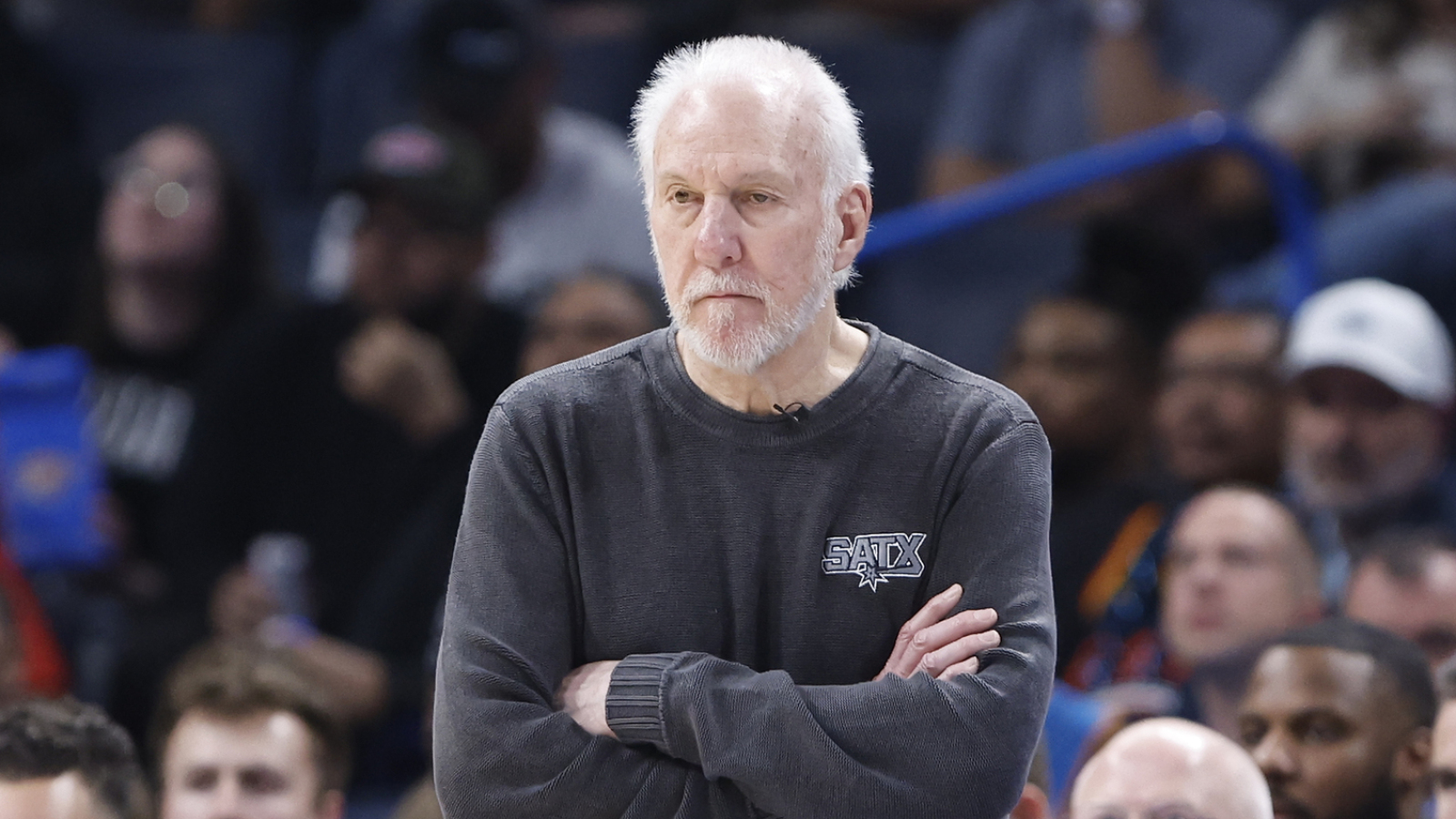

Popovichs Uncertain Future A Concerning Development For The Spurs

May 06, 2025

Popovichs Uncertain Future A Concerning Development For The Spurs

May 06, 2025 -

Broadway World Daily News For February 26 2025

May 06, 2025

Broadway World Daily News For February 26 2025

May 06, 2025