5 Smart Moves To Get A Private Credit Industry Job

Table of Contents

Master the Fundamentals of Private Credit

To succeed in private credit, you need a strong foundation in its core principles and practices. This involves understanding the landscape and possessing the necessary financial skills.

Understand the Private Credit Landscape

The private credit market encompasses various strategies and instruments. It's crucial to understand these nuances to excel in this field.

- Types of Private Credit: Direct lending offers bespoke financing solutions to companies; mezzanine financing sits between senior debt and equity, providing capital for expansion; distressed debt involves investing in debt securities of financially troubled companies.

- Key Players: Private equity firms, hedge funds, and specialized lenders dominate this market, each with its own investment strategies and risk appetites.

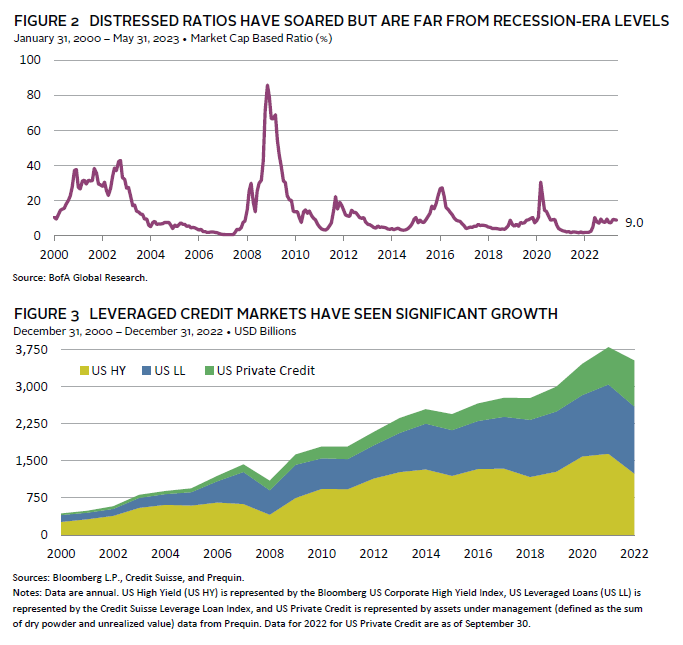

- Market Trends: Staying abreast of current trends, such as interest rate fluctuations, regulatory changes, and evolving investor preferences, is crucial for success.

Understanding the different types of private credit and their unique characteristics is vital. Direct lending, for example, involves negotiating tailored financing arrangements, demanding strong negotiation and structuring skills. Mezzanine financing requires a deep understanding of capital structures and risk assessment, while distressed debt necessitates expertise in analyzing financially troubled companies and restructuring opportunities. Due diligence, risk assessment, and portfolio management are integral components of all private credit strategies.

Develop Relevant Financial Skills

Proficiency in key financial skills is non-negotiable. Your analytical abilities will be constantly tested.

- Financial Modeling: Advanced Excel skills are essential, enabling you to build detailed financial models, conduct sensitivity analyses, and present your findings clearly.

- Accounting Principles: A solid grasp of GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) is critical for understanding financial statements and conducting due diligence.

- Valuation Techniques: Mastering valuation methodologies like discounted cash flow (DCF) analysis and precedent transaction analysis allows you to assess the fair value of investments.

- Credit Analysis: Developing expertise in assessing credit risk, including analyzing credit scores, financial ratios, and collateral, is paramount.

- Understanding Financial Statements: You must be adept at interpreting balance sheets, income statements, and cash flow statements to effectively evaluate a company's financial health.

Strong analytical skills and the ability to interpret complex financial data are crucial for success. Proficiency in specialized software, such as the Bloomberg Terminal, is highly advantageous.

Network Strategically Within the Private Credit Community

Networking is paramount in this industry. Building relationships opens doors to opportunities you won't find through traditional job boards.

Attend Industry Events and Conferences

Industry events provide invaluable networking opportunities.

- Relevant Conferences: SuperReturn, industry-specific seminars, and smaller, more niche conferences offer chances to connect with professionals.

- Professional Associations: Joining relevant associations increases your exposure to industry leaders and potential employers.

- Informational Interviews: Don't underestimate the power of informational interviews. These conversations provide insights and can lead to unexpected job opportunities.

These events offer a chance to connect with professionals, learn about job opportunities, and build relationships. Informational interviews are particularly valuable, allowing you to learn from experienced professionals and gain a deeper understanding of the industry.

Leverage Your Existing Network

Don't overlook your existing network. Let people know your career goals.

- Inform Your Network: Let your contacts know you are seeking a private credit role. You never know who might have a lead.

- LinkedIn: Optimize your LinkedIn profile and actively engage in private credit-related groups and discussions.

- Online Forums: Participate in online forums and discussions related to private credit to showcase your expertise and connect with other professionals.

Networking can unearth hidden job opportunities and provide invaluable insights. Leverage LinkedIn to connect with professionals in the field and actively engage in relevant discussions.

Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. Make them count.

Highlight Relevant Experience and Skills

Quantify your accomplishments to demonstrate your impact.

- Quantify Achievements: Use numbers to showcase your contributions. For example, "Increased portfolio returns by 15%."

- Focus on Relevant Experience: Highlight experience in financial analysis, credit assessment, portfolio management, and other relevant areas.

- Keywords: Incorporate keywords from private credit job descriptions to improve your resume's visibility in Applicant Tracking Systems (ATS).

Structure your resume and cover letter to emphasize relevant skills and experiences. Use action verbs and showcase quantifiable results.

Showcase Your Knowledge of Private Credit

Demonstrate your understanding of the industry.

- Key Concepts and Terminology: Use industry-specific terminology correctly to show your familiarity with private credit.

- Specific Transactions: Mention specific private credit transactions you've followed or analyzed.

- Firm Research: Research the specific firm's investment strategy and tailor your application to align with their goals.

Show your understanding by demonstrating an interest in market trends and the firms you're targeting.

Ace the Private Credit Interview

The interview is your chance to shine. Preparation is crucial.

Prepare for Technical and Behavioral Questions

Expect a mix of technical and behavioral questions.

- Case Studies: Practice case studies involving financial modeling and credit analysis.

- Behavioral Questions: Prepare answers to common behavioral questions, such as "Tell me about a time you failed" or "Describe your leadership style."

- Firm Research: Research the firm and the interviewer thoroughly.

Effectively approach case studies by demonstrating your problem-solving skills and attention to detail. For behavioral questions, use the STAR method (Situation, Task, Action, Result) to structure your responses.

Ask Thoughtful Questions

Asking insightful questions demonstrates your interest and engagement.

- Investment Strategy: Ask about the firm's investment strategy, current portfolio, and future plans.

- Team Culture: Ask about the team dynamics and work environment.

- Challenges: Ask about the firm's biggest challenges and how they are addressing them.

Thoughtful questions showcase your genuine interest and engagement.

Consider Further Education and Certifications

Further education can enhance your credentials and open doors to more senior roles.

Relevant Certifications (CFA, CAIA)

These certifications demonstrate your commitment to the field.

- CFA Charter: The Chartered Financial Analyst (CFA) charter is a highly respected credential in the finance industry.

- CAIA Charter: The Chartered Alternative Investment Analyst (CAIA) designation is specifically tailored to alternative investments, including private credit.

These credentials enhance your resume and demonstrate your commitment to the field.

Advanced Degrees (MBA)

An advanced degree can significantly boost your career prospects.

- MBA: An MBA from a reputable institution can open doors to senior roles and increase earning potential.

- Other Relevant Degrees: Consider other specialized degrees, such as a Master's in Finance or a Master's in Financial Engineering.

An advanced degree can open doors to higher-level positions and increase your earning potential.

Conclusion

Securing a job in the private credit industry requires a proactive and strategic approach. By mastering the fundamentals, networking effectively, tailoring your application materials, acing the interview, and potentially pursuing further education, you'll significantly increase your chances of success. Remember, persistence and a deep understanding of the private credit market are key to landing your dream private credit job. Start implementing these five smart moves today and take control of your career journey in private credit!

Featured Posts

-

The Count Of Monte Cristo A Modern Look At A Classic Swashbuckler

May 04, 2025

The Count Of Monte Cristo A Modern Look At A Classic Swashbuckler

May 04, 2025 -

Mayotte And Nice A Comparison Of French Colonial Legacies

May 04, 2025

Mayotte And Nice A Comparison Of French Colonial Legacies

May 04, 2025 -

Will Arnett And Bradley Cooper Spotted Filming Is This Thing On In Nyc

May 04, 2025

Will Arnett And Bradley Cooper Spotted Filming Is This Thing On In Nyc

May 04, 2025 -

Cut The Cord Watch Fox Without Cable Tv

May 04, 2025

Cut The Cord Watch Fox Without Cable Tv

May 04, 2025 -

Fleetwood Mac Tribute Concert Seventh Wonder In Perth Mandurah Albany

May 04, 2025

Fleetwood Mac Tribute Concert Seventh Wonder In Perth Mandurah Albany

May 04, 2025