$581 Million Deal: CMOC's Acquisition Of Lumina Gold Reshapes The Mining Landscape

Table of Contents

Deal Details and Financial Implications

The Acquisition Price and Structure

CMOC's $581 million acquisition of Lumina Gold represents a substantial investment in the gold mining sector. The deal structure likely involved a combination of cash and potentially stock, although the exact breakdown hasn't been publicly disclosed in all its detail. This acquisition represents a significant commitment to expanding CMOC's presence in the gold mining industry.

- Cost per share/ounce: The precise cost per share and per ounce of gold reserves acquired needs further clarification from official sources, but analysts will be closely scrutinizing this aspect to determine the valuation. This calculation will provide crucial insights into the deal's financial viability and the premium paid.

- CMOC's financial capacity: CMOC's existing financial strength and reserves will be key to successfully integrating Lumina Gold. Detailed analysis of CMOC's balance sheet and cash flow statements will help assess their capacity to manage this large-scale acquisition without compromising other operations. Reports will need to examine how the deal affects their debt-to-equity ratio.

- Debt financing and equity offerings: To finance the $581 million deal, CMOC may have utilized a mix of internal resources, debt financing, and potentially equity offerings. The details of their financing strategy will influence their future financial flexibility and operational capacity.

- Valuation premiums: The final price reflects the market's perception of Lumina Gold's value. The amount of any premium paid above Lumina Gold's market capitalization before the acquisition will be a key area of analysis.

CMOC's Strategic Rationale

CMOC's acquisition of Lumina Gold isn't merely a financial transaction; it's a strategic move designed to bolster its position within the gold mining market.

- Access to high-quality gold reserves: Lumina Gold possesses significant gold reserves, providing CMOC with immediate access to valuable resources. This acquisition represents a direct path to enhancing production and revenue streams.

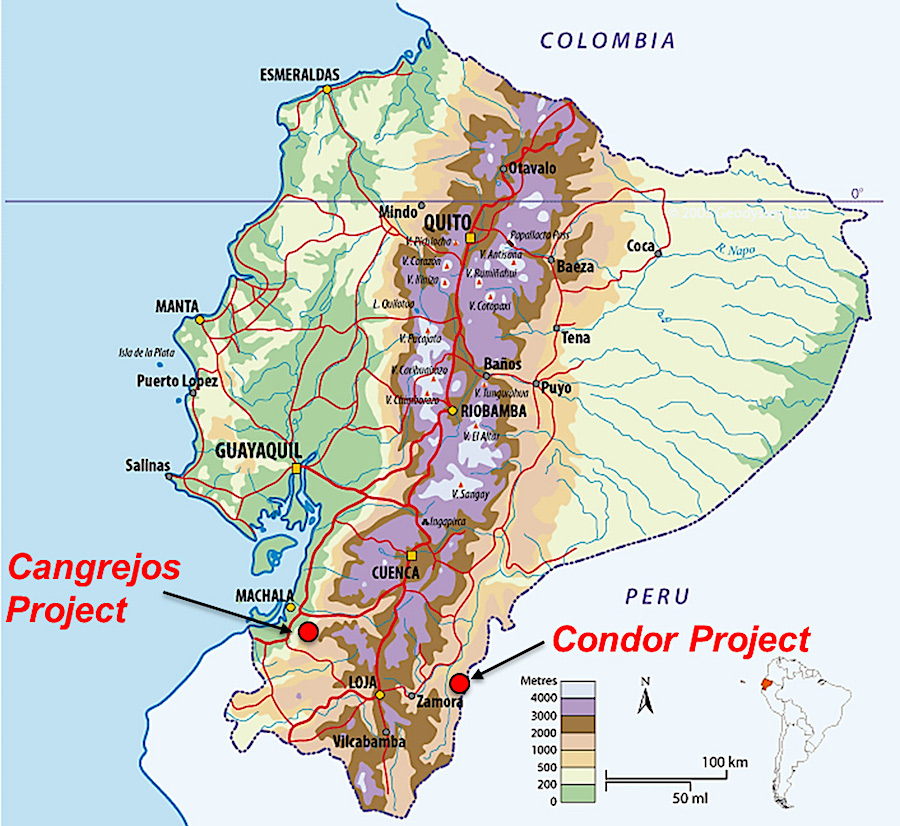

- Portfolio and geographic expansion: The acquisition broadens CMOC's geographic footprint and diversifies its mining portfolio, reducing its dependence on any single asset or region.

- Synergies and operational efficiencies: CMOC's existing operations and Lumina Gold's assets may present opportunities for cost savings and increased efficiency through synergies in resource management, technology, and expertise.

- Strengthening market position: This acquisition significantly enhances CMOC's market share in the global gold market, making them a more formidable player.

Impact on the Gold Mining Industry

Market Consolidation and Competition

The CMOC-Lumina Gold deal accelerates consolidation within the already competitive gold mining industry.

- Increased market share: CMOC's acquisition immediately elevates its market share, influencing the competitive dynamics within the sector.

- Effects on other miners: This significant deal could prompt other gold mining companies to consider mergers, acquisitions, or strategic alliances to remain competitive. The ripple effect may trigger a wave of similar transactions.

- Mergers and acquisitions: Expect increased merger and acquisition activity in the gold mining sector as companies strive to gain scale and access to valuable resources.

Implications for Gold Prices

The acquisition's impact on gold prices is complex and multifaceted, requiring detailed analysis.

- Gold supply: The increased production capacity resulting from the acquisition could potentially influence the overall gold supply, affecting prices in both the short and long term. However, this depends on various factors, including exploration success.

- Investor sentiment: Market reaction and investor sentiment towards the acquisition will also play a critical role in shaping gold prices. Positive investor confidence might push prices higher, while negative sentiment could have the opposite effect.

- Macroeconomic factors: Global economic conditions, inflation, and currency fluctuations remain major factors influencing gold prices, independently of this acquisition.

Future Outlook for CMOC and Lumina Gold

Integration Challenges and Opportunities

Integrating Lumina Gold into CMOC's operations presents both challenges and opportunities.

- Synergies and cost savings: Identifying and implementing operational synergies are crucial for achieving cost savings and improved efficiency.

- Cultural integration: Merging different corporate cultures and management styles requires careful planning and execution.

- Exploration and development: CMOC will need to determine its future exploration and development plans for Lumina Gold’s assets to fully realize their potential.

Long-Term Growth Strategy

CMOC's acquisition of Lumina Gold is a cornerstone of their long-term growth strategy.

- Production and revenue growth: CMOC projects increased gold production and revenue following successful integration.

- Market expansion: The acquisition may open doors to new markets and projects.

- Overall vision: CMOC's vision for its future involves becoming a leading player in the global gold mining industry.

Conclusion

CMOC's $581 million acquisition of Lumina Gold marks a pivotal moment in the gold mining industry. This strategic acquisition has significant implications for market competition, gold prices, and the future growth plans of both companies. The successful integration of Lumina Gold's assets will be key to realizing the full potential of this landmark deal. Careful analysis of this Mining Investment will reveal the long-term impacts.

Call to Action: Stay informed on the evolving landscape of the mining industry. Continue to follow the developments of CMOC and its transformative $581 million Lumina Gold acquisition. Learn more about strategic gold mining investments and market trends by [link to relevant resources/further reading].

Featured Posts

-

Staffel 2 Von Die 50 2025 Alles Ueber Teilnehmer Streaming Und Mehr

Apr 23, 2025

Staffel 2 Von Die 50 2025 Alles Ueber Teilnehmer Streaming Und Mehr

Apr 23, 2025 -

Pavel Pivovarov Predstavil Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025

Pavel Pivovarov Predstavil Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025 -

Brice Turangs Clutch Bunt Brewers Defeat Royals In Walk Off Fashion

Apr 23, 2025

Brice Turangs Clutch Bunt Brewers Defeat Royals In Walk Off Fashion

Apr 23, 2025 -

Marc Fiorentino L Impact De Sa Carte Blanche

Apr 23, 2025

Marc Fiorentino L Impact De Sa Carte Blanche

Apr 23, 2025 -

Brewers Defeat Cubs 9 7 A Game Shaped By The Wind

Apr 23, 2025

Brewers Defeat Cubs 9 7 A Game Shaped By The Wind

Apr 23, 2025