$6.1 Billion Celtics Sale: What It Means For The Future Of The Franchise

Table of Contents

Financial Implications of the $6.1 Billion Celtics Sale

The $6.1 billion sale has profound financial implications for the Boston Celtics, injecting unprecedented capital into the organization. This influx of funds opens doors to opportunities previously unimaginable.

Increased Financial Resources and Spending Power

The sale provides the new ownership group with significantly increased financial resources, dramatically altering the team's spending power.

- Higher Player Salaries: The Celtics can now compete aggressively for top free agents, offering salaries previously unattainable. This could lead to the acquisition of marquee players and the retention of key existing talent.

- Increased Player Recruitment: With a deeper war chest, the Celtics can invest heavily in scouting, player development, and advanced analytics, leading to smarter drafting and more effective player acquisition strategies.

- Improved Infrastructure: Investments in state-of-the-art training facilities, technology, and support staff can significantly enhance player performance and overall team efficiency.

- Attracting Top Free Agents: The Celtics can now realistically compete with teams like the Lakers and Clippers for top free agent talent, transforming their roster building capabilities.

- Improved Scouting and Draft Strategies: Increased financial resources translate to a larger and more skilled scouting department, enabling more effective draft strategies and better identification of future stars.

Long-Term Financial Stability and Investment

Beyond immediate spending power, the sale ensures the long-term financial health of the franchise.

- Minimized Financial Risks: The massive sale price significantly reduces the financial risks associated with fluctuating revenue streams, ensuring the team's long-term viability.

- Strategic Long-Term Investments: The new ownership can make strategic investments in various aspects of the organization, fostering sustainable growth and long-term success.

- Potential for Stadium Upgrades and Improved Fan Experience: Investments in TD Garden could enhance the fan experience, improving amenities, technology, and overall atmosphere.

- Investments in Community Outreach Programs: The increased financial capacity allows for greater investment in community initiatives, strengthening the Celtics' ties with the city of Boston.

Impact on the Celtics' On-Court Performance

The financial implications of the $6.1 billion Celtics sale directly translate into potential improvements in on-court performance.

Potential for Improved Player Recruitment

The increased financial flexibility allows the Celtics to build a championship-caliber roster.

- Attracting and Retaining Top Talent: The ability to offer competitive salaries allows the Celtics to attract and retain the best players in the league.

- Building a Championship-Caliber Roster: With a strong financial foundation, the Celtics can assemble a roster capable of contending for an NBA title.

- Improved Player Development Programs: Investments in player development can maximize the potential of existing players and young prospects within the organization.

- Strategic Trades and Signings: The Celtics will be in a stronger position to make strategic trades and signings to enhance their team composition.

- Competition for Top Players Intensifies: While the Celtics now have greater resources, the competition for elite talent remains fierce, highlighting the need for strategic decision-making.

Coaching and Management Changes

The new ownership might initiate changes in coaching and management, potentially altering the team's direction.

- Potential Coaching Staff Overhaul: The new owners might seek a fresh perspective and bring in a new head coach or assistant coaches to implement a new playing style.

- Front Office Restructuring: Changes in the front office could lead to alterations in team strategy, player evaluation, and overall team management.

- Improved Team Cohesion and Chemistry: New leadership could foster improved team cohesion, chemistry, and a more unified approach on the court.

- Analysis of Potential Impact: The impact of any potential management or coaching changes will need careful analysis to assess their effect on the team's performance.

- Maintaining Team Culture: It's crucial for the new ownership to maintain the strong team culture and traditions that have defined the Celtics' success.

The Celtics' Brand and Fan Engagement

The $6.1 billion Celtics sale also presents opportunities to enhance the brand image and fan engagement.

Enhanced Brand Image and Global Reach

The sale can significantly boost the Celtics' brand visibility and global appeal.

- Increased Marketing and Promotional Activities: The increased resources allow for more extensive marketing campaigns and promotional activities to reach a wider audience.

- Expansion into New Markets: The Celtics can expand their reach into new international markets, growing their global fanbase.

- Strengthening Relationships with Sponsors and Partners: The enhanced brand image can attract more lucrative sponsorship deals and partnerships.

- Improving Fan Experience Through Technology and Engagement: Investments in technology can create a more immersive and engaging fan experience both at TD Garden and through digital platforms.

Impact on Ticket Prices and Fan Accessibility

The increased value of the franchise might influence ticket pricing and accessibility for fans.

- Potential Ticket Price Increases: The sale might lead to increased ticket prices, potentially affecting fan attendance.

- Maintaining Fan Loyalty and Accessibility: Balancing profitability with fan affordability is crucial for maintaining fan loyalty and accessibility.

- Exploring Innovative Ticketing Models: Implementing innovative ticketing models and fan engagement strategies can help retain affordability while increasing revenue.

Conclusion

The $6.1 billion sale of the Boston Celtics is a watershed moment. The increased financial resources, enhanced stability, and potential for improved on-court performance offer a promising future. However, the new ownership's strategic decisions will be paramount in determining the long-term success of this iconic franchise. The impact of this sale on player acquisitions, coaching, and fan engagement will unfold over time, making this a compelling story to follow. To stay updated on the latest news and analysis surrounding the $6.1 billion Celtics sale and its consequences, keep checking back for more in-depth articles and analysis.

Featured Posts

-

Shtwtjart Ttlqa Dfet Menwyt Qbl Nhayy Alkas Btshkhys Isabt Stylr

May 17, 2025

Shtwtjart Ttlqa Dfet Menwyt Qbl Nhayy Alkas Btshkhys Isabt Stylr

May 17, 2025 -

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025

Red Carpet Rule Breakers Understanding Guest Misconduct

May 17, 2025 -

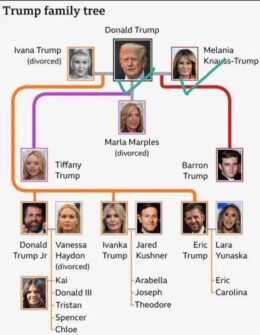

The Trump Family Tree A Look At The Newest Addition Baby Alexander

May 17, 2025

The Trump Family Tree A Look At The Newest Addition Baby Alexander

May 17, 2025 -

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Biseduan Cfare U Diskutua

May 17, 2025

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Biseduan Cfare U Diskutua

May 17, 2025 -

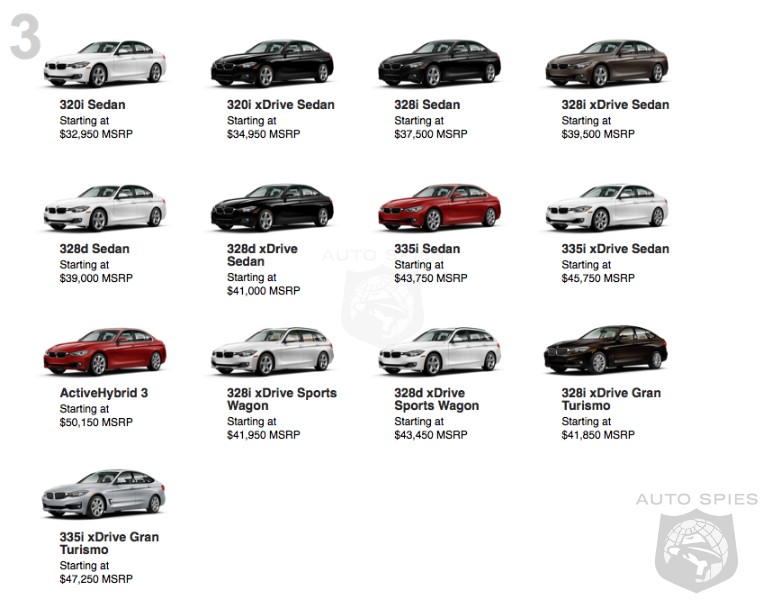

The China Market A Case Study Of Challenges For Premium Automakers Like Bmw And Porsche

May 17, 2025

The China Market A Case Study Of Challenges For Premium Automakers Like Bmw And Porsche

May 17, 2025