$70 Million Blow: Auto Carrier's Worst-Case Scenario From US Port Charges

Table of Contents

The Impact of Increased US Port Charges on Auto Carriers

Increased US port charges are creating a perfect storm for auto carriers. The combination of higher port fees, increased dwell times due to congestion, and rising fuel costs is creating a significant financial burden. This section breaks down the potential $70 million figure and analyzes the various charges impacting auto carriers.

-

The $70 Million Breakdown: This figure is based on an estimated average increase of $X per vehicle, multiplied by the projected number of vehicles imported through US ports annually. Assumptions include factors like average container size, average number of vehicles per container, and the percentage of imports affected by the new charges. This calculation is a worst-case scenario, assuming all factors contribute maximally to increased costs. (Note: Specific figures would need to be sourced from industry data for a truly accurate projection).

-

Types of Port Charges: Auto carriers face a multitude of charges, including:

- Demurrage: Charges levied for exceeding the allowed free time for keeping containers at the port. Port congestion significantly increases the likelihood of incurring demurrage fees.

- Detention: Charges for keeping chassis (the trailer that carries the car) beyond the allotted free time.

- Handling Fees: Charges for loading, unloading, and moving vehicles within the port.

- Storage Fees: Costs incurred for storing vehicles at the port if they can't be immediately transported.

- Permits & Licenses: Various permits and licenses required for operating within US ports.

-

Dwell Time Exacerbates Costs: Port congestion leads to increased dwell times, directly increasing the likelihood of demurrage and detention charges. Delays ripple through the supply chain, impacting inventory management and delivery schedules, adding additional operational costs.

-

Disproportionate Impact on Smaller Carriers: Smaller auto carriers, with fewer resources and less negotiating power, are disproportionately affected by these increased costs compared to their larger counterparts. They may struggle to absorb these increased expenses, potentially leading to financial difficulties or even business closures.

Strategies for Auto Carriers to Mitigate Rising Costs

While the increased US port charges present a significant challenge, auto carriers can employ several strategies to mitigate these rising costs and maintain profitability. Proactive planning and strategic partnerships are key to navigating this challenging environment.

-

Negotiating Lower Port Fees: Auto carriers should actively negotiate lower fees with terminal operators. This can involve leveraging volume discounts, demonstrating long-term commitment, and highlighting the importance of the automotive industry to the port's overall success.

-

Improving Port Efficiency and Reducing Dwell Times: Strategies include:

- Optimized Scheduling: Precise planning of vessel arrivals and departures to minimize waiting times.

- Improved Communication: Enhanced communication between carriers, terminal operators, and other stakeholders to ensure smooth operations.

- Technology Implementation: Utilizing technology for real-time tracking and monitoring of shipments.

-

Investigating Alternative Transportation Modes: Exploring rail transport or inland waterways can reduce reliance on ports, though these alternatives may have their own limitations regarding capacity and accessibility.

-

Advanced Supply Chain Management: Implementing advanced supply chain management systems enables better forecasting, inventory management, and planning, helping to minimize the impact of delays and unexpected costs.

-

Insurance Options: Exploring insurance policies designed to cover potential losses from increased port charges can offer a safety net against unexpected expenses.

The Ripple Effect: Consumer Impact and Market Instability

The increased US port charges won't stay contained within the logistics sector; they will inevitably ripple outwards, impacting consumers and creating market instability.

-

Higher Vehicle Prices: Increased shipping costs will almost certainly translate into higher vehicle prices for consumers, reducing affordability and potentially dampening demand.

-

Impact on Consumer Demand: Higher prices could significantly impact consumer demand, particularly if the increase is steep and widespread. This could lead to a slowdown in the automotive market.

-

Market Volatility and Inflation: Supply chain disruptions and higher prices contribute to market volatility and inflationary pressures within the broader economy.

Government Regulation and Policy Implications

Government intervention and policy changes are crucial for alleviating the burden on auto carriers and stabilizing the automotive industry.

-

Current Government Policies: Analyze current government policies related to port charges and their impact on the automotive sector. (Requires research on current US legislation and regulations).

-

Potential Government Interventions: This could include:

- Subsidies or tax breaks: Financial assistance to offset the increased costs.

- Infrastructure investments: Modernization of port facilities to improve efficiency and reduce congestion.

- Regulatory reforms: Streamlining processes and reducing bureaucratic hurdles.

-

Recommendations for Policy Changes: Advocating for policy changes to improve port infrastructure, streamline regulations, and invest in technological solutions to optimize port operations is vital.

Conclusion

The potential $70 million blow from increased US port charges presents a serious threat to auto carriers. This necessitates immediate action to mitigate risks, optimize costs, and adapt to the changing landscape of automotive logistics. From negotiating lower fees to exploring alternative transportation modes, proactive strategies are crucial for survival and long-term success in the face of these rising costs.

Call to Action: Understanding the full impact of rising US port charges is crucial for all stakeholders. Learn more about effective strategies to navigate this challenging environment and protect your business from the potential financial fallout. Don't let rising US port charges cripple your auto carrier business – take action today!

Featured Posts

-

Krogkommissionens Bedoemning Av Stockholm Stadshotell

Apr 26, 2025

Krogkommissionens Bedoemning Av Stockholm Stadshotell

Apr 26, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

Apr 26, 2025

Understanding The Value Of Middle Management In Todays Workplace

Apr 26, 2025 -

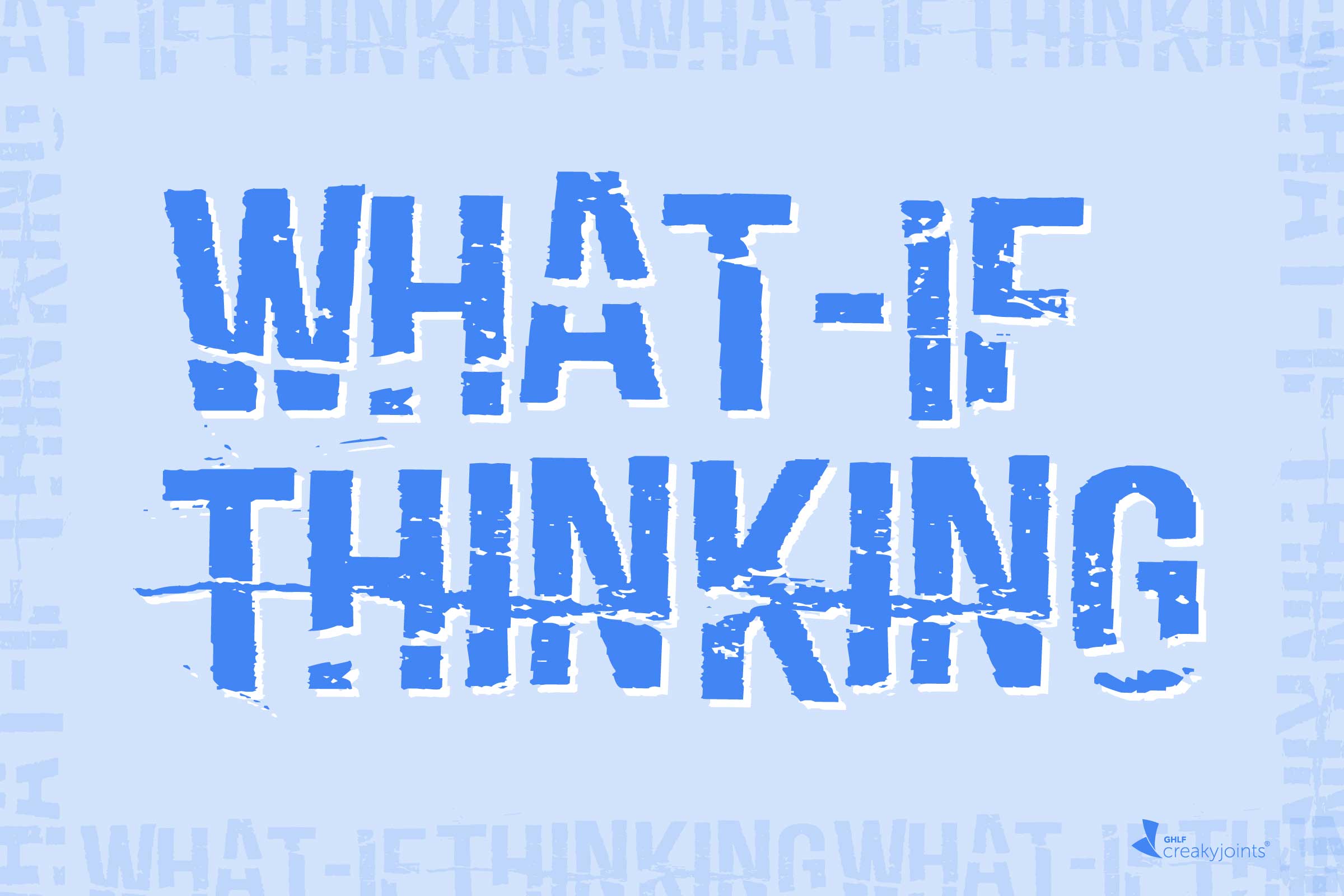

Geopolitical Showdown A Us Military Base And The China Challenge

Apr 26, 2025

Geopolitical Showdown A Us Military Base And The China Challenge

Apr 26, 2025 -

Private Credit Jobs 5 Dos And Don Ts For A Successful Application

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts For A Successful Application

Apr 26, 2025 -

Jennifer Aniston And Chelsea Handler The Real Reason Behind Their Fallout

Apr 26, 2025

Jennifer Aniston And Chelsea Handler The Real Reason Behind Their Fallout

Apr 26, 2025