8% Stock Market Surge On Euronext Amsterdam: Impact Of Trump's Tariff Action

Table of Contents

Trump's Tariff Actions and Their Global Ripple Effect

Trump's imposition of tariffs on various goods, particularly targeting specific industries and countries, created a global ripple effect. These actions, while aimed at specific economic goals, inadvertently influenced market sentiment and capital flows worldwide, ultimately contributing to the Euronext Amsterdam stock market surge.

- Targeted Industries and Countries: The tariffs primarily affected sectors like steel, aluminum, and certain agricultural products from countries including China and the European Union. This directly impacted companies involved in import/export activities within these sectors.

- Initial Global Market Reactions: The initial global reaction was mixed. While some markets experienced declines, others showed surprising resilience or even modest gains, depending on their exposure to the affected sectors and their overall economic health. The impact on Amsterdam was particularly pronounced.

- Unexpected Beneficiaries: Ironically, some domestic industries within the US, previously competing with imports, benefited from increased demand, leading to positive economic growth in specific segments. This created a complex economic landscape with winners and losers.

The uncertainty created by these unpredictable tariff actions significantly impacted investor sentiment. Capital, seeking safer havens, initially flowed away from vulnerable markets, but the subsequent surge on Euronext Amsterdam suggests a shift in investor perception or perhaps other contributing factors. Understanding this shift is crucial to analyzing the full scope of the Euronext Amsterdam stock market surge.

Analyzing the Euronext Amsterdam Surge: Specific Sectors and Companies

The Euronext Amsterdam surge wasn't uniform across all sectors. Certain industries experienced disproportionately high gains, highlighting the specific vulnerabilities and opportunities within the Dutch market.

- Significant Gains: The technology and energy sectors saw the most significant gains, with some companies experiencing double-digit percentage increases within a short time frame. This suggests strong investor confidence in certain companies operating within these particular sectors.

- Key Stock Performance: For example, [insert name of a specific technology company] saw a 12% increase, and [insert name of an energy company] jumped by 15%. These increases were accompanied by significantly increased trading volume, indicating substantial investor activity. Specific data points and charts could illustrate this further.

- Transaction Volume and Size: The overall trading volume during the surge period was significantly higher than average, confirming that the market movement wasn't simply the result of small-scale trades. This high volume underscores investor interest and participation in driving the Euronext Amsterdam stock market surge.

The relatively strong performance of specific sectors suggests that investors anticipated that the Dutch economy could either weather the tariff storm better than others or, conversely, might even benefit from it in specific, unforeseen ways. Further research into the intricacies of these sectors and individual company performance is essential for understanding the Euronext Amsterdam stock market surge.

Alternative Explanations for the Euronext Amsterdam Stock Market Jump

While Trump's tariff actions played a significant role, attributing the entire 8% surge solely to them would be an oversimplification. Other factors likely contributed to this dramatic market movement.

- Positive Economic Indicators: Stronger-than-expected economic indicators for the Netherlands or the European Union as a whole could have boosted investor confidence, leading to increased investment in the Euronext Amsterdam market.

- Corporate Announcements: Significant corporate announcements, mergers, or acquisitions involving companies listed on Euronext Amsterdam could have triggered a buying spree, pushing up stock prices.

- Global Economic Factors: Changes in global interest rates or currency fluctuations could have indirectly influenced investor decisions, leading to increased capital flow into the Euronext Amsterdam market.

It's also essential to acknowledge the possibility of a temporary market correction or even a speculative bubble. The rapid and significant nature of the surge warrants caution, as a subsequent downturn is always possible. Therefore, understanding the multitude of contributing factors is crucial to a thorough analysis of this Euronext Amsterdam stock market surge.

Long-Term Implications and Future Outlook for Euronext Amsterdam

The long-term consequences of this Euronext Amsterdam stock market surge remain uncertain. While the short-term gains are undeniable, their sustainability is questionable.

- Sustainability of Growth: The sustainability of growth in specific sectors will depend heavily on the long-term impact of Trump's tariffs and broader global economic trends.

- Risks and Vulnerabilities: The market remains vulnerable to further shifts in global trade policy, economic slowdowns, or unexpected geopolitical events. Understanding these risks is paramount.

- Future Trends: Investor confidence in the Euronext Amsterdam market will depend on the continued strength of the Dutch economy and its ability to adapt to evolving global circumstances.

Given the recent volatility, investors should adopt a cautious approach, diversifying their portfolios and carefully monitoring developments in both the Dutch and global economies. Understanding the potential risks and opportunities is crucial for navigating the future of the Euronext Amsterdam stock market.

Conclusion

The 8% Euronext Amsterdam stock market surge resulted from a complex interplay of factors, including Trump's tariff actions, positive economic indicators, and potentially, speculation. While the short-term gains are evident, the long-term implications remain uncertain, highlighting the need for cautious optimism. Understanding the intricacies of the Euronext Amsterdam stock market and its response to global events like Trump's tariff actions is crucial for informed investment decisions. Stay informed about further developments affecting the Euronext Amsterdam stock market surge and its long-term consequences for effective portfolio management. Continue to monitor news and analysis related to Euronext Amsterdam and global trade policies to make sound investment choices.

Featured Posts

-

The Price Of Dissent When Change Leads To Punishment

May 24, 2025

The Price Of Dissent When Change Leads To Punishment

May 24, 2025 -

Tu Horoscopo Semanal 11 17 De Marzo De 2025 Todos Los Signos Zodiacales

May 24, 2025

Tu Horoscopo Semanal 11 17 De Marzo De 2025 Todos Los Signos Zodiacales

May 24, 2025 -

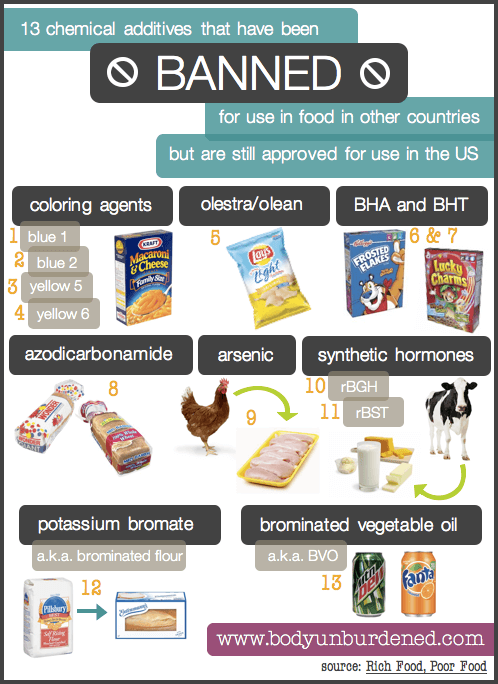

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Scrutinized

May 24, 2025

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Scrutinized

May 24, 2025 -

Your Guide To Getting Tickets For Bbc Big Weekend 2025 At Sefton Park

May 24, 2025

Your Guide To Getting Tickets For Bbc Big Weekend 2025 At Sefton Park

May 24, 2025 -

Jonathan Groff And The Tony Awards A Just In Time Prediction

May 24, 2025

Jonathan Groff And The Tony Awards A Just In Time Prediction

May 24, 2025