A Place In The Sun: Financing Your Dream Overseas Home

Table of Contents

Understanding the Unique Challenges of International Property Financing

Buying a home abroad is an exciting prospect, but it presents unique financial hurdles compared to domestic purchases. Successfully financing your dream overseas home requires careful planning and a thorough understanding of these challenges.

Currency Fluctuations and Exchange Rates

One of the biggest risks when financing an overseas property is currency fluctuation. Exchange rates can shift dramatically, impacting the cost of your mortgage repayments and the overall value of your investment.

- Impact on loan repayments: A strengthening of the foreign currency against your home currency means higher repayments.

- Potential for increased costs: Fluctuations can significantly increase the overall cost of the property and associated expenses.

- Advice on using currency exchange services: Utilizing services specializing in international money transfers can help mitigate some risks, but professional advice is crucial. Consider hedging strategies to protect against unfavorable exchange rate movements.

Differences in Mortgage Lending Practices

Mortgage markets vary significantly worldwide. Interest rates, loan-to-value ratios (LTVs), and eligibility criteria differ drastically between countries.

- Comparison of mortgage markets: For example, securing a mortgage in the US might be relatively straightforward, while obtaining one in Spain or Portugal may involve stricter requirements and different lending practices.

- Requirements for foreign buyers: Many countries have specific requirements for foreign buyers, including stricter proof of funds or higher down payment percentages.

- Types of mortgages available internationally: You might encounter different types of mortgages, such as fixed-rate, variable-rate, or interest-only mortgages, each with its own implications.

Legal and Documentation Requirements

Navigating international property laws and ensuring all documentation is in order is crucial for a smooth transaction.

- Importance of due diligence: Conduct thorough due diligence on the property and the seller to avoid potential legal complications.

- Necessary paperwork: You will need to provide extensive documentation, including proof of funds, identification documents, and potentially visa requirements, depending on the country.

- Engaging local lawyers and conveyancers: Hiring local legal professionals is highly recommended to ensure compliance with local laws and to navigate the complexities of the buying process. They can assist with translations and ensure all legal aspects are handled correctly.

Exploring Financing Options for Your Overseas Property

Several financing options exist to help you fund your international property purchase. Choosing the right one depends on your financial situation and the specific circumstances of your purchase.

Traditional Mortgages from Your Home Country

Many banks offer international mortgages, allowing you to borrow from your domestic bank for an overseas property purchase.

- Accessibility: The accessibility of these mortgages varies depending on your bank and creditworthiness.

- Interest rates: Interest rates on international mortgages are often higher than domestic mortgages.

- Limitations on international properties: Banks may impose limitations on the types of properties they will finance overseas.

- Potential difficulties with valuations: Valuations of overseas properties can be more complex and time-consuming.

Mortgages from Local Banks in Your Chosen Country

Securing a mortgage from a local bank in your chosen country offers a potentially more favorable interest rate and might provide a more streamlined process, although it presents its own challenges.

- Local requirements: You'll need to meet the specific requirements of the local banking system.

- Language barriers: Communication might be a hurdle if you don't speak the local language.

- Understanding local banking regulations: Familiarize yourself with the regulations and practices of the local banking system.

- Potential need for a local guarantor: You might need a local guarantor to secure a mortgage.

International Mortgage Brokers

International mortgage brokers specialize in connecting buyers with lenders offering international mortgages.

- Expertise in international markets: Brokers have a deep understanding of international mortgage markets.

- Access to a wider range of lenders: They have access to lenders you might not be able to find on your own.

- Assistance with paperwork and legal aspects: Brokers can significantly streamline the paperwork and legal aspects of the process.

Cash Purchases and Other Financing Methods

For those with sufficient funds, a cash purchase eliminates the complexities of securing a mortgage. Other financing methods include using investment funds or private lenders.

- Advantages and disadvantages: Cash purchases are straightforward but require substantial capital. Using investment funds involves specific regulations and tax implications.

- Tax implications: Consult with a tax advisor to understand the tax implications of each financing method.

- Financial planning considerations: Careful financial planning is essential regardless of the chosen method.

Essential Steps to Secure Financing

Securing financing for your overseas home involves careful planning and execution. Following these key steps will increase your chances of success.

Pre-Approval and Due Diligence

Before starting your property search, get pre-approved for a mortgage.

- Understand your borrowing capacity: Determine how much you can realistically borrow.

- Secure pre-approval letters: This strengthens your position when making an offer on a property.

- Conduct thorough property research and due diligence: Ensure the property is legally sound and meets your expectations.

Working with Real Estate Agents and Lawyers

Engaging experienced professionals is vital for a smooth transaction.

- Finding reputable agents with international expertise: Choose agents familiar with international property transactions.

- Utilizing legal professionals for contract review and closing procedures: Legal counsel is essential to protect your interests.

Managing the Closing Process and Post-Purchase Costs

The closing process involves finalizing the purchase and managing ongoing costs.

- Closing costs: Expect various closing costs, including legal fees, transfer taxes, and other expenses.

- Property taxes: Research local property taxes and insurance requirements.

- Insurance: Secure adequate insurance coverage for your overseas property.

- Ongoing maintenance expenses: Factor in ongoing maintenance and upkeep costs.

Conclusion

This guide has explored the complexities of financing your dream overseas home. While the process may seem daunting, by understanding the unique challenges and available options – from securing mortgages in your home country or overseas, to leveraging the expertise of international brokers – you can confidently navigate the path to owning your dream international property. Remember to conduct thorough research, seek expert advice, and carefully plan your finances. Don’t let the dream of owning a place in the sun remain just a dream—start exploring your financing options for your dream overseas home today!

Featured Posts

-

The Farage Factor Assessing Reform Uks Political Strength

May 03, 2025

The Farage Factor Assessing Reform Uks Political Strength

May 03, 2025 -

L Etat Palestinien Le Dissention Entre Netanyahu Et Macron S Accroit

May 03, 2025

L Etat Palestinien Le Dissention Entre Netanyahu Et Macron S Accroit

May 03, 2025 -

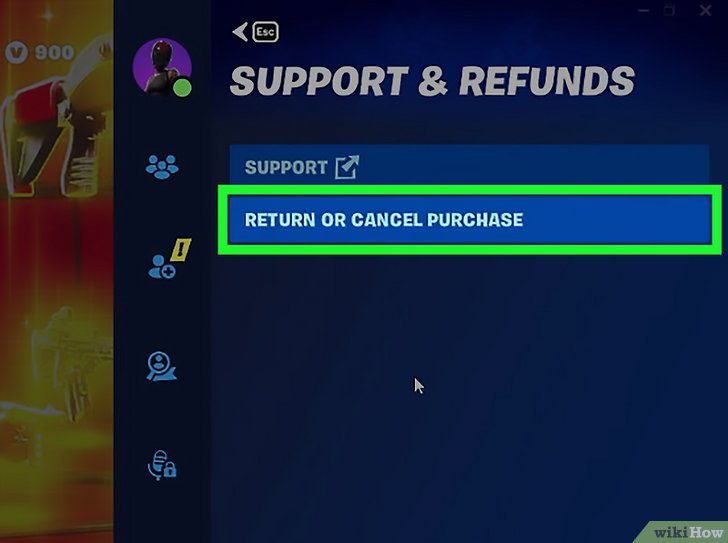

Fortnites Refund Policy And Its Impact On Cosmetic Sales

May 03, 2025

Fortnites Refund Policy And Its Impact On Cosmetic Sales

May 03, 2025 -

Nigel Farage Faces Defamation Claim From Rupert Lowe Analysis Of The Case

May 03, 2025

Nigel Farage Faces Defamation Claim From Rupert Lowe Analysis Of The Case

May 03, 2025 -

Securing Your Place In The Sun A Step By Step Guide To International Property Investment

May 03, 2025

Securing Your Place In The Sun A Step By Step Guide To International Property Investment

May 03, 2025