A Place In The Sun: Navigating The Legal And Financial Aspects Of Overseas Property Purchase

Table of Contents

Researching Your Chosen Location

Before you even start browsing overseas property listings, thorough research is paramount. This due diligence will protect your investment and prevent costly mistakes down the line.

Due Diligence is Key

Thorough research is crucial before investing in overseas property. Understand local laws, taxes, and potential risks to make a well-informed decision.

- Investigate property prices and trends: Analyze market data to understand the value of properties in your target area and identify potential for appreciation or depreciation. Consider using online property portals specific to your target country and consulting local real estate agents for insights.

- Research the local economy and its stability: A robust and growing local economy is a positive indicator. Investigate factors like unemployment rates, tourism, and overall economic growth to assess the long-term value of your investment.

- Assess the infrastructure: Consider access to transportation, reliable utilities (water, electricity, internet), and proximity to essential services like healthcare and education. Poor infrastructure can significantly impact your property's value and your quality of life.

- Examine the local legal system: Understand the laws governing property ownership, including inheritance rights and dispute resolution processes. Familiarize yourself with any specific regulations concerning foreign ownership.

- Check for environmental risks and building restrictions: Research potential environmental hazards (flooding, earthquakes, etc.) and any building codes or regulations that may limit development or renovation. This is crucial for mitigating future risks and avoiding unexpected costs.

Understanding Property Types and Regulations

Different countries have vastly different regulations regarding property ownership, often with specific restrictions on foreign buyers. This section highlights the importance of understanding these nuances before committing to a purchase.

- Familiarize yourself with property types: Understand the differences between apartments, villas, townhouses, and land plots, along with the associated costs and maintenance requirements. Each property type comes with unique financial and legal considerations.

- Understand zoning regulations and building codes: These regulations dictate what you can and cannot do with your property, impacting potential renovations or extensions. Non-compliance can lead to significant fines or legal issues.

- Check for restrictions on foreign ownership: Some countries impose limitations on the percentage of property that can be owned by foreign nationals. Understand any quotas, permits, or special taxes that might apply.

- Rental income regulations: If you plan to rent out your property, research local laws governing short-term and long-term rentals, including tax implications and tenant rights.

Securing Financing for Your Overseas Property Purchase

Financing an overseas property purchase often presents unique challenges compared to domestic financing. This section will guide you through the process of securing a mortgage and managing your finances effectively.

Exploring Mortgage Options

Securing a mortgage for overseas property requires careful planning and research. International mortgages often involve more stringent requirements and higher interest rates than domestic loans.

- Research international lenders: Identify lenders with experience in providing mortgages for overseas properties. Many international banks and specialized mortgage brokers offer such services.

- Compare interest rates, fees, and repayment terms: Interest rates and fees can vary significantly between lenders. Secure multiple quotes and compare the total cost of borrowing before making a decision.

- Prepare comprehensive financial documentation: Lenders will require extensive documentation to assess your creditworthiness, including proof of income, assets, and debt.

- Factor in exchange rate fluctuations: Exchange rate volatility can significantly impact the cost of your mortgage repayments. Consider hedging strategies to mitigate currency risk.

Managing Your Finances

Effective financial planning is crucial for a successful overseas property purchase. Consider all associated costs to ensure you are financially prepared for the entire process.

- Create a detailed budget: Include all anticipated expenses, such as the purchase price, legal fees, taxes, mortgage payments, insurance, maintenance, and travel costs.

- Secure sufficient funds for a down payment and closing costs: Typically, a larger down payment is required for international mortgages, which can also involve higher closing costs.

- Consider ongoing costs: Factor in property taxes, insurance, maintenance, and potential repair expenses. These recurring costs can add up, so it's crucial to budget accordingly.

- Consult a financial advisor: Seek professional advice from a financial advisor specializing in international investments to develop a comprehensive financial plan.

Navigating the Legal Landscape of Overseas Property Purchase

Navigating the legal aspects of an overseas property purchase requires expert guidance. Engaging qualified legal professionals is crucial to protect your interests and avoid potential pitfalls.

Engaging Legal Professionals

Employing a solicitor or lawyer specializing in international property law is non-negotiable. They will guide you through the complex legal processes and protect your rights.

- Seek recommendations: Ask for referrals from trusted sources, such as other property owners or financial advisors.

- Ensure legal expertise: Verify the lawyer's experience and familiarity with the local property laws and regulations in your target country.

- Review all legal documents: Don't hesitate to ask questions and seek clarification on any aspect of the contracts or documents you are asked to sign.

Understanding Contracts and Deeds

Contracts and deeds are legally binding documents. Meticulous review is essential to avoid misunderstandings or disputes.

- Seek legal advice on all contracts: Have your lawyer review all contracts and deeds thoroughly before signing any documents.

- Ensure clarity: Ensure all contracts and deeds are written in a language you understand or have been accurately translated.

- Clarify ambiguities: Don't hesitate to ask questions and seek clarification on any unclear or ambiguous clauses in the contracts.

Post-Purchase Considerations for Your Overseas Property

Owning overseas property involves ongoing responsibilities. Planning for property management, maintenance, and tax implications is crucial for long-term success.

Property Management and Maintenance

Managing an overseas property can be challenging, especially if you don't reside nearby. Consider your options for managing the property effectively.

- Self-management or professional management: Decide whether to manage the property yourself or hire a local property management company. Self-management requires more time and effort, while hiring a property manager involves additional costs.

- Budget for maintenance: Allocate funds for regular maintenance, repairs, and potential renovations. Unexpected expenses can quickly arise, so budgeting for contingencies is essential.

- Secure adequate insurance: Obtain appropriate insurance coverage to protect your property against damage, theft, and other risks.

Tax Implications

Understanding the tax implications of owning overseas property is essential. Consult with tax professionals to ensure compliance with all applicable laws.

- Research tax laws: Research tax laws in both your home country and the country where the property is located. Tax regulations vary significantly between countries.

- Seek tax advice: Consult with a tax professional familiar with international taxation to understand your tax obligations and optimize your tax strategy.

Conclusion

Owning overseas property can be a rewarding experience, offering a lifestyle change and a valuable investment. However, a thorough understanding of the legal and financial aspects of overseas property purchase is crucial for a smooth and successful transaction. By following the steps outlined in this guide, you can navigate the complexities of buying property abroad and confidently secure your dream overseas property. Don't hesitate to seek professional legal and financial advice throughout the process to ensure a secure and profitable overseas property purchase.

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 03, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 03, 2025 -

The Tulsa Day Center On The Rise Of Homelessness In Tulsa

May 03, 2025

The Tulsa Day Center On The Rise Of Homelessness In Tulsa

May 03, 2025 -

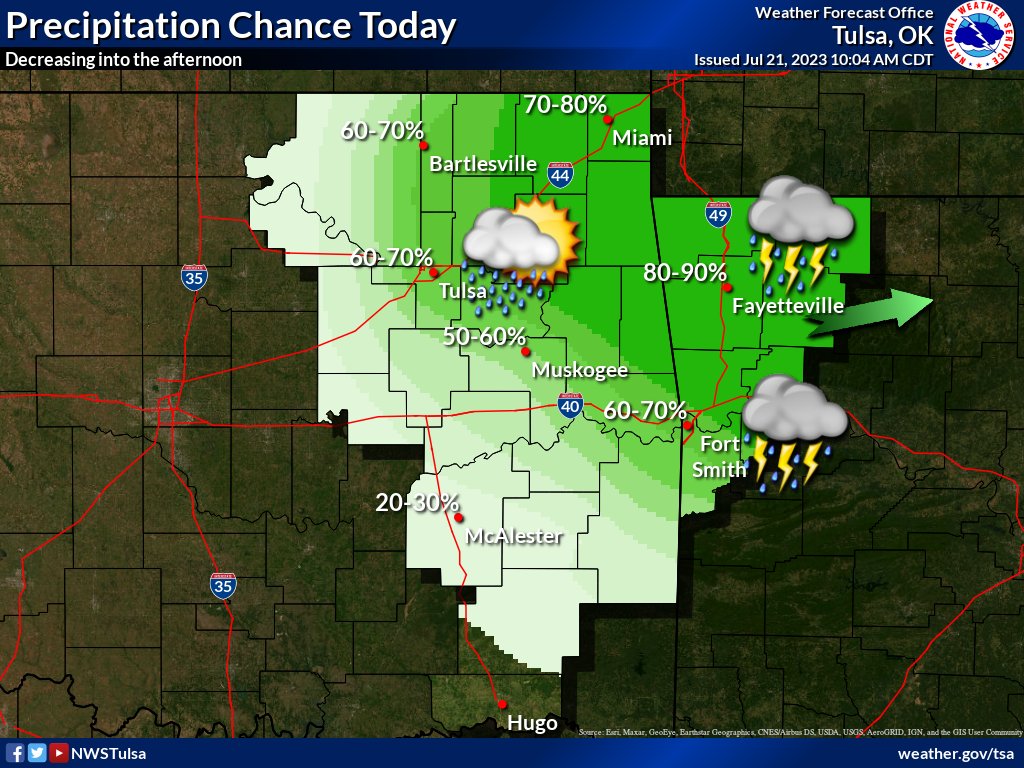

Tulsa Nws Forecaster Reports Near Blizzard Conditions

May 03, 2025

Tulsa Nws Forecaster Reports Near Blizzard Conditions

May 03, 2025 -

This Country An In Depth Look At Its Rich Heritage

May 03, 2025

This Country An In Depth Look At Its Rich Heritage

May 03, 2025 -

Mental Health Services In Ghana Examining The Severe Shortage Of Psychiatrists

May 03, 2025

Mental Health Services In Ghana Examining The Severe Shortage Of Psychiatrists

May 03, 2025