A Responsible Fiscal Plan For Canada: Moving Beyond Liberal Spending

Table of Contents

Curbing Government Spending

A responsible fiscal plan for Canada necessitates a critical examination of government spending. Simply put, we must spend taxpayer money wisely. This requires a two-pronged approach: identifying and eliminating inefficiencies, and reforming existing social programs for greater effectiveness.

Identifying Inefficiencies

Government spending often lacks transparency and accountability. To implement a responsible fiscal plan, a thorough review is essential.

- Conduct thorough audits of all government departments: Independent audits can expose wasteful spending and duplicated efforts.

- Identify overlapping programs and eliminate redundancies: Many programs share similar goals, leading to inefficient resource allocation. Consolidation and streamlining are crucial.

- Prioritize spending based on demonstrable impact and return on investment: Every dollar spent should contribute meaningfully to national priorities. Cost-benefit analyses are vital for assessing the value of government programs.

- Implement robust cost-benefit analyses for all new initiatives: Before launching new programs, a comprehensive assessment of their potential impact and costs is paramount. This ensures that only worthwhile projects receive funding. This is a key element of any responsible fiscal plan in Canada.

Reforming Social Programs

Social programs are vital, but their efficiency and effectiveness must be constantly evaluated. A responsible fiscal plan should focus on maximizing the impact of these programs.

- Explore targeted assistance rather than universal benefits where appropriate: Tailoring benefits to those most in need ensures resources are used effectively.

- Implement stronger measures to combat fraud and abuse: Robust systems for detecting and preventing fraud are essential for safeguarding taxpayer money.

- Focus on long-term solutions and preventative measures to reduce reliance on social safety nets: Investing in preventative programs can reduce the long-term demand for social assistance.

- Streamline bureaucratic processes to reduce administrative costs: Reducing red tape and simplifying application processes can free up resources and improve service delivery.

Boosting Economic Growth

A strong economy is the foundation of a responsible fiscal plan. This requires strategic investments and a supportive environment for businesses to thrive.

Investing in Infrastructure

Modern infrastructure is crucial for economic competitiveness. A responsible fiscal plan should prioritize strategic infrastructure projects.

- Prioritize projects with high economic impact, such as transportation networks and renewable energy infrastructure: These investments create jobs and stimulate long-term growth.

- Focus on projects that improve productivity and competitiveness: Investments should enhance efficiency and boost the nation's global standing.

- Attract private sector investment through public-private partnerships: Leveraging private capital can reduce the burden on taxpayers while accelerating project delivery.

Promoting Private Sector Growth

A thriving private sector is essential for economic prosperity. A responsible fiscal plan must foster a favorable business environment.

- Simplify tax codes and reduce corporate tax rates to attract businesses: A competitive tax system incentivizes investment and job creation.

- Reduce red tape and streamline bureaucratic processes for businesses: Easing regulatory burdens frees up businesses to focus on growth and innovation.

- Invest in education and skills training to develop a qualified workforce: A skilled workforce is the engine of a strong economy.

Tax Reform for Fiscal Responsibility

Tax reform is integral to a responsible fiscal plan. It requires simplifying the tax code and creating incentives for economic growth.

Tax Code Simplification

A complex tax code discourages compliance and hinders economic activity. Simplification is a key component of a responsible fiscal plan for Canada.

- Reduce tax brackets and simplify tax deductions: A simpler system increases fairness and compliance.

- Improve tax administration to reduce evasion and increase efficiency: Modernizing tax collection methods can improve revenue generation.

- Introduce measures to enhance tax transparency and accountability: Openness and accountability are crucial for building public trust.

Targeted Tax Incentives

Strategic tax incentives can stimulate investment in key sectors and promote economic growth.

- Provide tax credits for research and development: Incentivizing innovation drives technological advancement and competitiveness.

- Offer tax incentives for businesses investing in clean energy technologies: Promoting sustainable energy sources benefits the environment and the economy.

- Promote investment in skills training and education through tax breaks: Investing in human capital is crucial for long-term economic prosperity.

Conclusion

This article has outlined key elements of a responsible fiscal plan for Canada that moves beyond the current model of Liberal spending. By curbing government spending, boosting economic growth, and implementing targeted tax reforms, Canada can achieve a balanced budget, reduce its national debt, and ensure long-term economic prosperity. A responsible fiscal plan is not about austerity; it's about responsible stewardship of taxpayer money and ensuring a sustainable future for all Canadians. To learn more about creating a truly responsible fiscal plan for Canada, we encourage you to explore further research on responsible fiscal policies and engage in discussions on effective budgetary strategies for a brighter future. Let's build a better future with a responsible fiscal plan for Canada!

Featured Posts

-

Tesla Earnings Plunge 71 In First Quarter Analysis Of Political Impact

Apr 24, 2025

Tesla Earnings Plunge 71 In First Quarter Analysis Of Political Impact

Apr 24, 2025 -

Canadian Auto Dealers Fight Back A Five Point Plan To Counter Us Trade Actions

Apr 24, 2025

Canadian Auto Dealers Fight Back A Five Point Plan To Counter Us Trade Actions

Apr 24, 2025 -

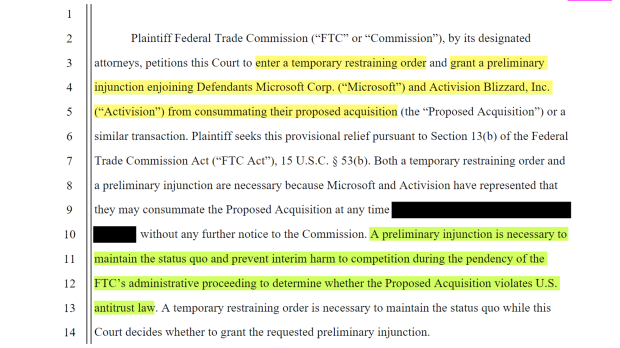

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025 -

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025