A Simple, Highly Profitable Dividend Investing Strategy

Table of Contents

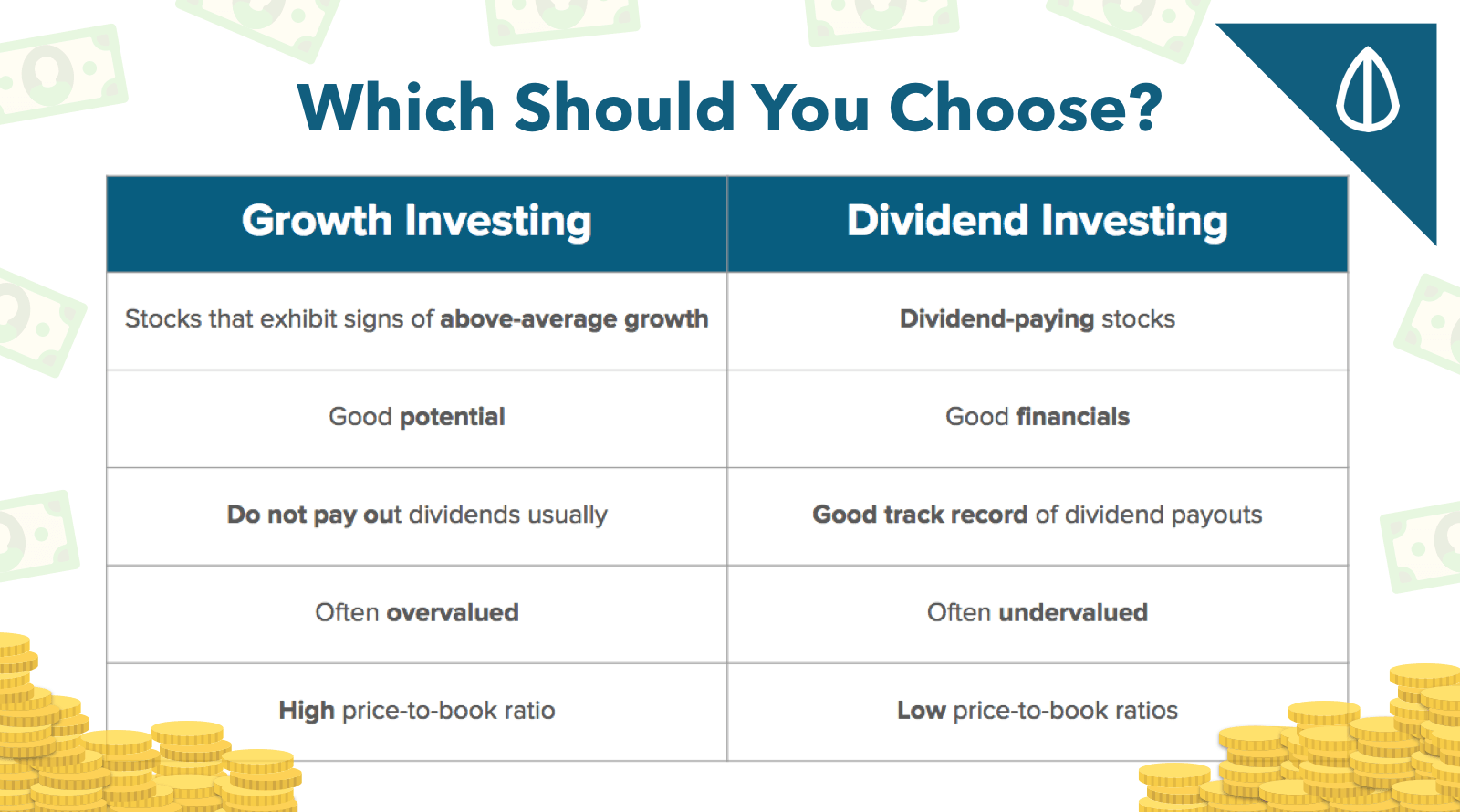

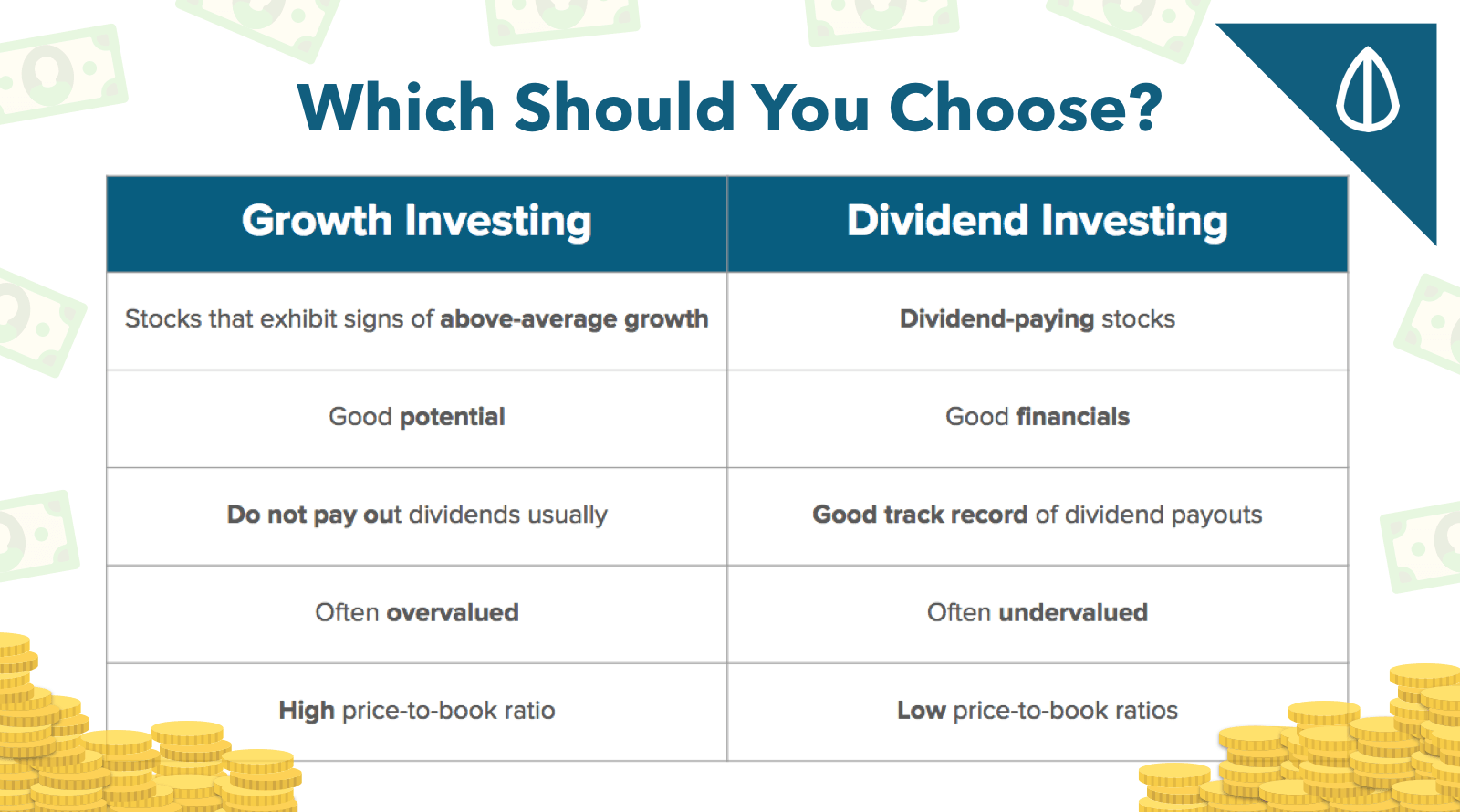

Understanding the Fundamentals of Dividend Investing

Before diving into specific strategies, it's crucial to grasp the basics of dividend investing.

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. There are several types of dividends:

- Regular Dividends: These are recurring payments made at fixed intervals, usually quarterly. These are the most common type.

- Special Dividends: These are one-time, larger-than-usual payments, often made when a company has excess cash.

- Stock Dividends: Instead of cash, companies sometimes issue additional shares of stock as dividends.

Tax Implications: Dividend income is generally taxable, but the tax rate depends on your income bracket and the type of dividend (qualified dividends often receive a lower tax rate). Understanding the ex-dividend date (the date after which you must own the stock to receive the dividend) and the dividend payment date is essential for proper tax reporting. The dividend yield, expressed as a percentage, represents the annual dividend per share relative to the stock price. The dividend payout ratio indicates the percentage of earnings paid out as dividends.

Identifying High-Yield Dividend Stocks

Finding high dividend yield stocks is a key element of a profitable dividend investing strategy. Several strategies can help:

- Utilize Online Tools: Many websites and brokerage platforms offer dividend stock screeners that allow you to filter stocks based on yield, payout ratio, and other criteria.

- Analyze Dividend History: Examine a company's history of dividend payments. Consistent and growing dividends suggest a financially stable company committed to returning value to shareholders.

- Assess Dividend Sustainability: Don't solely focus on high yield. Ensure the dividend is sustainable by analyzing the company's financials and ensuring the dividend payout ratio isn't excessively high (which could indicate future dividend cuts). High yield often comes with higher risk; careful dividend growth analysis is critical.

The Importance of Dividend Reinvestment

A dividend reinvestment plan (DRIP) allows you to automatically reinvest your dividend payments into additional shares of the same stock. This leverages the power of compound interest:

- Compounding Returns: Reinvesting dividends accelerates growth because your earnings generate further earnings over time.

- DRIPs vs. Manual Reinvestment: DRIPs often offer lower transaction fees than manually buying additional shares, making them a cost-effective way to reinvest. They are a powerful tool in dividend growth investing.

Building a Diversified Dividend Portfolio

Diversification is crucial to mitigate risk in any investment strategy, and dividend investing is no exception.

Diversification Strategies

- Across Sectors and Industries: Don't put all your eggs in one basket. Spread your investments across different sectors (e.g., technology, healthcare, consumer goods) and industries to reduce the impact of a downturn in any single area.

- ETFs and Mutual Funds: Exchange-Traded Funds (ETFs) and mutual funds offer diversified exposure to a range of stocks, making it easier to achieve diversification, especially for beginners. They are useful tools for portfolio diversification.

- Risk and Reward Balance: Find a balance between high-yield, potentially riskier stocks, and lower-yield, more stable stocks to manage your risk tolerance effectively. This is crucial for risk management.

Assessing Company Financial Health

Before investing in any company, it's essential to conduct thorough due diligence:

- Key Financial Metrics: Analyze financial ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio to assess a company's financial health and sustainability. Fundamental analysis is crucial here.

- Dividend Sustainability: A company's financial stability is paramount for ensuring the continued payment of dividends. Look for companies with strong balance sheets and consistent earnings growth. Utilize available resources for company financials research.

Long-Term Growth and Tax Optimization

A successful dividend investing strategy focuses on the long term and incorporates tax efficiency.

The Power of Long-Term Dividend Growth Investing

- Reinvesting for Growth: Consistently reinvesting dividends through a DRIP is key to maximizing long-term returns, accelerating compound interest and building long-term wealth.

- Consistent Dividend Increases: Prioritize companies with a proven track record of consistently increasing their dividends over time. This signifies financial strength and a commitment to shareholder returns. The impact of compounding on long-term wealth building cannot be overstated.

Tax-Efficient Dividend Investing Strategies

- Tax Implications: Dividend income and capital gains are taxable. Understanding the tax implications is vital for maximizing your after-tax returns.

- Tax-Advantaged Accounts: Utilize tax-advantaged accounts like Roth IRAs or 401(k)s to minimize your tax liability on dividend income and capital gains. Effective tax optimization is a key part of a successful strategy.

Conclusion

A simple, highly profitable dividend investing strategy involves understanding the fundamentals, building a diversified portfolio, and focusing on long-term growth and tax optimization. By carefully selecting high-yield dividend stocks, reinvesting dividends consistently, and regularly monitoring your portfolio, you can generate passive income and build lasting wealth. Start building your own profitable dividend investing strategy today! Learn more about effective and begin your journey to financial freedom.

Featured Posts

-

Combat Ufc 315 Montreal Zahabi Contre Aldo Duree Et Enjeux

May 11, 2025

Combat Ufc 315 Montreal Zahabi Contre Aldo Duree Et Enjeux

May 11, 2025 -

New York Yankees Dominant Win Over Pittsburgh Pirates Judge And Fried Lead The Charge

May 11, 2025

New York Yankees Dominant Win Over Pittsburgh Pirates Judge And Fried Lead The Charge

May 11, 2025 -

Where To Watch The Ny Knicks Vs Cleveland Cavaliers Game Live Stream And Tv Info

May 11, 2025

Where To Watch The Ny Knicks Vs Cleveland Cavaliers Game Live Stream And Tv Info

May 11, 2025 -

Yankees Brewers Series Tracking Key Injuries March 27 30

May 11, 2025

Yankees Brewers Series Tracking Key Injuries March 27 30

May 11, 2025 -

New Calvin Klein Campaign Featuring Lily Collins Image 5133600

May 11, 2025

New Calvin Klein Campaign Featuring Lily Collins Image 5133600

May 11, 2025