AbbVie (ABBV) Stock Rises On Exceeding Sales Expectations And Revised Profit Forecast

Table of Contents

AbbVie's Q3 Earnings Beat Expectations

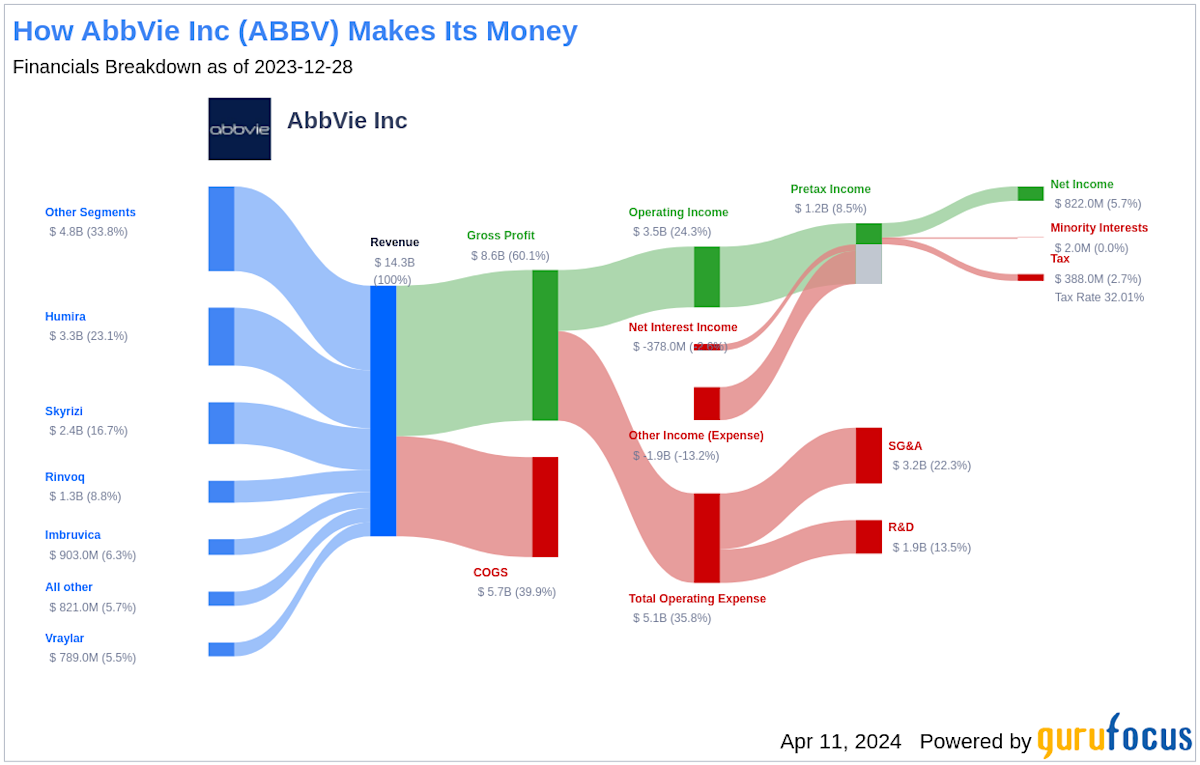

AbbVie's Q3 2023 earnings report showcased remarkably strong performance, exceeding analyst expectations across several key metrics. Revenue figures significantly surpassed predictions, fueled by the robust performance of several key drugs within its portfolio. This success highlights the continued strength of AbbVie's product pipeline and its ability to maintain market leadership in several therapeutic areas.

- Key Drug Performance: Humira, despite facing biosimilar competition, continued to contribute significantly to overall revenue, generating X billion in sales. Skyrizi and Rinvoq, AbbVie's newer immunology drugs, demonstrated exceptional growth, achieving sales of Y billion and Z billion respectively. These figures represent a substantial increase compared to Q3 2022.

- Sales Growth Breakdown:

- Humira: X% increase compared to Q3 2022.

- Skyrizi: Y% increase compared to Q3 2022.

- Rinvoq: Z% increase compared to Q3 2022.

- Reasons for Strong Sales: The success can be attributed to a combination of factors, including increased market share, successful marketing campaigns focusing on the unique benefits of these drugs, and strong demand driven by the effectiveness and safety profiles of these medications. Keywords: AbbVie earnings, Q3 results, Humira sales, Skyrizi sales, Rinvoq sales, revenue growth.

Revised Profit Forecast Fuels Investor Optimism

The upgraded profit forecast further fueled investor optimism and contributed significantly to the ABBV stock price increase. AbbVie revised its full-year earnings per share (EPS) guidance upward, reflecting the exceeding sales performance and improved operational efficiency.

- Forecast Revision: The previous forecast projected an EPS of A dollars, while the revised forecast now stands at B dollars, representing a substantial increase of C%.

- Reasons for Upward Revision: This positive revision is driven by several factors, including better-than-expected sales from key drugs, effective cost-cutting measures, and enhanced operational efficiency across various departments.

- Analyst Reactions: Several leading financial analysts reacted positively to the upgraded forecast, reiterating their buy or hold ratings for AbbVie stock, citing the company's strong financial position and promising future prospects. Keywords: AbbVie profit, earnings forecast, profit guidance, investor sentiment, stock market reaction.

Market Reaction and Future Outlook for AbbVie (ABBV) Stock

The market reacted swiftly and positively to AbbVie's Q3 earnings report. The ABBV stock price surged significantly following the announcement, reflecting investor confidence in the company's future performance.

- Immediate Market Reaction: ABBV stock experienced a D% increase in price immediately following the release of the earnings report. Trading volume also spiked, indicating heightened investor interest.

- Long-Term Implications: The strong Q3 results and upwardly revised profit forecast paint a positive picture for AbbVie's long-term prospects. This improved outlook suggests continued growth and potential for increased shareholder returns.

- Potential Risks and Challenges: Despite the positive outlook, AbbVie faces potential challenges, including increased competition in the pharmaceutical market, patent expirations for some existing drugs, and the ever-evolving regulatory landscape.

- Future Growth Opportunities: AbbVie is actively pursuing several avenues for future growth, including research and development of innovative new therapies, strategic acquisitions, and expansion into new geographic markets. Keywords: ABBV stock price, market analysis, stock forecast, future growth, investment opportunities, pharmaceutical stocks.

Conclusion: Investing in the Future of AbbVie (ABBV) Stock

In summary, AbbVie's Q3 earnings significantly exceeded expectations, leading to a substantial upward revision of its profit forecast and a strong positive market reaction. This success highlights the company's ability to deliver robust financial performance, driven by its leading drug portfolio and innovative pipeline. While potential risks exist, AbbVie's overall outlook remains promising. Investors interested in strong growth potential within the pharmaceutical sector should consider AbbVie (ABBV) stock, conducting thorough research before making any investment decisions. Consider the long-term implications and potential returns of an AbbVie investment, explore ABBV shares further, and assess the AbbVie stock outlook carefully before committing to an investment strategy.

Featured Posts

-

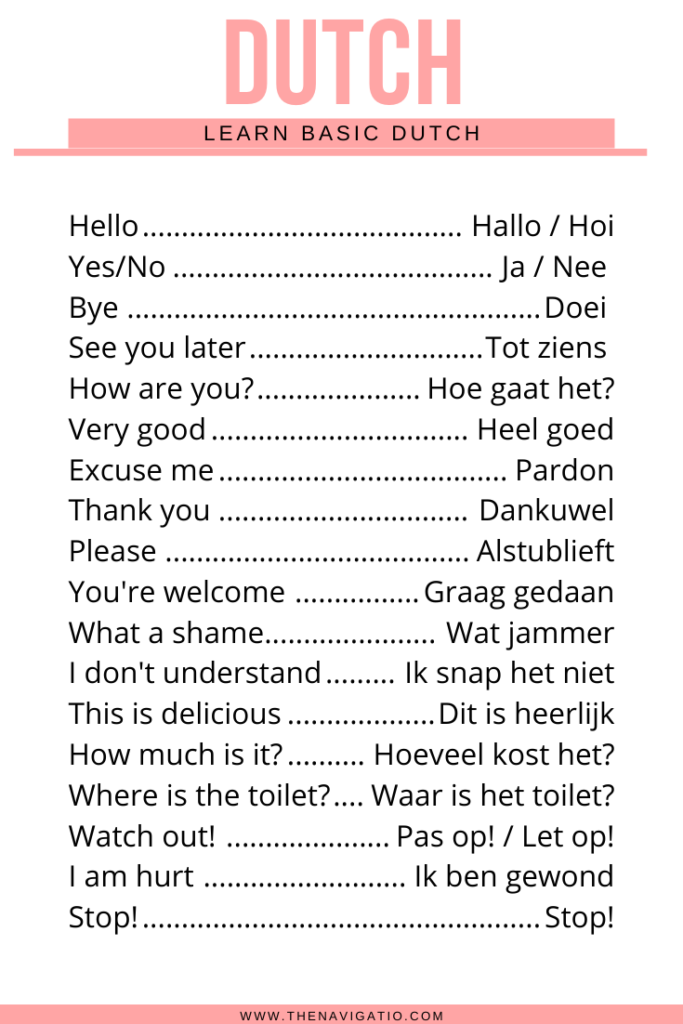

Spring Into Dutch Essential Lente Vocabulary

Apr 26, 2025

Spring Into Dutch Essential Lente Vocabulary

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Behind The Scenes In Svalbard

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Behind The Scenes In Svalbard

Apr 26, 2025 -

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025 -

Cassidy Hutchinson Plans Memoir Detailing January 6th Testimony

Apr 26, 2025

Cassidy Hutchinson Plans Memoir Detailing January 6th Testimony

Apr 26, 2025 -

The Shedeur Sanders Nfl Draft Espn Analysts Insight On Deion Sanders Evaluation

Apr 26, 2025

The Shedeur Sanders Nfl Draft Espn Analysts Insight On Deion Sanders Evaluation

Apr 26, 2025