ABN Amro's Bonus Scheme Under Investigation By Dutch Regulator

Table of Contents

The AFM's Investigation: Scope and Concerns

The AFM, responsible for supervising the integrity, soundness, and efficiency of the Dutch financial markets, has a crucial role in ensuring fair and transparent practices within the banking industry. Their investigation into ABN Amro's bonus scheme focuses on several key areas. The specific aspects under scrutiny include:

-

Potential Conflicts of Interest: The AFM is reportedly examining whether the bonus structure incentivized risky behavior or created conflicts of interest for ABN Amro executives. This includes analyzing whether bonus targets were misaligned with the bank's overall strategic goals and long-term sustainability.

-

Allegations of Excessive Bonuses Despite Poor Performance: The investigation is examining whether bonuses awarded were disproportionate to the bank's actual performance, raising concerns about a disconnect between reward and results. This includes scrutiny of bonus payouts even during periods of financial difficulty or regulatory setbacks.

-

Lack of Transparency in Bonus Calculations: The AFM is investigating the transparency of ABN Amro's bonus calculation methodology. Concerns exist regarding the clarity and understandability of the criteria used to determine bonus amounts, potentially leading to a lack of accountability.

-

Compliance with EU Banking Regulations Regarding Executive Remuneration: The investigation is also focused on ensuring ABN Amro's bonus scheme fully complies with stringent EU regulations designed to curb excessive risk-taking within the banking sector. This includes scrutiny of the scheme's alignment with the EU's Capital Requirements Directive (CRD) and other relevant legislation.

The timeline of the investigation is currently unclear, but potential penalties for ABN Amro could range from substantial fines to reputational damage. While an official AFM spokesperson has yet to issue a public statement detailing specific allegations, the initiation of the investigation itself signals serious concerns.

Impact on ABN Amro's Reputation and Share Price

The ABN Amro bonus scheme investigation is already having a noticeable impact on the bank's reputation and share price. The short-term effects include:

-

Negative Media Coverage and Public Perception: News of the investigation has led to negative media coverage, potentially damaging public trust and confidence in ABN Amro.

-

Potential Loss of Clients and Business Opportunities: Concerns about ethical practices and regulatory compliance could lead to some clients reconsidering their relationship with the bank, impacting future business opportunities.

Long-term consequences could include:

-

Increased Regulatory Scrutiny: The investigation is likely to result in increased scrutiny of ABN Amro's operations and internal controls, leading to potentially higher compliance costs.

-

Volatility in Stock Prices: The uncertainty surrounding the outcome of the investigation has caused and will likely continue to cause volatility in ABN Amro's share price.

ABN Amro has yet to release a comprehensive public statement addressing the specifics of the investigation, adding to the uncertainty surrounding the situation.

Wider Implications for the Dutch Banking Sector

The implications of this ABN Amro bonus scheme investigation extend beyond the bank itself. The investigation could trigger a domino effect, prompting:

-

Increased Pressure on Banks to Review their Compensation Structures: Other Dutch banks may be compelled to review their own bonus schemes to ensure compliance and avoid similar scrutiny.

-

Potential Changes in Banking Regulations Related to Bonuses: The investigation could lead to further tightening of regulations surrounding executive compensation in the Netherlands, mirroring similar trends in other countries.

-

Scrutiny of Corporate Governance Practices within the Sector: The investigation highlights the importance of robust corporate governance practices within the Dutch banking industry, leading to renewed focus on transparency, accountability, and ethical conduct.

Comparison with International Banking Practices

Comparing ABN Amro's bonus scheme to those of international banks reveals a mixed picture. While many international banks have faced similar scrutiny regarding executive compensation, the specifics vary widely. International best practices often emphasize:

- Long-term incentive schemes: Aligning executive compensation with long-term shareholder value creation.

- Clawback provisions: The ability to recover bonuses if performance targets are not met or if unethical conduct is discovered.

- Transparent and clearly defined performance metrics: Ensuring fairness and accountability in bonus calculations.

Significant differences in bonus structures and regulatory frameworks across countries highlight the need for consistent international standards to promote transparency and ethical conduct in the banking industry.

Conclusion

The AFM's investigation into ABN Amro's bonus scheme underscores critical issues of executive compensation, transparency, and regulatory compliance within the Dutch banking sector. The outcome of this ABN Amro bonus scheme investigation will significantly impact ABN Amro's reputation, share price, and potentially the wider banking landscape. The investigation serves as a reminder of the importance of ethical and responsible practices within the financial industry.

Call to Action: Stay informed about the developments in the ABN Amro bonus scheme investigation and the evolving regulatory landscape surrounding executive compensation in the Dutch banking sector. Follow our updates for the latest news on this significant event and learn more about the implications of this ABN Amro bonus scheme investigation.

Featured Posts

-

Real Madrid Manager Rumours Klopps Agent Speaks Out

May 21, 2025

Real Madrid Manager Rumours Klopps Agent Speaks Out

May 21, 2025 -

Kroyz Azoyl Ston Teliko Champions League To Oneiro Toy Giakoymaki Zontano

May 21, 2025

Kroyz Azoyl Ston Teliko Champions League To Oneiro Toy Giakoymaki Zontano

May 21, 2025 -

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 21, 2025

Appeal Pending Ex Tory Councillors Wife And Racial Hatred Tweet

May 21, 2025 -

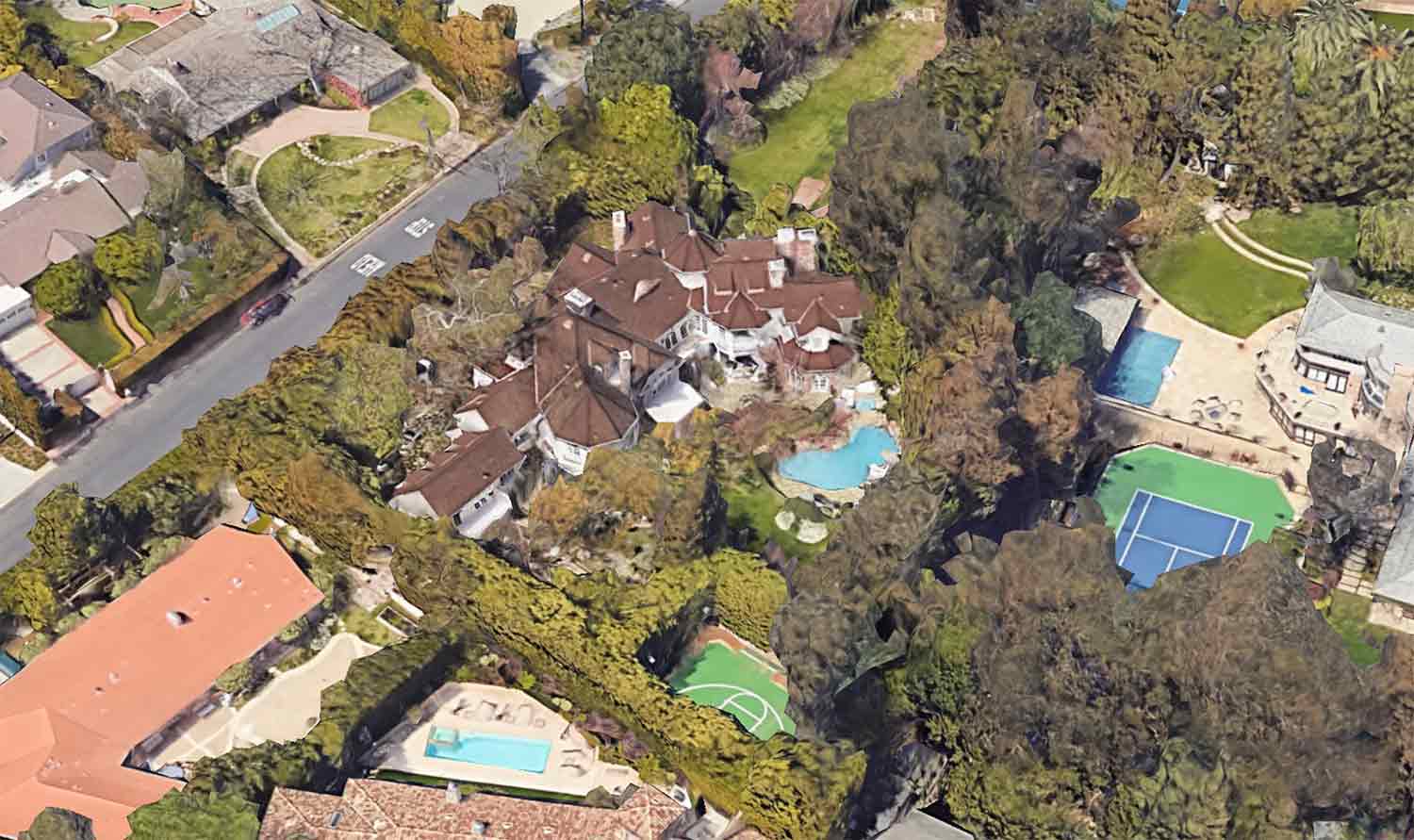

Full List Famous Homes Destroyed In The Palisades Fire

May 21, 2025

Full List Famous Homes Destroyed In The Palisades Fire

May 21, 2025 -

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 21, 2025

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 21, 2025