Accessing Capital For Sustainable Practices In Your SME

Table of Contents

Sustainable practices, in the context of SMEs, encompass a range of initiatives aimed at minimizing environmental impact and promoting ethical operations. This includes energy efficiency improvements (like installing solar panels or upgrading to energy-efficient equipment), waste reduction strategies (implementing recycling programs or reducing packaging), ethical sourcing of materials, and fair labor practices. Successfully integrating these practices often requires a significant financial investment, making accessing capital a crucial first step.

Government Grants and Subsidies for Sustainable Initiatives

Many governments offer substantial financial support for businesses adopting green initiatives. These grants and subsidies are designed to encourage sustainable practices and reduce the financial burden on SMEs. The availability and specifics of these programs vary by country and region, so it's crucial to research the options available in your location.

- Different Types of Grants: Examples include energy efficiency grants for upgrading equipment, waste management grants for implementing recycling programs, and grants supporting the adoption of renewable energy technologies. For instance, in the UK, the Green Business Fund offers various grants, while the US offers similar schemes under the Environmental Protection Agency (EPA) and Department of Energy (DOE).

- Eligibility Criteria: Eligibility often depends on factors such as business size (often defined by employee count or turnover), geographical location (some programs target specific regions), and the type of sustainable project being undertaken.

- Application Processes and Deadlines: The application process typically involves submitting a detailed proposal outlining the project, its environmental benefits, and the requested funding. Deadlines vary, so timely application is crucial. Check relevant government websites for details.

- Relevant Government Websites: [Insert links to relevant government websites for grants and subsidies in your target region]. Regularly checking these sites for updates is highly recommended, as programs and funding availability can change frequently.

Green Loans and Financing from Banks and Financial Institutions

The financial sector is increasingly recognizing the importance of sustainability and is offering tailored financing solutions for environmentally friendly projects. Green loans and other specialized financing options are becoming more readily available for SMEs committed to sustainable practices.

- Benefits of Green Loans: These often come with lower interest rates and more favorable repayment terms compared to traditional business loans. Lenders may view sustainable practices as reducing risk, leading to better terms.

- Types of Projects Funded: Typical projects include renewable energy installations (solar panels, wind turbines), sustainable building renovations (improving energy efficiency), and the implementation of water conservation technologies.

- Strong Business Plan and Financial Projections: Securing a green loan requires a well-structured business plan demonstrating the project's financial viability and environmental benefits. Robust financial projections are essential.

- Potential Challenges: While accessibility is improving, securing these loans might still present challenges. Stringent eligibility requirements and the need for detailed documentation are common.

Crowdfunding and Impact Investing for Sustainable SMEs

Crowdfunding and impact investing offer alternative avenues for accessing capital, particularly for innovative and impactful sustainable projects. These methods rely on attracting investors who are motivated not only by financial returns but also by the social and environmental impact of the business.

- Crowdfunding Models: Reward-based crowdfunding offers non-equity incentives (e.g., early access to products), while equity-based crowdfunding allows investors to receive a stake in your company in exchange for funding.

- Compelling Story and Impact Communication: Successfully raising funds through crowdfunding requires a compelling narrative that clearly communicates the project's positive social and environmental impact.

- Impact Investing: Impact investors actively seek out businesses with a strong social and/or environmental mission, prioritizing both financial returns and positive societal change. They often invest in businesses focused on sustainability.

- Platforms and Resources: Numerous online platforms facilitate both crowdfunding and impact investing. Research and identify platforms suitable for your project and target audience. [Insert links to relevant crowdfunding and impact investing platforms].

Internal Financing and Bootstrapping Sustainable Practices

Before seeking external funding, explore opportunities to finance sustainable initiatives through internal resources and bootstrapping strategies. This can significantly reduce reliance on external funding.

- Optimizing Existing Resources: Analyze current operations to identify areas where resource utilization can be improved and waste minimized. This may involve process optimization, energy audits, or waste reduction strategies.

- Reinvesting Profits: Allocate a portion of your profits to fund sustainable initiatives. This demonstrates a commitment to sustainability and can attract further investment.

- Careful Budgeting and Financial Planning: Developing a detailed budget outlining the costs and benefits of sustainable projects is vital for effective resource allocation.

- Reducing Operating Costs: Implementing cost-saving measures frees up capital that can be reinvested into sustainability initiatives. This can involve negotiating better deals with suppliers, improving operational efficiency, or reducing energy consumption.

Securing Your Path to Sustainable Growth

Accessing capital for sustainable practices is crucial for SMEs aiming for long-term growth and profitability. We've explored various options, including government grants and subsidies, green loans, crowdfunding, and internal financing. Each approach offers unique advantages and requires a different strategy. The most effective approach often involves a combination of these methods.

Sustainability is no longer just a trend; it's a business imperative. Embracing sustainable practices enhances your brand reputation, attracts environmentally conscious customers, and can lead to significant cost savings in the long run. Don't delay your journey towards a sustainable future. Start exploring the options for accessing capital for sustainable practices in your SME today! Begin by researching government grants in your area and assessing your internal financial capacity. Remember, a sustainable business is a profitable business. [Insert links to relevant resources and further reading].

Featured Posts

-

Cohep Garantizando La Transparencia Del Proceso Electoral Con Su Observacion

May 19, 2025

Cohep Garantizando La Transparencia Del Proceso Electoral Con Su Observacion

May 19, 2025 -

Legendary Singers Final Performance A Farewell Due To Memory Issues

May 19, 2025

Legendary Singers Final Performance A Farewell Due To Memory Issues

May 19, 2025 -

Londons Summer Festivals Cancelled Following Court Case Impact On Culture Assessed

May 19, 2025

Londons Summer Festivals Cancelled Following Court Case Impact On Culture Assessed

May 19, 2025 -

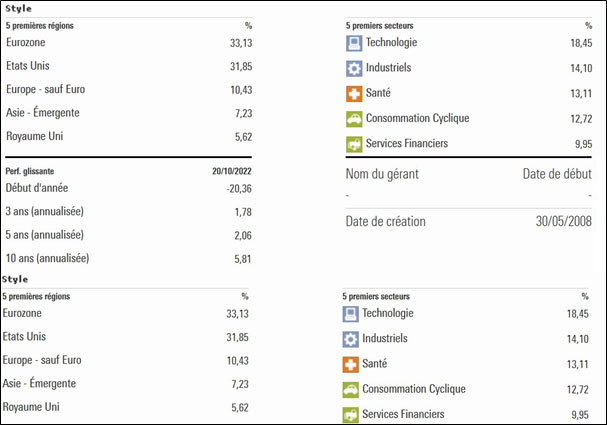

Credit Mutuel Am Previsions Et Performance Financiere Q4 2024

May 19, 2025

Credit Mutuel Am Previsions Et Performance Financiere Q4 2024

May 19, 2025 -

Gazze De Ramazan Ayi Anadolu Ajansi Ndan Son Dakika Gelismeleri

May 19, 2025

Gazze De Ramazan Ayi Anadolu Ajansi Ndan Son Dakika Gelismeleri

May 19, 2025