Acquisition Battle Brewing: Toronto Firm Eyes Hudson's Bay

Table of Contents

The Potential Acquirer: A Deep Dive into the Toronto Firm

While the specific name of the Toronto-based firm remains undisclosed at this time, reports indicate it is likely a large private equity firm with a significant history of real estate investments. This suggests their interest in HBC stems not only from the existing retail operations but also, and perhaps primarily, from the immense value of its real estate portfolio.

- Extensive Real Estate Portfolio: The firm is known for its strategic acquisitions of large property holdings, often followed by redevelopment and repositioning for maximum return.

- Strong Financial Capabilities: Their previous acquisitions demonstrate substantial financial capacity to handle a deal of HBC's scale, indicating a serious commitment to this potential retail acquisition.

- Focused Investment Philosophy: The firm's investment strategy prioritizes long-term value creation, suggesting a potential interest in revitalizing the HBC brand alongside its real estate assets.

- Acquisition Strategy: Given the firm's past acquisitions, a combination of negotiation and possibly a hostile takeover if necessary, seems probable.

The firm's potential motivations extend beyond purely financial gains. The acquisition of such a recognizable brand as HBC could provide substantial brand recognition and potential synergies with existing retail holdings. Acquiring HBC also allows access to prime real estate locations across Canada, opening up exciting avenues for redevelopment and repositioning in lucrative markets.

Hudson's Bay Company: A Retail Icon Facing Challenges

Hudson's Bay Company (HBC), a Canadian institution, finds itself navigating a challenging retail environment. While possessing significant brand recognition and a prime real estate portfolio, HBC has faced considerable headwinds in recent years.

- Declining Financial Performance: Recent financial reports show a decline in profitability, partially attributed to the increasing competition from online retailers.

- E-commerce Competition: HBC has struggled to keep pace with the rapid growth of e-commerce giants, impacting its sales and market share.

- Strategic Direction Uncertainty: The company's strategic direction remains unclear, with ongoing discussions surrounding its future and potential asset sales.

- Valuable Real Estate Holdings: HBC owns a vast and valuable real estate portfolio, including flagship stores in prime downtown locations across Canada. This asset is often cited as being worth significantly more than the current market valuation of the entire company.

The current market value of HBC is significantly lower than the potential value of its real estate assets, making it an attractive target for real estate investment firms looking for a significant return. The potential sale price will depend greatly on the bidding process and the assessment of both the retail operations and the property portfolio.

The Acquisition Battle: Potential Players and Scenarios

While the Toronto firm is the most prominent contender currently, the potential for competing offers remains high. Other private equity firms and potentially even large retail conglomerates might see HBC as a worthwhile acquisition target, particularly given its valuable real estate holdings.

- Competing Bids: The possibility of a bidding war driving up the price cannot be ruled out, particularly if other players enter the fray.

- Acquisition Timeline: The acquisition process will likely involve thorough due diligence, negotiations with HBC's board, and securing regulatory approvals, potentially spanning several months.

- Impact on Employees and Customers: The outcome of the acquisition will significantly impact HBC employees and customers. Job security and potential changes in store operations and brand offerings will be major concerns.

Impact on the Canadian Retail Landscape

A successful HBC acquisition by a Toronto-based firm would significantly impact the Canadian retail market. This could lead to:

- Market Consolidation: Further consolidation of the Canadian retail landscape, with potentially far-reaching consequences for smaller retailers.

- Job Market Impacts: Potential job losses or restructuring within HBC's operations could affect employment in the retail sector.

- Consumer Impact: Changes in pricing strategies, product offerings, and store operations could impact consumers.

The Real Estate Implications

The real estate aspect of a potential Hudson's Bay acquisition is arguably the most significant factor. HBC's prime locations, particularly its flagship stores, hold enormous redevelopment potential.

- Redevelopment Opportunities: The acquiring firm could repurpose these locations into mixed-use developments, incorporating residential, commercial, or hospitality elements.

- Increased Property Values: The acquisition and subsequent redevelopment could significantly boost property values in the surrounding areas.

- Urban Revitalization: The redevelopment could contribute positively to urban revitalization projects and enhance the overall appeal of city centres.

Conclusion

The potential Hudson's Bay acquisition by a Toronto-based firm represents a pivotal moment for the Canadian retail and real estate sectors. This deal hinges on the Toronto firm's ambition, HBC’s willingness to sell, and the potential for competing bids. The outcome will shape the future of Canadian retail, impacting employment, consumer experiences, and urban landscapes. The value of HBC's extensive real estate portfolio is a key driver of this potential department store acquisition, and the final deal will likely reflect this. Stay tuned for updates on this developing story, as the future of this retail giant remains uncertain. Continue following our coverage for more in-depth analysis of the Hudson's Bay acquisition and its implications.

Featured Posts

-

Navigating This Country Tips For Tourists And Expats

May 02, 2025

Navigating This Country Tips For Tourists And Expats

May 02, 2025 -

Around The World Northumberland Mans Diy Boat Adventure

May 02, 2025

Around The World Northumberland Mans Diy Boat Adventure

May 02, 2025 -

From Scratch To Global Seas A Northumberland Mans Sailing Journey

May 02, 2025

From Scratch To Global Seas A Northumberland Mans Sailing Journey

May 02, 2025 -

School Closings And Trash Pickup Delays Impact Of Snow And Ice On Friday

May 02, 2025

School Closings And Trash Pickup Delays Impact Of Snow And Ice On Friday

May 02, 2025 -

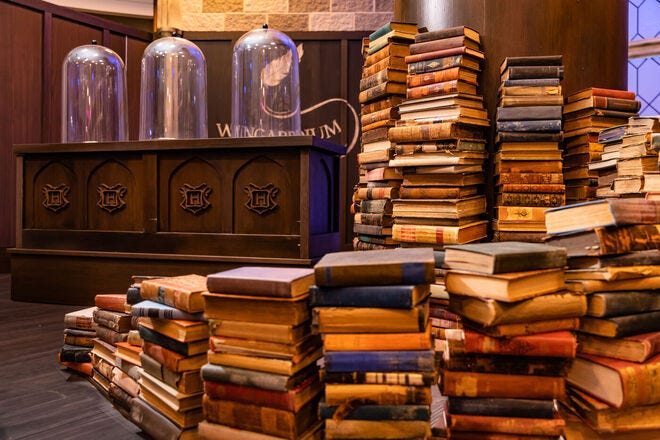

The New Harry Potter Shop In Chicago A Fans Guide

May 02, 2025

The New Harry Potter Shop In Chicago A Fans Guide

May 02, 2025