Activist Investor Fails In Bid To End Rio Tinto's Dual Listing

Table of Contents

The Activist Investor's Campaign

Arguments for a Single Listing

The activist investor's campaign centered on the argument that a single listing would significantly enhance shareholder value. Their primary reasons included:

- Increased efficiency: Eliminating the redundancy of reporting and regulatory compliance across two exchanges would streamline operations and reduce administrative costs.

- Reduced administrative burden: Maintaining two separate listings necessitates significant resources dedicated to compliance, reporting, and investor relations in two distinct markets.

- Improved investor focus: A single listing could potentially lead to a more concentrated and engaged investor base, leading to a more efficient allocation of capital.

- Better alignment of interests: A single listing could simplify shareholder communication and potentially improve alignment between the company's management and its investors.

The activist investor claimed that the costs associated with maintaining a dual listing on both the LSE and ASX outweighed any perceived benefits, creating a drag on Rio Tinto's overall profitability and shareholder returns. They highlighted the increased regulatory compliance burden, potential for conflicts of interest between the two markets, and the complexities of managing investor relations across two different jurisdictions.

Rio Tinto's Response and Defense of the Dual Listing

Maintaining the Status Quo

Rio Tinto vigorously defended its dual listing, emphasizing the strategic advantages it offered:

- Access to a broader investor pool: Maintaining listings on both the LSE and ASX provides access to a diverse range of investors in two major global financial centers.

- Maintaining strong relationships with UK and Australian investors: A dual listing allows Rio Tinto to cultivate strong relationships with investors in both the UK and Australia, crucial markets for the company's operations and financing.

- Enhanced liquidity: The dual listing contributes to increased trading volume and liquidity for Rio Tinto's shares, benefitting all shareholders.

Rio Tinto's management argued that the benefits of maintaining a dual listing far outweighed the costs, emphasizing the importance of its presence in both the UK and Australian markets for its long-term strategic goals. They countered the activist's claims by highlighting the robust corporate governance framework already in place and the negligible impact of the dual listing on operational efficiency.

Shareholder Reaction and Market Response

Impact on Share Price and Trading Volume

The activist investor's campaign initially caused some volatility in Rio Tinto's share price on both the LSE and ASX. However, the market ultimately reacted positively to Rio Tinto's defense of its dual listing structure.

- Share price fluctuations: While there were initial dips, the share price largely stabilized and even saw some upward movement following Rio Tinto's response.

- Changes in trading volume: Trading volume increased during the campaign, indicating heightened investor interest and engagement.

- Market sentiment: Overall, the market seemed to endorse Rio Tinto's strategy, suggesting that the perceived benefits of the dual listing outweighed the concerns raised by the activist investor.

The outcome suggests that the market values the strategic advantages of a dual listing, at least in the case of a large, multinational mining company like Rio Tinto. The experience could set a precedent for other dual-listed companies facing similar activist pressure.

Implications for Corporate Governance and Future Activism

The Future of Dual Listings in the Mining Industry

The failed activist campaign highlights the ongoing debate surrounding the optimal corporate structure for multinational companies, particularly within the mining sector.

- Increased scrutiny of corporate structures: This event has brought increased scrutiny to the corporate governance practices of dual-listed companies and will likely lead to further analysis and discussion.

- Potential for future activist campaigns: While this particular campaign failed, it's likely that other activist investors will continue to target dual-listed companies, particularly those perceived as inefficient or lacking in shareholder value.

- Impact on investor confidence: The outcome demonstrates that the market carefully weighs the pros and cons of dual listings, and that a well-articulated defense of such a structure can maintain investor confidence.

The role of institutional investors will be crucial in shaping future debates on corporate structure and the prevalence of dual listings. Furthermore, regulatory frameworks may evolve in response to such activism, potentially influencing the attractiveness of dual listings in the years to come.

Conclusion

The activist investor's failed bid to end Rio Tinto's dual listing underscores the complexities of corporate governance and the strategic considerations surrounding dual listings. While the activist presented arguments focused on efficiency and cost reduction, Rio Tinto successfully defended its position by highlighting the benefits of maintaining access to diverse investor bases and strong market presence in key regions. The relatively positive market response following the campaign reinforces the importance of considering the specific circumstances of each company when evaluating the merits of dual listings. The failure of this attempt, however, does not necessarily signal the end of such debates.

The failure of this activist investor's bid to end Rio Tinto's dual listing raises important questions about corporate governance and the future of dual listings in the mining sector. Stay informed on developments in this ongoing debate around activist investor strategies and the implications for companies with dual listings, as the discussion around optimal corporate structure continues to evolve. Keep reading for more analysis on activist investor strategies and dual listings.

Featured Posts

-

Reform Uk And Nigel Farage A Powerful Political Combination

May 03, 2025

Reform Uk And Nigel Farage A Powerful Political Combination

May 03, 2025 -

Aid Ship To Gaza Under Attack Sos Issued Near Maltese Coast

May 03, 2025

Aid Ship To Gaza Under Attack Sos Issued Near Maltese Coast

May 03, 2025 -

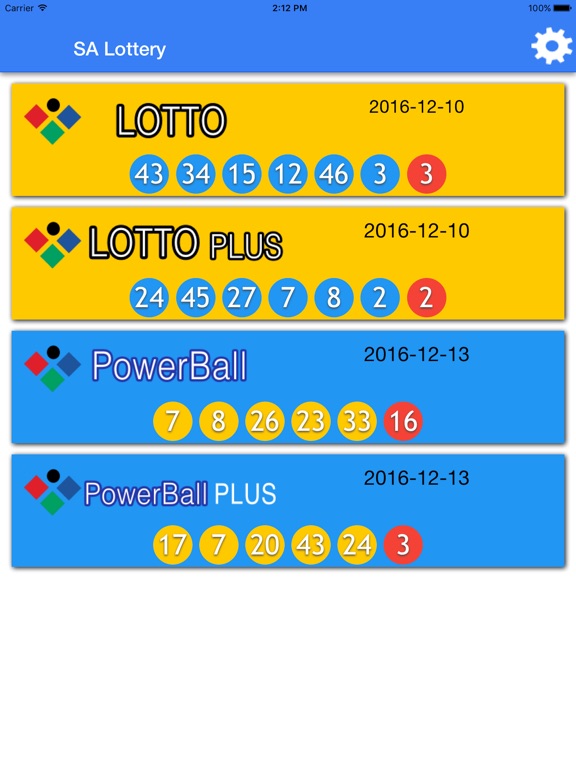

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025 -

Reform Uk In Crisis Five Threats To Nigel Farages Political Future

May 03, 2025

Reform Uk In Crisis Five Threats To Nigel Farages Political Future

May 03, 2025 -

Boris Johnsons Return Could He Save The Conservative Party

May 03, 2025

Boris Johnsons Return Could He Save The Conservative Party

May 03, 2025