Activist Investor Fails To Oust Rio Tinto's Dual Listing Structure

Table of Contents

Activist investor attempts to dismantle Rio Tinto's dual listing structure have failed. This article delves into the recent unsuccessful campaign by an activist investor to force a change in Rio Tinto's dual listing on the London and Australian stock exchanges. We will explore the reasons behind this campaign, examine the arguments presented by both sides, and analyze the implications of the outcome for shareholders and the future of dual listings within the mining industry. This case study offers valuable insights into shareholder activism and the complexities of managing dual listings in a global market.

<h2>The Activist Investor's Campaign: Arguments and Strategy</h2>

The activist investor, [Activist Investor Name], a significant shareholder in Rio Tinto, launched a campaign targeting the company's dual listing on the London Stock Exchange (LSE) and the Australian Stock Exchange (ASX). Their significant investment provided the leverage for this ambitious challenge to established corporate structure.

The activist investor's core grievances centered around the perceived inefficiencies and complexities inherent in maintaining a dual listing:

- Reduced Corporate Governance Efficiency: The argument was made that a dual listing led to duplicated efforts and potentially conflicting reporting requirements, hindering efficient corporate governance.

- Increased Complexity: Managing two separate listings was presented as unnecessarily burdensome, increasing administrative costs and diverting resources from core business activities.

- Potential for Conflicting Regulatory Requirements: The activist investor highlighted the potential for navigating conflicting regulations in two different jurisdictions as a significant challenge.

- Higher Costs: The costs associated with maintaining two listings, including legal, administrative, and compliance expenses, were cited as a drain on company resources.

The proposed solution was a single listing, either on the LSE or the ASX, deemed to streamline operations and improve efficiency. The strategy involved a multifaceted approach:

- Shareholder Pressure: Direct engagement with other shareholders to garner support for the proposed changes.

- Media Campaign: Publicly disseminating their arguments through media outlets to raise awareness and sway public opinion.

- Proxy Fight: An attempt to influence voting outcomes at shareholder meetings by soliciting proxy votes.

Specific actions taken by the activist investor included:

- Issuing public statements outlining their concerns and proposed solutions.

- Lobbying key institutional investors.

- Submitting formal proposals for shareholder votes.

<h2>Rio Tinto's Defense and Counterarguments</h2>

Rio Tinto strongly defended its dual listing structure, emphasizing the significant strategic advantages it offered:

- Access to a Broader Investor Base: Maintaining listings on both the LSE and ASX provided access to a wider pool of investors, enhancing liquidity and reducing reliance on a single market.

- Enhanced Liquidity: The dual listing ensured greater trading volume and improved price discovery, benefiting all shareholders.

- Strategic Advantages in Both Markets: Rio Tinto argued that a presence in both London and Australia was crucial for its strategic positioning within the global mining industry, facilitating access to capital and key stakeholders in both regions.

While Rio Tinto didn't offer direct concessions, they actively countered the activist investor’s claims through:

- Detailed reports highlighting the benefits of the dual listing structure.

- Presentations to institutional investors explaining the strategic rationale behind their approach.

- Public statements reiterating their commitment to maximizing shareholder value.

Rio Tinto’s key arguments against the proposed change included:

- The potential negative impact on liquidity and share price.

- The disruption and costs associated with transitioning to a single listing.

- The loss of access to a diverse investor base.

<h2>The Outcome and its Implications</h2>

The activist investor's campaign ultimately failed to oust Rio Tinto's dual listing structure. The reasons for this failure likely include:

- Lack of Sufficient Shareholder Support: The activist investor failed to secure the necessary level of shareholder support to force a change.

- Stronger Arguments from Rio Tinto: Rio Tinto's compelling counterarguments successfully convinced a significant portion of shareholders that maintaining the dual listing was in their best interests.

- Strategic Importance of Dual Listing: The strategic benefits of maintaining access to both the London and Australian markets clearly outweighed the concerns raised by the activist investor for a significant portion of shareholders.

The implications of this outcome are significant:

- Short-Term: No immediate changes to Rio Tinto’s corporate structure, potentially leading to a period of stability for the company.

- Long-Term: The decision reinforces the perceived value of dual listings for multinational companies, particularly in the resource sector. It may deter similar campaigns against other companies with dual listings.

- Wider Impact: The outcome provides a case study for future shareholder activism campaigns targeting corporate structures, highlighting the challenges involved in successfully challenging established practices.

Key implications for the company, investors, and the broader market include:

- Continued operational efficiency may not significantly improve.

- Shareholder confidence in Rio Tinto's existing management and strategy is affirmed.

- Companies in similar situations can better assess the strategic viability of their own dual listings.

<h3>Impact on Share Price</h3>

[Insert data and charts/graphs here illustrating the impact of the activist investor's campaign and the outcome on Rio Tinto's share price. This section requires market data and should be updated regularly.]

<h2>Conclusion</h2>

The activist investor's attempt to dismantle Rio Tinto's dual listing structure ultimately failed. This article highlighted the compelling arguments for and against maintaining this structure, emphasizing the importance of considering various factors such as investor access, regulatory compliance, and corporate governance. The outcome provides valuable insights into shareholder activism in the mining industry and the complexities involved in managing dual listings. Understanding the intricacies of dual listings and the dynamics of shareholder activism is crucial for anyone investing in companies with such structures. For more in-depth analysis of dual listing challenges and activist investor strategies, continue your research into [link to relevant resource, if available].

Featured Posts

-

Trade War Weighs On Japans Economy Bank Of Japan Revises Forecast Downward

May 02, 2025

Trade War Weighs On Japans Economy Bank Of Japan Revises Forecast Downward

May 02, 2025 -

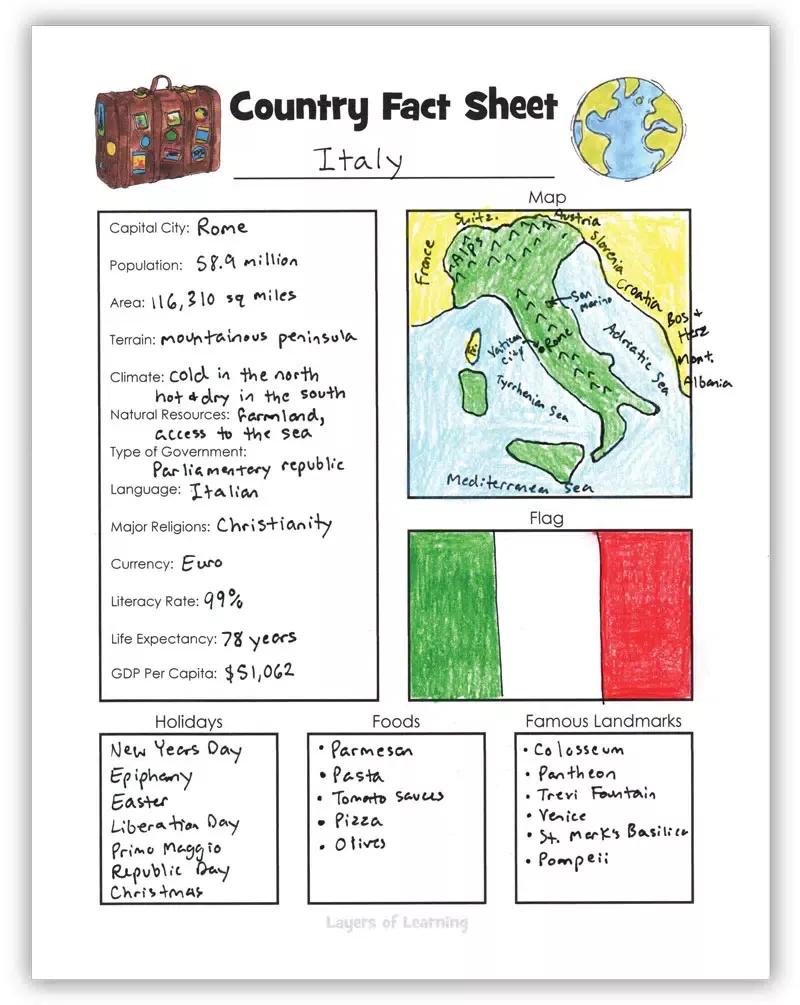

This Country Facts Figures And Insights

May 02, 2025

This Country Facts Figures And Insights

May 02, 2025 -

Englands Six Nations Victory Dalys Late Game Heroics Secure Win Over France

May 02, 2025

Englands Six Nations Victory Dalys Late Game Heroics Secure Win Over France

May 02, 2025 -

Funding Crisis Puts Indigenous Arts Festival At Risk

May 02, 2025

Funding Crisis Puts Indigenous Arts Festival At Risk

May 02, 2025 -

Lionesses Vs Belgium Tv Channel Kick Off Time And Streaming Options

May 02, 2025

Lionesses Vs Belgium Tv Channel Kick Off Time And Streaming Options

May 02, 2025