Adani Ports Jumps 4%, Market Rebound: Detailed Stock Market Analysis

Table of Contents

Adani Ports' 4% Surge: A Deeper Dive

The 4% jump in Adani Ports' share price represents a substantial increase, demanding a thorough examination. Let's analyze the specifics:

- Share Price Movement: The share price opened at ₹[Insert Opening Price] and closed at ₹[Insert Closing Price], representing a gain of approximately 4%. This translates to an increase of ₹[Insert Rupee Value Increase] per share.

- Trading Volume: Trading volume for Adani Ports today was [Insert Volume Data], significantly [higher/lower/similar] to the average daily volume. This [high/low/average] volume suggests [insert interpretation based on volume - e.g., increased investor interest, potential short-covering, etc.].

- Day-to-Day Comparison: Compared to yesterday's closing price of ₹[Insert Yesterday's Closing Price], today's surge represents a remarkable turnaround/continuation of a recent trend (choose the appropriate description based on recent performance).

- Triggering Events: While no single event decisively triggered the surge, [mention any relevant news, such as positive earnings reports, contract wins, or positive industry news]. This positive news likely contributed to the increased investor confidence reflected in the share price.

The Broader Market Rebound: Contextualizing Adani Ports' Performance

The rise in Adani Ports' share price isn't isolated; it's part of a broader market rebound. Understanding the overall market context is crucial for a complete analysis:

- Index Performance: The Nifty 50 index increased by [Insert Percentage]% today, and the Sensex rose by [Insert Percentage]%. This overall market positivity undoubtedly contributed to the positive sentiment surrounding Adani Ports.

- Investor Sentiment: Investor sentiment appears to be improving, evidenced by the increase in market indices and increased trading volumes across various sectors. Growing optimism regarding economic recovery likely boosted investor confidence.

- Economic Indicators: Recent positive economic indicators, such as [mention relevant indicators, e.g., improved manufacturing PMI, positive GDP growth forecasts], might have played a role in enhancing market confidence.

- Correlation: The positive correlation between Adani Ports' performance and the overall market trend reinforces the significance of the broader market rebound in driving the stock's upward movement.

Sector-Specific Factors Influencing Adani Ports

Beyond the general market rebound, sector-specific factors also played a role in Adani Ports' performance:

- Port Sector Developments: Recent developments in the port and logistics sector, such as [mention specific news like new infrastructure projects, government policy changes favoring the sector, or increased global trade activity], could have positively impacted investor perception of Adani Ports.

- Global Trade Dynamics: Increased global trade activity, particularly in [mention specific regions or goods], may have positively impacted Adani Ports' business prospects and contributed to investor confidence.

- Company Financial Performance: [If available, incorporate data on Adani Ports' recent financial performance – e.g., quarterly earnings, revenue growth – to support the analysis. If no relevant data is publicly available, omit this point].

Future Outlook and Investment Implications

Predicting the future trajectory of Adani Ports' share price is inherently challenging, but based on our analysis, we can offer a cautious outlook:

- Short-Term Outlook: In the short term, the stock price might consolidate around its current levels, subject to broader market fluctuations and any significant news related to the company or the sector.

- Long-Term Outlook: The long-term outlook depends on several factors including sustained growth in the port sector, global trade dynamics, and Adani Ports' ability to maintain its competitive edge.

- Potential Risks: Investing in Adani Ports, like any stock, carries inherent risks, including market volatility, competition, and potential regulatory changes.

- Recommendations: [Disclaimer: This is not financial advice]. Based on the current analysis, investors should conduct their own thorough research before making any investment decisions. Comparing Adani Ports' performance against its competitors in the sector is crucial for a comprehensive investment assessment.

Conclusion

The 4% jump in Adani Ports' share price today reflects a confluence of factors: a broader market rebound, positive investor sentiment, and potentially sector-specific tailwinds. While the surge is encouraging, investors should exercise caution and consider both the potential upside and inherent risks before making any investment decisions. Understanding the interplay between macroeconomic conditions, sector-specific trends, and the company's performance is crucial for informed investment strategies. Stay informed about the performance of Adani Ports and other major players in the stock market by regularly checking our analysis and insights. Follow us for more detailed stock market analysis and informed investment strategies, including future updates on Adani Ports stock price.

Featured Posts

-

Weston Cage And Nicolas Cage Latest Developments In Ongoing Lawsuit

May 10, 2025

Weston Cage And Nicolas Cage Latest Developments In Ongoing Lawsuit

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community

May 10, 2025 -

Will Leon Draisaitl Play In The Oilers Playoffs Injury Timeline And Outlook

May 10, 2025

Will Leon Draisaitl Play In The Oilers Playoffs Injury Timeline And Outlook

May 10, 2025 -

The Epstein Files And Ag Pam Bondi Should The Public Vote

May 10, 2025

The Epstein Files And Ag Pam Bondi Should The Public Vote

May 10, 2025 -

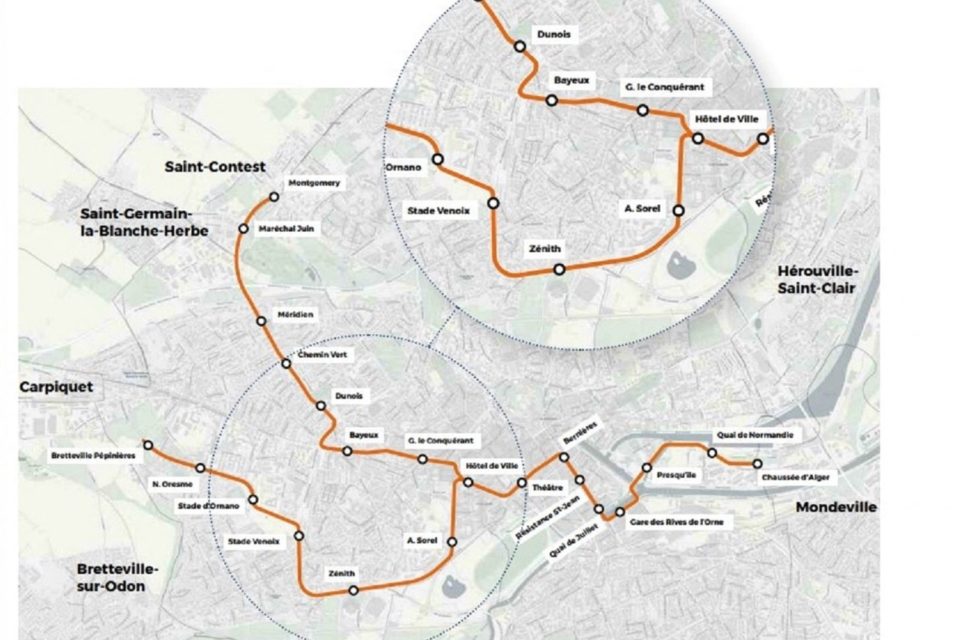

Dijon La Concertation Sur La 3e Ligne De Tramway Approuvee Par Le Conseil Metropolitain

May 10, 2025

Dijon La Concertation Sur La 3e Ligne De Tramway Approuvee Par Le Conseil Metropolitain

May 10, 2025

Latest Posts

-

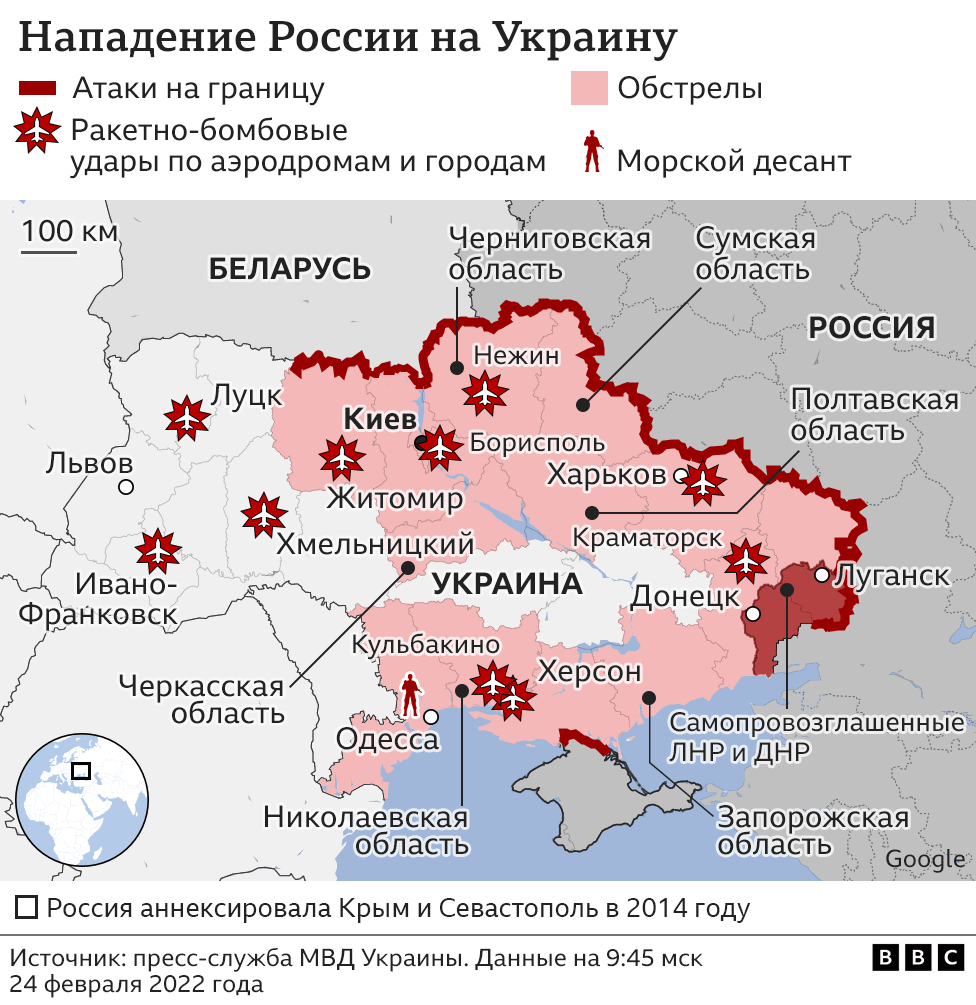

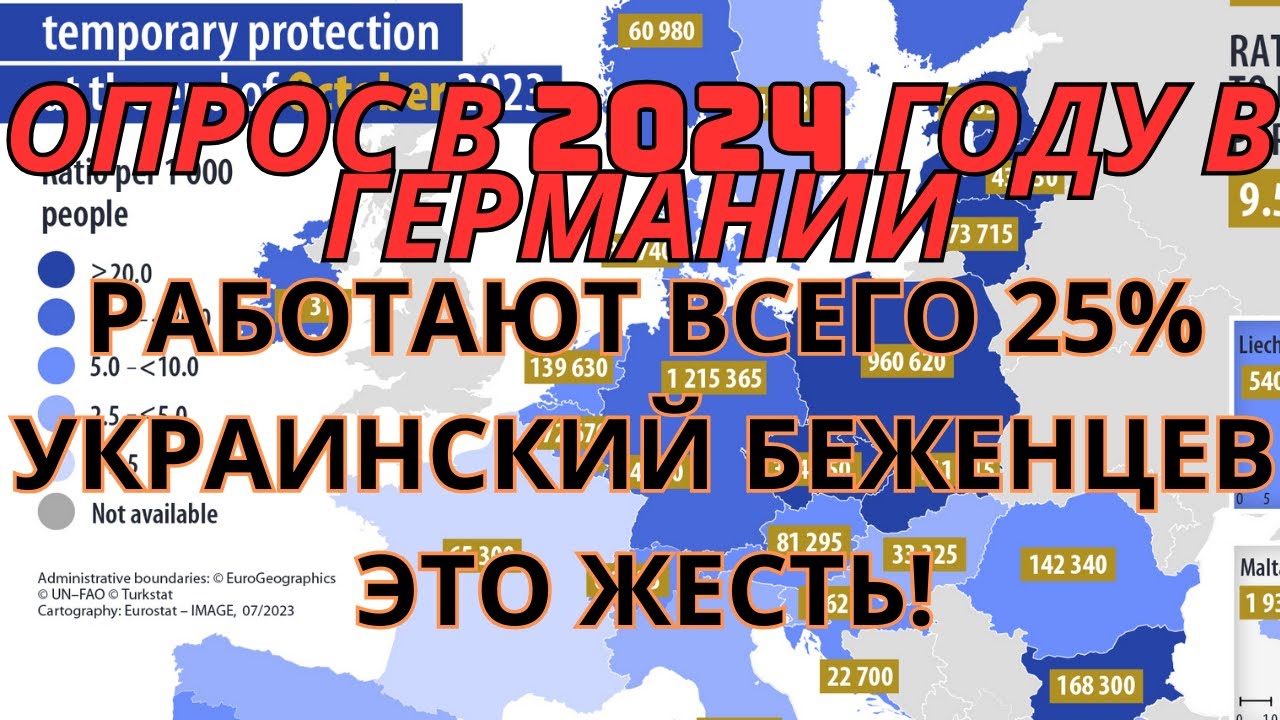

Bezhentsy Iz Ukrainy Germaniya Otsenivaet Riski Novogo Naplyva V Svyazi S Deystviyami S Sh A

May 10, 2025

Bezhentsy Iz Ukrainy Germaniya Otsenivaet Riski Novogo Naplyva V Svyazi S Deystviyami S Sh A

May 10, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package

May 10, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Package

May 10, 2025 -

Vozmozhniy Noviy Potok Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 10, 2025

Vozmozhniy Noviy Potok Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 10, 2025 -

Germaniya Riski Novogo Volny Ukrainskikh Bezhentsev Sprovotsirovannoy S Sh A

May 10, 2025

Germaniya Riski Novogo Volny Ukrainskikh Bezhentsev Sprovotsirovannoy S Sh A

May 10, 2025 -

Firstpost Imfs Decision On Pakistans 1 3 Billion Package And Current Events

May 10, 2025

Firstpost Imfs Decision On Pakistans 1 3 Billion Package And Current Events

May 10, 2025