Addressing Investor Anxiety: BofA's Take On Elevated Stock Market Valuations

Table of Contents

Keywords: Investor anxiety, stock market valuations, BofA, elevated valuations, market volatility, investment strategy, risk management, stock market outlook, economic outlook, Price-to-Earnings ratio, Shiller PE ratio, value investing, sector rotation.

Investor anxiety is palpable as stock market valuations remain elevated. This article delves into Bank of America's (BofA) perspective on these high valuations, exploring potential risks and offering insights to navigate this uncertain market landscape. We’ll examine BofA’s analysis to help you understand the current climate and potentially alleviate your concerns. Understanding how to manage your investments during periods of high valuations is crucial for long-term success.

BofA's Assessment of Current Market Conditions

BofA generally maintains a cautious optimism regarding current market valuations. While acknowledging the elevated levels, they don't necessarily predict an imminent crash, but they do highlight significant risks. Their analysis incorporates a range of valuation metrics and considers macroeconomic factors.

-

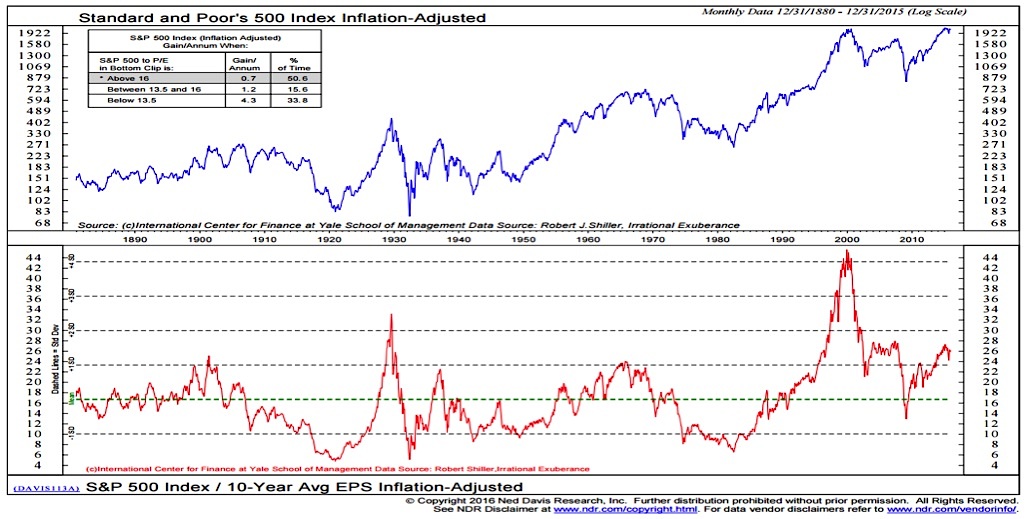

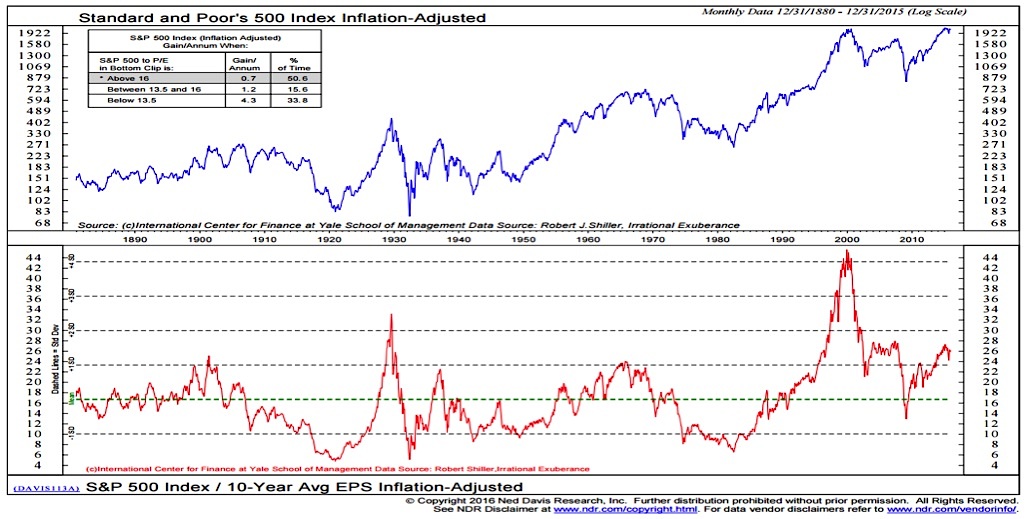

Valuation Metrics: BofA utilizes key metrics like the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) to gauge market valuation. High P/E ratios generally indicate that the market is pricing in significant future growth, which may or may not materialize. The Shiller PE ratio, which considers inflation-adjusted earnings over a longer period, provides a more stable long-term perspective.

-

Overvalued and Undervalued Sectors: BofA's research often identifies specific sectors that appear overvalued (e.g., technology stocks during certain periods of rapid growth) and others that appear undervalued (e.g., certain segments of the energy or materials sectors depending on commodity prices). These assessments are dynamic and change based on market conditions.

-

Macroeconomic Factors: Inflation, interest rate hikes by central banks, geopolitical instability, and supply chain disruptions are all macroeconomic factors that significantly influence BofA's assessment of market valuations. These factors introduce uncertainty and can impact investor sentiment.

Identifying Potential Risks

BofA highlights several potential risks associated with elevated stock market valuations:

-

Inflationary Pressures: Persistent high inflation erodes purchasing power and can lead to central banks raising interest rates, potentially slowing economic growth and impacting corporate earnings.

-

Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic activity and reducing corporate profitability. This can lead to lower stock prices.

-

Market Corrections: Elevated valuations inherently carry a higher risk of a market correction – a significant, but not necessarily catastrophic, drop in prices. Corrections can be triggered by various factors, including negative economic news or shifts in investor sentiment.

-

Geopolitical Uncertainty: Global political instability can create volatility and uncertainty in the markets, affecting investor confidence and leading to price fluctuations.

How to Mitigate Risks: Investors can mitigate these risks through diversification, risk management strategies, and a long-term investment horizon.

Opportunities within Elevated Valuations

Despite the elevated valuations, BofA identifies potential opportunities:

-

Value Investing: Even in a generally overvalued market, some individual stocks or sectors may still be undervalued. Value investing strategies focus on identifying these opportunities.

-

Sector Rotation: Shifting investments from overvalued sectors to undervalued ones can help investors adjust to changing market conditions and potentially improve returns.

-

Strategic Asset Allocation: Diversifying across different asset classes (stocks, bonds, real estate, etc.) can help reduce overall portfolio risk.

Strategies for Managing Investor Anxiety

Managing investor anxiety requires a rational approach:

-

Long-Term Investment Strategy: Focus on long-term goals rather than short-term market fluctuations. A long-term perspective helps to weather market volatility.

-

Diversification: A well-diversified portfolio spreads risk across various assets, reducing the impact of any single investment's poor performance.

-

Regular Portfolio Review and Rebalancing: Periodically review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to maintain your target allocation.

-

Seek Professional Financial Advice: A financial advisor can provide personalized guidance tailored to your specific circumstances and risk tolerance.

Emotional Investing vs. Rational Investing

Emotional decision-making is a significant risk in investing:

-

Fear and Greed: Fear can lead to selling assets at the bottom of a market downturn, while greed can cause over-investment in assets that are already overvalued.

-

Data-Driven Decisions: Rely on data and analysis rather than emotions when making investment choices.

-

Well-Defined Investment Plan: A well-defined investment plan provides a framework for making rational decisions, regardless of market fluctuations.

BofA's Predictions and Outlook

BofA's predictions are subject to change and inherent uncertainty. They typically offer a range of scenarios, considering potential catalysts for market growth or decline. Their outlook usually incorporates their assessment of macroeconomic factors and potential policy changes. For specific predictions, you should refer to BofA's latest research reports.

Conclusion:

BofA's analysis highlights the significant risks and potential opportunities within the current landscape of elevated stock market valuations. Managing investor anxiety requires a rational, long-term perspective, diversification, and a well-defined investment strategy. Understanding and mitigating these risks is crucial for long-term investment success. Stay informed about market fluctuations and address your investor anxiety by regularly reviewing BofA's analysis and other reputable financial resources. Understanding stock market valuations is crucial for making informed investment decisions. Learn more about managing your portfolio in light of elevated valuations and consult with a financial professional.

Featured Posts

-

Fotos La Clase Nacional De Boxeo Invade El Zocalo

May 01, 2025

Fotos La Clase Nacional De Boxeo Invade El Zocalo

May 01, 2025 -

Historic Flooding Tornadoes And Heavy Snow Pummel Louisville In 2025

May 01, 2025

Historic Flooding Tornadoes And Heavy Snow Pummel Louisville In 2025

May 01, 2025 -

Tongas Victory A Setback For Sis Pacific Games Aspirations

May 01, 2025

Tongas Victory A Setback For Sis Pacific Games Aspirations

May 01, 2025 -

Cruising In 2025 A Look At The New Ships And Their Key Features

May 01, 2025

Cruising In 2025 A Look At The New Ships And Their Key Features

May 01, 2025 -

Trumps Ripple Mention Sends Xrp Price Higher

May 01, 2025

Trumps Ripple Mention Sends Xrp Price Higher

May 01, 2025