Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall view of the current economic landscape is nuanced, acknowledging both strengths and weaknesses. While acknowledging strong corporate earnings in certain sectors, they also highlight persistent inflationary pressures and the ongoing impact of the Federal Reserve's monetary policy. Their assessment considers several key economic indicators:

-

Inflationary pressures and their impact on valuations: BofA analysts closely monitor inflation rates and their potential to erode corporate profits and investor confidence. High inflation can lead to higher interest rates, making borrowing more expensive for businesses and potentially impacting stock valuations. Their analysis likely incorporates measures like the Consumer Price Index (CPI) and Producer Price Index (PPI).

-

The Federal Reserve's monetary policy and its influence on the market: The Federal Reserve's actions, particularly interest rate hikes, significantly influence the stock market. BofA's analysis considers the Fed's policy decisions, their effectiveness in controlling inflation, and their potential impact on economic growth and stock market performance. This includes careful monitoring of statements from the Federal Open Market Committee (FOMC).

-

Global economic growth forecasts and their relation to stock prices: Global economic growth is a crucial factor affecting stock market valuations. BofA incorporates global economic forecasts from various sources into their analysis, considering the interconnectedness of global markets and the potential impact of global events on US stock prices. This includes analyzing GDP growth rates in major economies worldwide.

Identifying Factors Contributing to High Stock Market Valuations

BofA points to several factors driving high stock market valuations, acknowledging that these are not mutually exclusive and often interact. Key elements include:

-

Strong corporate earnings (in specific sectors): While overall earnings growth might be slowing, some sectors are demonstrating robust performance, supporting higher stock prices in those areas. BofA's analysis likely delves into specific sectors and companies exhibiting significant earnings growth.

-

Historically low interest rates (until recently): Low interest rates for an extended period have made borrowing cheaper, encouraging corporate investment and boosting profitability. However, rising interest rates are now changing this dynamic.

-

Investor sentiment and speculation: Positive investor sentiment, even in the face of economic uncertainty, can drive stock prices higher. BofA's analysis likely considers investor confidence levels and speculative trading activity.

Let's examine some specific valuation metrics:

-

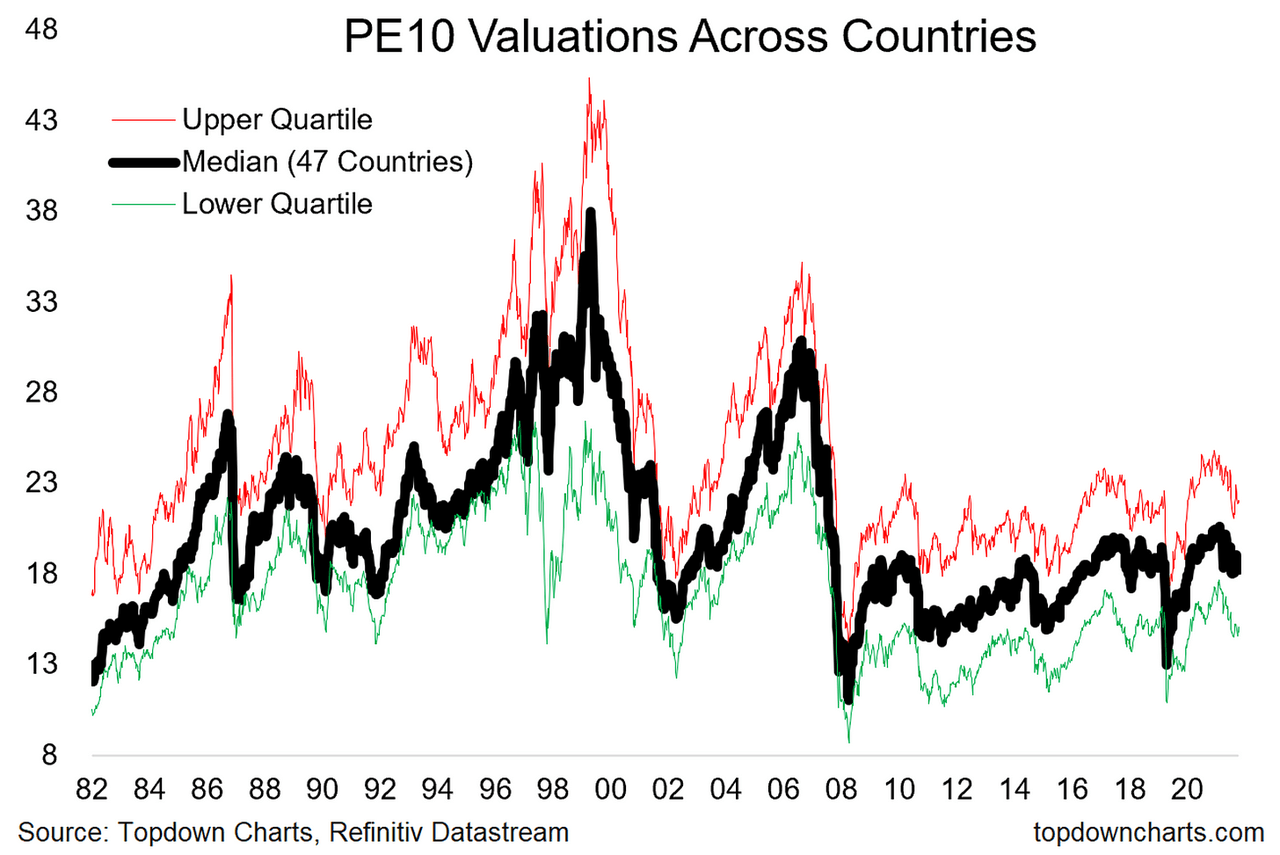

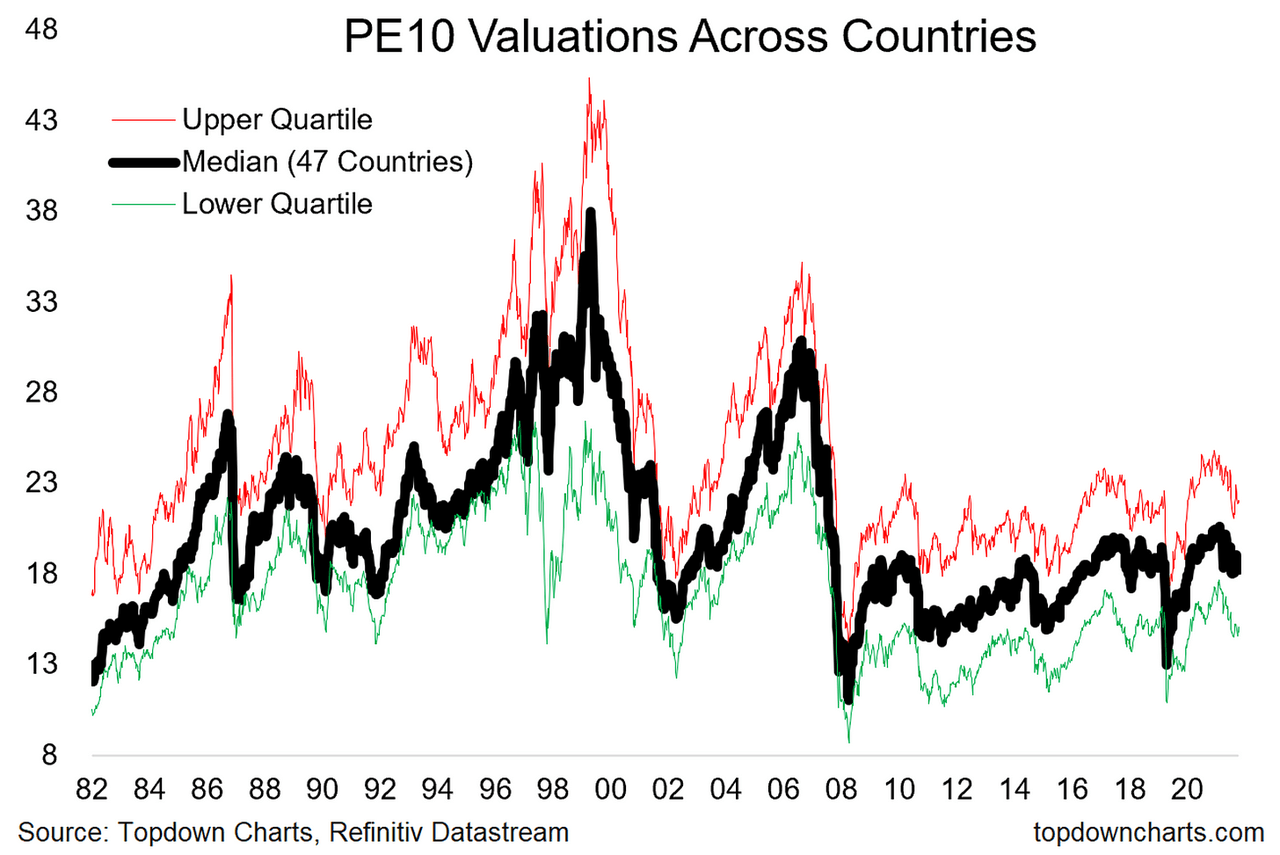

Analysis of the Price-to-Earnings ratio (P/E) across different sectors: BofA analyzes P/E ratios across various sectors to assess relative valuations. High P/E ratios might suggest overvaluation, while lower ratios could indicate undervaluation, relative to historical averages and comparable companies.

-

Discussion of market capitalization and its relation to overall valuation: The total market capitalization of the stock market provides an overall picture of valuation. BofA's analysis considers whether the total market capitalization is justified by underlying economic fundamentals.

-

Examination of earnings growth and its sustainability: Sustainable earnings growth is crucial for justifying high valuations. BofA assesses whether current earnings growth is sustainable in the long term, considering economic factors and potential headwinds.

BofA's Recommendations for Investors

Navigating a high-valuation market requires a cautious and strategic approach. BofA likely recommends:

-

Strategies for mitigating risk in a high-valuation market: This could involve diversifying across asset classes, employing defensive investment strategies, or focusing on value stocks rather than growth stocks.

-

Advice on asset allocation and diversification: BofA might suggest adjusting portfolio allocations to reduce exposure to high-valuation sectors and increase exposure to potentially less volatile or undervalued sectors.

-

Suggestions for specific sectors or investment opportunities: Based on their analysis, BofA might identify specific sectors or companies that present attractive investment opportunities despite the overall high valuations. This might include sectors with strong underlying fundamentals and potential for future growth.

Potential Risks and Opportunities in the Current Market

BofA's analysis likely highlights both the potential risks and opportunities:

-

Analysis of market volatility and its potential impact: High valuations often correlate with increased market volatility, meaning larger price swings. Investors need to prepare for potential short-term market corrections.

-

Assessment of recessionary risks and their likelihood: High valuations can increase the vulnerability to an economic downturn, and BofA would likely assess the probability of a recession and its potential impact on the market.

-

Identification of potential investment opportunities in undervalued sectors: While overall valuations may be high, certain sectors might be undervalued relative to their fundamentals. BofA's expertise can help investors identify these opportunities.

Conclusion

This article summarized BofA's analysis of high stock market valuations, highlighting key economic factors, valuation metrics, and investor recommendations. The analysis underscores the need for a cautious yet opportunistic approach in the current market environment. Understanding BofA's perspective on high stock market valuations is crucial for informed investment decisions. Stay updated on market analysis and continue to monitor BofA's insights on high stock market valuations to refine your investment strategy. Learn more about managing your investments in a high-valuation market.

Featured Posts

-

Case Study Schneider Electrics Success With Trade Show Marketing

Apr 30, 2025

Case Study Schneider Electrics Success With Trade Show Marketing

Apr 30, 2025 -

Kevin Fiala Leads Kings To Victory Over Stars In Shootout

Apr 30, 2025

Kevin Fiala Leads Kings To Victory Over Stars In Shootout

Apr 30, 2025 -

Processo Becciu Data D Inizio Dell Appello E Dichiarazione Dell Imputato

Apr 30, 2025

Processo Becciu Data D Inizio Dell Appello E Dichiarazione Dell Imputato

Apr 30, 2025 -

Inmates Hour Long Torture And Death In Jail Family Demands Answers

Apr 30, 2025

Inmates Hour Long Torture And Death In Jail Family Demands Answers

Apr 30, 2025 -

Yueksekten Duesme Nevsehir Deki Kayma Kazasi Detaylari

Apr 30, 2025

Yueksekten Duesme Nevsehir Deki Kayma Kazasi Detaylari

Apr 30, 2025