Addressing Investor Concerns: BofA On Stretched Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's analysis of current stock market valuations paints a picture of caution. Their assessment utilizes several key metrics to gauge the market's health, primarily focusing on the relationship between price and underlying value. These metrics help determine whether current stock prices accurately reflect the potential for future earnings and growth.

-

Key Metrics and Findings: BofA likely employs metrics like the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE), and price-to-sales ratios. These metrics provide a comparative view of current valuations against historical averages and industry benchmarks. Specific numerical findings from BofA's reports should be included here, referencing their published research for accuracy. For example, "BofA's analysis reveals a CAPE ratio of X, significantly higher than the historical average of Y, suggesting overvaluation."

-

Historical Comparisons: A crucial aspect of BofA's analysis involves comparing current valuations to historical data. This reveals whether current prices deviate significantly from long-term trends, highlighting potential overvaluation or undervaluation. Visual aids, like charts comparing current P/E ratios to historical averages, would enhance understanding.

-

Sector-Specific Analysis: BofA's reports likely identify specific sectors or industries showing signs of significant overvaluation. Highlighting these sectors allows investors to focus their risk management strategies on potentially vulnerable areas. Examples could include "BofA flagged the technology and consumer discretionary sectors as particularly susceptible to a correction."

-

Geographical Considerations: The analysis will likely consider geographical market differences. BofA may compare valuations in the US market to those in international markets, identifying potential discrepancies and regional risks.

Underlying Factors Contributing to Stretched Valuations

Several factors contribute to the current stretched valuations. Understanding these factors is key to anticipating potential market shifts.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper, encouraging companies to take on debt and driving up stock prices. This environment also pushes investors seeking yield into higher-risk assets like equities.

-

Quantitative Easing (QE): QE programs, where central banks inject liquidity into the market, can inflate asset prices, including stocks. This artificial increase in money supply can create a disconnect between fundamental value and market prices.

-

Inflation and Inflation Expectations: Rising inflation can erode the purchasing power of future earnings, impacting stock valuations. However, expectations of future inflation also influence current market pricing. If investors anticipate high inflation, they may bid up stock prices to compensate.

-

Robust Corporate Earnings (if applicable): Strong corporate earnings can justify higher stock prices, even in the face of other overvaluation indicators. However, it is important to assess the sustainability of these earnings.

-

Investor Sentiment: Market psychology significantly affects valuations. A predominantly bullish market sentiment can drive prices beyond their fundamental justification, creating a speculative bubble.

Potential Risks and Implications of Overvalued Markets

Investing in an overvalued market presents significant risks. Understanding these risks is crucial for effective risk management.

-

Market Correction/Crash: Overvalued markets are susceptible to sharp corrections or even crashes. These events can lead to significant and rapid declines in stock prices.

-

Investment Losses: A market correction can result in substantial investment losses, particularly for investors holding heavily overvalued assets. The magnitude of these losses depends on the severity and duration of the correction.

-

Impact on Asset Classes: A market correction doesn't affect all asset classes equally. Understanding the potential impact on different asset classes (e.g., bonds, real estate) is vital for portfolio diversification.

-

Historical Precedents: Studying historical market corrections provides valuable insights into potential scenarios and their triggers. Analyzing past events helps investors better understand the potential risks and develop appropriate strategies.

Strategies for Navigating Stretched Stock Market Valuations

While the risks are real, investors can mitigate potential losses through proactive strategies.

-

Portfolio Diversification: Diversifying across various asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk. This approach minimizes the impact of a downturn in any single asset class.

-

Risk Management: Employing various risk management techniques, like stop-loss orders and hedging strategies, can protect against significant losses.

-

Defensive Investing: Shifting towards more defensive investment strategies, focusing on lower-risk, value-oriented stocks, can provide relative stability in a volatile market.

-

Value Investing: Identifying undervalued stocks within a potentially overvalued market requires careful research and analysis. Value investing focuses on finding companies trading below their intrinsic worth.

-

Alternative Investments: Exploring alternative investment options, such as bonds or real estate, can provide diversification and potentially lower risk exposure compared to heavily valued equities.

Conclusion

BofA's concerns about stretched stock market valuations underscore the need for careful risk management. Factors like low interest rates, QE, and investor sentiment have contributed to these valuations, raising the possibility of a market correction. To navigate this environment effectively, investors should prioritize portfolio diversification, employ risk management techniques, and consider defensive or value investing strategies. Don't ignore the signals – proactively address your concerns about stretched stock market valuations by reviewing your investment strategy and consulting a financial advisor. Taking these steps can help you safeguard your investments in this challenging market environment.

Featured Posts

-

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025 -

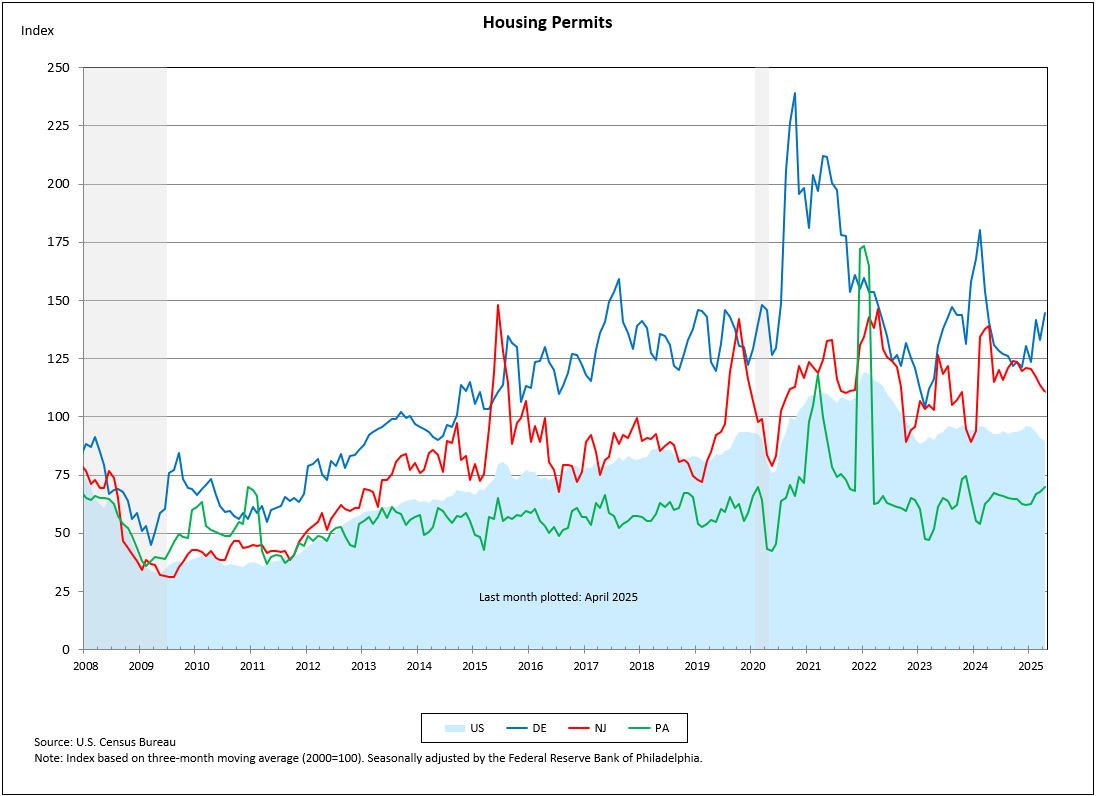

Drop In Housing Permits Despite Efforts To Increase Construction

May 28, 2025

Drop In Housing Permits Despite Efforts To Increase Construction

May 28, 2025 -

Ayndhwfn Btla Lldwry Alhwlndy Ttwyj Msthq

May 28, 2025

Ayndhwfn Btla Lldwry Alhwlndy Ttwyj Msthq

May 28, 2025 -

Middle Management Essential For Company Success And Employee Growth

May 28, 2025

Middle Management Essential For Company Success And Employee Growth

May 28, 2025 -

Waspada Hujan Prakiraan Cuaca Bandung Dan Jawa Barat 26 Maret

May 28, 2025

Waspada Hujan Prakiraan Cuaca Bandung Dan Jawa Barat 26 Maret

May 28, 2025