Addressing Investor Concerns: BofA's Analysis Of Stock Market Valuations

Table of Contents

Keywords: Stock market valuations, BofA, investor concerns, stock market analysis, market outlook, investment strategy, portfolio management, equity valuation, risk assessment, Price-to-Earnings ratio, Price-to-Sales ratio, Discounted Cash Flow analysis, inflation, interest rates, geopolitical risks.

Investor sentiment is currently volatile, fueled by concerns about inflation, interest rates, and geopolitical instability. This makes understanding current stock market valuations crucial for any investor. This article delves into Bank of America's (BofA) recent analysis of stock market valuations, providing insights into their assessment of current market conditions and potential implications for your investment strategy. We'll examine their key findings and explore what this means for your portfolio management and risk assessment.

BofA's Valuation Methodology

BofA employs a multifaceted approach to assess stock market valuations, incorporating several key metrics and models. Their analysis isn't a single number, but rather a sophisticated assessment considering various factors.

-

Detailed description of each valuation metric used: BofA likely utilizes a combination of relative valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, alongside intrinsic valuation models like Discounted Cash Flow (DCF) analysis. The P/E ratio compares a company's stock price to its earnings per share, while the P/S ratio compares the stock price to its revenue per share. DCF analysis estimates the present value of a company's future cash flows.

-

Discussion of any adjustments or modifications BofA made to their standard models: Given the current market uncertainty, BofA likely adjusts its models to account for factors like increased inflation and interest rate volatility. This might involve using higher discount rates in their DCF models or applying sensitivity analysis to account for various economic scenarios.

-

Explanation of how these models account for current market uncertainties: BofA's sophisticated models likely incorporate variables reflecting geopolitical risks, supply chain disruptions, and changing consumer behavior. They probably run simulations to test the robustness of their valuations under various stress scenarios.

The strengths of BofA's methodology lie in its multi-faceted approach, combining relative and intrinsic valuation techniques. However, limitations exist; any valuation model relies on assumptions about future performance, which are inherently uncertain. Potential biases might include inherent optimism or pessimism depending on the analysts' outlook, although peer review and rigorous internal checks likely mitigate this.

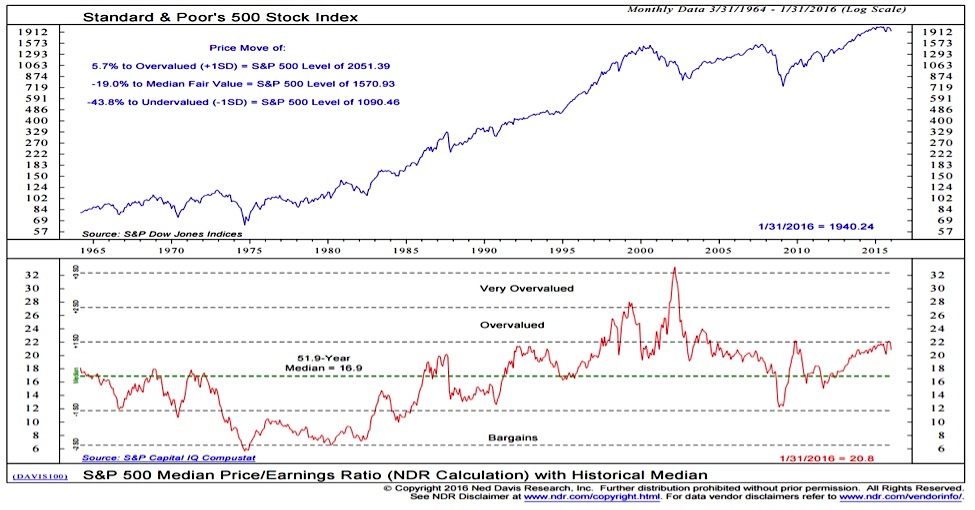

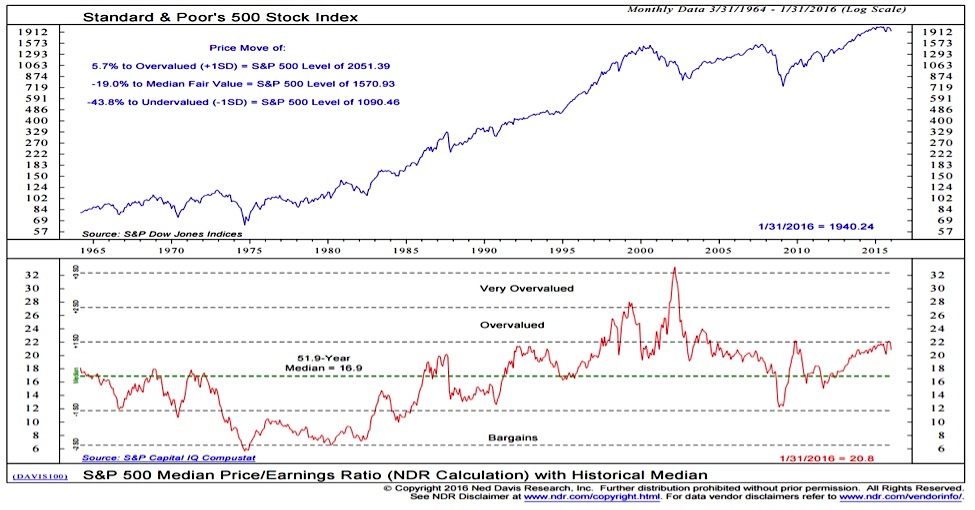

Key Findings on Current Market Valuations

BofA's assessment of current market valuations is crucial for investors. Their conclusions provide a valuable perspective on whether the market is appropriately priced or if significant adjustments are expected. (Note: Specific figures and conclusions from BofA's actual report should be inserted here, citing the source directly. This section will need to be updated to reflect BofA's most recent findings.)

-

Specific valuation figures (with sources cited): [Insert BofA's data and source here, e.g., "According to BofA's report released on [Date], the S&P 500's P/E ratio stands at [Value], compared to the historical average of [Value]."]

-

Comparison to historical valuations to put current figures in context: [Insert comparative data here, providing context to the current figures.]

-

Identification of sectors or asset classes that are particularly overvalued or undervalued: [Insert BofA's sector-specific findings here.]

Factors driving BofA's assessment likely include projected earnings growth (or contraction) across various sectors, expectations regarding future interest rate hikes by central banks, and the ongoing impact of geopolitical risks like the war in Ukraine and trade tensions.

Addressing Specific Investor Concerns

Investor anxieties surrounding inflation, interest rate hikes, and geopolitical risks significantly impact stock market valuations. BofA's analysis likely addresses these concerns directly.

Inflationary Pressures

BofA's analysis likely accounts for inflation's impact on company earnings and future cash flows. High inflation erodes purchasing power and can increase input costs for businesses, squeezing profit margins. BofA's models probably incorporate inflation forecasts to project realistic earnings growth.

Interest Rate Hikes

Rising interest rates affect discount rates in valuation models, directly impacting the present value of future cash flows. Higher interest rates make future cash flows less valuable today, potentially leading to lower valuations. BofA’s analysis incorporates various interest rate scenarios to assess their potential impact on market valuations.

Geopolitical Risks

Geopolitical uncertainty, such as the ongoing war in Ukraine, introduces considerable risk into equity valuation. BofA's models probably incorporate various scenarios to gauge the possible impact on companies’ operations and profitability. Supply chain disruptions, sanctions, and shifts in global trade patterns are all considered.

BofA's Investment Recommendations

Based on their valuation analysis, BofA offers investment recommendations tailored to different risk tolerances. (Note: Specific recommendations should be inserted here, based on BofA’s current report.)

-

Clear and concise recommendations for investors with different risk tolerances: [Insert BofA’s recommendations for conservative, moderate, and aggressive investors here.]

-

Rationale behind each recommendation, clearly linking it to BofA's valuation findings: [Explain the reasoning behind each recommendation, showing how it connects to BofA's valuation analysis.]

-

Specific examples of investment strategies that align with their analysis: [Provide concrete examples of investment strategies that align with BofA's findings, such as sector rotation, diversification, or specific stock picks.]

Conclusion

This article summarized Bank of America's comprehensive analysis of current stock market valuations, highlighting their methodology, key findings, and resulting recommendations. BofA's assessment provides crucial context for investors navigating the current market uncertainty. Understanding these valuations is key to making informed investment decisions. The interplay of inflation, interest rates, and geopolitical risks significantly influences equity valuations. By considering BofA’s findings, investors can refine their portfolio management and risk assessment strategies.

Call to Action: Stay informed about market fluctuations and refine your investment strategy by regularly reviewing analyses like BofA's assessment of stock market valuations. Learn more about BofA's research and stay ahead of the curve in the ever-changing world of finance. Understanding stock market valuations is crucial for successful investing.

Featured Posts

-

Knicks Season Update Jalen Brunson Injury Tyler Koleks Impact And Upcoming Games

May 17, 2025

Knicks Season Update Jalen Brunson Injury Tyler Koleks Impact And Upcoming Games

May 17, 2025 -

Nba Playoffs 76ers Vs Celtics A Winning Prediction

May 17, 2025

Nba Playoffs 76ers Vs Celtics A Winning Prediction

May 17, 2025 -

Analisis Deportivo Semanal Previsiones Y Noticias De Prensa Latina

May 17, 2025

Analisis Deportivo Semanal Previsiones Y Noticias De Prensa Latina

May 17, 2025 -

North Dakotas Richest Person Awarded Msum Honorary Degree

May 17, 2025

North Dakotas Richest Person Awarded Msum Honorary Degree

May 17, 2025 -

Effektivnoe Upravlenie Industrialnymi Parkami Luchshie Praktiki

May 17, 2025

Effektivnoe Upravlenie Industrialnymi Parkami Luchshie Praktiki

May 17, 2025