Addressing Investor Concerns: BofA's Analysis Of Stretched Stock Market Valuations

Table of Contents

BofA's Key Findings on Overvalued Stocks

BofA's analysis employed a robust methodology, considering a range of valuation metrics and macroeconomic factors to assess market valuations. Their report meticulously examined various sectors and individual stocks, identifying several as significantly overvalued. This assessment wasn't based on a single metric but a holistic view, considering factors like historical performance, future growth projections, and prevailing market sentiment.

-

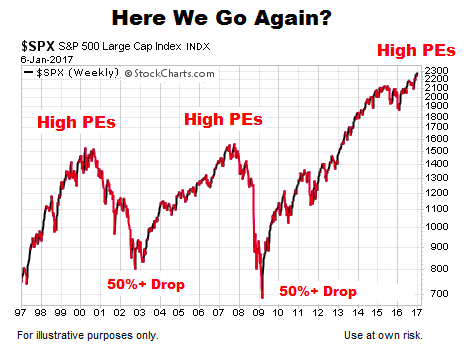

Specific examples of overvalued sectors: The report pointed to the Technology and Consumer Discretionary sectors as exhibiting particularly stretched valuations. These sectors, fueled by strong growth in recent years, have seen their price-to-earnings (P/E) ratios rise considerably above historical averages.

-

Key valuation metrics used: BofA employed several key valuation metrics in their analysis, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B). These metrics provided a multi-faceted view of the relative valuation of different stocks and sectors.

-

Quantifying overvaluation: While the specific numbers vary depending on the asset and metric used, BofA's report indicated a substantial degree of overvaluation in several sectors, suggesting a heightened risk of correction. The analysis quantified this overvaluation, providing concrete data points to support their findings. This quantification allowed investors to better understand the magnitude of the risk. This data is crucial for investors formulating informed investment decisions.

Underlying Factors Contributing to Stretched Valuations

Several underlying factors contributed to the stretched valuations observed by BofA. Understanding these factors is crucial for interpreting the analysis and anticipating future market trends.

-

Low interest rate environment: The prolonged period of low interest rates, a consequence of monetary policies implemented in response to economic downturns, has pushed investors towards riskier assets like equities in search of higher returns. This increased demand has driven up stock prices, contributing to inflated valuations.

-

Quantitative easing (QE): The implementation of QE programs injected significant liquidity into the market, further fueling asset price inflation. This abundance of capital has contributed to a speculative environment, where valuations may not fully reflect underlying fundamentals.

-

Investor sentiment and market speculation: Positive investor sentiment and market speculation have played a significant role in pushing stock prices higher, often exceeding levels justified by fundamental analysis. Behavioral economics principles highlight how optimism and herd mentality can lead to irrational exuberance and inflated valuations.

BofA's Recommendations for Investors

Navigating the current market requires a cautious and strategic approach. BofA's recommendations provide a roadmap for investors seeking to protect their portfolios and mitigate risks associated with stretched valuations.

-

Portfolio adjustments: BofA advises investors to review their portfolios and consider reducing exposure to overvalued sectors identified in their analysis. This might involve selling some holdings or reallocating capital to less-expensive assets.

-

Diversifying investments: Diversification remains a crucial risk-management strategy. BofA suggests diversifying across asset classes (e.g., stocks, bonds, real estate) to reduce the overall portfolio's exposure to market fluctuations in any single sector.

-

Risk management and hedging strategies: Investors should consider employing hedging strategies to protect against potential market downturns. This could involve using options or other derivative instruments to limit losses in the event of a market correction.

Potential Market Implications of Stretched Valuations

The stretched valuations highlighted by BofA carry potential short-term and long-term implications for the market and investors.

-

Potential scenarios for market correction: The high valuations increase the likelihood of a market correction, where prices decline sharply to reflect more realistic valuations. The extent and duration of such a correction are uncertain, but the risk is undeniable.

-

Impact on different asset classes: A market correction would impact different asset classes differently. Overvalued sectors would likely experience sharper declines, while less-expensive assets might offer better relative performance.

-

Long-term growth prospects: While current valuations pose short-term risks, the long-term growth prospects of the economy and certain sectors remain largely unaffected. However, investors should be aware that higher valuations mean potentially lower future returns.

Conclusion: Navigating the Market with BofA's Insights on Stretched Stock Market Valuations

BofA's analysis offers a critical assessment of stretched stock market valuations and their potential implications. The report's key findings highlight the risks associated with overvalued sectors and the importance of proactive risk management. By understanding the underlying factors contributing to these high valuations and following BofA's recommendations, investors can develop a more robust investment strategy capable of navigating the complexities of the current market. To gain a deeper understanding of these issues and make informed investment decisions, further research into BofA's report is strongly encouraged. Developing a sound investment strategy that accounts for stretched stock market valuations is paramount in today's dynamic environment.

Featured Posts

-

Is Group Support The Key To Effective Adhd Management

Apr 29, 2025

Is Group Support The Key To Effective Adhd Management

Apr 29, 2025 -

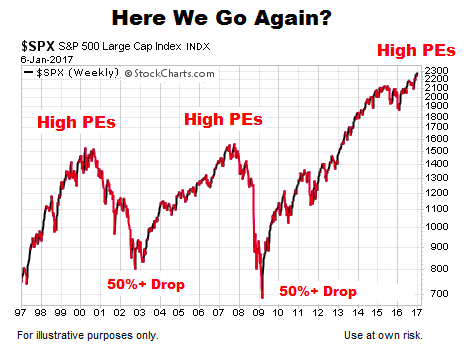

2024 Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025

2024 Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025 -

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025 -

I Texnologia Ton Ypologiston Apo Ines Kai I Prolipsi Astheneion

Apr 29, 2025

I Texnologia Ton Ypologiston Apo Ines Kai I Prolipsi Astheneion

Apr 29, 2025 -

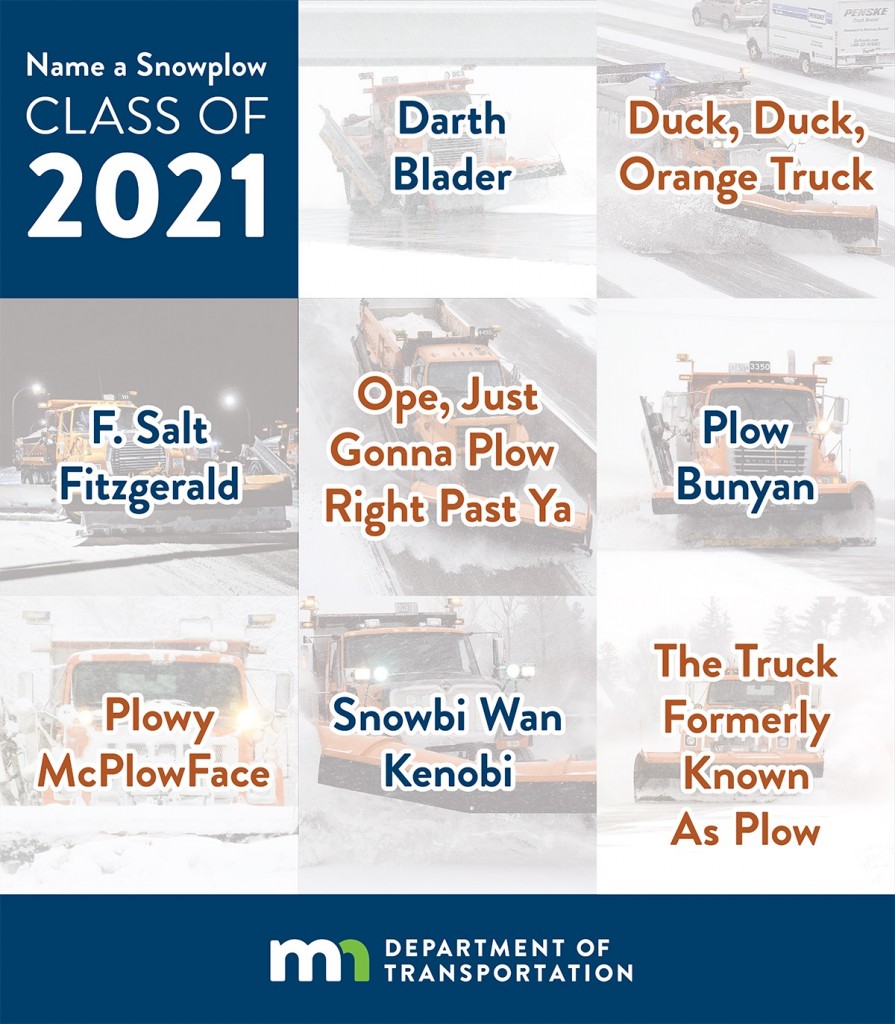

Understanding Chicagos Zombie Office Buildings And Their Impact

Apr 29, 2025

Understanding Chicagos Zombie Office Buildings And Their Impact

Apr 29, 2025