AEX Index Plummets: Analysis Of Amsterdam Stock Market Drop

Table of Contents

Macroeconomic Factors Influencing the AEX Index Drop

Several macroeconomic headwinds have significantly impacted the AEX Index's recent performance. These global forces create uncertainty and ripple through national markets, like the Amsterdam Stock Exchange.

Global Economic Uncertainty

The global economy faces significant challenges, creating a climate of uncertainty that directly affects the AEX.

- Impact of US Federal Reserve policy: The US Federal Reserve's aggressive interest rate hikes to combat inflation have tightened global monetary conditions, impacting investment flows into emerging markets, including those represented in the AEX. Higher interest rates make borrowing more expensive, dampening economic activity and reducing corporate profits.

- Eurozone economic slowdown: Slowing economic growth within the Eurozone, a major trading partner for the Netherlands, directly impacts Dutch businesses and investor confidence, leading to a decline in the AEX. Concerns about a potential recession in Europe further exacerbate the situation.

- Global supply chain disruptions: Ongoing supply chain bottlenecks and inflationary pressures continue to constrain economic activity, reducing corporate earnings and impacting investor sentiment, which is reflected in the AEX's performance. Data from the International Monetary Fund (IMF) shows a significant downward revision in global growth forecasts, further fueling concerns.

These factors combine to create a negative sentiment among investors, leading to sell-offs and a decrease in the AEX Index.

Geopolitical Risks and Their Impact

Geopolitical instability significantly contributes to the volatility of the AEX Index.

- Energy price volatility: The war in Ukraine has caused significant energy price volatility, impacting energy-intensive industries in the Netherlands and increasing inflation. This uncertainty directly affects the profitability of companies and investor confidence.

- Supply chain disruptions due to conflict: The ongoing conflict disrupts global supply chains, affecting the availability of raw materials and impacting production for many Dutch companies, leading to lower profits and decreased stock prices.

- Investor uncertainty about future geopolitical events: The unpredictable nature of geopolitical events creates uncertainty among investors, leading them to adopt a more risk-averse approach and sell off assets, including those listed on the AEX. Concerns about escalating conflicts and their economic consequences contribute to this trend.

Sector-Specific Performances within the AEX

The recent AEX decline isn't uniform across all sectors. Some sectors are more susceptible to the current economic climate than others.

Energy Sector Volatility

The energy sector, a significant component of the AEX, is particularly vulnerable to global energy price fluctuations.

- Impact of oil and gas price swings: Fluctuations in oil and gas prices directly impact the profitability of energy companies listed on the AEX. Price volatility creates uncertainty, leading to stock price swings.

- Performance of major energy companies listed on the AEX: Specific analysis of individual energy companies listed on the AEX reveals the varied impact of the current market conditions, with some companies more resilient than others.

- Alternative energy investments and their impact: The increasing focus on alternative energy sources also influences the performance of traditional energy companies and presents both opportunities and challenges for the sector's future.

Technology and Financials Sector Trends

The technology and financial sectors have also experienced significant impacts, contributing to the overall AEX decline.

- Impact of interest rate hikes on financial institutions: Higher interest rates negatively impact financial institutions' profitability by reducing lending margins and increasing the cost of borrowing.

- Tech sector performance in relation to global tech trends: The performance of technology companies listed on the AEX is closely tied to global tech trends, making them susceptible to global economic downturns and shifts in investor sentiment.

- Impact of investor sentiment on these sectors: Negative investor sentiment significantly influences the performance of both technology and financial companies, impacting their stock valuations and contributing to the overall AEX decline.

Investor Sentiment and Market Psychology

Investor sentiment plays a critical role in driving market movements, including the recent AEX drop.

Impact of Negative News and Media Coverage

Negative news cycles significantly impact investor confidence and contribute to market volatility.

- Role of financial news media: Financial news media plays a critical role in shaping investor perceptions and driving market sentiment. Negative headlines can trigger sell-offs.

- Social media influence on market sentiment: Social media platforms increasingly influence market sentiment, with viral news and opinions rapidly affecting trading behavior.

- Impact of negative economic forecasts: Negative economic forecasts and warnings from financial institutions further exacerbate negative sentiment, leading to increased selling pressure on the AEX.

Short-Term vs. Long-Term Investment Strategies

The AEX decline presents both challenges and opportunities for investors depending on their investment horizon.

- Advice for short-term traders: Short-term traders should exercise caution and closely monitor market developments, potentially adopting a more conservative strategy during periods of high volatility.

- Strategies for long-term investors: Long-term investors may view the decline as a potential buying opportunity, focusing on undervalued companies with strong fundamentals.

- Diversification strategies to mitigate risk: Diversification across different asset classes and sectors remains crucial to mitigate risk and protect portfolios during periods of market uncertainty.

Conclusion

The recent plummet in the AEX Index reflects a complex interplay of macroeconomic factors, geopolitical risks, and sector-specific challenges. Understanding these interwoven elements is vital for investors navigating the current market volatility. While the short-term outlook may seem uncertain, a careful analysis of the AEX Index and its underlying components can lead to more informed investment decisions. For comprehensive insights into the Dutch market and future AEX performance, consistent monitoring of market news and economic indicators is essential. Stay informed about the AEX Index and its fluctuations to make well-informed investment choices. Understanding the dynamics of the AEX Index is crucial for navigating the Dutch stock market.

Featured Posts

-

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025 -

High Speed Refueling Police Pursuit Ends In Astonishment

May 24, 2025

High Speed Refueling Police Pursuit Ends In Astonishment

May 24, 2025 -

M56 Motorway Collision Paramedics Respond To Overturned Vehicle

May 24, 2025

M56 Motorway Collision Paramedics Respond To Overturned Vehicle

May 24, 2025 -

Today Show Anchors Absence Explained By Co Hosts

May 24, 2025

Today Show Anchors Absence Explained By Co Hosts

May 24, 2025 -

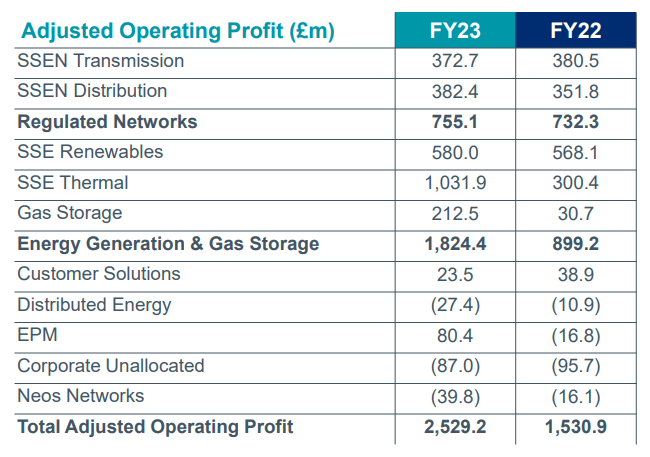

The Sse 3 Billion Spending Cut A Detailed Breakdown

May 24, 2025

The Sse 3 Billion Spending Cut A Detailed Breakdown

May 24, 2025