Alterya Acquired By Blockchain Giant Chainalysis: Implications For The Future Of Crypto

Table of Contents

Enhanced Blockchain Security and Investigations

Chainalysis, already a prominent name in blockchain analytics and investigation, has significantly bolstered its capabilities with the acquisition of Alterya. Alterya's specialized technology brings advanced investigative tools and expertise to the table, creating a formidable force in combating cryptocurrency-related crime. This merger translates into several key improvements:

- Improved tracing of illicit cryptocurrency transactions: The combined entity will possess enhanced capabilities to track the movement of funds across various blockchains, making it far more difficult for criminals to launder money or conceal illicit activities. This involves advanced techniques like transaction graph analysis and network mapping.

- Enhanced identification of crypto-related financial crimes: Alterya's expertise in identifying complex financial schemes will be invaluable in uncovering sophisticated crypto-related fraud, scams, and other illegal activities. This includes improved identification of mixers and other obfuscation techniques.

- More effective sanctions compliance for cryptocurrency businesses: With more robust investigative tools, cryptocurrency exchanges and businesses can more effectively comply with international sanctions and regulations, minimizing their risk exposure. This includes streamlined KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

- Advanced real-time threat detection and response: The integration of Alterya’s technology will allow for more proactive threat detection and response, enabling faster identification and mitigation of emerging risks within the cryptocurrency market.

This enhanced security will be a boon for law enforcement agencies worldwide, providing them with more effective tools to investigate and prosecute crypto-related crimes. Simultaneously, cryptocurrency exchanges and businesses will benefit from improved risk management and enhanced compliance capabilities.

Expanded Data Analysis and Intelligence

Alterya's strength lies in its sophisticated data analysis capabilities. Integrating this expertise into Chainalysis's already comprehensive platform will result in a significant expansion of data analysis and intelligence capabilities within the crypto space. The combined entity will boast:

- Larger datasets for more accurate risk assessment: Access to larger and more diverse datasets allows for more nuanced and accurate risk assessments, providing crucial insights into potential threats and vulnerabilities within the cryptocurrency market.

- Improved predictive analytics for future crypto trends: The enhanced data processing power facilitates improved predictive modeling, allowing for better forecasting of market trends and potential risks. This is crucial for both investors and businesses operating in the crypto space.

- More comprehensive market intelligence for investors: Investors will gain access to more robust market intelligence, helping them make better-informed decisions and navigate the often volatile cryptocurrency market.

- Enhanced understanding of cryptocurrency adoption patterns: Analyzing larger datasets will offer a deeper understanding of cryptocurrency adoption rates, user demographics, and market behavior, potentially shaping future developments in the industry.

This increased data analysis capacity promises greater market transparency, leading to increased investor confidence and a more mature cryptocurrency market.

Implications for Regulatory Compliance

The cryptocurrency industry is facing increasing pressure to comply with stringent regulations. The combined power of Chainalysis and Alterya directly addresses this challenge. The enhanced capabilities will significantly aid cryptocurrency businesses in meeting KYC and AML requirements. Regulatory bodies will also benefit substantially:

- Better tools for monitoring cryptocurrency transactions: Regulators gain access to more advanced tools to monitor cryptocurrency transactions, helping identify and investigate suspicious activity more efficiently.

- Enhanced capabilities to investigate and prosecute crypto crimes: Law enforcement agencies will have significantly improved capabilities to investigate and prosecute individuals and entities involved in cryptocurrency-related crimes.

- Increased transparency in the cryptocurrency market: The enhanced surveillance capabilities contribute to greater market transparency, reducing the potential for illicit activities and boosting investor confidence.

- Improved framework for the regulation of cryptocurrencies: The data and insights generated by the combined entity can inform the development of more effective and comprehensive regulatory frameworks for the cryptocurrency industry.

The Alterya acquisition may lead to significant changes in regulatory frameworks globally, promoting a more regulated and compliant cryptocurrency ecosystem.

Future of Crypto: A More Secure and Transparent Ecosystem?

The long-term implications of the Chainalysis acquisition of Alterya are far-reaching. While benefits are significant, potential drawbacks must also be considered.

- Increased adoption of cryptocurrencies due to improved security and compliance: A more secure and regulated environment might encourage wider adoption of cryptocurrencies by both individuals and businesses.

- Further development of blockchain technology for enhanced traceability: The acquisition might spur further innovation in blockchain technology to enhance traceability and transparency.

- A shift towards a more regulated and transparent cryptocurrency market: This is a likely outcome, possibly leading to greater stability and maturity within the market.

- Potential challenges related to privacy and data security: The increased data collection capabilities raise concerns about potential threats to user privacy and the security of sensitive data.

The future of crypto, post-acquisition, points towards a more secure and transparent ecosystem. However, navigating the complexities of privacy and data security will be crucial in realizing this vision.

Conclusion: The Alterya Acquisition and the Future of Crypto – A New Era of Security and Transparency?

The Chainalysis acquisition of Alterya marks a significant turning point for the cryptocurrency industry. The combined entity brings unparalleled capabilities in blockchain security, data analytics, and regulatory compliance. This merger promises a more secure and transparent cryptocurrency ecosystem, benefiting investors, businesses, regulators, and users alike. However, the implications require ongoing monitoring and careful consideration of the potential challenges regarding privacy and data security. Stay informed about further developments in the crypto space following this pivotal "Alterya Acquired by Chainalysis" event, and continue researching the profound implications of this significant event for the future of cryptocurrencies. [Link to Chainalysis resources here] [Link to Alterya resources (if available) here].

Featured Posts

-

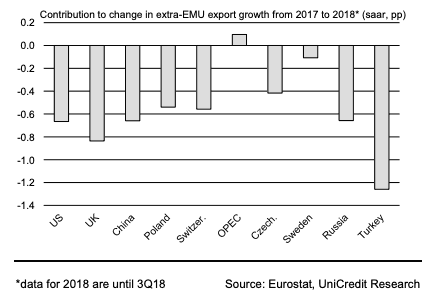

Slowdown In Uk Luxury Exports To Eu Brexits Role

May 20, 2025

Slowdown In Uk Luxury Exports To Eu Brexits Role

May 20, 2025 -

Mark Zuckerbergs Challenges In A Post Trump World

May 20, 2025

Mark Zuckerbergs Challenges In A Post Trump World

May 20, 2025 -

Why Did D Wave Quantum Inc Qbts Stock Price Jump This Week

May 20, 2025

Why Did D Wave Quantum Inc Qbts Stock Price Jump This Week

May 20, 2025 -

Synaylia Sto Dimotiko Odeio Rodoy Kathigites Stin Dimokratiki

May 20, 2025

Synaylia Sto Dimotiko Odeio Rodoy Kathigites Stin Dimokratiki

May 20, 2025 -

The Pointless Comeback Why Michael Schumachers Return Failed Despite Red Bulls Input

May 20, 2025

The Pointless Comeback Why Michael Schumachers Return Failed Despite Red Bulls Input

May 20, 2025