Aluminum Trade War: Canadian Trader's Bankruptcy Underscores Economic Strain

Table of Contents

The Impact of Tariffs and Trade Restrictions on the Aluminum Industry

The aluminum trade war has unleashed a torrent of negative consequences for the industry. Tariffs and trade restrictions, implemented by various countries, have directly impacted aluminum prices, creating market instability and uncertainty. This volatility has severely hampered the ability of businesses to plan for the future and invest in growth. Canadian aluminum producers and traders, heavily reliant on international markets, have been particularly vulnerable.

The ripple effect is devastating:

- Increased production costs: Tariffs increase the cost of imported raw materials and components, squeezing profit margins.

- Reduced competitiveness in global markets: Higher production costs make Canadian aluminum less competitive against producers in countries with lower tariffs or subsidies.

- Loss of market share: Canadian producers are losing ground to competitors who benefit from more favorable trade conditions.

- Difficulty accessing export markets: Trade restrictions limit access to key export markets, reducing sales opportunities and revenue streams.

The Bankruptcy Case Study: A Detailed Analysis

The bankruptcy of the unnamed Canadian aluminum trader offers a compelling case study of the aluminum trade war's devastating effects. While specific financial details may be confidential, the contributing factors clearly point to the role of the trade war. The company likely faced a perfect storm of challenges including:

- Specific financial challenges faced: Reduced sales, increased debt, and diminished cash flow, directly linked to decreased demand and higher production costs caused by the aluminum trade war.

- Impact on jobs and employment: The bankruptcy resulted in significant job losses for employees and potentially ripple effects on related industries.

- Supply chain disruptions: The instability created by the aluminum trade war disrupted supply chains, making it difficult for the trader to secure consistent and affordable raw materials.

- Legal ramifications: The bankruptcy proceedings will involve complex legal battles, further adding to the costs and complications.

Broader Economic Consequences in Canada

The consequences extend far beyond the single bankruptcy. The aluminum trade war is inflicting significant damage on the Canadian economy. The impact is felt across the aluminum sector and related industries. This includes:

- Job losses across the aluminum sector: Thousands of jobs are at risk across the entire aluminum supply chain, from mining to manufacturing to trading.

- Impact on GDP growth: The decline in aluminum production and trade negatively impacts overall GDP growth, affecting the entire Canadian economy.

- Government interventions and policies: The Canadian government has implemented some support measures, but these may prove insufficient to counteract the damaging effects of the aluminum trade war.

- Long-term economic outlook: The continued uncertainty and instability caused by the aluminum trade war threaten the long-term health and competitiveness of Canada's aluminum industry.

Global Implications of the Aluminum Trade War

The Canadian trader's bankruptcy is not an isolated incident; it reflects a global crisis fueled by the aluminum trade war. The implications extend far beyond Canada, affecting the global aluminum market and creating instability in international trade relations.

- Global supply chain instability: The trade war disrupts global supply chains, leading to shortages, price hikes, and uncertainty for businesses worldwide.

- Increased consumer prices: The increased costs associated with tariffs and trade restrictions are ultimately passed on to consumers through higher prices for aluminum products.

- Geopolitical implications: The aluminum trade war exacerbates existing geopolitical tensions, creating further uncertainty and instability in international relations.

- International trade tensions: The protectionist measures taken during the aluminum trade war escalate tensions between countries, hindering international cooperation and collaboration.

Aluminum Trade War's Devastating Impact: A Call to Action

The bankruptcy of the Canadian aluminum trader is a stark illustration of the devastating impact of the ongoing aluminum trade war. This case study clearly demonstrates the link between protectionist policies and significant economic hardship. The ripple effects on jobs, GDP, and international relations are substantial and far-reaching.

Understanding the ongoing repercussions of the aluminum trade war is crucial. Stay informed about the latest developments and advocate for policies that promote fair and stable international trade. We must work towards resolving trade disputes and mitigating the devastating economic consequences of protectionism. The future of global aluminum trade depends on it.

Featured Posts

-

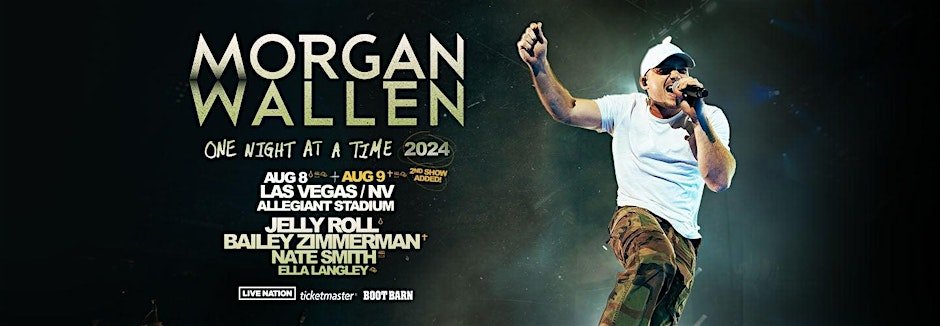

Morgan Wallen And Tate Mc Raes Whats Wrong A Controversial Duet

May 29, 2025

Morgan Wallen And Tate Mc Raes Whats Wrong A Controversial Duet

May 29, 2025 -

Tate Mc Rae Faces Backlash Over Collaboration With Morgan Wallen On Whats Wrong

May 29, 2025

Tate Mc Rae Faces Backlash Over Collaboration With Morgan Wallen On Whats Wrong

May 29, 2025 -

Get Morgan Wallen Tickets For The 2025 Tour Your Complete Guide

May 29, 2025

Get Morgan Wallen Tickets For The 2025 Tour Your Complete Guide

May 29, 2025 -

Venlose Politiek De Terugkeer Van Jozanne Van Der Velden

May 29, 2025

Venlose Politiek De Terugkeer Van Jozanne Van Der Velden

May 29, 2025 -

Potom Penzert Gyujtoi Markak A Lidl Ben Miert Erdemes Sietni

May 29, 2025

Potom Penzert Gyujtoi Markak A Lidl Ben Miert Erdemes Sietni

May 29, 2025