Amsterdam AEX Index: Over 4% Fall Triggers Market Concerns

Table of Contents

Understanding the Amsterdam AEX Index's Dramatic Fall

The Amsterdam AEX Index (AEX Index) is a benchmark stock market index for the Euronext Amsterdam exchange, representing the 25 largest and most liquid companies listed on the exchange. Its performance is crucial for understanding the overall health of the Dutch economy. On [Insert Date], the AEX Index suffered a sharp decline of over 4%, closing at [Insert Closing Value]. This represents a significant drop compared to the previous day's closing value of [Insert Previous Day's Closing Value] and is one of the most significant single-day drops in recent years. Historically, comparable drops have been seen during periods of major global economic uncertainty, such as the 2008 financial crisis.

- Specific Figures: The AEX Index fell by [Insert Percentage]% points, representing a loss of [Insert Monetary Value] in market capitalization.

- Key Companies Affected: ASML, Unilever, and ING, major components of the AEX Index, all experienced substantial losses, reflecting the broad-based nature of the decline. [Insert Specific Percentage Losses for each company if available]

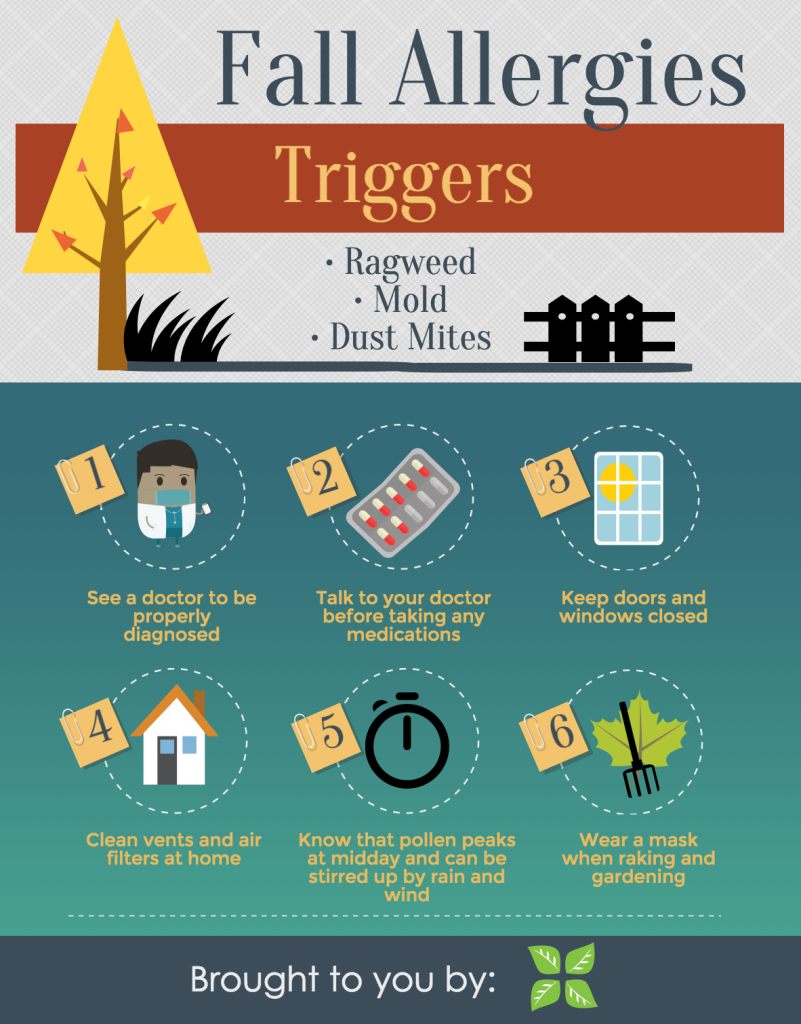

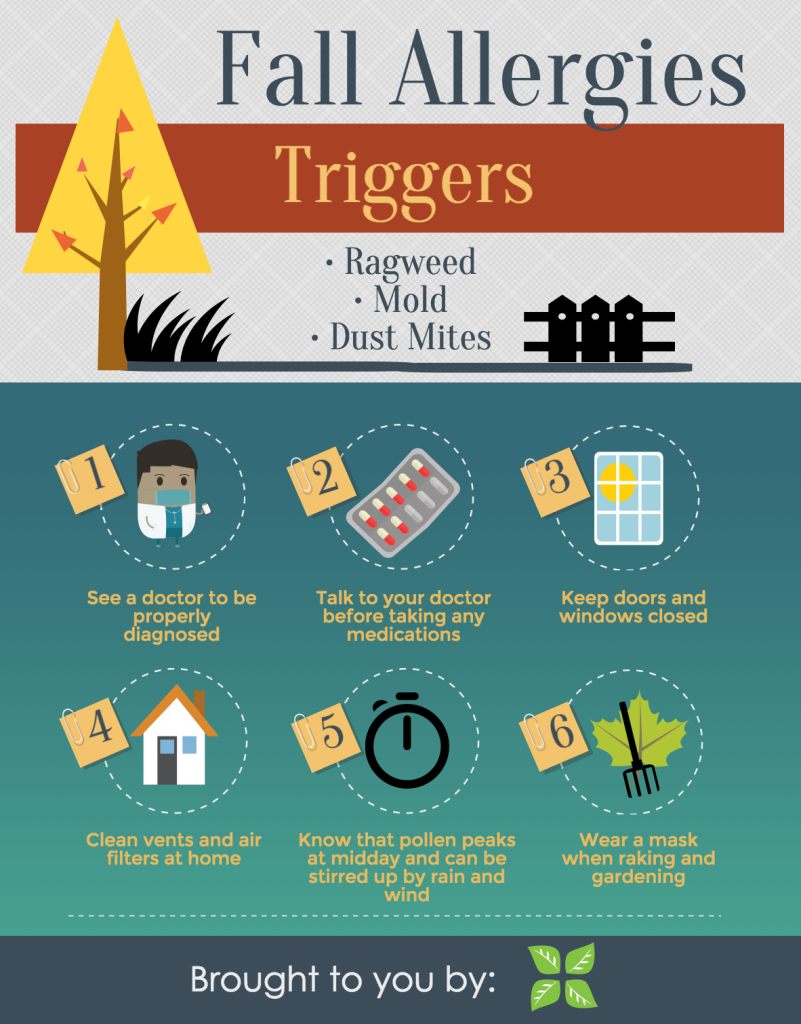

- [Insert Chart or Graph visually representing the decline. Ideally, this would show the AEX Index performance over a period including the date of the drop, clearly highlighting the significant decrease.]

Potential Causes Behind the AEX Index Decline

Several factors likely contributed to the sharp decline in the AEX Index. These include both global economic headwinds and specific issues affecting the Dutch market.

-

Global Economic Factors: Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent fears of a global recession have created a climate of uncertainty, leading to risk aversion among investors. This has affected global markets, including the Dutch stock market.

-

Sector-Specific Issues: The technology sector, a significant component of the AEX, experienced a downturn, impacting companies like ASML. Furthermore, energy price volatility continues to create uncertainty for numerous businesses.

-

Geopolitical Influences: The ongoing war in Ukraine and persistent global trade tensions contribute to a volatile economic environment. These geopolitical uncertainties negatively impact investor confidence and fuel market instability.

-

Detailed Explanation: Each of these factors played a role in influencing investor sentiment and driving the sell-off in the AEX Index. The interconnected nature of global markets means that events in one region can have a ripple effect across the world.

-

Supporting Sources: [Insert links to reputable sources like the Financial Times, Reuters, or Bloomberg supporting the claims made above]

-

Expert Opinion: "[Insert Quote from a financial analyst about the contributing factors to the AEX decline]"

Market Reaction and Investor Sentiment

The immediate reaction to the AEX Index drop was widespread selling pressure, resulting in increased market volatility. Trading volume surged significantly as investors reacted to the unexpected decline. This reflects a sharp decrease in investor confidence and a shift towards risk-averse investment strategies. Many investors opted to reduce their exposure to equities in favor of safer assets like bonds or cash.

- Investor Reactions: The sharp decline prompted a wave of panic selling, as investors attempted to protect their portfolios from further losses.

- Trading Volume and Volatility: Trading volume on the Euronext Amsterdam exchange increased dramatically following the drop, indicating heightened market activity and uncertainty. Volatility indices also spiked, reflecting the increased uncertainty.

- Financial News Sources: "[Insert quotes from financial news sources regarding investor sentiment and market reaction]"

The Outlook for the Amsterdam AEX Index

Predicting the future performance of the AEX Index is challenging, but several factors will likely influence its trajectory. While a short-term recovery is possible, sustained growth depends on mitigating the underlying economic and geopolitical risks.

- Short-Term Outlook: A short-term rebound is possible, particularly if global economic data improves or geopolitical tensions ease. However, further volatility is expected in the near term.

- Long-Term Outlook: The long-term outlook for the AEX Index hinges on the recovery of the global economy and the resolution of geopolitical uncertainties. A sustained period of economic growth would likely lead to a recovery in the AEX Index.

- Investor Advice: Investors should carefully assess their risk tolerance and investment horizon before making any decisions. Diversification is crucial, especially during periods of heightened market volatility.

Conclusion: Navigating the Volatility of the Amsterdam AEX Index

The over 4% plunge in the Amsterdam AEX Index underscores the significant volatility currently affecting the Dutch stock market and the global economy. Several factors contributed to this decline, including global economic uncertainty, sector-specific issues, and geopolitical concerns. The market's reaction demonstrated a shift in investor sentiment toward risk aversion. While the outlook for the AEX Index remains uncertain, understanding these factors and carefully considering investment strategies is crucial. Stay updated on the latest developments affecting the Amsterdam AEX Index and make informed decisions about your investment strategy. Consult with a qualified financial advisor to discuss your options and create a personalized investment plan tailored to your risk tolerance and financial goals. Remember that this analysis is for informational purposes only and is not financial advice. The information provided regarding the Amsterdam AEX Index, Dutch stock market, and market analysis should be considered carefully before making any investment decisions.

Featured Posts

-

Borsa Cautela Prevale Banche Deboli Italgas In Luce

May 24, 2025

Borsa Cautela Prevale Banche Deboli Italgas In Luce

May 24, 2025 -

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Escape To The Countryside Making The Move A Success

May 24, 2025

Escape To The Countryside Making The Move A Success

May 24, 2025 -

Philips 2025 Annual General Meeting Key Updates Announced

May 24, 2025

Philips 2025 Annual General Meeting Key Updates Announced

May 24, 2025