Amsterdam Exchange Suffers 7% Fall: Trade War Intensifies Market Instability

Table of Contents

The Trade War's Direct Impact on Amsterdam Exchange Trading

The intensifying trade war significantly impacts the Amsterdam Exchange through several mechanisms. The imposition of tariffs on goods disrupts international trade, directly affecting businesses listed on the exchange. Sectors heavily reliant on global trade, such as technology, manufacturing, and agriculture, are particularly vulnerable.

- Increased import/export tariffs: Higher tariffs lead to increased prices for imported goods and reduced export competitiveness, shrinking trade volume and impacting profitability for companies involved in international trade.

- Global supply chain disruption: Uncertainty surrounding tariffs and trade policies creates instability in global supply chains. This impacts businesses' ability to source materials and deliver products, leading to production delays and financial losses.

- Reduced investor confidence: The geopolitical uncertainty stemming from the trade war erodes investor confidence, leading to a sell-off in stocks as investors seek safer havens for their assets. This reduced confidence fuels the market volatility and contributes to the stock market crash like conditions.

- Specific examples: Companies heavily involved in exporting Dutch agricultural products or technologically advanced manufacturing equipment are experiencing significant challenges due to increased trade barriers and reduced market access.

Analysis of Market Volatility and Investor Behavior

The 7% fall in the Amsterdam Exchange triggered substantial market volatility. Following the initial drop, we observed significant price fluctuations as investors reacted to the unfolding situation. The question remains: are investors primarily selling off assets or holding onto them in hopes of a recovery?

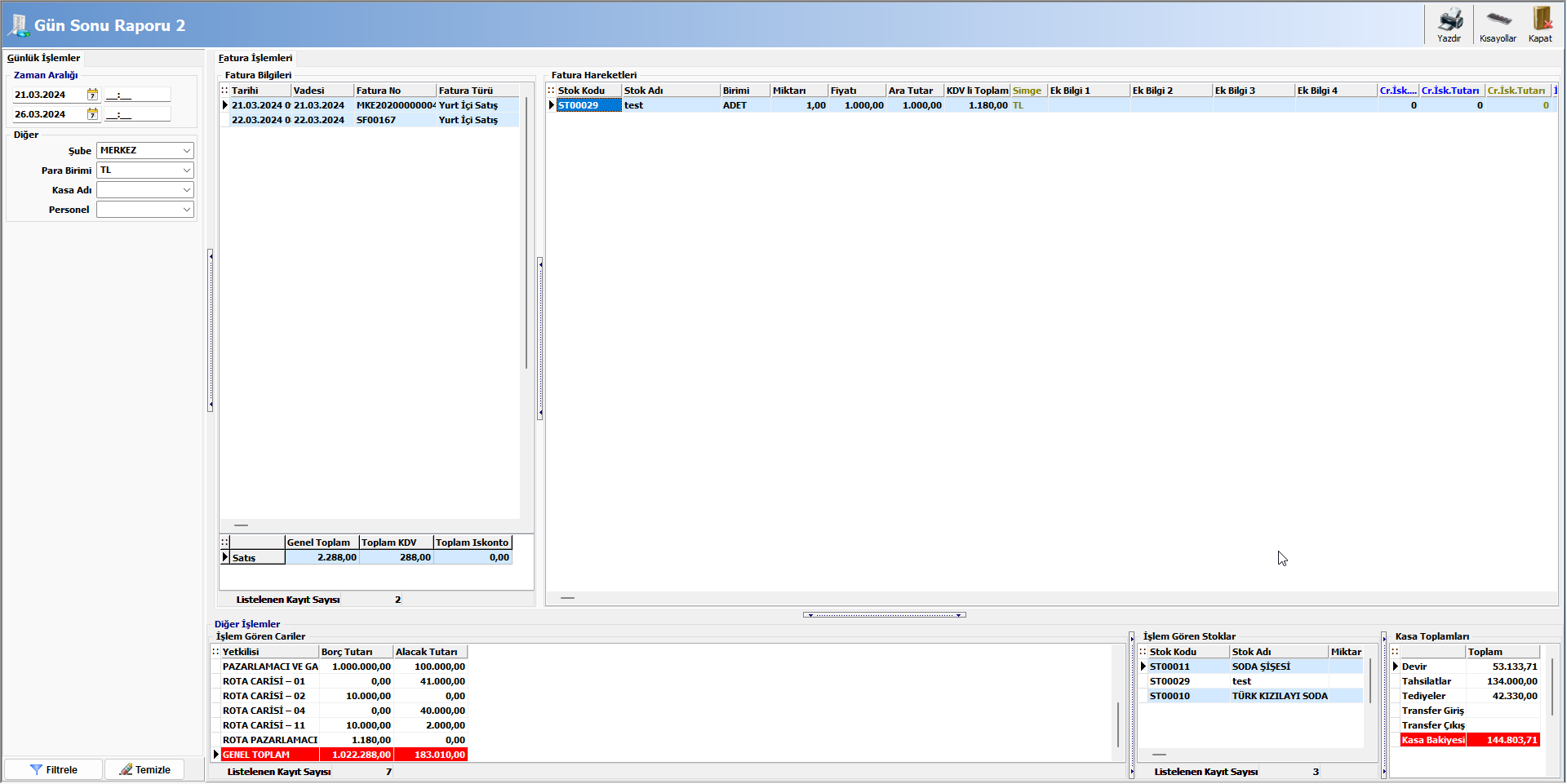

- Charts and Graphs: [Insert relevant chart or graph illustrating the market volatility following the 7% drop. Source should be cited]. This visual representation helps to clearly illustrate the extent of the market volatility.

- Expert Quotes: [Include quotes from financial analysts or experts commenting on investor sentiment and behavior. Sources should be cited]. These expert opinions provide valuable insights into the market reaction.

- Safe-haven assets: As investors seek safety, we've seen increased demand for safe-haven assets like gold and government bonds, further emphasizing the risk-averse sentiment in the market.

- Government intervention: The Dutch government's response, if any, to stabilize the market and mitigate the economic impact of the trade war is a crucial factor to consider.

Potential Long-Term Consequences for the Amsterdam Exchange and Dutch Economy

The long-term consequences of the trade war for the Amsterdam Exchange and the Dutch economy are significant and uncertain. The initial shock could potentially lead to a prolonged period of economic slowdown.

- Sustained economic slowdown: Reduced trade and investment could lead to a sustained period of slower economic growth, impacting various sectors of the Dutch economy.

- Impact on employment: A slowing economy could result in job losses, increasing unemployment rates and exacerbating social and economic challenges.

- Government policy responses: The effectiveness of government policies aimed at mitigating the impact of the trade war on businesses and employment will be critical.

- Long-term investment prospects: The overall long-term investment outlook depends heavily on the resolution of the trade war and the ability of the Dutch economy to adapt to the changing global landscape.

Comparison with Other Global Stock Markets

The 7% drop in the Amsterdam Exchange needs to be viewed in the context of the performance of other global stock markets. This allows us to determine if the fall is unique to Amsterdam or part of a broader global trend.

- Comparative data: Comparing the Amsterdam Exchange's performance with major global indices like the Dow Jones, FTSE 100, and DAX reveals whether the decline is isolated or a reflection of wider global market correlation. [Include comparative data in a table or chart. Sources must be cited].

- Analysis of relative performance: Analyzing the relative performance helps determine whether similar factors are affecting other markets or if the Amsterdam Exchange is disproportionately affected.

- Global market sentiment: The overall global market sentiment plays a crucial role. If global confidence is low, the impact on the Amsterdam Exchange will likely be more pronounced.

Conclusion: Understanding the Amsterdam Exchange's Fall and Navigating Future Uncertainty

The 7% fall in the Amsterdam Exchange is undeniably linked to the intensifying trade war, causing significant market volatility and impacting investor confidence. The potential long-term consequences for the Amsterdam Exchange and the Dutch economy are substantial. Investors need to be aware of these risks and adopt appropriate strategies to navigate this uncertain market. Diversification of portfolios is crucial to mitigate investment risk associated with market volatility. Stay informed about developments in the Amsterdam Exchange and the global trade war to make informed investment decisions. Closely monitor the Amsterdam stock market and adjust your strategies accordingly to manage risk effectively.

Featured Posts

-

Positief Beurzenklimaat Na Trump Uitstel Aex Performance Analyse

May 24, 2025

Positief Beurzenklimaat Na Trump Uitstel Aex Performance Analyse

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Avrupa Borsalari Guen Sonu Raporu Karisik Islemler

May 24, 2025

Avrupa Borsalari Guen Sonu Raporu Karisik Islemler

May 24, 2025 -

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025 -

Escape To The Country Securing A Peaceful And Rewarding Lifestyle

May 24, 2025

Escape To The Country Securing A Peaceful And Rewarding Lifestyle

May 24, 2025