Amsterdam Stock Exchange Plunges 2% After Trump's Tariff Hike

Table of Contents

Understanding the Impact of Trump's Tariff Hike on the AEX

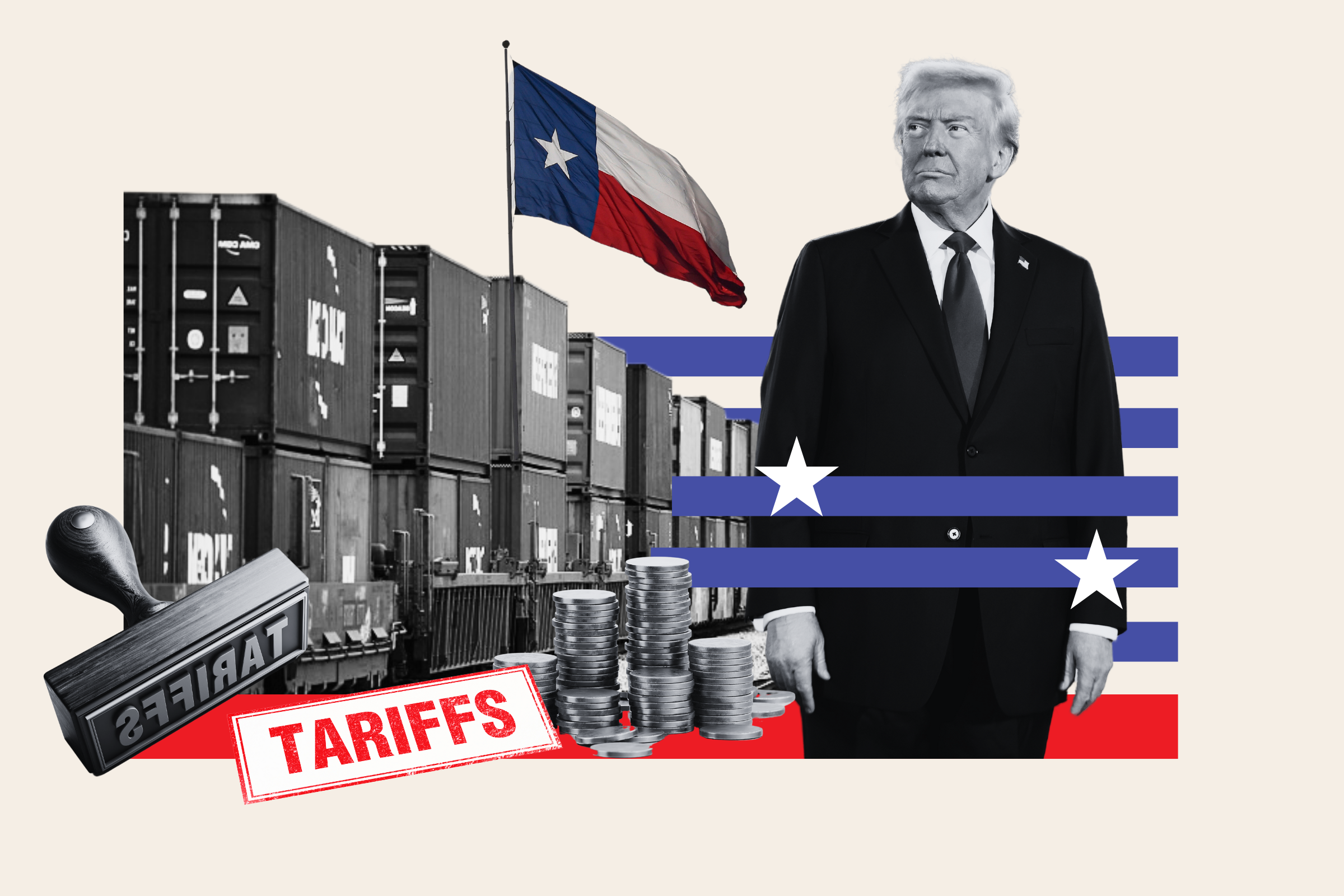

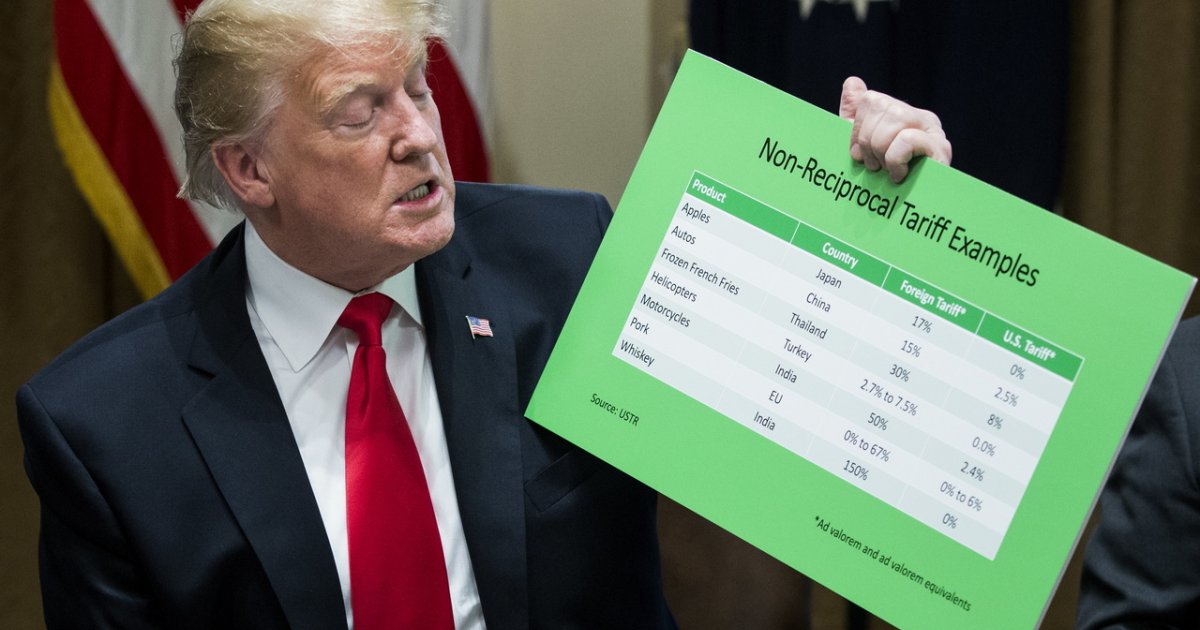

The Trump administration's tariff hike has had both direct and indirect effects on Dutch businesses and the AEX index. The direct impact stems from increased import and export costs for Dutch companies engaging in trade with the US. Indirectly, the increased uncertainty and volatility in global markets contribute to a decline in investor confidence, further depressing stock prices.

Specific sectors have been hit harder than others. The most vulnerable include:

-

Technology companies: Many Dutch technology firms heavily rely on the US market for sales and distribution. The tariffs increase their costs, making their products less competitive and impacting their bottom line. Companies with significant US operations saw notable share price declines following the announcement.

-

Agricultural exporters: Dutch agricultural products, such as dairy and flowers, face increased import duties in the US, reducing their competitiveness and export revenue. This sector is particularly susceptible to trade wars given its export-oriented nature.

-

Manufacturing firms: Dutch manufacturers using US-sourced components now face higher input costs, squeezing profit margins and potentially affecting their ability to compete globally. This ripple effect extends beyond the immediate cost of the tariffs themselves.

The role of investor sentiment and market volatility cannot be overstated. Fear and uncertainty surrounding future trade policies significantly exacerbated the AEX's plunge, as investors reacted by selling off assets to minimize potential losses. This created a feedback loop, further driving down the AEX index and impacting overall investor confidence in Dutch stocks. The resulting market volatility underlines the fragility of the global economic system in the face of trade wars.

Analyzing the AEX's Response to Previous Trade Wars

To understand the current situation fully, it's crucial to analyze how the AEX performed during previous periods of heightened trade tensions. Historically, the AEX, like other global markets, has shown sensitivity to trade wars and protectionist policies.

Let's compare the current situation with past experiences:

-

The 2018 Trade War: The initial imposition of tariffs between the US and China in 2018 led to a period of uncertainty that negatively impacted the AEX, although the impact was less pronounced than the recent plunge.

-

The European Debt Crisis: While not directly a trade war, the European Debt Crisis (2010-2012) created economic uncertainty that significantly affected the AEX. This demonstrates the sensitivity of the Dutch market to wider global economic shifts.

These past events highlight some similarities with the current situation: increased market volatility, investor uncertainty, and negative impacts on export-oriented sectors. However, the current situation also presents unique challenges due to the specific targeting of certain sectors and the broader geopolitical context.

Potential Future Implications for the Dutch Economy

The long-term consequences of the tariff hike on the Dutch economy are still unfolding, but several potential outcomes are evident:

-

Short-term: Reduced export revenue, increased inflation, and job losses in affected sectors are highly probable in the near term.

-

Long-term: The risk of a prolonged economic slowdown or even a recession cannot be dismissed. This is particularly true if the trade dispute escalates further or if other global economic factors negatively impact the Dutch economy.

The Dutch government has a crucial role to play in mitigating the negative consequences. Potential mitigation strategies include:

-

Government intervention: Fiscal stimulus measures, targeted support for affected industries, and exploring alternative trade agreements are all options the Dutch government could implement.

-

Trade diversification: A long-term strategy to diversify trade partnerships, reducing dependence on the US market, is crucial for the Dutch economy's resilience. This will require strategic investments and diplomatic efforts to cultivate relationships with alternative trade partners.

Expert Opinions and Market Predictions

Financial analysts and economists offer diverse opinions and market predictions regarding the AEX's future performance. Some remain cautiously optimistic, anticipating a recovery once the trade tensions ease. Others are more pessimistic, predicting a longer period of sluggish growth or even a contraction. These predictions often hinge on the eventual resolution of the trade dispute and the broader global economic outlook. Many analysts emphasize the need for diversification and proactive government policies to navigate this challenging period.

The Ongoing Impact of Trump's Tariff Hike on the Amsterdam Stock Exchange

In summary, the Trump administration's tariff hike has dealt a significant blow to the Amsterdam Stock Exchange, causing a notable drop in the AEX index. The impact has been particularly pronounced on technology, agricultural, and manufacturing sectors, leading to uncertainty and volatility in the market. The potential for a more protracted economic slowdown or recession remains a serious concern, requiring a proactive response from the Dutch government and a strategic shift towards greater trade diversification.

The future performance of the AEX remains uncertain, heavily dependent on the resolution of ongoing trade negotiations and broader global economic conditions. Stay updated on the latest developments concerning the Amsterdam Stock Exchange and the effects of ongoing trade negotiations to make informed investment decisions. Careful market analysis and a well-defined investment strategy are crucial for navigating the complexities of this evolving situation and effectively managing risks associated with the AEX and the broader Dutch economy.

Featured Posts

-

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025 -

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025

Borse In Picchiata L Impatto Dei Dazi E Le Contromisure Ue

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025 -

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025