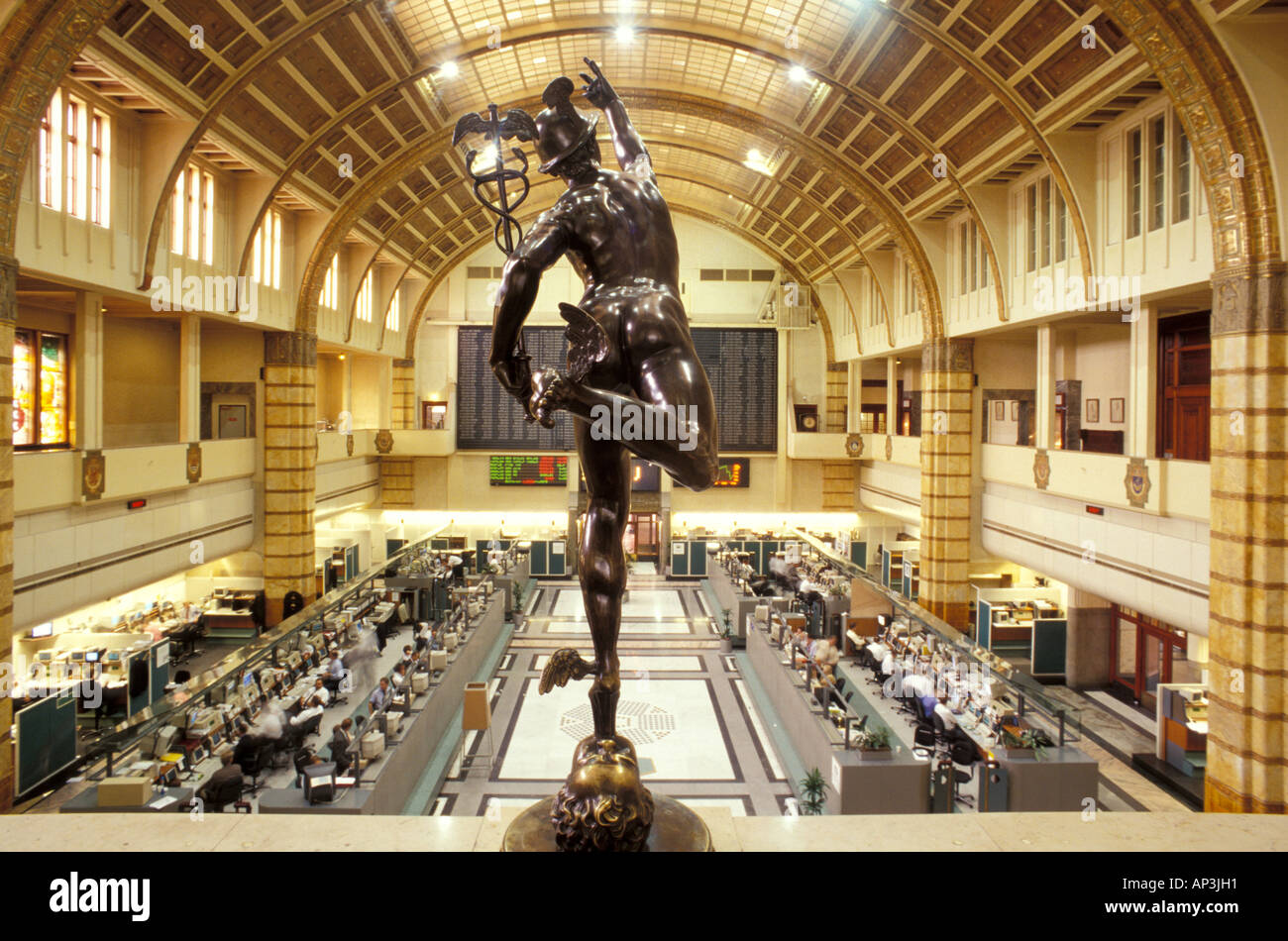

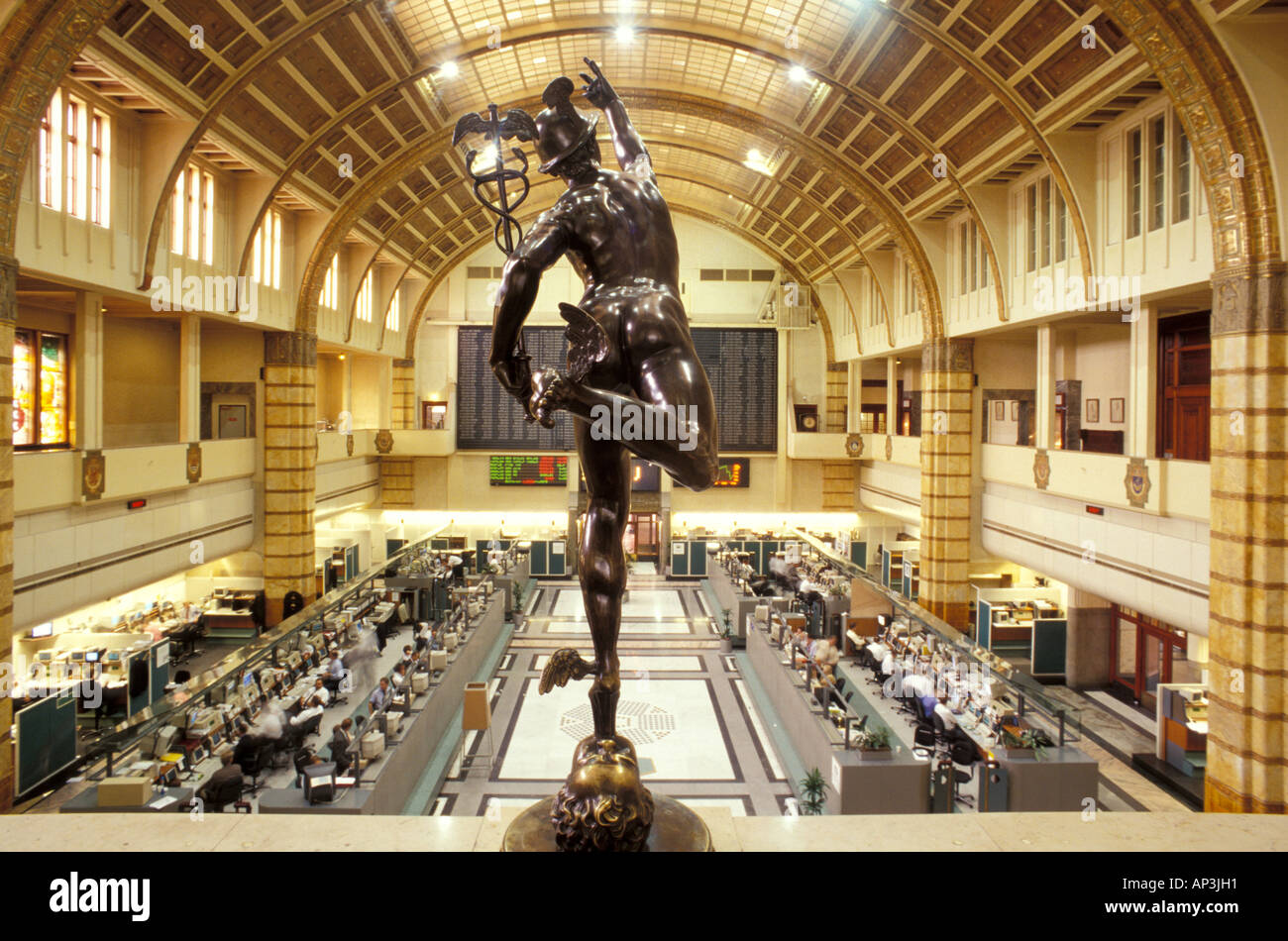

Amsterdam Stock Exchange: Three-Day Losing Streak, 11% Decline

Table of Contents

Causes of the Amsterdam Stock Exchange Decline

The 11% drop in the AEX is a multifaceted issue stemming from a confluence of global and sector-specific factors, all contributing to a climate of heightened uncertainty.

Global Market Uncertainty

The recent downturn in the Amsterdam Stock Exchange mirrors a broader trend of global market uncertainty. Several significant macroeconomic factors are at play:

- Rising Interest Rates: Central banks worldwide, including the European Central Bank, are aggressively raising interest rates to combat persistent inflation. This increases borrowing costs for businesses, impacting investment and potentially slowing economic growth. Higher rates also make bonds more attractive, diverting investment away from equities.

- Energy Crisis: The ongoing energy crisis, exacerbated by the war in Ukraine and reduced supply from Russia, continues to put pressure on businesses and consumers across Europe, including the Netherlands. This uncertainty is reflected in stock market performance.

- War in Ukraine: The ongoing conflict continues to fuel geopolitical instability, creating uncertainty and impacting global supply chains. This uncertainty discourages investment and contributes to market volatility.

- Supply Chain Disruptions: Lingering supply chain issues, stemming from the pandemic and the war in Ukraine, are adding to inflationary pressures and impacting business profitability. This translates to lower investor confidence.

The AEX mirrored a global trend, with major indices in Europe and the US also experiencing significant losses during this period, highlighting the interconnectedness of global markets.

Sector-Specific Weakness

The decline in the AEX wasn't uniform across all sectors. Certain sectors experienced disproportionately large losses:

- Technology: The technology sector, often sensitive to interest rate hikes and economic slowdowns, saw significant declines. Companies reliant on venture capital funding were particularly impacted. For example, [Insert example of a tech company listed on the AEX and its percentage drop].

- Energy: While energy prices remain high, the volatility in the energy market, coupled with concerns about future demand, led to a decrease in energy company valuations. [Insert example of an energy company listed on the AEX and its percentage drop].

These sector-specific weaknesses contributed significantly to the overall decline in the AEX.

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in market movements. The recent decline in the AEX reflects a shift towards risk aversion:

- Increased Selling Pressure: Investors, anticipating further economic uncertainty, engaged in increased selling, driving down prices.

- Decreased Trading Volume: The lower trading volume suggests a lack of confidence and a reluctance to engage in active trading.

- Flight to Safety: Investors are moving their funds into safer assets, such as government bonds, further contributing to the decline in the AEX.

Negative news headlines regarding global economic prospects further fueled this negative investor sentiment.

Impact on Investors and the Dutch Economy

The three-day slump in the Amsterdam Stock Exchange has significant implications for both individual investors and the Dutch economy.

Losses for Dutch Investors

The AEX decline translates directly into losses for Dutch investors holding AEX-listed stocks:

- Portfolio Losses: Individual investors experienced significant portfolio losses, impacting retirement savings and investment goals.

- Decreased Retirement Savings: Many Dutch citizens rely on investments in the AEX for retirement, making the recent losses particularly concerning.

- Impact on SMEs: The downturn also affects small and medium-sized enterprises (SMEs) listed on the AEX, potentially impacting their access to capital and future growth.

Wider Economic Consequences

The AEX decline has broader implications for the Dutch economy:

- Impact on Consumer Confidence: A falling stock market can negatively impact consumer confidence, leading to reduced spending and potentially slowing economic growth.

- Reduced Investment: The uncertainty may discourage both domestic and foreign investment in the Netherlands.

- Effect on GDP Growth: The downturn could negatively affect the overall Gross Domestic Product (GDP) growth of the Netherlands.

- Government Response: The Dutch government may need to consider fiscal or monetary policies to mitigate the economic fallout.

Potential Recovery and Future Outlook for the Amsterdam Stock Exchange

The future trajectory of the Amsterdam Stock Exchange remains uncertain, dependent on a complex interplay of global and domestic factors.

Short-Term Projections

A short-term rebound is possible, contingent on several factors:

- Easing of Global Concerns: If global inflationary pressures ease, interest rate hikes slow, and geopolitical tensions subside, investor confidence could return.

- Positive Economic Indicators: Positive economic data from the Netherlands and the Eurozone could boost market sentiment.

- Analyst Predictions: Several analysts offer varying short-term projections, some suggesting a rebound based on potential bargains in the market.

Long-Term Implications

The long-term impact of this downturn requires careful monitoring:

- Structural Changes in the Market: This event could accelerate structural changes within the AEX, leading to consolidation and shifts in sector dominance.

- Shifting Investor Preferences: Investors may shift their preferences towards more defensive sectors or asset classes.

- Long-Term Growth or Stagnation: The long-term growth trajectory of the AEX will depend on the overall economic recovery and the resolution of global uncertainties.

Conclusion

The recent 11% decline in the Amsterdam Stock Exchange over three trading days underscores the significant volatility affecting global markets. This downturn is a consequence of interacting global uncertainties, sector-specific weaknesses, and shifting investor sentiment. The impact on Dutch investors and the broader economy is substantial, raising significant concerns about both short- and long-term prospects. While a rebound is possible, careful monitoring of global events and market trends is crucial for both investors and policymakers.

Call to Action: Stay informed about developments affecting the Amsterdam Stock Exchange and make informed decisions regarding your investments. Continue to follow our analysis of the Amsterdam Stock Exchange for the latest updates and insights into navigating this volatile market.

Featured Posts

-

Finding Solace In Nature A Seattle Womans Pandemic Story

May 25, 2025

Finding Solace In Nature A Seattle Womans Pandemic Story

May 25, 2025 -

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 25, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 25, 2025 -

New Music Joy Crookes Shares Carmen

May 25, 2025

New Music Joy Crookes Shares Carmen

May 25, 2025 -

M56 Motorway Incident Car Overturn Results In Casualty

May 25, 2025

M56 Motorway Incident Car Overturn Results In Casualty

May 25, 2025