Amsterdam Stock Market: 4%+ Fall Triggers Concerns

Table of Contents

Causes of the Amsterdam Stock Market Decline

The recent 4%+ drop in the Amsterdam Stock Market is a complex issue with multiple contributing factors. A confluence of global economic headwinds and specific concerns regarding the Dutch economy appear to be the primary drivers of this market correction. These factors include:

-

Global Inflation and Rising Interest Rates: Soaring inflation across the globe has forced central banks, including the European Central Bank, to aggressively raise interest rates. This increases borrowing costs for Dutch companies, dampening investment and slowing economic growth. Higher rates also make bonds more attractive relative to stocks, leading to capital flight from the equity market.

-

The Ongoing European Energy Crisis: The energy crisis, exacerbated by the war in Ukraine, continues to heavily impact the Dutch economy. High energy prices significantly increase production costs for businesses, squeezing profit margins and impacting investor confidence in energy-intensive sectors.

-

Geopolitical Risks: Geopolitical instability, particularly the ongoing conflict in Ukraine and its global ramifications, contributes to market uncertainty. The war's impact on energy supplies, inflation, and global trade has created a ripple effect impacting even seemingly insulated economies like the Netherlands.

-

Sector-Specific Downturns: The recent decline hasn't been uniform across all sectors. The technology sector, for example, has experienced a particularly sharp downturn, reflecting concerns about valuations and future growth prospects. Similarly, energy companies, while benefiting from high prices in the short term, face long-term uncertainty related to energy transition policies.

Impact on Dutch Businesses and Investors

The Amsterdam Stock Market fall has far-reaching consequences for Dutch businesses and investors alike.

-

Impact on Dutch Businesses: The decline reduces company valuations, making it more difficult to raise capital through equity offerings. Reduced investor confidence can lead to decreased investment in expansion and innovation, potentially hampering long-term growth. Businesses may also face tighter credit conditions due to higher interest rates.

-

Changes in Investor Behavior: The market volatility is causing investors to reassess their investment strategies. Many are shifting towards more conservative approaches, leading to decreased risk appetite and potentially a further slowdown in market activity. This is particularly true for individual investors and pension funds.

-

Effect on Economic Growth: The stock market decline is a strong indicator of weakening economic sentiment. It could signal a potential slowdown in economic growth for the Netherlands, impacting consumer spending and overall economic activity.

Expert Opinions and Market Predictions

Financial analysts offer varying perspectives on the market's future trajectory. Some believe the current downturn represents a temporary correction, while others foresee a more prolonged period of volatility.

-

Duration of the Downturn: Predictions range from a few weeks to several months, depending on the evolution of global economic conditions and geopolitical events.

-

AEX Index Recovery: Analysts anticipate a gradual recovery of the AEX Index, but the timeline remains uncertain. The speed of recovery will depend largely on inflation rates, interest rate policies, and the resolution of geopolitical tensions.

-

Expert Advice: Experts advise investors to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Diversification remains key to mitigating risk.

Strategies for Navigating Market Uncertainty

Navigating market uncertainty requires a proactive approach to risk management and investment strategy.

-

Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and geographic regions reduces overall portfolio risk.

-

Risk Mitigation Strategies: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. This might involve reducing exposure to volatile assets or increasing holdings in more stable investments.

-

Long-Term Investment Approach: A long-term investment strategy, focused on consistent contributions and weathering short-term market fluctuations, is crucial for long-term success.

-

Financial Planning: Working with a financial advisor to develop a comprehensive financial plan can provide personalized guidance and support during periods of market uncertainty.

Conclusion

The recent 4%+ fall in the Amsterdam Stock Market highlights the significant impact of global economic uncertainty and geopolitical risks on even relatively stable economies. The decline has affected Dutch businesses, prompting changes in investor behavior and raising concerns about economic growth. Understanding market volatility is paramount, and adopting effective investment strategies, including diversification and long-term planning, is crucial for navigating this challenging period. Stay informed on the Amsterdam Stock Market, monitor the AEX Index closely, and consult a financial advisor for personalized guidance on navigating the Amsterdam Stock Market and understanding the factors influencing the Amsterdam Stock Market. Don't hesitate to seek professional help to build a robust investment strategy tailored to your individual needs.

Featured Posts

-

Atletico Madrid In Espanyol E Yenilgisinde Hakem Faktoerue

May 25, 2025

Atletico Madrid In Espanyol E Yenilgisinde Hakem Faktoerue

May 25, 2025 -

Doert Oyuncunun Gelecegi Tehlikede Kuluep Skandali

May 25, 2025

Doert Oyuncunun Gelecegi Tehlikede Kuluep Skandali

May 25, 2025 -

Melanie Thierry Et Raphael Elever Des Enfants Avec Un Grand Ecart D Age

May 25, 2025

Melanie Thierry Et Raphael Elever Des Enfants Avec Un Grand Ecart D Age

May 25, 2025 -

Amira Al Zuhair A Zimmermann Highlight At Paris Fashion Week

May 25, 2025

Amira Al Zuhair A Zimmermann Highlight At Paris Fashion Week

May 25, 2025 -

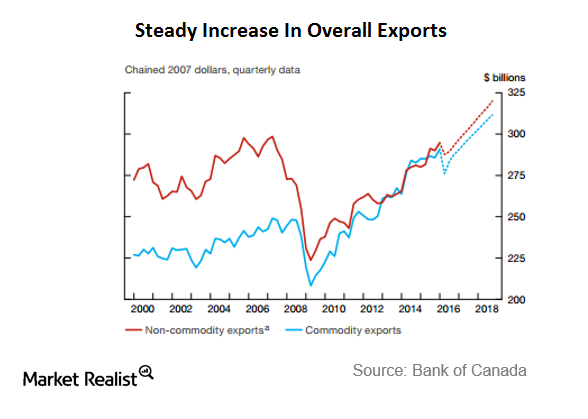

The Impact Of Rising Retail Sales On Bank Of Canadas Monetary Policy

May 25, 2025

The Impact Of Rising Retail Sales On Bank Of Canadas Monetary Policy

May 25, 2025